Market Dynamics: The Impact of Middle Eastern Tensions on Oil Prices

Introduction to Current Market Trends

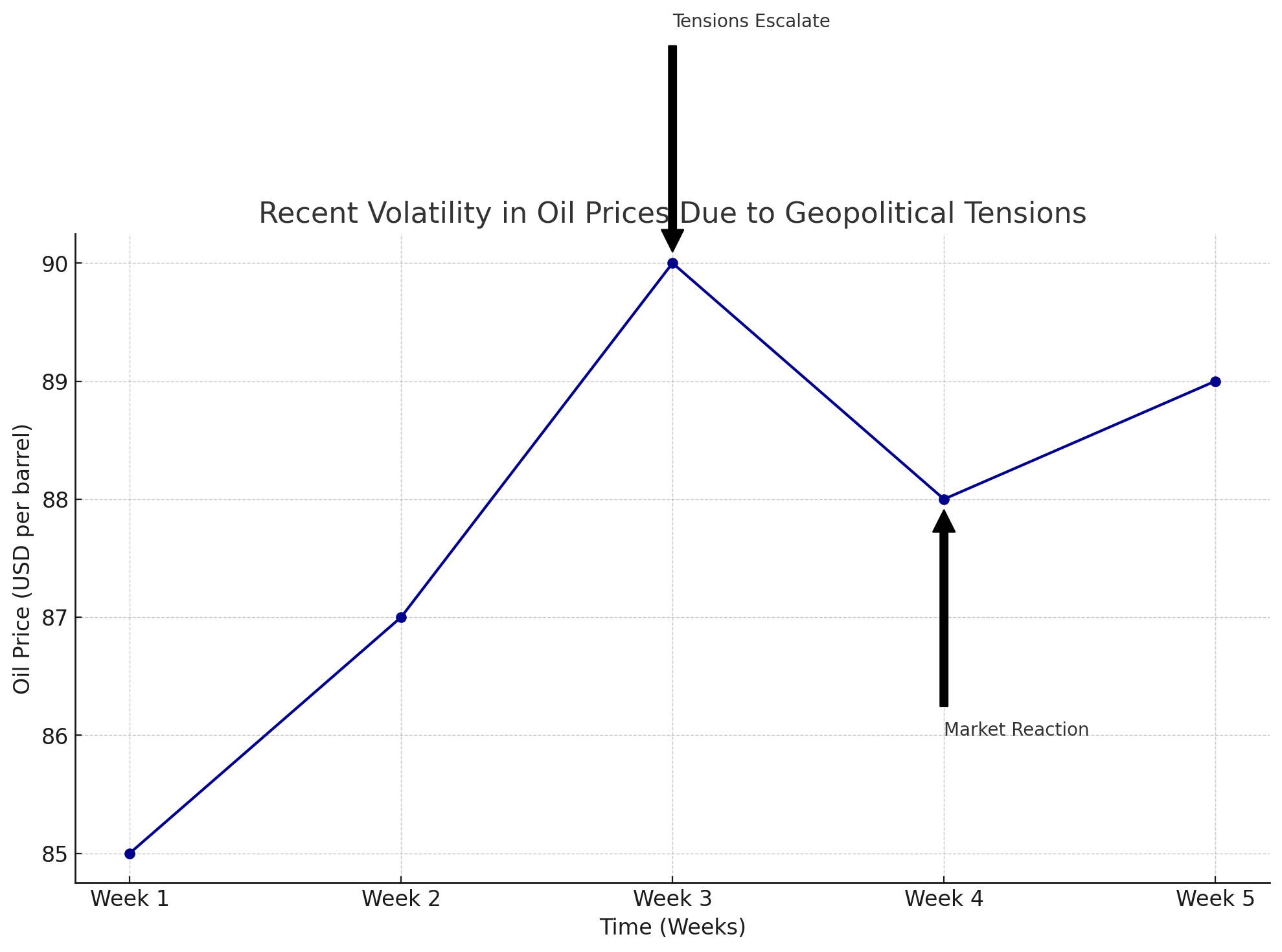

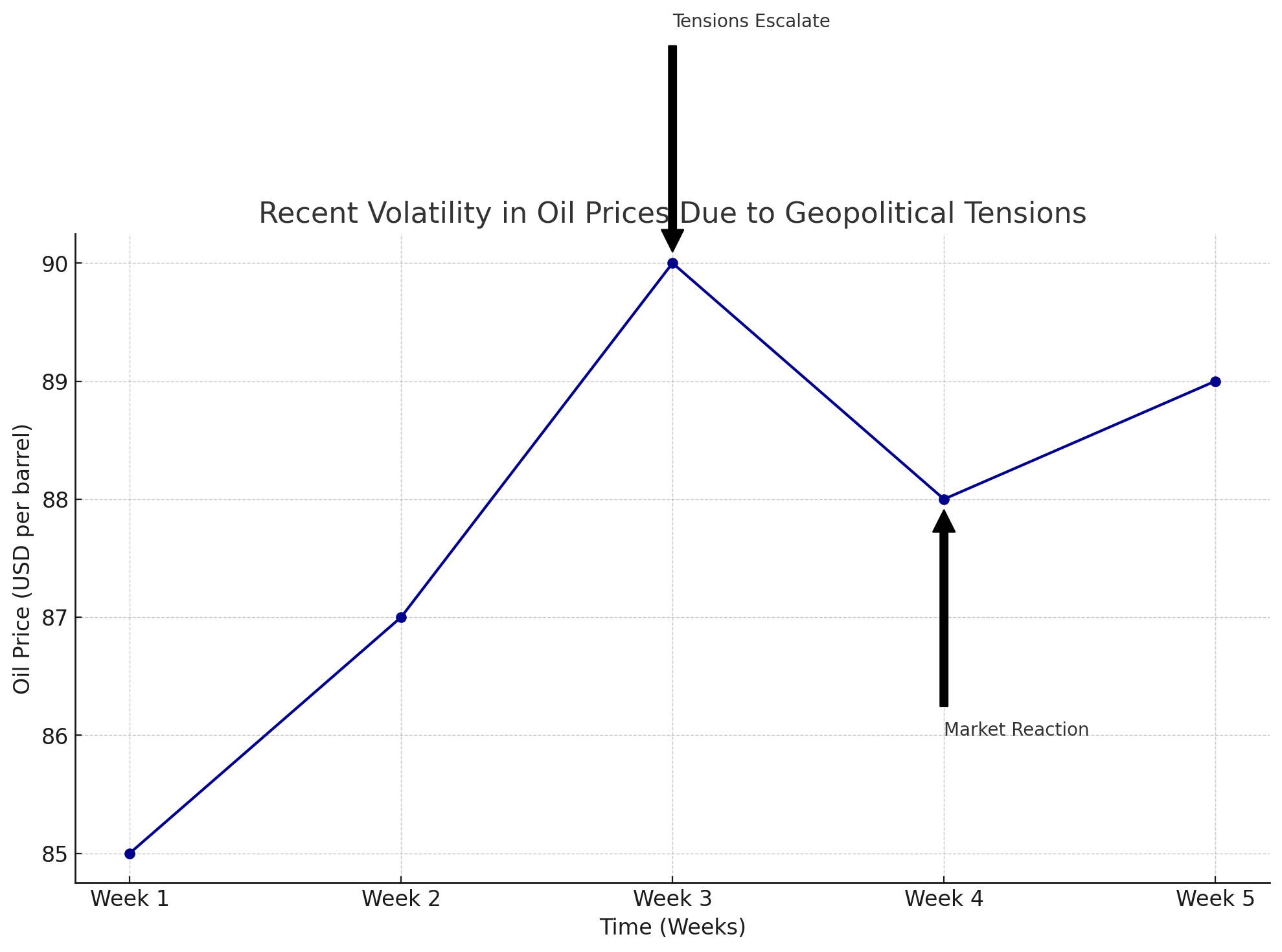

In recent weeks, the oil market has exhibited significant volatility, influenced heavily by geopolitical tensions in the Middle East. Notably, the escalation following Iran's military strike against Israel has intensified market movements, drawing keen interest from investors and analysts globally.

Analysis of Crude Oil Options Trading

Last week marked an unprecedented surge in trading volumes for crude oil options. Investors traded over 1 million call options on Brent crude, with particular focus on the $95 and $100 strike prices. This surge in options trading suggests a strategic bet on oil reaching $100 per barrel in the near future. Such activity typically reflects market sentiments anticipating higher prices, possibly driven by geopolitical risks that could disrupt supply lines.

The Strategic Role of Futures and Options

Futures and options markets play a crucial role in commodities trading, providing investors with mechanisms to hedge against potential price spikes. For instance, the notable increase in call options trading—options that allow the purchase of oil at predetermined prices—indicates a hedge against rising oil prices. This trend is supported by recent data showing that options for $100 and $110 per barrel are the most actively held positions over the next year.

Impact of Geopolitical Events on Oil Prices

The recent attack by Iran on Israeli territory initially seemed to set the stage for higher oil prices, given the potential for escalating conflict and the involvement of major oil-producing nations. However, the actual market response was more muted than anticipated. Despite the severity of the attack, Brent crude prices slightly declined to below $90 per barrel immediately following the incident. This counterintuitive reaction could be attributed to several factors, including advanced market preparation and strategic hedging by oil producers.

The Role of OPEC and Production Strategies

In response to the fluctuating market, OPEC's role becomes critically important. Analysts from Goldman Sachs and other institutions noted that OPEC, with a spare capacity of 6 million barrels per day, possesses significant influence over global oil prices. Decisions made by OPEC and its allies regarding production levels can either amplify or mitigate the impact of geopolitical tensions on oil prices.

Market Predictions and Future Trends

Looking ahead, the potential for further escalation or de-escalation in the Middle East remains a pivotal factor in forecasting oil prices. Should tensions relax, we might see a gradual decrease in the geopolitical risk premium currently factored into oil prices. Conversely, any intensification of conflict could push prices towards, or even beyond, $100 per barrel, reflecting a direct impact on global supply chains and market stability.

Strategic Implications for Investors

Investors and market strategists must remain vigilant, considering both the immediate impacts of geopolitical events and the broader economic implications. The strategic use of options and futures markets as hedging tools is essential in navigating this high-stakes environment. Additionally, monitoring OPEC's production decisions and the ongoing geopolitical developments will be crucial for making informed investment decisions.

Conclusion

In conclusion, while the immediate market reaction to recent Middle Eastern events might suggest a subdued impact, the underlying volatility and potential for sudden changes underscore the complexity of global oil markets. Investors should maintain a strategic approach, utilizing derivatives for protection against spikes in oil prices, and stay informed on geopolitical developments that could affect market dynamics.