Market Dominance of Sociedad Química y Minera de Chile NYSE:SQM

Dive into SQM's robust market strategies and financial projections as it leads innovation in the global chemical industry, aiming for significant growth in data center technologies and 5G deployment | That's TradingNEWS

Strategic Initiatives and Expanding Horizons at Sociedad Química y Minera de Chile (NYSE:SQM)

Overview and Market Position

Sociedad Química y Minera de Chile S.A. (NYSE:SQM), a heavyweight in the global chemical industry, particularly in the lithium sector, has established a pivotal market position. With a market capitalization hovering around $13.339 billion and an average trading volume that underscores substantial investor interest, SQM is a beacon in the fluctuating realm of commodities essential for modern technologies such as electric vehicles and renewable energy storage.

Financial Resilience and Projections

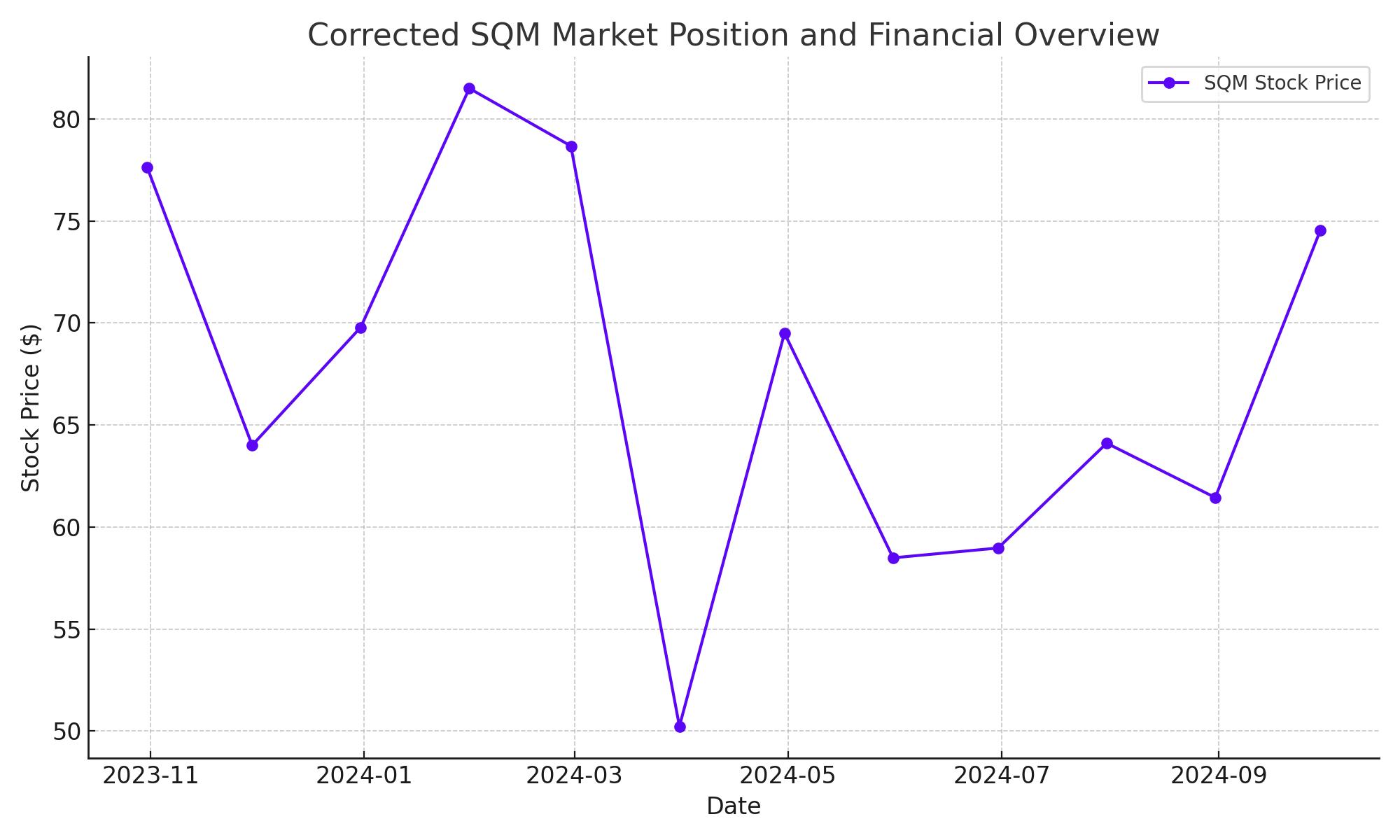

Despite past volatility, evidenced by a 52-week trading range from $38.50 to $81.50, SQM has demonstrated resilience with a current stock price of $46.70. The company's PE ratio stands at an attractive 6.62, suggesting a potentially undervalued stock relative to its earnings power. Financial forecasts are optimistic, projecting an increase in EPS to $7.05 TTM and anticipating substantial revenue growth from $5.33 billion in 2025 to a projected $6.97 billion in 2026.

Strategic Growth Through Technological and Sectoral Expansion

SQM is not merely riding the wave of existing market conditions but is actively steering towards lucrative waters with strategic technological innovations and market adaptations. The company’s efforts are particularly focused on enhancing its capabilities in data centers—a market projected to swell to approximately $69 billion by 2025. Initiatives like the development of advanced materials for more efficient data processing and power consumption are setting SQM apart from its competitors.

Recovery and Expansion in Enterprise and Carrier Segments

The enterprise and carrier segments, though recently downturned, are poised for a strong recovery by the second half of FY25. This expected resurgence is backed by increased global investment in 5G technology and expanding enterprise networking solutions. SQM’s proactive strategies in these areas are expected to catalyze a robust upcycle, reinforcing its market stance.

Investment Perspective: A Bullish Outlook

From an investment standpoint, the bullish sentiment surrounding SQM is hard to ignore. Analysts are leaning towards a positive trajectory for SQM, with a target estimate of $71.80, signaling a significant potential upside from its current trading levels. This optimism is anchored in SQM’s solid fundamentals, strategic innovations, and its pivotal role in critical, fast-growing economic sectors.

Recommendations for Potential Investors

Investors considering SQM should weigh the company’s robust strategic initiatives against the backdrop of its financial health and market dynamics. With a forward dividend yield of 10.76% and a strong track record of resilience and strategic growth, SQM represents a compelling opportunity for long-term growth-focused investors.