Can Alphabet (GOOGL) Deliver Over 20% Upside by 2025?

With $192B in ad revenue and surging cloud growth, Alphabet's innovation drives its bright future | That's TradingNEWS

Alphabet Inc. (NASDAQ:GOOGL): A Diversified Giant Poised for Sustained Growth

Google's Core Strength in Search and Advertising

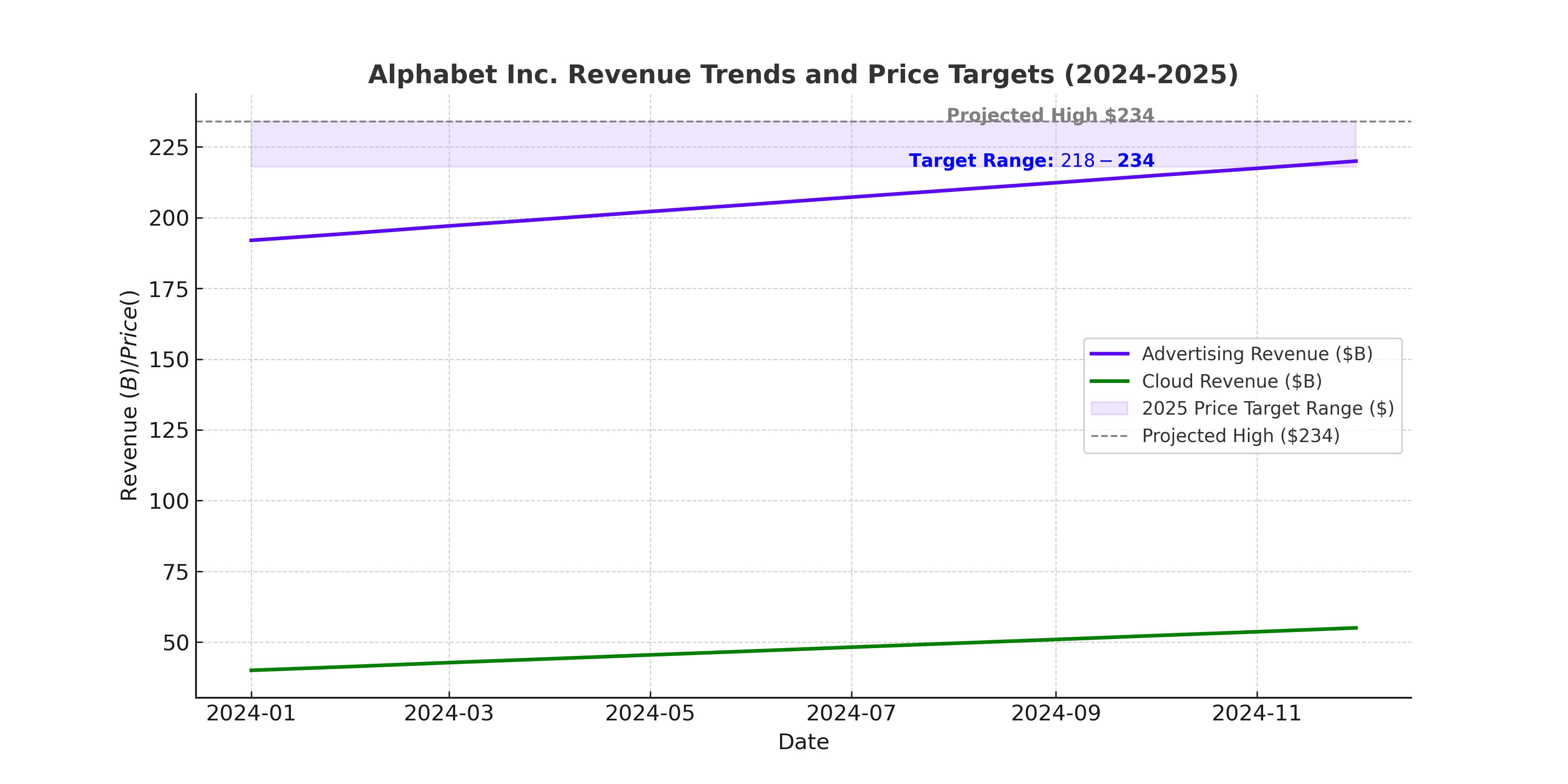

Alphabet Inc. (NASDAQ:GOOGL) remains a dominant force in the digital advertising landscape, generating an impressive $192 billion from its Google Ads segment in the first nine months of 2024 alone. Google Search leads the way, with $144 billion in revenue, bolstered by YouTube Ads at $25.6 billion. Despite facing antitrust scrutiny and increasing competition from Amazon and TikTok, Google's ability to integrate AI into its services, such as AI Overviews and Google Lens, has strengthened its ad-targeting precision and user engagement. These innovations not only maintain Google's relevance but also sustain its 40% operating margin in its Services division, emphasizing the continued resilience of its core business.

Waymo and the Robotaxi Revolution

Waymo, Alphabet's autonomous vehicle division, is establishing itself as a leader in the burgeoning robotaxi market. Currently operational in Phoenix, San Francisco, and Los Angeles, Waymo has delivered over 150,000 fully autonomous rides weekly across a 500-square-mile service area. Its progress is evident in a remarkable 5 million paid trips in 2024, up from 700,000 in 2023. Valued at $45 billion following a $5.6 billion fundraising round, Waymo is closing in on profitability, reducing operating losses in Alphabet's "Other Bets" segment to $1.12 billion in Q3 2024 from $2.3 billion in Q2. With the robotaxi industry set to grow exponentially, Waymo’s early success positions it as a major contributor to Alphabet's diversification efforts.

Google Cloud's Rapid Growth and Profitability

Google Cloud has emerged as Alphabet's fastest-growing segment, with Q3 2024 revenue surging by 35% YoY to $11.35 billion. The unit achieved a 17% operating margin, reflecting its improving efficiency. This performance underscores the increasing demand for AI-driven cloud solutions and positions Google Cloud as a credible competitor to Amazon Web Services and Microsoft Azure. With further investments in AI infrastructure and a focus on differentiation, Google Cloud's growth trajectory remains robust, contributing significantly to Alphabet's diversification strategy.

Quantum Computing: A Long-Term Bet

Google's advancements in quantum computing, highlighted by the introduction of its Willow processor, mark a significant milestone in the tech giant's innovation pipeline. By achieving exponential reductions in qubit errors, Google moves closer to building a scalable quantum computer. While commercialization remains years away, the potential applications in drug discovery, financial modeling, and AI algorithm enhancement promise substantial long-term revenue opportunities. Google's strategy to control the quantum computing technology stack mirrors NVIDIA's success in accelerated computing, underscoring its commitment to leveraging this nascent technology for future growth.

Addressing Legal Risks and Antitrust Challenges

Alphabet faces mounting antitrust scrutiny, with the DOJ proposing remedies that could disrupt its search business. However, Google's proactive counterproposal, which includes adjustments to its distribution agreements, aims to mitigate potential revenue and operational impacts. Analysts suggest these measures could preserve Alphabet's revenue base while potentially increasing operating income by over 10%. Given the historical difficulty of enforcing regulatory breakups, Alphabet's legal risks may be overstated, especially as the company actively engages in solutions to address government concerns.

Financial Resilience and Shareholder Value

Alphabet's financial health remains a cornerstone of its investment appeal. With $93.28 billion in cash and short-term investments and a debt-to-equity ratio of just 0.09, the company is well-positioned to navigate economic uncertainties and fund strategic initiatives. Alphabet generated $105.10 billion in cash flow from operations over the trailing twelve months, supporting $56 billion in free cash flow even amid elevated capital expenditures for AI infrastructure. The company returned nearly $70 billion to shareholders through stock buybacks and dividends in 2024, reflecting its commitment to delivering long-term value.

Valuation and Growth Potential

Alphabet trades at a forward P/E ratio of 21.91, significantly lower than its Magnificent Seven peers, positioning the stock as undervalued relative to its growth prospects. Analysts estimate EPS growth at 12.21% in 2025, and a forward PEG ratio of 1.79 suggests room for upside. If Alphabet maintains its median free cash flow margin of 22% and achieves a 15% annual revenue growth rate, its intrinsic value could reach $218 per share. Factoring in potential outperformance in EPS, a fair valuation of $234 by FY2025 appears achievable, offering a compelling case for long-term investors.

Conclusion

Alphabet Inc. (NASDAQ:GOOGL) is a standout investment in the technology sector, offering substantial upside potential of over 20% by 2025, with a projected fair value of $234 per share. Its $192 billion in advertising revenue, rapid cloud growth of 35% YoY, and leadership in AI and autonomous vehicles through Waymo underscore its unmatched innovation and financial stability. Despite legal challenges, Alphabet's adaptability and $56 billion in free cash flow position it for sustained growth. With a forward P/E of 21.91 and diverse growth drivers, Alphabet offers a compelling buy opportunity in a rapidly evolving market.

That's TradingNEWS

Read More

-

Global X Uranium ETF (NYSEARCA:URA) Jumps 93.69% to $51.87 as AI Power Crunch Fuels $5.64B Nuclear Rally

11.10.2025 · TradingNEWS ArchiveStocks

-

XRP-USD Holds $2.73 as Ripple ETF Launches Stall: XRP ETFs Drop Sharply Amid SEC Freeze

11.10.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas (NG=F) Dives 5% to $3.09 as Storage Glut and Warm Weather Sink Demand

11.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen Rallies to 153.06 as Dollar Strength

11.10.2025 · TradingNEWS ArchiveForex