Morgan Stanley Q1 2024 Financial Performance

In-depth Analysis of Morgan Stanley's Revenue Streams, Market Strategy, and Investment Potential as it Prepares for a Dynamic 2024 | That's TradingNEWs

In-Depth Analysis of Morgan Stanley (NYSE:MS) Amid Evolving Financial Landscape

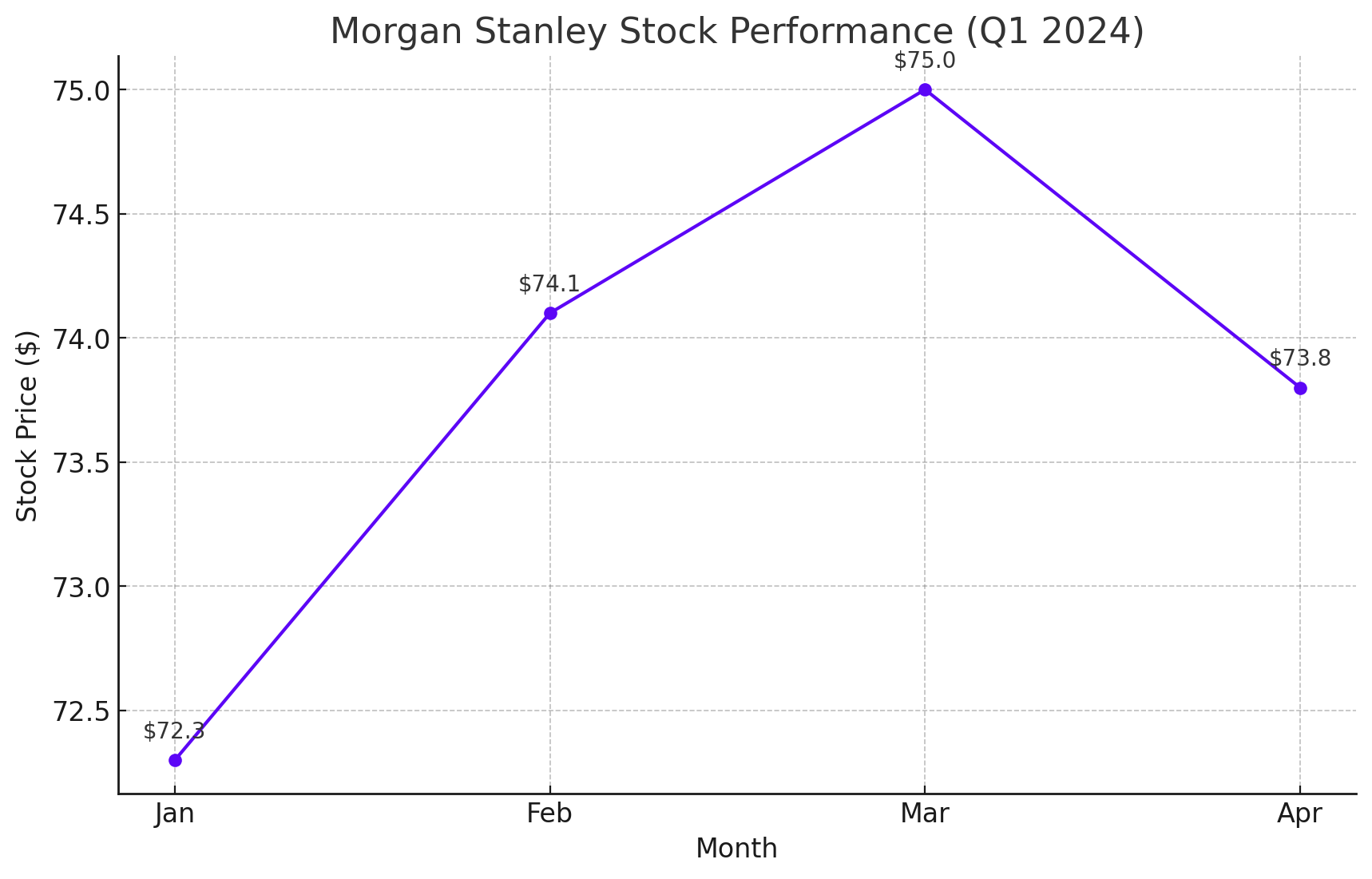

Market Position and Recent Stock Performance

NYSE:MS has demonstrated resilience and adaptability in a challenging economic environment characterized by persistently high interest rates expected throughout 2024. As an investment bank and wealth management firm, Morgan Stanley differentiates itself from traditional banks, focusing less on standard banking operations and more on high-value investment services. This unique positioning helps the firm navigate market fluctuations more effectively.

Comprehensive Q1 Financial Overview

Morgan Stanley reported remarkable financial results for Q1 2024, with net revenues reaching $15.1 billion, a 4% increase year-over-year and a significant beat against the analysts' consensus of $14.3 billion. This top-line success was primarily driven by robust performances in investment banking and trading revenues amidst volatile market conditions.

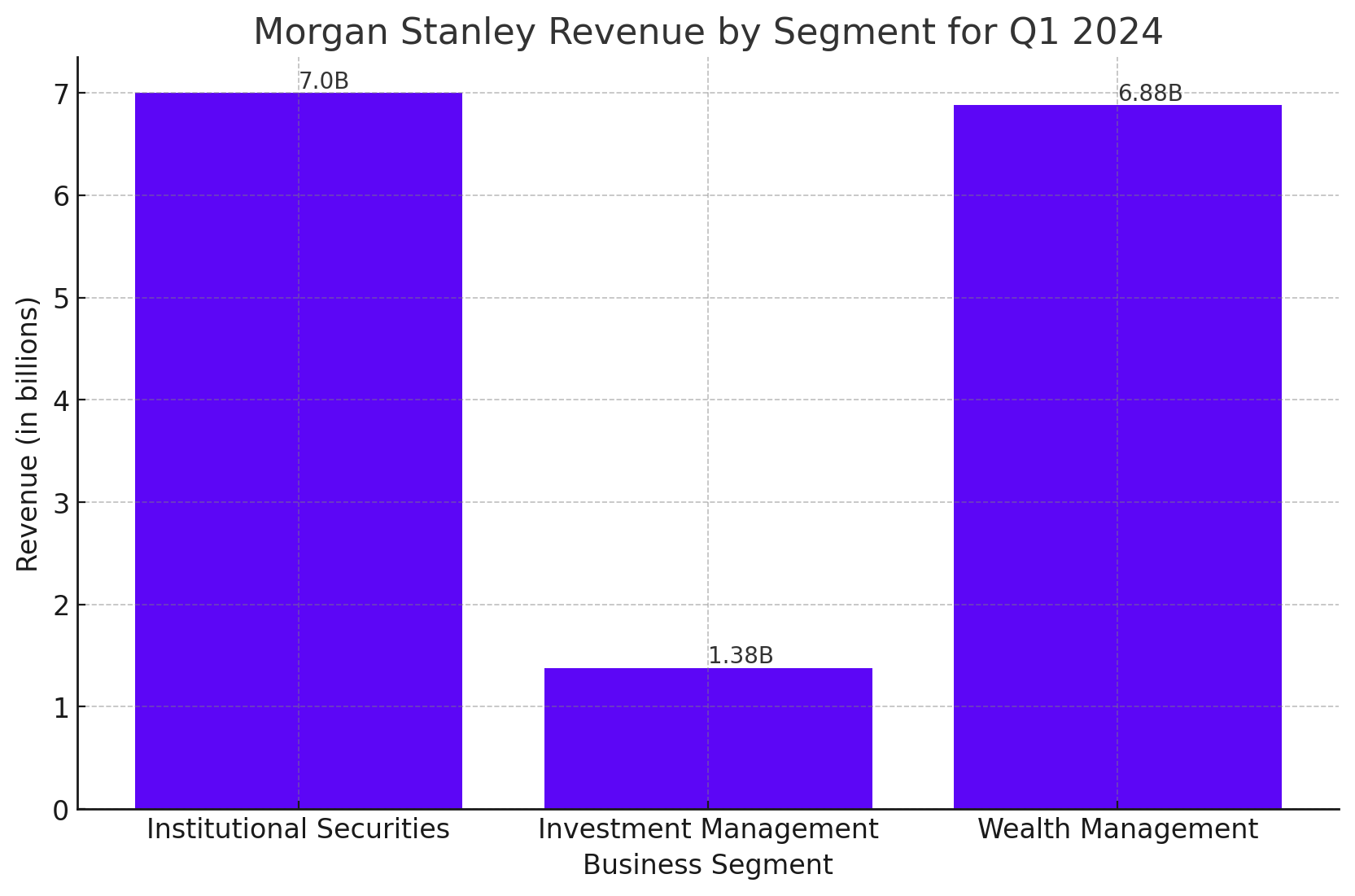

Detailed Segment Analysis

Institutional Securities

The Institutional Securities segment witnessed a revenue increase to $7.0 billion, slightly up by $0.22 billion from the previous year. This growth was attributed mainly to strong underwriting and equity performance, despite a slight downturn in fixed income by $90 million.

Investment Management

This segment also saw positive movement, with revenues climbing to $1.38 billion from $1.29 billion the previous year, bolstered by higher asset management fees and an increase in assets under management, reflecting a robust market in Q1.

Wealth Management

Morgan Stanley's Wealth Management division reported a revenue increase of $330 million to $6.88 billion. This rise was driven by a surge in asset management revenues and transactional revenue, although net interest income saw a slight decline due to the challenging interest rate environment.

Operational Efficiency and Profitability

Morgan Stanley's consolidated pre-tax margins stood strong at 29%, showcasing efficient management of both compensation and non-compensation expenses. Net income escalated to $3.4 billion, or $2.02 per share, up from $3.0 billion, or $1.70 per share in the previous year, highlighting the firm's capacity to enhance shareholder value amidst varying market pressures.

Forward-Looking Statements

With the backdrop of high, sustained interest rates and a slow pace of rate cuts, Morgan Stanley is expected to continue its strong performance, particularly in its core areas of investment banking and wealth management. The firm's adaptability to market conditions and strategic management of its portfolio positions it well for future growth.

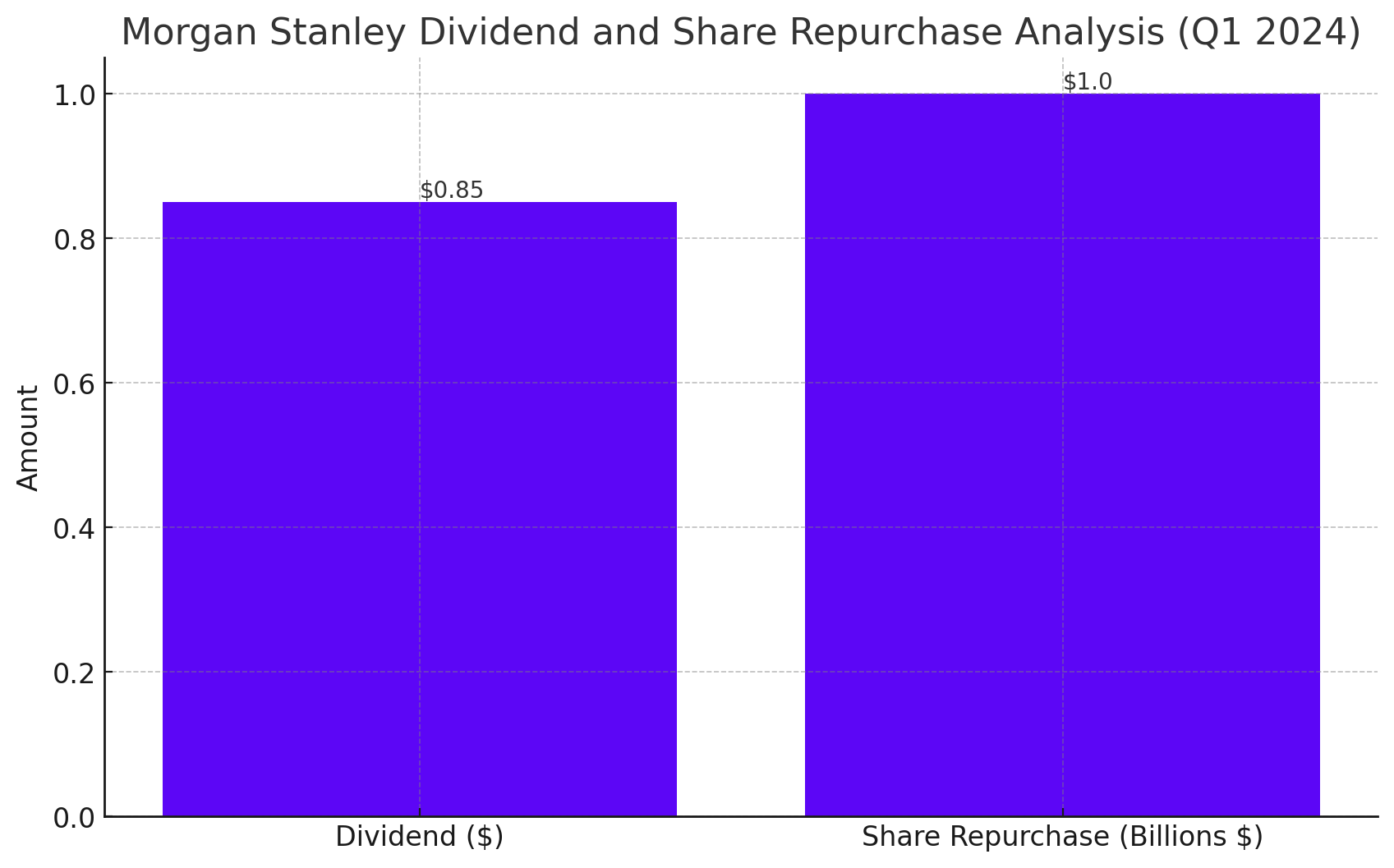

Dividend and Share Repurchase Analysis

Morgan Stanley's commitment to returning value to shareholders is evident from its dividend increase to $0.85 per share and the repurchase of $1.0 billion of its common stock during the quarter. These actions not only enhance shareholder returns but also reflect confidence in the firm’s financial health and stability.

Strategic Movements and Regulatory Considerations

Despite facing probes regarding compliance with KYC laws, Morgan Stanley's wealth management arm remains a powerhouse, contributing significantly to its revenue stream. The firm's proactive measures in acquiring entities like E*Trade and expanding its asset management capabilities underscore its strategic intent to dominate the wealth management space.

Investment Recommendation: Buy on Weakness

Given Morgan Stanley's robust financial health, strategic market positioning, and strong Q1 performance, the stock presents a compelling buy opportunity, particularly if prices dip into the $70's range. Long-term investors should consider accumulating shares to leverage both capital appreciation and dividend growth potential.

For real-time analysis and detailed stock insights, investors can refer to Morgan Stanley's stock profile on Trading News and stay updated on insider transactions here.

Conclusion

Morgan Stanley (NYSE:MS) stands out as a robust player in the investment banking and wealth management sectors, poised for continued success in 2024. With strategic initiatives in place and a strong track record of financial performance, Morgan Stanley is well-equipped to navigate the complexities of the current financial landscape, making it a solid choice for discerning investors.