Alibaba (NASDAQ:BABA): A High-Potential Investment Positioned for 74% Upside

Can Alibaba’s international e-commerce and AI-driven cloud growth fuel a turnaround in 2025? | That's TradingNEWS

A Deep Dive into NASDAQ:BABA: Unpacking Alibaba’s 74% Upside Potential

E-Commerce Dominance and Innovations

Alibaba Group (NASDAQ:BABA) continues to dominate as China’s leading e-commerce player, driven by its platforms Taobao and Tmall. Despite a modest 1.4% YoY growth in its core e-commerce segment during Q2 2025, the stability amid China’s economic slowdown highlights the enduring strength of its ecosystem. Key initiatives such as integrating WeChat Pay and launching AI-powered marketing tools like Quanzhantui have significantly boosted engagement. For instance, these tools played a pivotal role in driving sales during the recent Singles' Day shopping festival. Alibaba is also expanding internationally, with Morocco becoming its first African market entry. This expansion not only supports Moroccan exports but also strengthens Alibaba’s logistical and e-commerce foothold to tap into North Africa and beyond. Similarly, the launch of Tao, a cross-border e-commerce service in Japan, opens a promising avenue in the world’s third-largest economy, positioning BABA for robust growth in diverse markets.

Logistics Expansion Enhances Reach

The logistics arm, Cainiao Network, has accelerated Alibaba’s global growth by establishing efficient freight routes such as the Ningbo-to-Bangkok corridor. By cutting shipping costs from $2.6/kg to $1.4/kg and reducing transit times, this initiative significantly enhances the appeal of Alibaba’s platforms to international merchants and consumers. These logistics efficiencies dovetail with the company’s strategic expansion goals and underscore its focus on becoming a global e-commerce leader.

Alibaba Cloud and AI Integration Driving Future Growth

Alibaba Cloud remains a crown jewel, achieving an 11.3% YoY revenue growth to $4.21 billion in Q2 2025. AI-related product revenues have seen triple-digit growth for five consecutive quarters, further cementing Alibaba’s dominance in China’s cloud market and the fourth position globally. Recent innovations, such as the Qwen2.5 Coder with 72 billion parameters, demonstrate Alibaba’s prowess in AI and machine learning. These advancements enable developers to deploy cutting-edge AI solutions efficiently, positioning Alibaba Cloud as a preferred provider for businesses aiming to integrate AI into their operations. By heavily investing $7.06 billion in AI infrastructure, including chip technologies and incentive programs for partners, Alibaba is setting a solid foundation for long-term growth in this lucrative market.

Financial Strength Ensures Resilience and Opportunity

Alibaba’s robust balance sheet, featuring $78.99 billion in cash and investments, supports its aggressive investments in AI, cloud, and international expansion. With an LTM free cash flow of $14.75 billion, the company is well-positioned to weather economic uncertainties in China while sustaining growth initiatives. This financial resilience allows Alibaba to continue strategic share buybacks, which have already reduced outstanding shares by nearly 10% since FY2019, enhancing shareholder value.

Valuation Metrics Highlight Massive Undervaluation

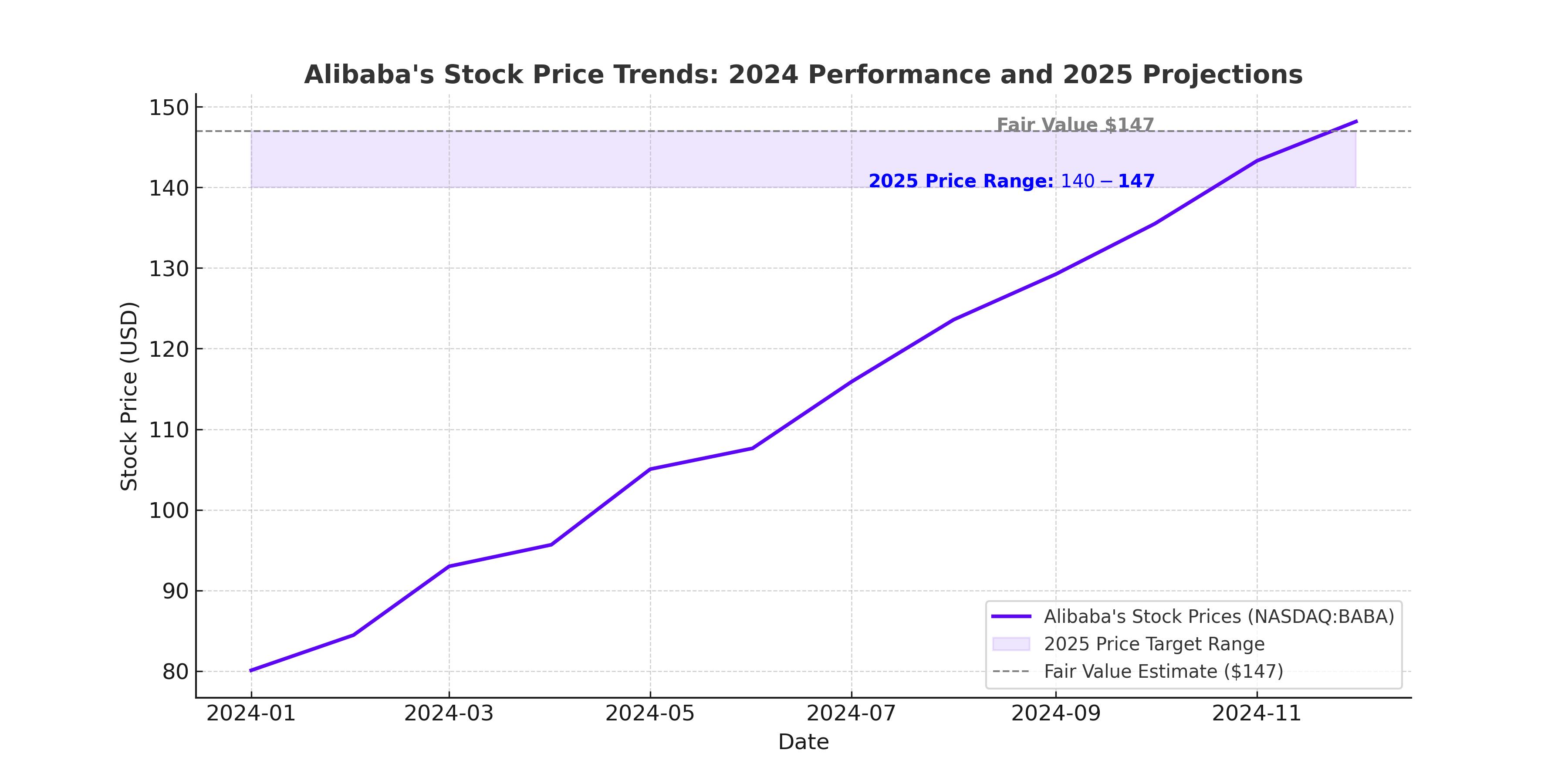

Alibaba is trading at highly attractive valuation metrics, with a forward P/E ratio of 9.82x, well below its five-year average of 16.12x and significantly lower than global peers like Amazon (45.42x) and MercadoLibre (53.47x). The forward PEG ratio of 0.63x further underscores its undervaluation. Analysts project a fair value of $147 per share, representing a 74% upside from current levels. When compared to its global peers and historical valuation multiples, Alibaba’s discounted metrics make it one of the most undervalued quality stocks in the market today.

Risks to Consider

Alibaba’s primary challenges stem from China’s macroeconomic headwinds, including property market instability, high debt levels, and sluggish GDP growth. Additionally, fierce competition from JD.com, PDD Holdings, and emerging players like Temu poses risks to Alibaba’s market share. However, the company’s strategic initiatives and international diversification provide a cushion against these challenges, offering significant upside potential as macro conditions stabilize.

Conclusion: Is NASDAQ:BABA a Buy?

Given its strong financial foundation, innovative strides in AI and cloud computing, and undervaluation relative to peers, NASDAQ:BABA presents a compelling investment opportunity. While China’s economic environment poses near-term risks, Alibaba’s global expansion and tech-driven growth initiatives position it for long-term success. For investors willing to navigate short-term uncertainties, Alibaba offers significant upside potential, with fair value estimates indicating gains of up to 74% and long-term targets exceeding $180 per share. With the stock trading at a significant discount to both its historical and peer valuations, Alibaba remains a strong buy for value-oriented and growth-focused investors.