Cocoa Market 2024 - Rising Prices and Their Chocolate Industry Ripple Effects

Understanding the Future: How Climatic Changes, Supply Deficits, and Industry Strategies Shape the Cocoa Market Landscape | That's TradingNEWS

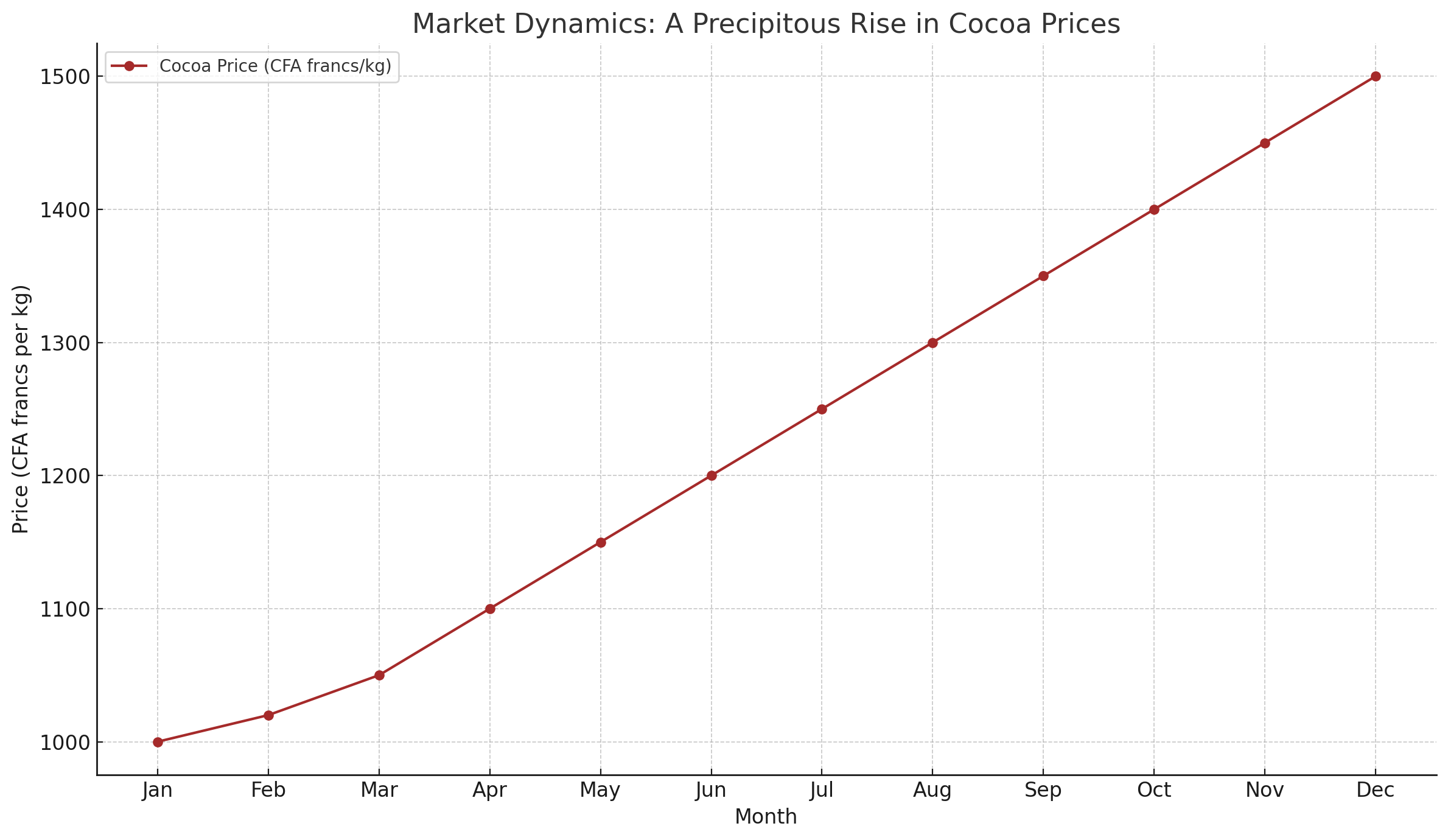

Market Dynamics: A Precipitous Rise

The epicenter of this narrative is the Ivory Coast, which alongside Ghana, architects over 70% of the world's cocoa supply. In a move reflective of the broader market volatility, the Ivory Coast has proposed an increase in the official cocoa farmgate price to 1,500 CFA francs ($2.47) per kg, a significant jump from the current 1,000 CFA. This adjustment is a direct response to the tripling of cocoa prices over the last year, a period marked by disease outbreaks and adverse weather conditions leading to a third successive global market deficit.

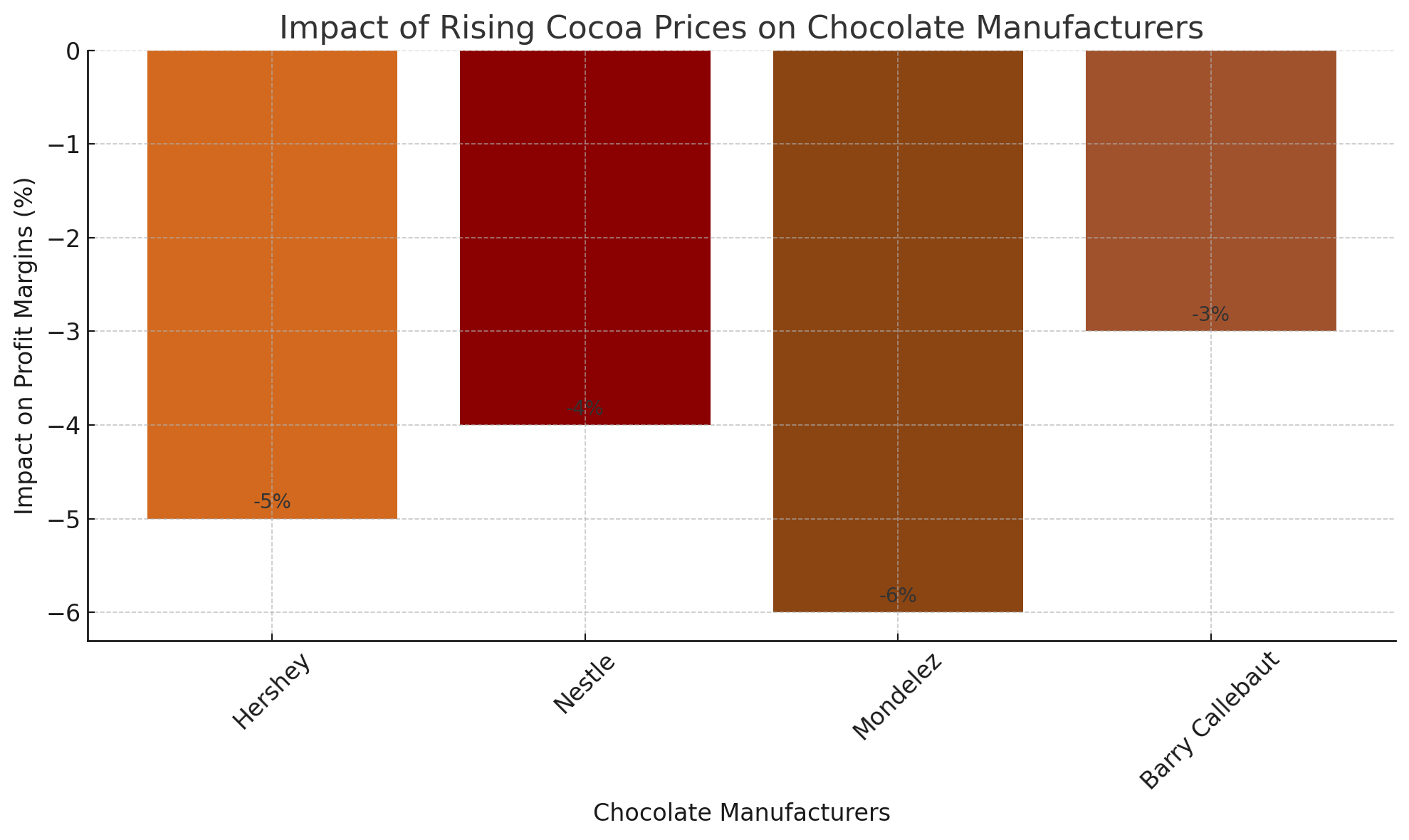

The Chocolate Industry at a Crossroads

For confectionery behemoths like Hershey, Nestle, Mondelez, and Barry Callebaut, the repercussions of these soaring costs are multifaceted. Hershey's, for instance, has candidly addressed the potential impact of record cocoa prices on its earnings growth, highlighting a pervasive industry concern over shrinking profit margins. The ramifications extend to the retail shelf, where consumers might encounter steeper prices, smaller chocolate bars, or compromised quality due to reformulations aimed at cost management.

A Glimpse into Future Valuations and Forecasts

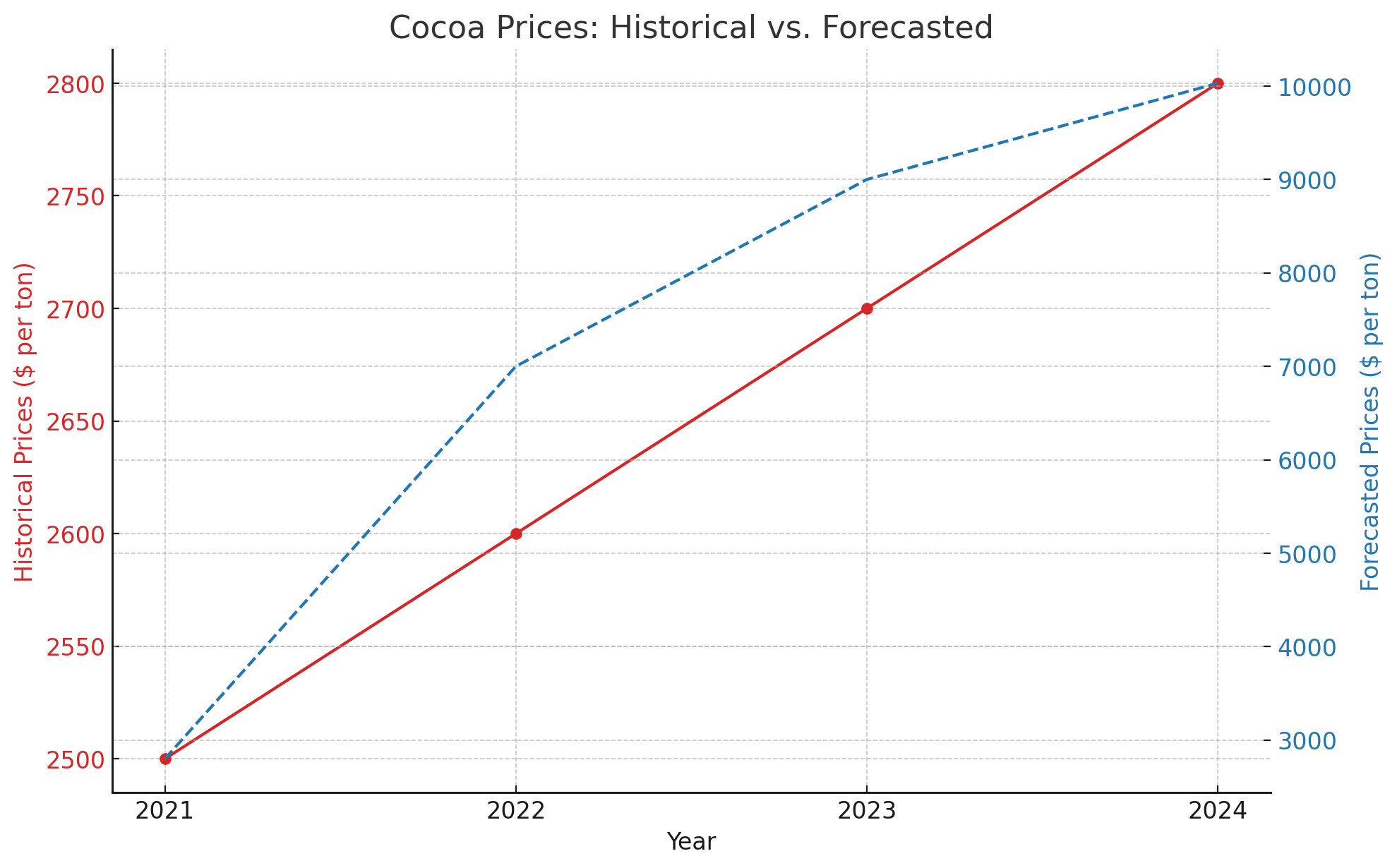

The trajectory of cocoa prices from 2021 to 2023 illuminates the widening gap between supply and demand. The International Cocoa Organization (ICCO) reported a 10.4% increase in global cocoa bean output for the crop year beginning October 2020, a stark contrast to the demand slump induced by the COVID-19 pandemic. This mismatch set the stage for the price escalations that would follow.

The 2021/2022 cocoa season saw an 8% drop in output to 4.82 million tons against a grinding demand of 4.99 million tons, yielding a deficit of 214,000 tons. This deficit, coupled with adverse weather and disease in key producing regions, propelled cocoa prices on the New York Mercantile Exchange (NYMEX) and London futures to close the year at around $2,600 per ton and more than £2,000/ton, respectively.

2024 and Beyond: What Lies Ahead

Looking ahead, the cocoa market is poised at a critical juncture. Analyst forecasts for 2024 peg London cocoa futures at an average of £4,687.80/ton, with NYMEX prices anticipated to reach $10,030.66/ton by the end of Q2. These projections reflect a confluence of factors including weather conditions, West African production outputs, and potential increases from other cocoa-producing nations.

The 2023/2024 season is expected to witness a pronounced deficit, further intensifying the upward pressure on prices. ICCO estimates a shortfall of 374,000 tons, driven by a projected 10.9% fall in global cocoa output to 4.45 million tons. This anticipated deficit underscores the structural issues plaguing the industry, from aging trees to the persistent challenges of disease management and climatic variability.

Adapting to the New Normal

In response to these challenges, chocolate manufacturers are exploring a variety of strategies, from product reformulation to diversifying their cocoa supply sources. The trend towards using fillers and alternative ingredients to mitigate costs, however, raises questions about the long-term sustainability of these practices and their impact on product quality and consumer perception.

Navigating Uncertainty: A Strategic Imperative

As the cocoa market navigates this period of unprecedented volatility, the path forward for industry stakeholders is fraught with uncertainty. The strategic decisions made today—from pricing strategies to supply chain management—will invariably shape the future landscape of the chocolate industry. Amidst these dynamics, the resilience, adaptability, and innovation of cocoa producers, chocolate manufacturers, and consumers will be tested as never before.

That's TradingNEWS