Impact of Inflation and Central Bank Moves on the U.S. Dollar and Euro

Exploring the Dynamic Relationship Between Inflation Reports, Federal Reserve Strategies, and the European Central Bank’s Monetary Policies on Currency Valuations | That's TradingNEWS

The U.S. Dollar's Recent Slip: A Momentary Blip or a Sign of Things to Come?

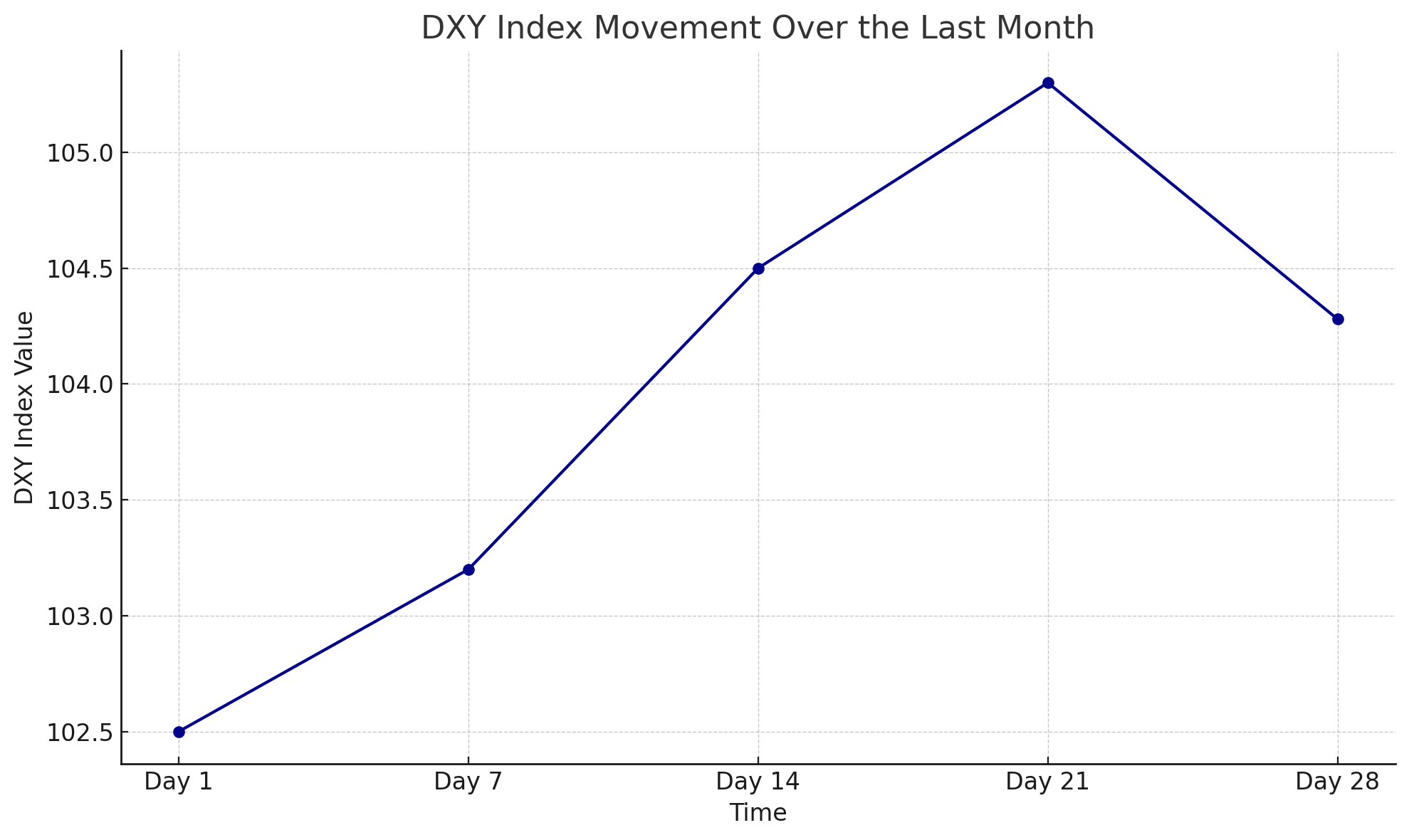

The U.S. Dollar, as denoted by the DXY index, experienced a slight setback, ending a triumphant three-week surge that saw it reach 5-month peaks. The slip of 0.24% to settle at 104.28 was predominantly due to the euro gaining strength. However, experts caution against hastily dismissing the dollar's potential for recovery. Upcoming U.S. inflation data could play a pivotal role, especially if it indicates a stalling in disinflation efforts, potentially reigniting the dollar's ascendancy.

Anticipation Builds Around March's U.S. Inflation Report

Forecasters predict a 0.3% rise in the headline CPI for March, potentially elevating the annual rate to 3.4%. Although the core gauge is expected to mirror this monthly increase, its annual projection might show a slight deceleration. Such figures are critical, as they could dictate the Federal Reserve's monetary maneuvers in the upcoming months.

Federal Reserve's Stance: A Hawkish Horizon?

Recent remarks from Fed Chair Powell emphasize a steady course, hinting at potential rate adjustments based on economic projections. However, diverging opinions within the Fed signal a complex decision-making landscape, particularly with inflation's trajectory remaining uncertain. Notably, Fed Governor Michelle Bowman and Fed Dallas President Lorie Logan express caution, suggesting that premature rate cuts might be off the table if inflation pressures persist.

Implications of the Inflation Outlook on Fed Policy

Should inflation trends deviate unfavorably, the Fed might adopt a more hawkish stance, supported by a robust labor market. This could delay anticipated rate cuts, altering the financial terrain for investors and currency markets alike.

EUR/USD Dynamics: Technical and Fundamental Forces at Play

The EUR/USD pair showcased resilience, bouncing off significant support levels and overstepping moving averages. This rebound, while promising, faces challenges, notably from the European Central Bank's (ECB) policy direction and upcoming U.S. inflation data. A stronger-than-expected CPI reading could bolster the dollar, while a softer figure might lend strength to the euro, adding layers to the pair's technical landscape.

GBP/USD and USD/JPY: Navigating Uncertainty

Both GBP/USD and USD/JPY pairs present unique scenarios influenced by broader economic indicators and central bank policies. Technical analyses suggest potential volatility, with key resistance and support levels offering traders short-term directional cues amidst prevailing economic uncertainties.

Forward-Looking Analysis: A Week of Watchful Waiting

As traders and investors gear up for a week filled with crucial economic reports, the currency markets stand at a crossroads. The forthcoming U.S. inflation data, alongside the ECB's monetary policy decisions, could significantly impact currency valuations, directing the next wave of market movements.

In conclusion, while the U.S. dollar's recent dip might appear as a temporary setback, the underlying economic indicators and central bank narratives paint a complex picture. As the financial world awaits pivotal data releases, the interplay between inflation trends, central bank policies, and market sentiment will undoubtedly shape the currency landscape in the weeks to come.

That's TradingNEWS