Bitcoin's Halving: A Comprehensive Market Analysis

Dive into how Bitcoin halving shapes market dynamics, influences economic strategies, and alters investor behaviors in the cryptocurrency landscape | That's TradingNEWS

Impacts of Bitcoin's Halving Event: An In-depth Analysis

Understanding Bitcoin Halving and Its Market Dynamics

Bitcoin halving is a fundamental event that halves the rate at which new bitcoins are created and entered into circulation, an event that occurs approximately every four years. This is a core part of Bitcoin's economic model, based on controlled supply, which mimics the extraction of gold or other precious resources from the earth. The most recent data confirms that we are approaching the fourth Bitcoin halving, with the mining reward set to decrease from 6.25 BTC to 3.125 BTC. Historically, such events have led to significant bullish runs in the cryptocurrency market due to the decreased supply of new bitcoins and subsequent increased scarcity.

Historical Performance and Current Expectations

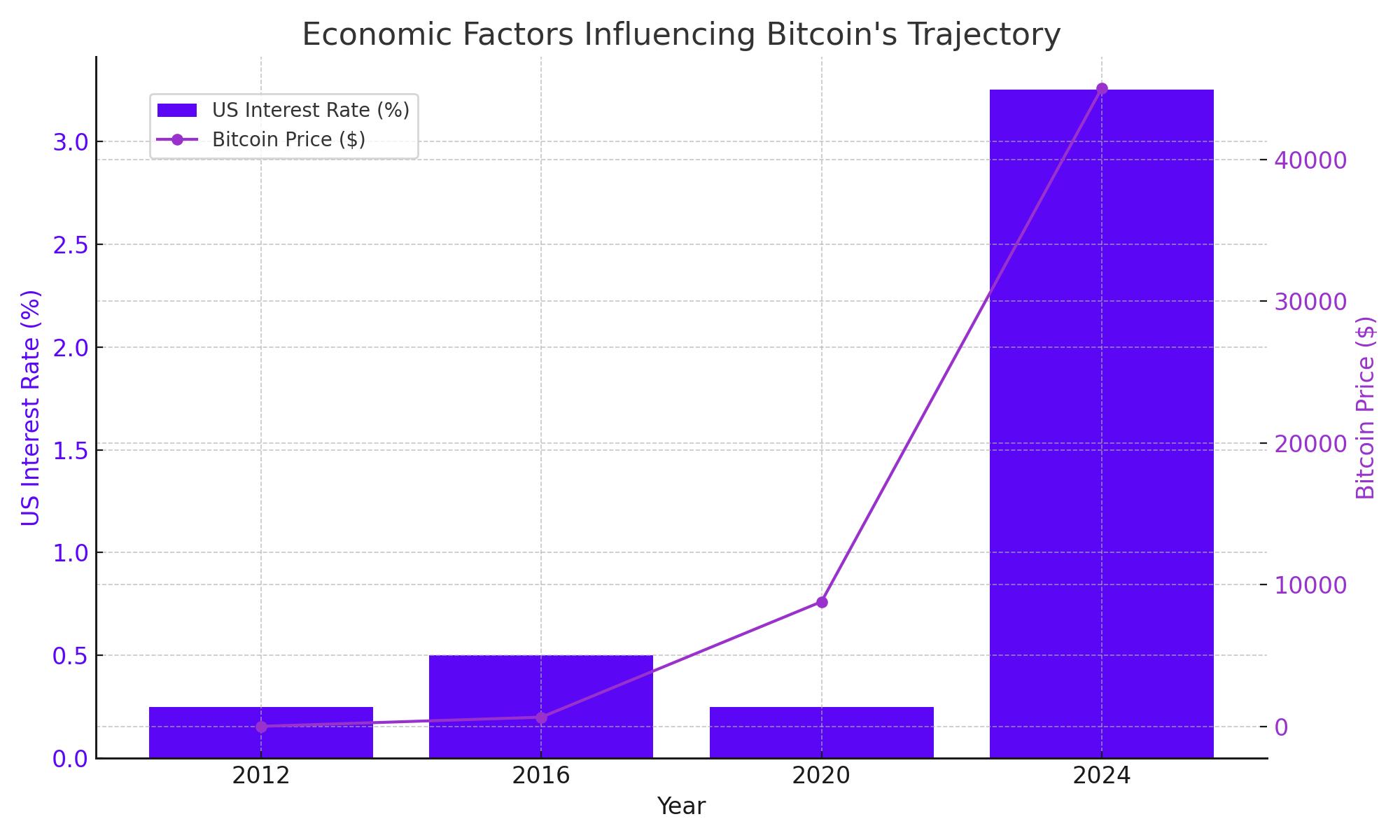

Previous halvings in 2012, 2016, and 2020 have all led to substantial increases in Bitcoin's price, driven by heightened demand amid dwindling new supply. However, this upcoming halving could diverge from past trends due to several unique factors currently influencing the market. Bitcoin is already trading close to record highs, and the market dynamics have evolved with increased institutional participation and broader economic factors at play.

Economic Context and Its Influence on Bitcoin's Trajectory

The economic landscape has shifted significantly since the last Bitcoin halving. The U.S. Federal Reserve's shift towards higher interest rates to combat inflation has altered investment strategies across the board. Higher interest rates have made fixed-income assets like U.S. Treasuries more attractive compared to riskier assets like cryptocurrencies, potentially dampening the bullish impact of the halving. Moreover, the global economic recovery from the pandemic has been uneven, influencing discretionary spending and investment in cryptocurrencies.

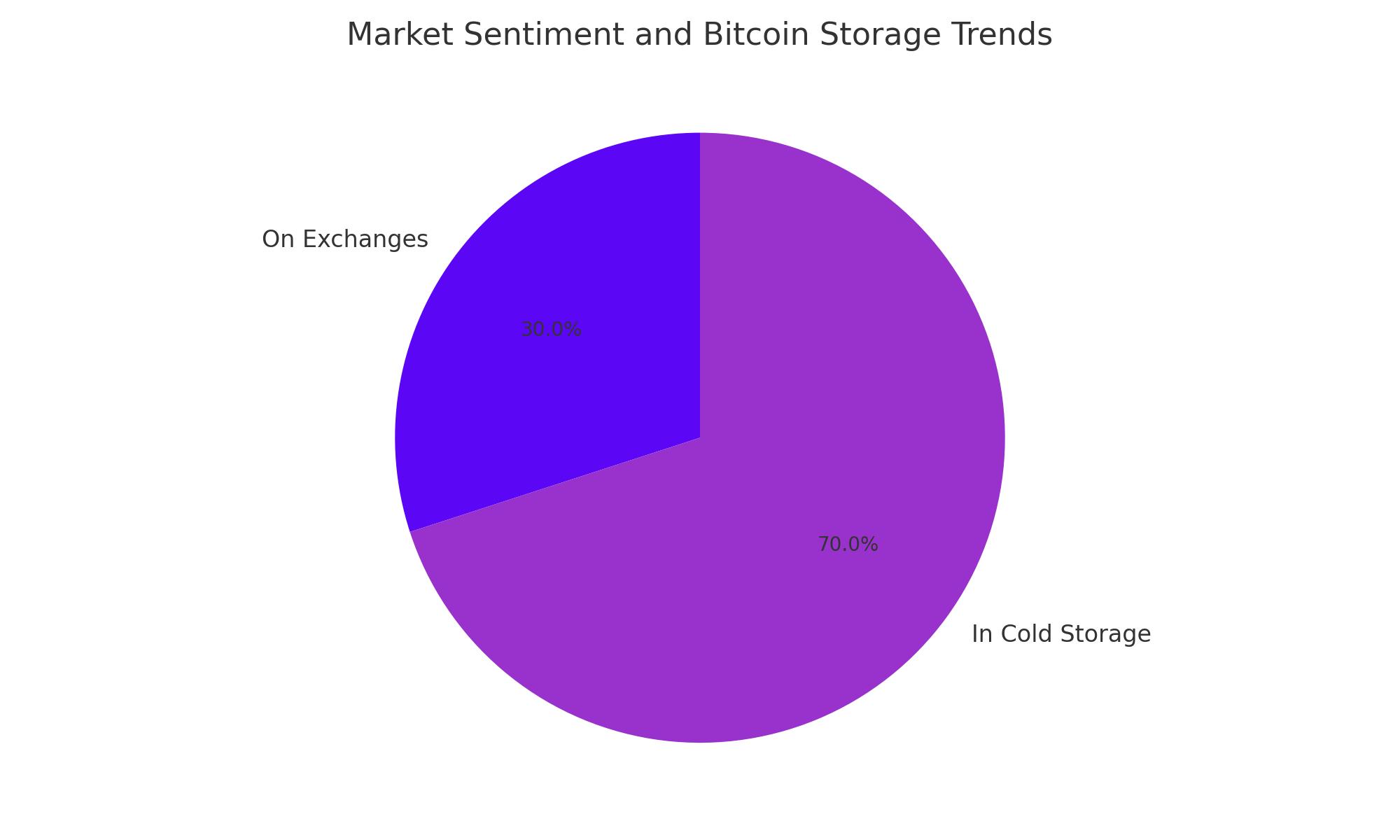

Market Sentiment and Investor Behavior

Leading up to the halving, there's a notable trend in Bitcoin transactions and storage behaviors that suggests investors are anticipating a price increase. A significant amount of Bitcoin has been moved off exchanges and into cold storage, indicating that many expect to hold long-term rather than sell in the immediate post-halving period. This behavior mirrors the actions observed before the 2020 halving, which preceded a significant price rally.

However, it's also crucial to acknowledge that some long-term holders are taking advantage of the higher prices to realize gains, which could increase selling pressure around the halving event. This sell-off could temper short-term gains but may not necessarily impact the long-term bullish trend expected from decreased supply.

Regulatory and Market Developments

Regulatory developments have also provided mixed signals. On one hand, the approval of Bitcoin ETFs in the U.S. and Hong Kong has provided a bullish sentiment by facilitating easier access to Bitcoin for retail and institutional investors. On the other hand, the European Union's regulatory environment remains restrictive for crypto ETFs, potentially limiting participation from a significant investor base.

Technological Innovations and Bitcoin's Network Health

From a technological standpoint, Bitcoin continues to see improvements in network security and efficiency. The introduction of new token standards and enhancements in transaction privacy and speed could bolster Bitcoin's appeal. However, the network must continue to balance scalability with security, especially as the stakes grow higher with increased valuation.

Bitcoin's Price Outlook and Investment Implications

Given the current context, the upcoming Bitcoin halving presents a complex but potentially rewarding investment landscape. While historical patterns suggest a bullish outcome, macroeconomic factors, regulatory developments, and market sentiment could result in a more nuanced impact on Bitcoin's price.

Investment Outlook: Cautiously Optimistic

Investors should consider a diversified approach, weighing Bitcoin's long-term potential against the immediate economic and regulatory risks. Monitoring the market's reaction to the halving, regulatory changes, and broader economic indicators will be crucial in navigating the post-halving period.

As the cryptocurrency market continues to mature, the impacts of events like halving will likely become more nuanced, reflecting a broader array of influencing factors beyond simple supply and demand dynamics. This complexity underscores the importance of staying informed and agile in a rapidly evolving investment landscape.

That's TradingNEWS

Read More

-

GDX ETF at $88 While Gold Tests $4,400: Are Gold Miners Poised for $100?

19.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF Boom: XRPI at $10.94 and XRPR at $15.49 as XRP-USD Clings to the $1.80–$1.90 Zone

19.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovering Near $3.92 As Weather, LNG And Storage Collide

19.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen Near 157 as BoJ’s 0.75% Rate Hike Backfires on the Yen

19.12.2025 · TradingNEWS ArchiveForex