Waymo Drives Alphabet (NASDAQ:GOOGL) into a Winner-Takes-All Autonomous Race

Alphabet Inc. (NASDAQ:GOOGL) is making massive strides, leveraging Waymo's autonomous driving leadership and groundbreaking technological advancements. As of now, GOOGL trades at $171, and with its diversified growth avenues, the stock presents a 32% upside potential with a price target of $226. Waymo’s market penetration, combined with Alphabet’s quantum computing breakthrough via the Willow chip, creates an unmatched growth trajectory.

Waymo’s Expansion: A Strategic Game Changer for GOOGL

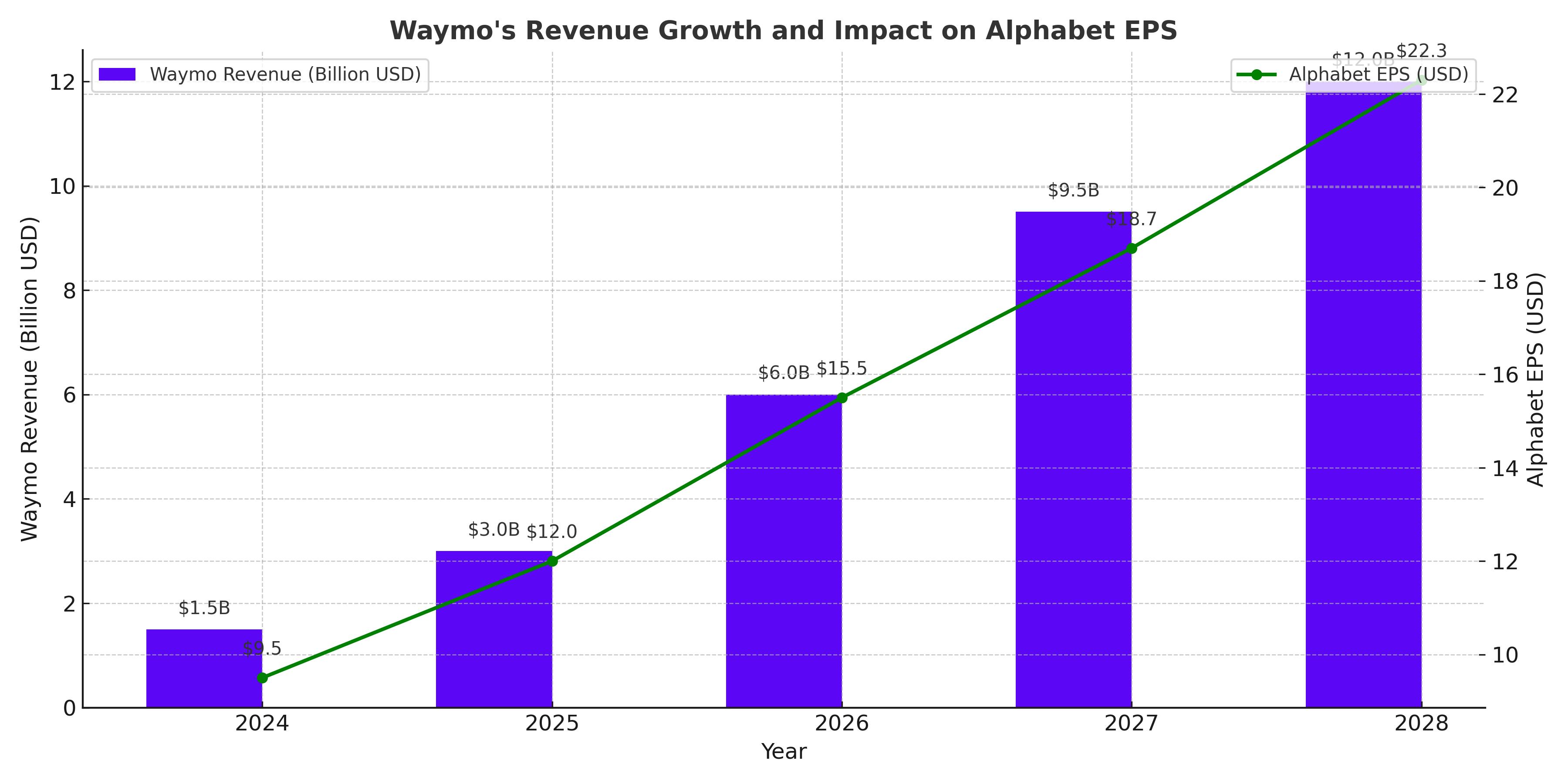

Waymo’s recent announcement of expansion into Miami highlights its unmatched technological maturity, with the capability to handle challenging weather conditions. This move sent Uber (NYSE:UBER) and Lyft (NASDAQ:LYFT) stocks tumbling by 10%, underscoring Waymo’s disruptive potential. The autonomous driving sector is witnessing a paradigm shift as Waymo surpasses 150,000 weekly trips, up from 100,000 in August 2024. Projections suggest 2 million weekly trips by the end of 2025, contributing over $3 billion annually to Alphabet’s revenue.

Unlike Tesla (NASDAQ:TSLA), which requires human intervention every 13 miles for its Autopilot system, Waymo operates with precision, making it a clear leader in the autonomous race. Tesla’s ambitious claims of launching robotaxis in 2025 appear overpromised, with significant technological gaps yet to bridge.

Alphabet’s Financial Advantage and Waymo’s Revenue Impact

Alphabet’s financial robustness, with nearly $120 billion in cash reserves, provides a solid foundation to scale Waymo’s operations. The $5.6 billion funding round for Waymo ensures resources for rapid geographical expansion and technological upgrades. Analysts anticipate this diversification to improve Alphabet’s EPS significantly, given the higher-margin potential of autonomous services.

With an average fare of $30 per trip, Waymo’s anticipated 100 million annual trips could push Alphabet’s top-line revenue upward, presenting a compelling growth story for investors seeking exposure to the autonomous driving revolution.

The Quantum Leap: Google’s Willow Chip Revolutionizes Computing

Beyond autonomous driving, Alphabet's Quantum AI Lab has unveiled the Willow quantum computing chip, marking a transformative leap in computational power. Willow’s capability to perform calculations in five minutes that would take classical computers septillions of years reaffirms Alphabet's leadership in next-generation technologies.

Quantum computing is projected to be a $30 billion market by 2035, with healthcare and AI leading its applications. Willow’s error-correction breakthroughs position Alphabet as a pioneer, opening potential revenue streams exceeding $138 billion if it captures a dominant market share akin to Nvidia (NASDAQ:NVDA) in AI chips.

Earnings Growth and Valuation

Alphabet’s core business remains robust, with Q3 2024 revenue surging 16.4% year-over-year to $88.3 billion. Operating income grew 34%, demonstrating strong cost efficiency. Google Cloud, which now represents 13% of total revenue, grew 35% year-over-year, outpacing competitors like AWS and Azure.

At just 17x its EPS forecast for 2026, GOOGL is undervalued compared to peers like Tesla, which trades at over 100x EPS. With Waymo contributing to revenue diversification and the Willow chip unlocking untapped markets, analysts expect significant upward EPS revisions.

Why Alphabet (NASDAQ:GOOGL) Is a Buy

Alphabet’s ability to lead in high-growth markets—autonomous driving, cloud computing, and quantum technology—makes it a rare tech giant with immense potential. The current pullback, driven by regulatory concerns over Chrome’s potential divestiture, offers an attractive entry point for long-term investors. Regulatory risks remain, but Alphabet's vast resources and legal expertise position it to weather such challenges effectively.

With the stock trading at $171 and a fair value of $226, Alphabet’s growth avenues and diversified business model make it a strong buy. Investors seeking exposure to disruptive innovations and high-margin businesses should consider Alphabet as a foundational portfolio asset.