Financial Analysis - Is Snapchat Stock NYSE:SNAP a Buy ?

Analyzing Snap Inc.’s Q4 Performance and Its Strategic Emphasis on Gen Z Engagement Through Innovative Offerings Like Snapchat+ | That's TradingNEWS

In-Depth Financial Analysis of Snap Inc. (NYSE:SNAP): Navigating the Social Media Landscape

NYSE:SNAP Performance Overview and Strategic Initiatives

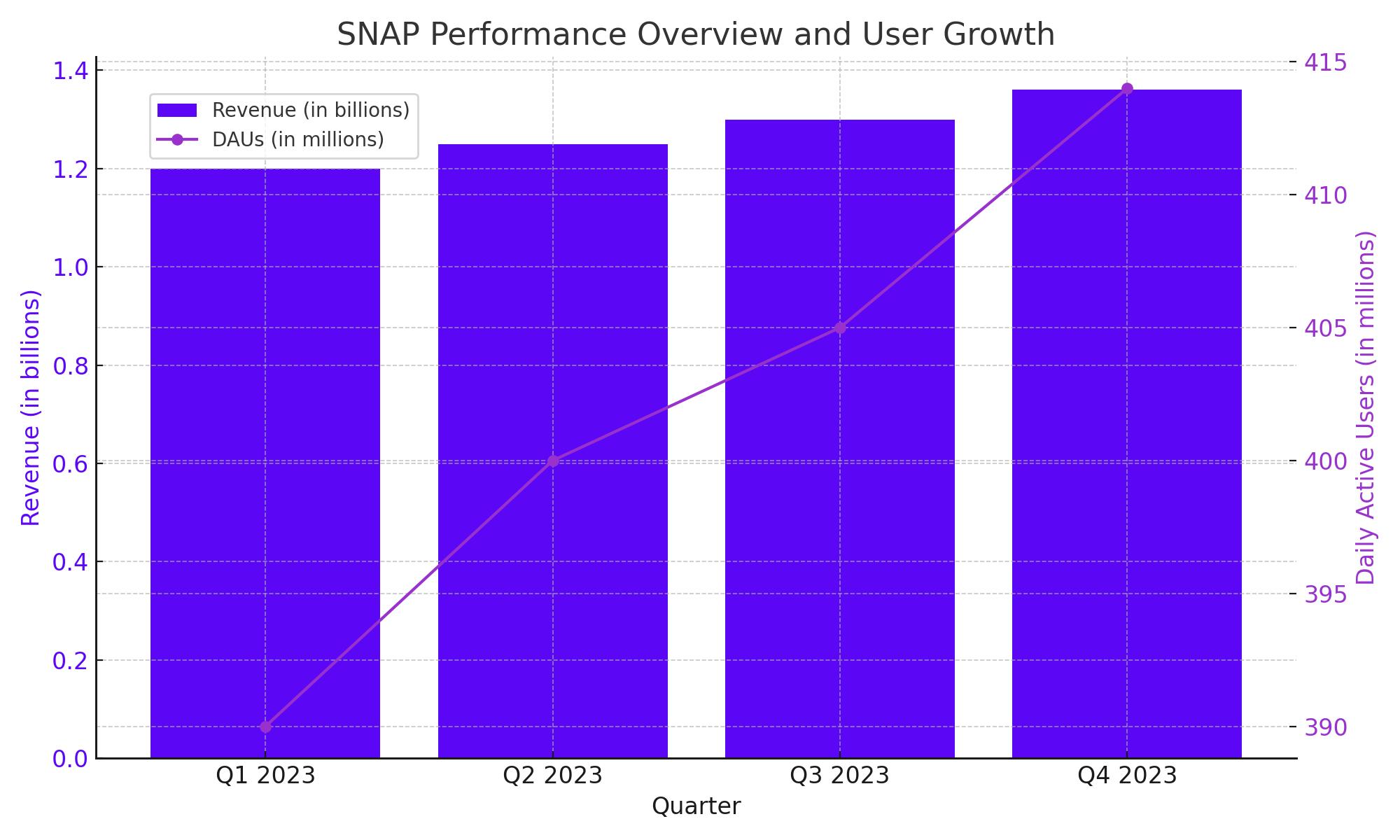

Snap Inc., the parent company of Snapchat, showcased a lukewarm performance in Q4 2023, yet managed to record a 10% year-over-year increase in daily active users, reaching 414 million. Revenue grew by 5% to $1.36 billion during the same period. Despite these gains, Snap faces skepticism regarding its ability to compete with larger social media conglomerates, particularly in the advertising domain.

In response to evolving market dynamics, Snap has intensified efforts to boost user engagement through innovative offerings such as Snapchat+. This subscription service is part of a broader strategy to diversify revenue streams and enhance user interaction, particularly among the Gen Z demographic—a key user base for Snapchat.

Gen Z Engagement and Snapchat’s Unique Appeal

Snapchat has carved a unique niche within the digital ecosystem, particularly among Gen Z users, by facilitating an impressive volume of daily interactions—over 4 billion messages and 5 billion snaps. More than just a messaging app, Snapchat has become a crucial digital repository for photos and videos, acting as a modern-day scrapbook that captures the fleeting moments of youth. This functionality is augmented by Snapchat's Memories feature, which allows users to save snaps and stories in a personal collection. This feature not only enhances user engagement by encouraging content creation but also fosters long-term platform loyalty by becoming an integral part of the users' social media routine.

Snapchat’s appeal to Gen Z is further magnified by its immersive AR (Augmented Reality) features, which resonate well with a demographic that values creativity and interactive experiences. According to internal data, users interact with AR features more than 30 times per day on average, underlining the feature's role in daily engagement. The platform's focus on privacy, ephemeral content, and a highly visual interface aligns seamlessly with Gen Z's preferences, differentiating Snapchat from competitors who focus more on permanence and text-based updates.

Financial Health and Market Position

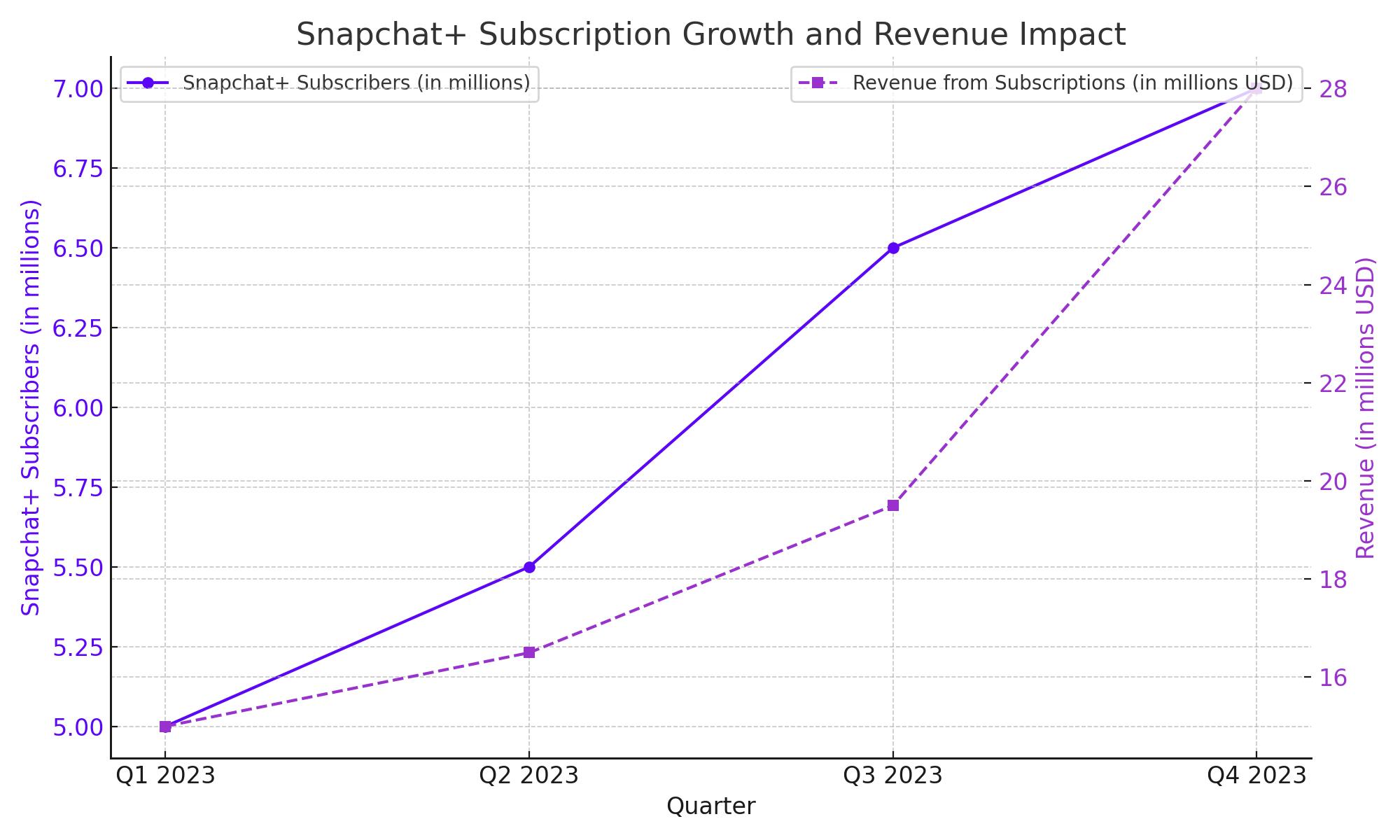

Despite facing a slowdown in revenue growth, Snapchat's strategic initiatives around its subscription model, Snapchat+, show promising diversification. Introduced as a premium tier offering exclusive features such as the ability to replay snaps, see who rewatched a story, and access unique icons and badges, Snapchat+ reached 7 million subscribers by the end of Q4 2023. This service is priced at $3.99 per month, contributing an annualized revenue run rate of approximately $249 million by year-end, signaling robust growth potential. This move not only capitalizes on Snapchat's engaged user base but also aligns with the industry's broader shift towards subscription-based revenue models, which provide more predictable income streams compared to ad-based models.

Challenges and Market Competition

Snap Inc. faces significant challenges in the advertising domain, particularly from larger entities like Meta Platforms, which command vast shares of global digital ad spend. Snapchat's innovative features and targeted demographic have not yet translated into equivalent advertising revenue, partly due to the platform's niche appeal and the transient nature of its content, which poses unique challenges for sustained advertiser engagement. The potential U.S. ban on TikTok presents a strategic opportunity for Snapchat, potentially freeing up market share in the digital ad space and increasing user engagement. Should such a ban materialize, Snapchat could see increased growth in both user base and ad revenue, as advertisers seek to capitalize on Snapchat's engaged, youthful audience.

Revenue Trends and Strategic Outlook

While Snap’s ARPU (Average Revenue Per User) has experienced a downturn, falling 19% from Q4 2021 to Q4 2023, the company’s strategic pivot towards enhanced subscription services and international market penetration offers a counterbalance to this trend. Notably, in markets like India, Snapchat has seen exponential user growth, with daily active users surging by 150% since 2021. This international expansion is not just enhancing Snapchat’s global footprint but also diversifying its revenue streams beyond the saturated North American market. The company's ability to adapt to regional preferences and leverage local cultural elements has been key to its success in these emerging markets.

Investment Consideration for Snap Inc. (NYSE:SNAP)

Investment Outlook: Hold

Given the current market conditions and Snap Inc.'s strategic positioning, the recommendation for investors is to hold their positions. While Snap presents compelling growth opportunities through its innovative features and subscription services, several risks need to be weighed carefully.

Bullish Factors:

-

Strong Gen Z Engagement: Snapchat's deep penetration in the Gen Z demographic, characterized by high daily engagement rates, positions it well for sustained user growth. The app’s innovative features, like AR filters and the Memories function, continue to resonate with younger audiences, potentially driving longer-term loyalty and usage.

-

Growth of Snapchat+: The subscription service Snapchat+ has shown significant growth, reaching 7 million subscribers by the end of Q4 2023. This not only provides a steady revenue stream but also reduces the company's reliance on ad revenues, which are more susceptible to economic downturns and market volatility.

-

International Expansion: Snapchat’s aggressive expansion in international markets, particularly in India, has yielded substantial user growth. This diversification helps mitigate the impact of competitive and market pressures in the U.S. and opens up new revenue avenues.

Bearish Considerations:

-

Ad Revenue Challenges: Despite its popularity among younger audiences, Snap has struggled to monetize its user base effectively compared to its peers like Meta. The advertising model, which is the primary revenue source for Snap, faces significant challenges due to intense competition and market saturation.

-

Economic Dependence on Market Trends: Snapchat's business model and revenue streams are highly sensitive to broader economic trends, especially in the advertising sector. Any downturns or disruptions in market conditions could disproportionately affect Snap's financial performance.

-

Potential Market Volatility: The tech sector, particularly social media, is subject to rapid shifts in technology, user preferences, and regulatory environments. Snap's stock may experience heightened volatility as it navigates these changes, making it a potentially risky bet for investors seeking stability.

Investment Strategy:

Given these considerations, maintaining a hold position allows investors to benefit from Snap's potential upsides while mitigating risks associated with its volatile revenue streams and competitive challenges. Investors should closely monitor the company’s quarterly performance, particularly in terms of user growth and revenue per user, and stay updated on industry trends that might impact Snap’s market position. This cautious approach will enable investors to make more informed decisions based on emerging market dynamics and Snap's strategic responses.

That's TradingNEWS