Alibaba Stock Analysis: Strategic Investments and Strong Financials

A Deep Dive into Alibaba’s (NYSE: BABA) Market Position, Financial Performance, and Future Growth Prospects | That's TradingNEWS

Alibaba (NASDAQ: BABA): An In-Depth Analysis of Future Potential

Overview of Alibaba's Stock Performance

Alibaba's (NASDAQ: BABA) stock performance has been a point of concern for investors, marked by a significant decline of 15.82% since its IPO in 2014. Despite its robust financial growth, BABA has faced various challenges, including geopolitical tensions, regulatory hurdles, and economic slowdown in China. The stock hit a low of $66.63 in early 2024 but has since shown signs of recovery, currently trading around $78.41, indicating a potential bottom formation.

Financial Resilience and Strategic Shifts

Alibaba has consistently demonstrated financial resilience, with significant growth in both top-line and bottom-line numbers. The company's strategic pivot towards high-growth sectors such as cloud computing and artificial intelligence (AI) aligns with global economic trends and China's policy shifts favoring technological integration.

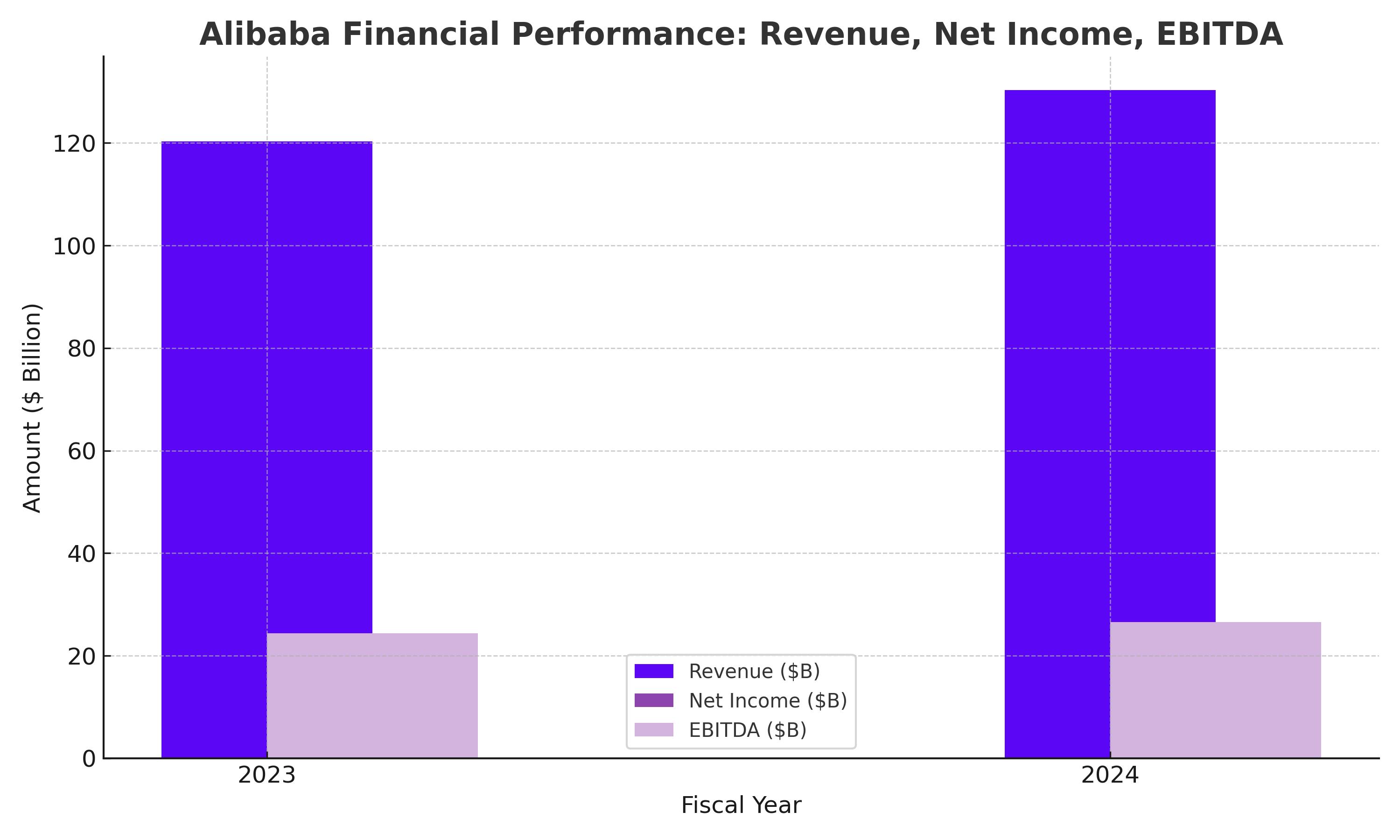

Revenue and Profitability:

- Fiscal year 2024 revenue: $130.35 billion (up 8.3% from $120.31 billion in 2023).

- Net income for 2024: $11.04 billion (up from $10.04 billion in 2023).

- EBITDA for 2024: $26.55 billion (up from $24.34 billion in 2023).

Despite these impressive figures, operating cash flow dropped to $25.29 billion from $27.67 billion, indicating some financial strain towards the end of the fiscal year.

Sector Analysis: Cloud and AI Dominance

Alibaba's Cloud Intelligence Group is pivotal to its growth strategy. As the largest cloud computing company in the Asia-Pacific region and the fourth largest globally, Alibaba is well-positioned to capitalize on the growing demand for cloud services.

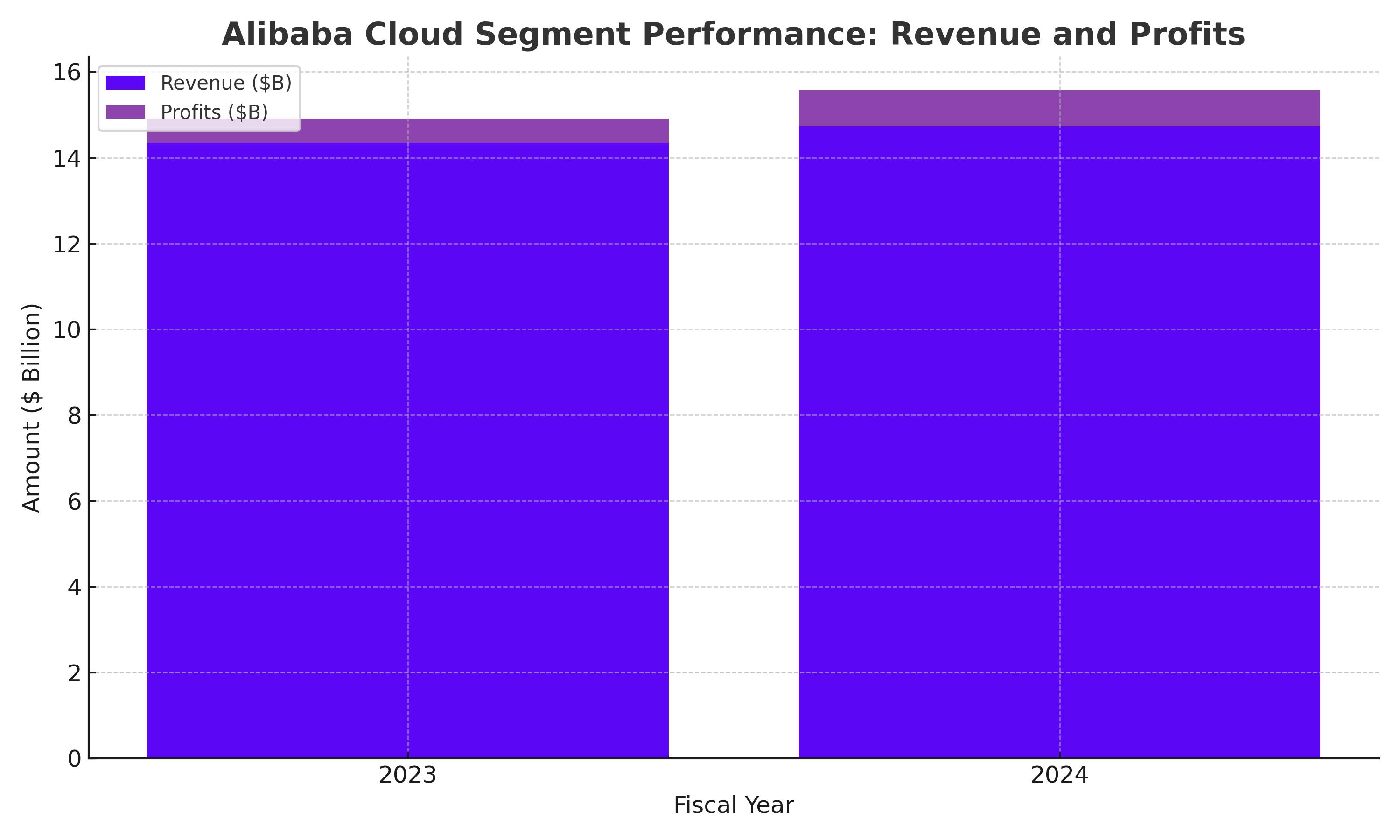

Cloud Segment Performance:

- FY 2024 revenue: $14.73 billion (up 2.8% from $14.34 billion in 2023).

- FY 2024 segment profits: $848 million (up from $568 million in 2023).

Alibaba's deliberate shift away from low-margin projects is expected to bolster future revenue growth. The global cloud market is projected to grow from $680 billion in 2024 to $1.44 trillion by 2029, presenting significant opportunities for Alibaba.

International Expansion and E-commerce Growth

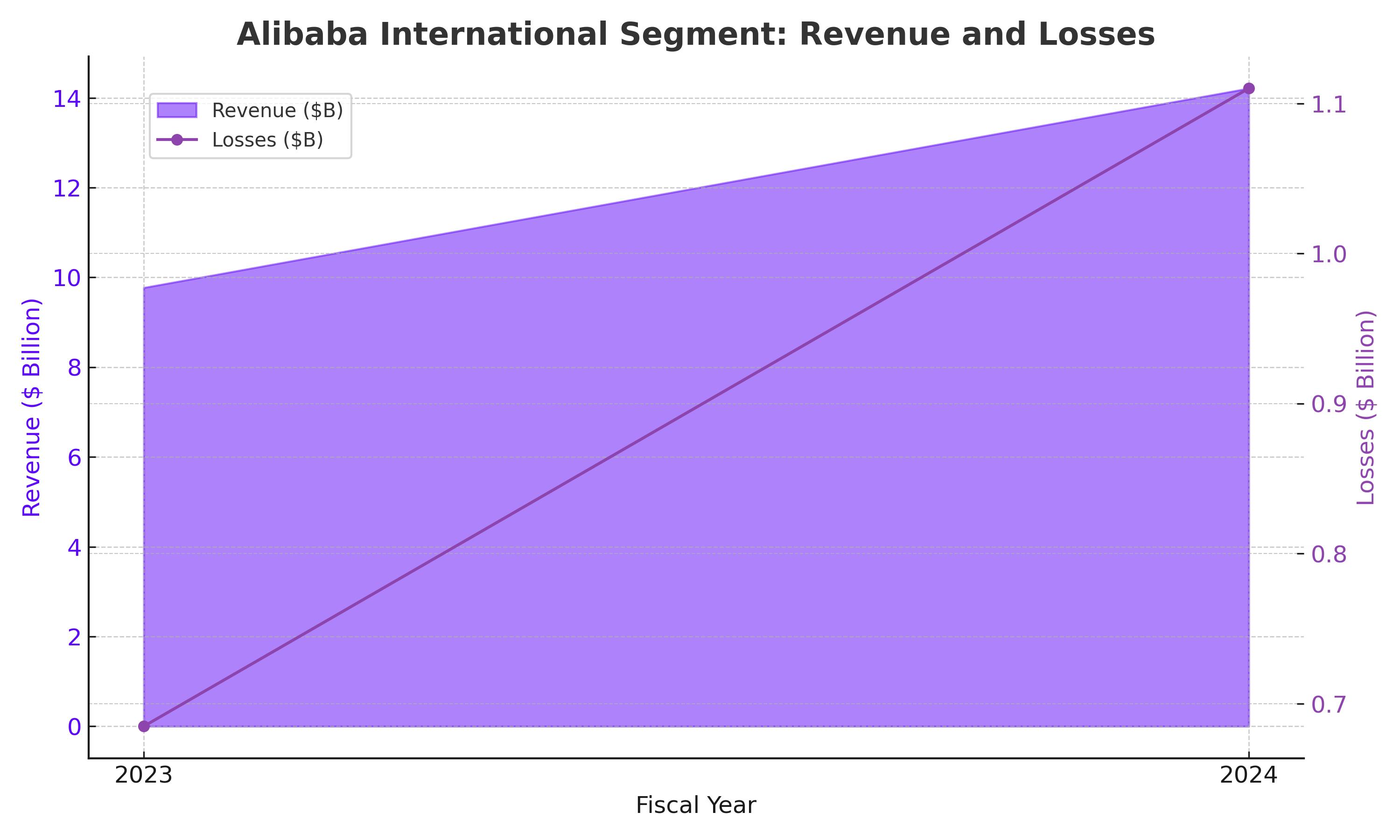

The Alibaba International Digital Commerce Group has shown remarkable growth, primarily driven by its retail operations.

International Segment Performance:

- FY 2024 revenue: $14.21 billion (up 45.5% from $9.77 billion in 2023).

- However, profitability declined, with losses increasing to $1.11 billion from $685 million.

Investments in initiatives like AliExpress' Choice program and cross-border operations in Trendyol and Miravia have driven traffic and monetization improvements, setting the stage for future profitability.

Logistics and Fulfillment Efficiency

Cainiao Smart Logistics Network, focusing on efficient customer fulfillment, has shown significant improvement.

Logistics Segment Performance:

- FY 2024 revenue: Increased by 27.8% year-over-year.

- Segment profit: $194 million (a turnaround from a $54 million loss).

The efficiency and profitability of Cainiao's operations highlight Alibaba's capability to manage complex logistics effectively, comparable to giants like Amazon.

Valuation and Capital Allocation

From a valuation perspective, Alibaba remains one of the most undervalued major tech companies.

Valuation Metrics:

- Forward P/E ratio: 8.95

- PEG ratio: 0.38

Alibaba's extensive cash reserves of $137.82 billion, including $34.37 billion in cash and $36.42 billion in short-term investments, provide substantial liquidity. The company’s strategic investments and robust capital allocation plan, including a $4 billion dividend and $12.5 billion in share buybacks for fiscal 2024, reflect strong shareholder returns.

Market Outlook and Analyst Predictions

Despite recent challenges, analysts remain optimistic about Alibaba's potential. The consensus price target suggests a 37.17% upside, with a forecasted price of $108.79 within the next 12 months. Analysts emphasize Alibaba's strategic focus on AI and cloud services as key growth drivers.

Analyst Ratings:

- Loop Capital: Price target raised to $115.00

- Barclays: Maintains Overweight with a price target of $107.00

- Bank of America: Price target raised to $103.00

Financial and Operational Metrics

Revenue Growth and Profitability

Alibaba's robust financial performance is highlighted by its continuous revenue growth and solid profitability. The company generated $130.35 billion in revenue for fiscal year 2024, marking an 8.3% increase from $120.31 billion in 2023. Net income rose to $11.04 billion from $10.04 billion, while EBITDA increased to $26.55 billion from $24.34 billion.

Key Financial Metrics:

- Revenue (FY 2024): $130.35 billion

- Net Income (FY 2024): $11.04 billion

- EBITDA (FY 2024): $26.55 billion

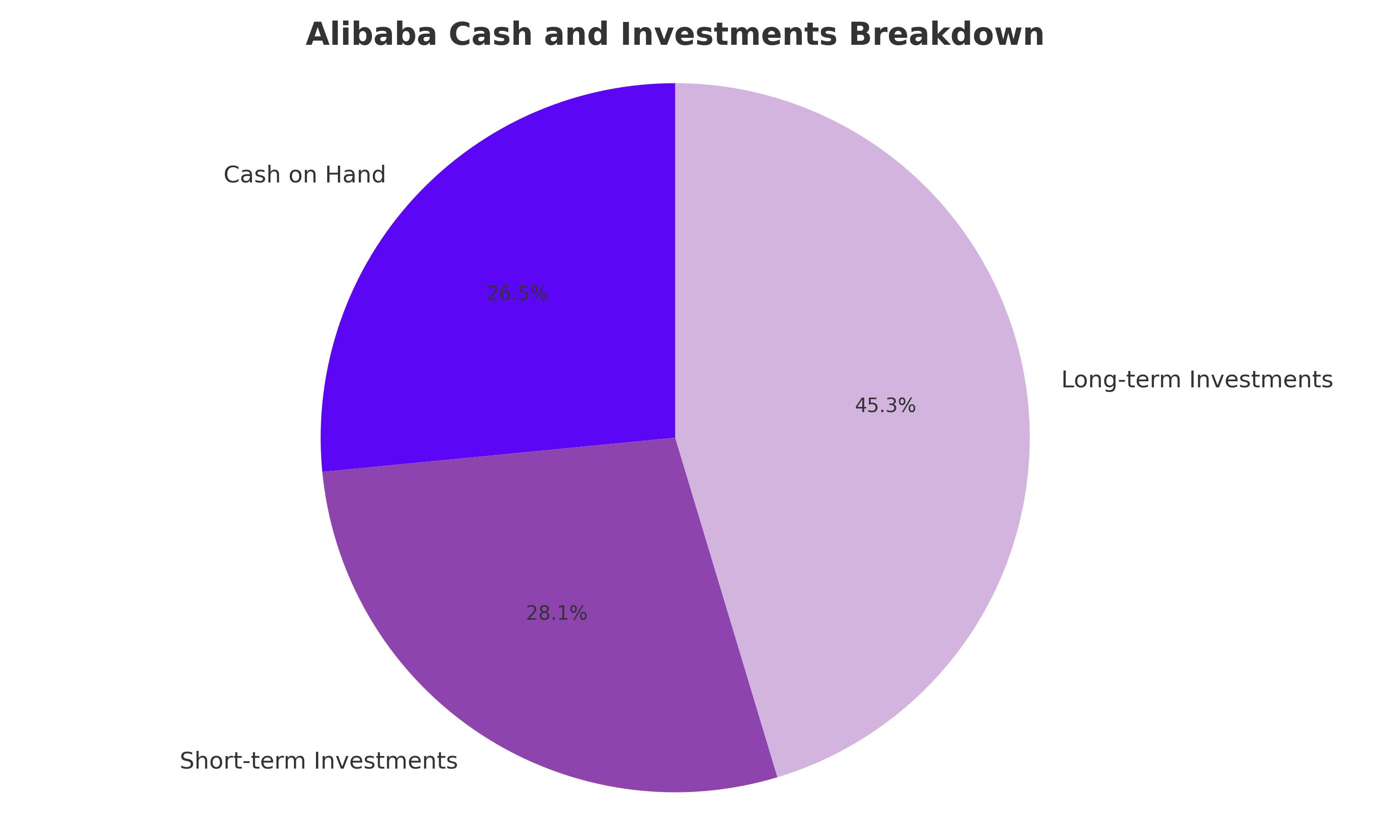

Cash Flow and Liquidity

Alibaba maintains a strong liquidity position, crucial for its strategic investments and capital allocation plans. The company has $137.82 billion in cash and investments, which is 71.23% of its market cap. After accounting for $19.64 billion in long-term debt and $1.77 billion in short-term borrowings, Alibaba's net liquidity stands at $116.42 billion.

Cash and Investments Breakdown:

- Cash on Hand: $34.37 billion

- Short-term Investments: $36.42 billion

- Long-term Investments: $58.73 billion

- Net Liquidity: $116.42 billion

Strategic Investments and Shareholder Returns

Capital Allocation

Alibaba’s capital allocation strategy includes a $4 billion dividend and $12.5 billion in share repurchases for fiscal 2024. The company has repurchased 11.04% of its outstanding shares since the close of fiscal year 2021, demonstrating a commitment to returning value to shareholders.

Shareholder Returns:

- Dividend (FY 2024): $4 billion

- Share Buybacks (FY 2024): $12.5 billion

Strategic Investments

Alibaba’s focus on cloud computing, AI, and digital services underpins its long-term growth strategy. Investments in Moonshot AI and other AI startups align with its vision to replicate Microsoft's success in this domain. The company’s cloud infrastructure spending in China, which grew 22% YoY to $9.7 billion in Q4 2023, positions Alibaba as a leader in this fast-growing market.

Key Investments:

- Moonshot AI: $1 billion fundraising round

- Cloud Infrastructure Spending (Q4 2023): $9.7 billion

Sector Performance and Competitive Position

Cloud and AI

Alibaba's Cloud Intelligence Group, the largest cloud computing firm in the Asia-Pacific region and the fourth globally, is critical to its growth. The group reported a modest revenue growth of 2.8% to $14.73 billion in FY 2024, with segment profits rising to $848 million.

Cloud Segment Highlights:

- Revenue (FY 2024): $14.73 billion

- Segment Profits (FY 2024): $848 million

E-commerce and International Expansion

The Alibaba International Digital Commerce Group saw a 45.5% increase in revenue to $14.21 billion in FY 2024. Despite higher losses due to significant investments, the potential for future profitability is substantial as global e-commerce expands.

International Segment Highlights:

- Revenue (FY 2024): $14.21 billion

- Losses (FY 2024): $1.11 billion

Logistics and Fulfillment

Cainiao Smart Logistics Network transformed from a $54 million loss to a $194 million profit in FY 2024, driven by a 27.8% increase in revenue. This segment focuses on efficient fulfillment services, crucial for Alibaba’s e-commerce operations.

Logistics Segment Highlights:

- Revenue Growth: 27.8%

- Segment Profit (FY 2024): $194 million

Valuation Metrics and Comparisons

Alibaba's valuation remains attractive compared to its peers. Trading at a forward P/E ratio of 8.95 and a PEG ratio of 0.38, Alibaba is significantly undervalued relative to other tech giants.

Valuation Metrics:

- Forward P/E Ratio: 8.95

- PEG Ratio: 0.38

Comparative Valuations:

| Company | P/E Ratio | Price/Operating Cash Flow | EV/EBITDA |

|---|---|---|---|

| Alibaba | 17.8 | 7.8 | 5.8 |

| Alphabet | 27.3 | 21.8 | 19.1 |

| Amazon | 51.0 | 19.4 | 18.8 |

Analyst Forecasts and Long-Term Outlook

Analyst Consensus:

- Consensus Price Target: $108.79 (37.17% upside)

- Highest Target: $115.00

- Lowest Target: $85.00

Insider Transactions

Insider transactions often signal confidence in the company's future. Investors can monitor these activities through the detailed insider transaction records available here.

Conclusion: A Bullish Stance on Alibaba

Alibaba’s strategic investments, strong financial position, and leading market position in cloud and AI present a compelling growth narrative. The company’s ability to navigate regulatory challenges and capitalize on China's economic policies will be crucial. Given its undervalued status and robust growth prospects, Alibaba represents a significant investment opportunity. Investors should closely monitor the stock’s performance and market developments through real-time updates available here.

In summary, Alibaba's strategic focus on high-growth sectors, combined with its strong financials and undervalued stock, positions it as a top contender for long-term investment.