AI Boom - Nvidia Surpasses Microsoft Becoming World's Most Valuable Company

Exploring Nvidia's Meteoric Rise Driven by AI Chip Demand and Market Dynamics | That's TradingNEWS

Nvidia Becomes World's Most Valuable Company

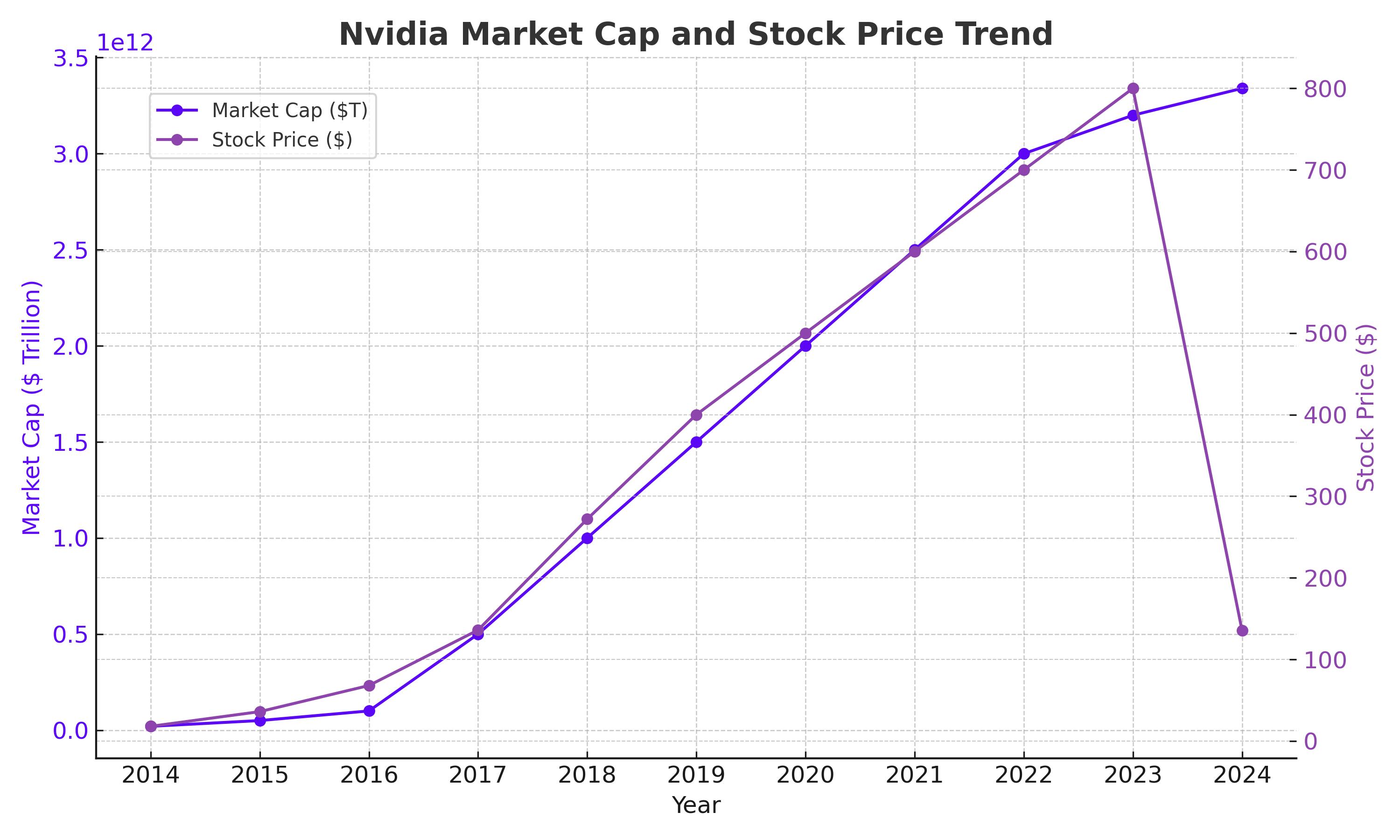

Nvidia (NASDAQ: NVDA) has ascended to the pinnacle of the tech industry, becoming the world's most valuable company with a market capitalization of $3.34 trillion. This milestone was achieved as Nvidia's stock price soared to an all-time high, closing at $135.58, marking a 3.5% increase on Tuesday. The company's market value has nearly doubled since the beginning of the year, reflecting its dominance in the AI chip market.

Impact of AI Chip Demand

Nvidia's unprecedented growth has been primarily driven by the surging demand for its AI chips. These chips are essential for training and running generative AI models, including OpenAI's ChatGPT. The firm's AI technology is regarded as the "new gold" in the tech sector, positioning Nvidia at the forefront of the AI revolution. This demand has resulted in successive quarters of substantial revenue growth, with a year-on-year increase of 265% in February and 262% in May.

Strategic Insights from Leadership

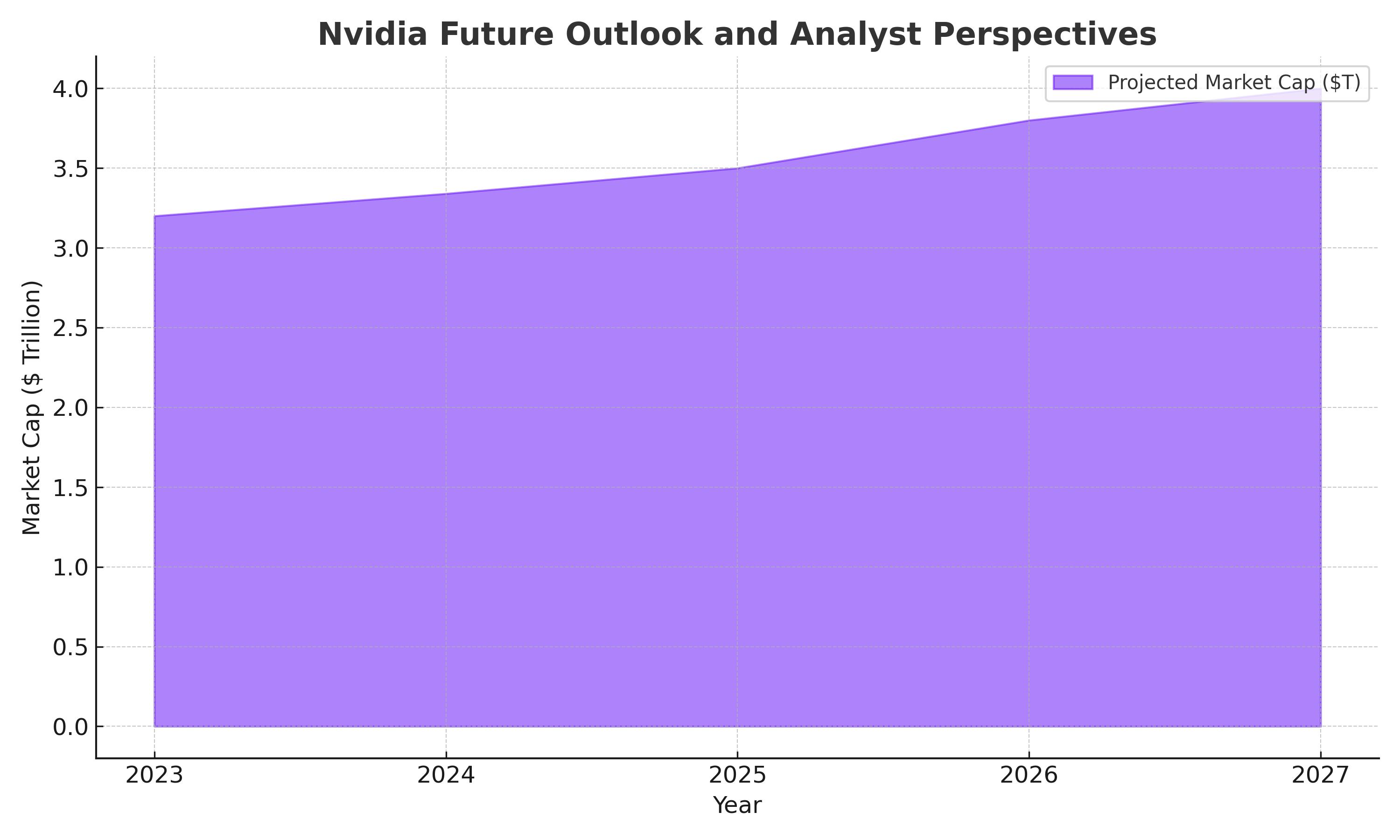

Chris Penrose, Nvidia's global head of business development for telecommunications, emphasized the transformative impact of generative AI at a recent event in Copenhagen. "The generative AI journey is really transforming businesses and telcos around the world," Penrose stated. Analysts from Wedbush Securities echo this sentiment, predicting that Nvidia will continue to lead the race to a $4 trillion market cap, alongside tech giants Apple and Microsoft.

Historical Context and Market Position

Eight years ago, Nvidia's stock was valued at less than 1% of its current price. Initially competing with AMD in the graphics card market, Nvidia's focus has shifted significantly towards AI technology. The company has also benefited from the cryptocurrency boom, particularly during the Bitcoin mining rush in 2020. CEO Jensen Huang, renowned for his charismatic leadership and iconic leather jacket, has been instrumental in steering Nvidia to its current status.

Market Influence and Performance

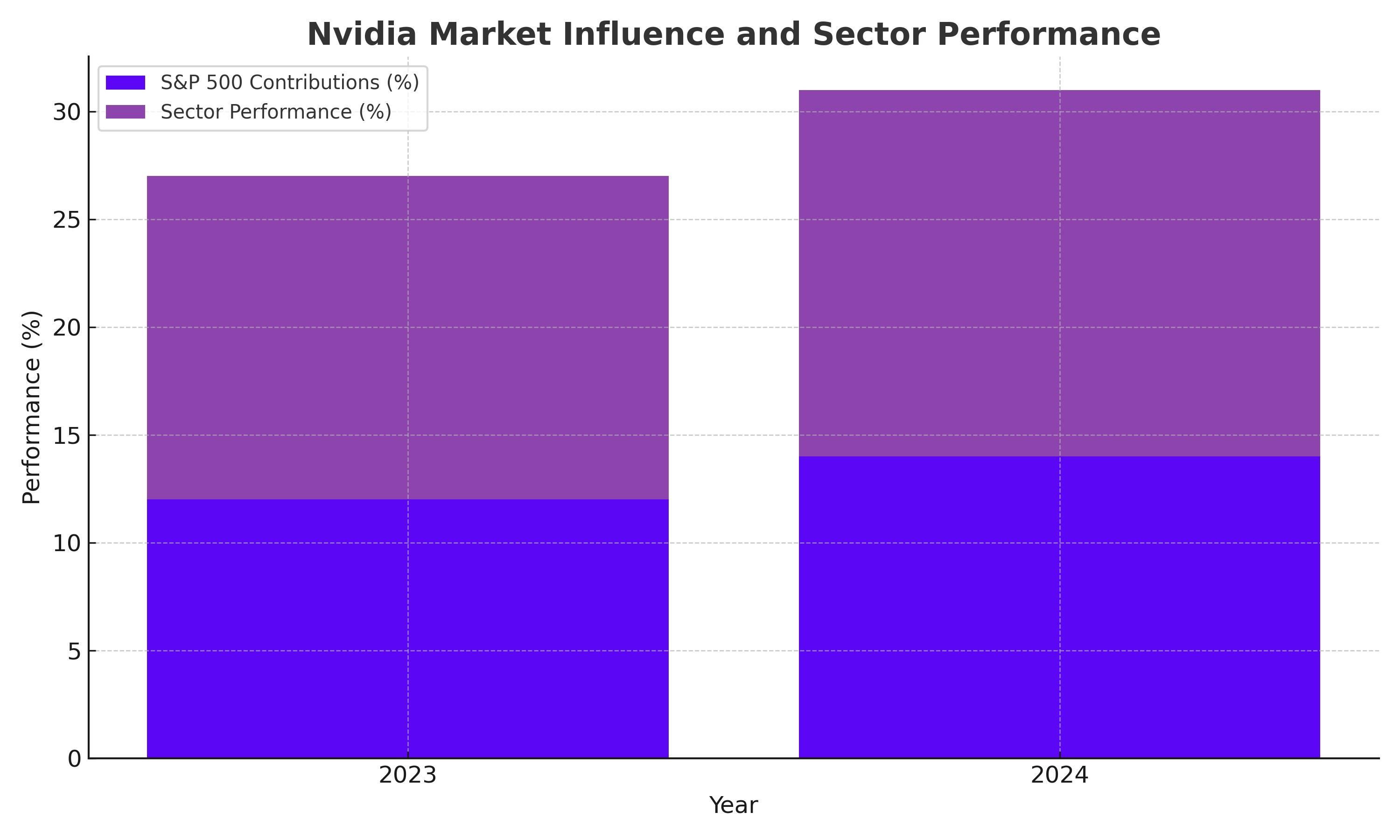

Nvidia's impact on broader stock indices is substantial. Its share price gains have been a major contributor to the 14% year-to-date increase in the S&P 500 index. The company's Hopper series graphic processing units are widely adopted by tech giants like Google, Microsoft, and Amazon for their cloud services, further cementing Nvidia's market dominance. Despite competition from AMD and Intel, Nvidia continues to lead the AI chip market with its cutting-edge technology and robust software ecosystem, Cuda.

Future Outlook and Analyst Perspectives

The competitive landscape for AI development includes major players like Microsoft, Google-owner Alphabet, Meta, and Apple. However, Nvidia's strategic positioning and continuous innovation keep it ahead. Analysts like Stacy Rasgon from Bernstein highlight the unprecedented financial performance driving Nvidia's stock, suggesting that its current market rally has more room to grow.

Market Dynamics and Economic Indicators

Despite Nvidia's impressive rise, some analysts remain cautious about its ability to maintain such a large market share amid increasing competition. Barclays credit analyst Sandeep Gupta has raised concerns about the sustainability of Nvidia's dominance, especially with its stock trading at $135.58 as of the latest close. Gupta questions how Nvidia’s customers will monetize AI software, which is critical to justifying the high valuations.

Nevertheless, the overall market sentiment remains bullish. Nvidia's financial performance has consistently surpassed expectations, reinforcing its strong market positioning. The company's revenue for the latest quarter was $26 billion, representing a year-on-year increase of 262%. These robust figures suggest that Nvidia’s growth trajectory is far from plateauing. As of now, Nvidia's market capitalization stands at an unprecedented $3.34 trillion, underscoring investor confidence in its continued expansion and innovation in the AI chip sector.

Insider Transactions and Market Sentiment

Insider transactions further highlight the confidence in Nvidia's future. For detailed insights into Nvidia's insider transactions, refer to the Nvidia Insider Transactions.

Conclusion: Navigating Market Volatility with Strategic Insights

Nvidia's ascent to the top spot reflects broader economic trends and investor enthusiasm for AI technology. Despite potential short-term volatility, the long-term outlook for Nvidia remains robust. Investors are advised to monitor key technical levels and broader market trends to navigate this dynamic environment effectively. As Nvidia continues to innovate and dominate the AI chip market, its strategic positioning will be crucial in maintaining its lead amidst growing competition.

For real-time updates on Nvidia's stock performance, visit Nvidia Real-Time Chart.