Financial Performance - Is Alphabet NASDAQ:GOOG a Buy ?

Detailed Insights into NASDAQ:GOOG's Market Valuation, Revenue Growth, and Innovative Investments for Future Growth | That's TradingNEWS

NASDAQ:GOOG Financial Overview

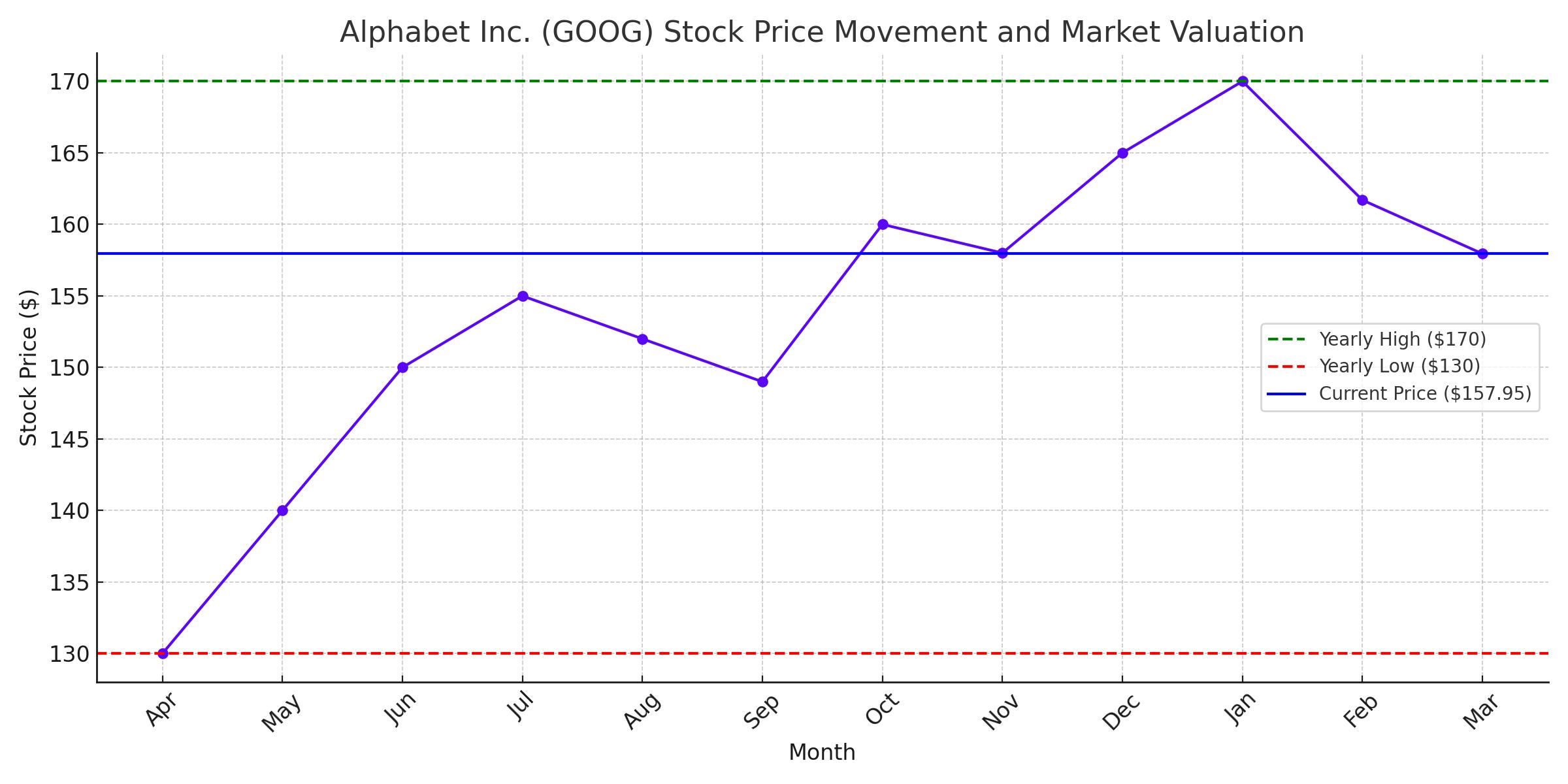

Alphabet Inc. (NASDAQ:GOOG) recently closed at $157.95, marking a decrease of 1.96% from the previous session. This movement is in contrast to its previous close of $176.88, demonstrating the volatile nature of tech stocks in the current economic landscape. Over the last year, Alphabet's stock has oscillated between a low of $104.50 and a high of $161.70, reflecting the broader market fluctuations and investor sentiments influenced by global economic conditions.

Comprehensive Valuation Metrics

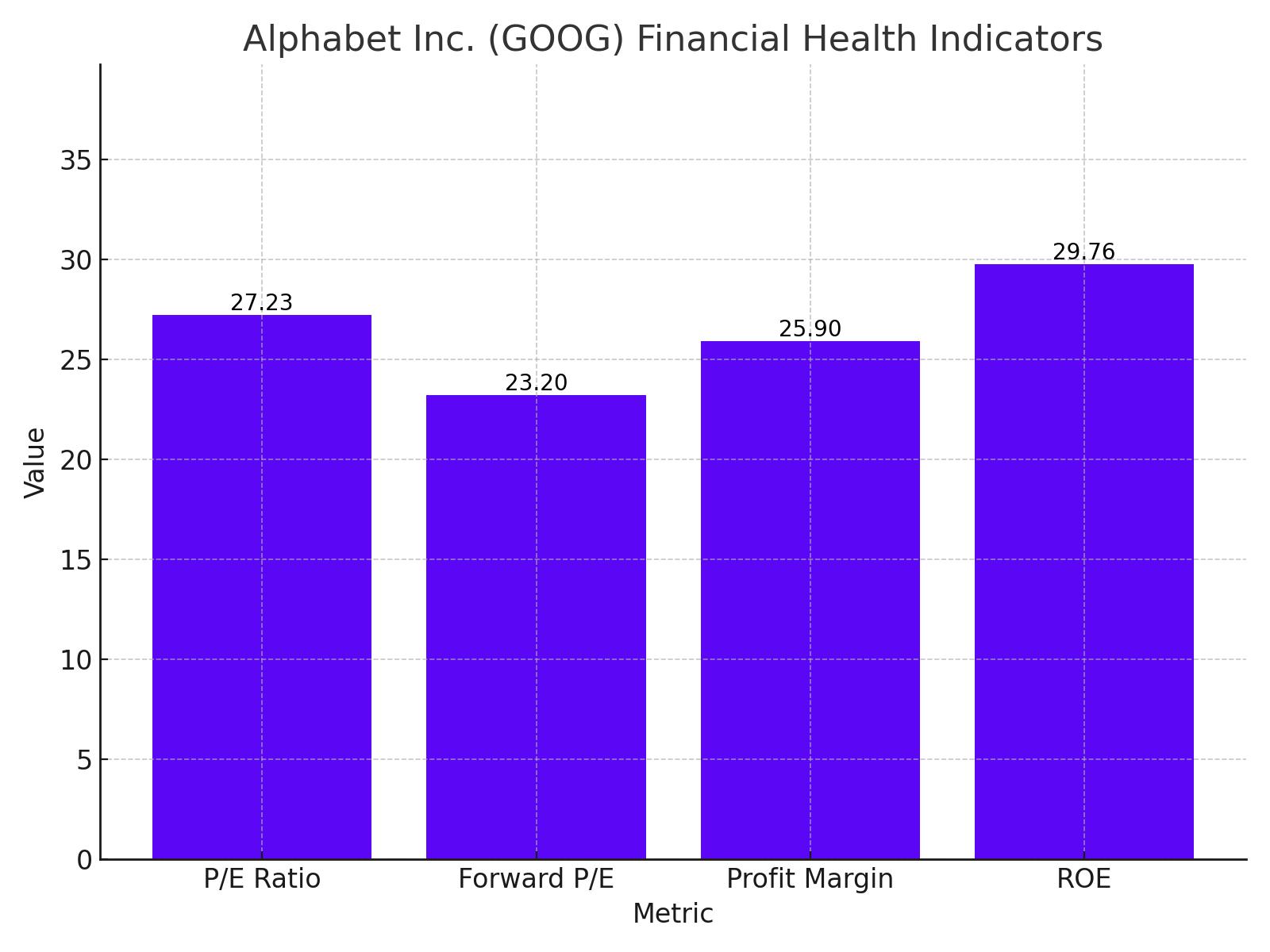

As of the most recent data, Alphabet boasts a market capitalization of approximately $1.95 trillion. This valuation is supported by a price-to-earnings (P/E) ratio of 27.23 and a forward P/E that suggests a bullish sentiment at 23.20. The enterprise value stands at $1.87 trillion, which includes total debt and subtracts cash on hand, indicating the company's actual takeover price.

Performance Metrics and Market Impact

Alphabet has demonstrated robust profitability with a profit margin of 25.90% and an impressive return on equity (ROE) of 29.76%. These figures are critical as they highlight the company's efficiency in converting its investments into profits. For a tech giant like Alphabet, maintaining a high ROE and profit margin is indicative of its strong market position and operational excellence.

Revenue Streams and Growth Projections

In the most recent quarter ending March 31, 2024, Alphabet reported revenue of $318.15 billion, with a year-over-year quarterly revenue growth of 15.40%. Such growth is pivotal as it showcases the company's ability to increase its sales and market share amid increasing competition and varying consumer preferences.

Liquidity and Capital Resources

Alphabet's total cash reserves are substantial, amounting to $108.09 billion, which provides the company with significant flexibility to pursue new projects, acquisitions, and innovations, particularly in burgeoning fields like artificial intelligence and cloud computing. The company's current ratio of 2.15 indicates healthy short-term liquidity, ensuring it can meet its obligations without financial strain.

Insider Transactions and Shareholder Returns

For potential and current investors, understanding insider transactions offers insights into how those closest to the company view its financial health and future prospects. Alphabet's current setup shows a conservative approach with insider holdings at a minimal 0.02%, which could suggest a varied confidence level internally about the company's future growth trajectory. Details on these transactions can be found on the TradingNews Insider Transactions page.

Future Outlook and Strategic Investments

Alphabet's strategic focus remains heavily tilted towards innovation in artificial intelligence and enhancing its cloud infrastructure, areas that are expected to be pivotal in the tech industry's next growth phase. The company's commitment to these sectors is evidenced by its planned capital expenditures and the aggressive expansion of its cloud services.

Investment Outlook for NASDAQ:GOOG

With Alphabet Inc.'s robust expansion in its advertising and cloud computing segments and its strategic allocation of substantial capital towards share buybacks and dividends, the company showcases a strong financial foundation and a clear intent to enhance shareholder value. These factors underscore a bullish outlook for Alphabet's stock in the near to mid-term.

The initiation of a dividend, coupled with ongoing aggressive share repurchase programs, reflects confidence in sustained cash flows and profitability. However, investors must remain vigilant regarding Alphabet’s adaptability in an ever-evolving technological landscape and its ability to navigate macroeconomic challenges such as fluctuating interest rates and global economic uncertainties.

Considering Alphabet's strategic positioning, continuous innovation, and financial health, the recommendation for NASDAQ:GOOG is a Buy. This advice is based on the company’s consistent performance, potential for growth in key areas of technological advancement, and its proactive efforts to return value to its investors. For real-time updates and deeper insights, investors should monitor Alphabet's performance on platforms like TradingNews Real-Time Chart.

That's TradingNEWS

Disney's Strong Q1 2024 Surpassing Earnings Expectations

Moody's Q1 2024 Financials Exceeding Expectations with Growth

Apple Historic $110 Billion Buyback Post Strong Q2 Results