Is SoundHound AI (NASDAQ:SOUN) the Next Big AI Disruptor?

With explosive growth and partnerships across industries, SoundHound is reshaping conversational AI | That's TradingNEWS

SoundHound AI (NASDAQ:SOUN): Revolutionizing Conversational AI with Massive Upside Potential

SoundHound AI (NASDAQ:SOUN) is redefining conversational artificial intelligence, with a clear focus on disrupting industries such as quick-service restaurants (QSRs), automotive, and enterprise sectors. With an addressable market exceeding $100 billion, SOUN is rapidly gaining traction, securing partnerships with 7 of the top 20 QSR brands and deploying its technology in over 10,000 restaurant locations globally. The company’s proprietary AI model, Polaris, underpins this growth, offering unmatched accuracy and efficiency with low hosting costs, establishing a robust competitive moat.

Expanding Presence Across Diverse Sectors

The company’s momentum extends far beyond QSRs. Its automotive division collaborates with leading manufacturers like Stellantis, Kia, and emerging EV companies in China, India, and the Middle East. SoundHound’s multilingual and generative AI capabilities are particularly appealing to global markets, driving adoption in advanced vehicle systems. Meanwhile, its expansion into financial services, healthcare, and insurance further diversifies its revenue streams, reducing dependence on automotive—a sector that previously contributed 72% of total revenue but now represents just 12%.

Financial Performance: Scaling Rapidly

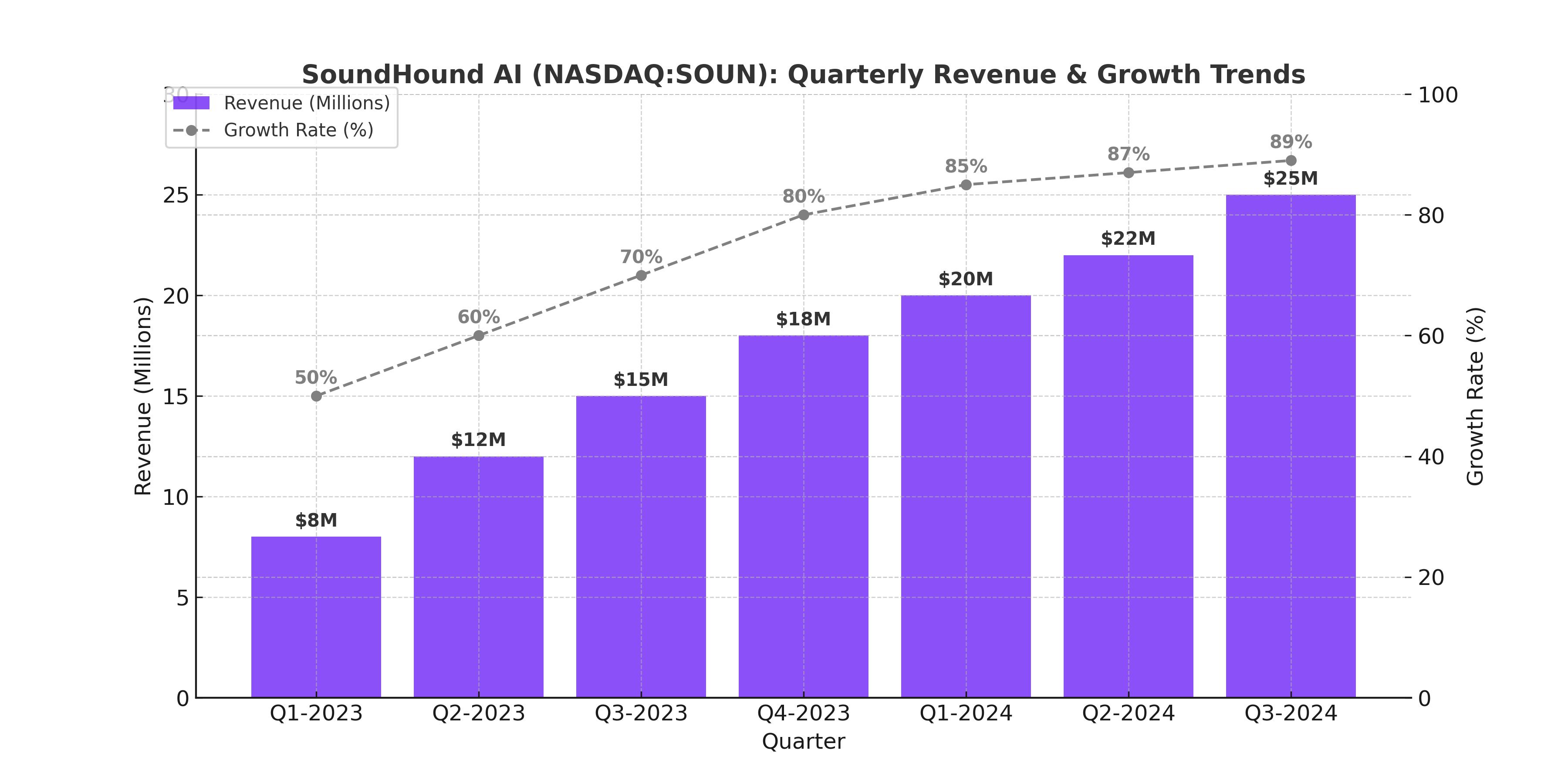

SoundHound delivered its highest-ever revenue of $25 million in Q3 2024, representing an 89% year-over-year increase. This marked the fourth consecutive quarter of 50%-plus topline growth. Revenue diversification continues to improve; the top five customers now contribute less than 33% of revenue, down from 90% a year ago. While operational losses persist, with Q3 seeing an operating loss of $35.1 million, the company is investing heavily in R&D and marketing to sustain growth and achieve long-term profitability.

Strong Balance Sheet Amid Growth Investments

SoundHound’s balance sheet reflects strategic prudence, with total debt reduced from $85.5 million to under $40 million in just two quarters. The company boasts over $135 million in cash and continues deleveraging while maintaining strong liquidity. Free cash flow turned positive in Q3 at $16 million, underscoring improving financial efficiency.

Valuation and Upside Potential

Despite high valuation multiples—such as an EV/sales ratio of 72—SoundHound’s robust growth justifies its premium pricing. With a forward revenue growth rate exceeding 74%, the company is positioned for exponential gains in a rapidly expanding AI market. Using projected cash flows, SOUN’s intrinsic value is estimated at $25 per share, offering alignment with its current trading range while supporting significant future upside.

Risks and Considerations

Potential risks include competition from tech giants like Google and Amazon, whose established ecosystems could challenge SoundHound’s dominance. Additionally, negative publicity from social media—if AI systems underperform in high-profile use cases—could impact brand adoption. However, SoundHound’s market leadership and continued innovation mitigate these risks.

Conclusion: A Transformational AI Play with Long-Term Promise

SoundHound AI is a frontrunner in conversational AI, uniquely positioned to capitalize on multi-industry demand. With partnerships in key sectors, sustained revenue growth, and a clear path toward profitability by 2025, the company offers compelling upside for long-term investors. At a current price of $24, SoundHound represents a strategic entry point for investors seeking exposure to transformative AI technologies, with growth poised to outpace market expectations.

That's TradingNEWS

Read More

-

Global X Uranium ETF (NYSEARCA:URA) Jumps 93.69% to $51.87 as AI Power Crunch Fuels $5.64B Nuclear Rally

11.10.2025 · TradingNEWS ArchiveStocks

-

XRP-USD Holds $2.73 as Ripple ETF Launches Stall: XRP ETFs Drop Sharply Amid SEC Freeze

11.10.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas (NG=F) Dives 5% to $3.09 as Storage Glut and Warm Weather Sink Demand

11.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen Rallies to 153.06 as Dollar Strength

11.10.2025 · TradingNEWS ArchiveForex