Alphabet Inc. (NASDAQ:GOOGL): A Data-Driven Powerhouse in Search, AI, and Cloud with Long-Term Upside

Dominance of Search and the Rising AI Threat

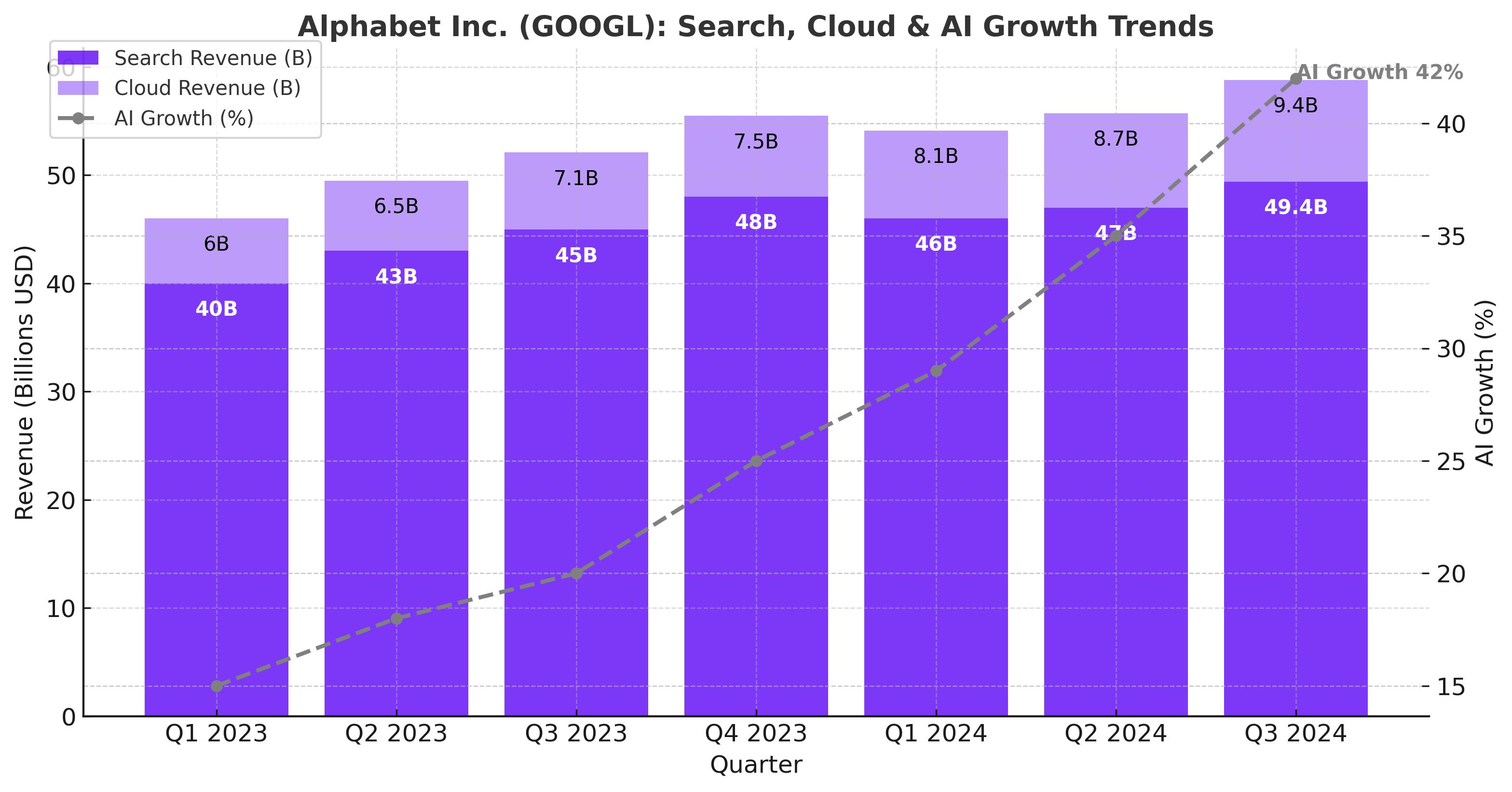

Alphabet Inc. (NASDAQ:GOOGL) has long been the undisputed leader in the search engine market, holding 89.9% of global search engine share as of Q3 2024. While this figure is slightly down from 92.3% in Q3 2022, it remains an unshakable position for now, with search revenue increasing 12% YoY to $49.38 billion in Q3 2024. This growth highlights Alphabet’s resilience despite rising competition from AI-driven search alternatives like OpenAI’s ChatGPT and Perplexity.

The rapid rise of AI tools threatens Alphabet’s dominance. Data shows that AI-powered tools such as Perplexity experienced significant growth, with visits rising from 55 million in August 2024 to over 90 million by October. OpenAI's SearchGPT, although currently limited to paying users, marks another significant step. Statista projects AI tool users to increase from 314.3 million in 2024 to 729.1 million by 2030, representing a 132% surge. While AI tools are gaining traction, Alphabet’s continued scale and revenue-generating infrastructure show no immediate threat to its core search business.

Although competition looms, Alphabet’s ability to monetize its massive user base sets it apart. The company’s $49 billion quarterly search revenue highlights its unparalleled capacity to extract value from user activity. With internet penetration expanding globally, Alphabet’s search dominance, even at a slightly reduced share, will continue driving ad revenue growth.

Google Cloud’s Accelerating Market Share Growth

Alphabet’s strategy to diversify beyond search hinges on its Google Cloud segment, which has emerged as a key growth driver. Google Cloud currently holds 12% of the cloud market, behind Microsoft Azure (20%) and Amazon AWS (31%), but it is growing faster than its competitors. Over the last four quarters, Google Cloud’s growth accelerated from 22.4% in Q3 2023 to 35% in Q3 2024. This sustained momentum starkly contrasts AWS’s stagnant 19% growth and Azure’s moderate 29%-33% range.

The launch of Google’s Trillium 6th generation TPU further strengthens its position in the cloud market. Trillium delivers a 4x performance boost compared to its predecessor with a 67% improvement in energy efficiency. This technological edge not only powers Google’s own AI models but also enhances Google Cloud’s appeal to enterprise clients looking for cost-effective, high-performance AI solutions.

Google’s custom TPUs have enabled it to bypass reliance on Nvidia chips, positioning Alphabet as a leader in the AI-accelerated cloud infrastructure market. DIGITIMES Research projects Alphabet to command over 74% of the custom cloud AI accelerator market in 2024, up from 71% in 2023. This dominance gives Alphabet a competitive advantage as enterprises increasingly adopt AI workloads, translating to continued revenue growth for Google Cloud.

Alphabet is also investing aggressively in data center expansion. In Q3 2024 alone, the company announced $7 billion in planned investments, including $6 billion allocated to U.S.-based projects. Global cloud spending reached $82 billion in Q3 2024, a 21% YoY increase, and Alphabet’s continued infrastructure expansion ensures it will capture a growing share of this high-growth market.

AI Leadership: Gemini 2.0 and Custom Silicon

Alphabet’s progress in AI has been pivotal in silencing early concerns about falling behind competitors like OpenAI and Microsoft. The launch of Gemini 2.0, described as Alphabet’s most advanced AI model to date, highlights its innovation pipeline. Gemini 2.0 Flash delivers faster performance with superior handling of complex tasks, including math equations, coding, and multimodal queries. Benchmarks indicate that Gemini matches or outperforms GPT-4 in key areas, restoring confidence in Alphabet’s AI capabilities.

Alphabet’s custom Tensor Processing Units (TPUs) further solidify its competitive edge. The latest TPU v6 achieves 4x performance at one-third the power consumption of previous generations, significantly reducing operational costs for AI model deployment. Unlike competitors that rely on third-party chips, Alphabet’s in-house silicon innovation drives both performance and profitability, making Google the most comprehensive AI provider in the cloud space.

Alphabet’s AI progress positions it to capitalize on the broader AI adoption trend. Management has outlined AI integration across its core platforms, including Search, YouTube, and Google Cloud, with substantial monetization potential. By combining AI model development, cloud infrastructure, and software integration, Alphabet remains uniquely positioned to dominate the AI ecosystem.

Quantum Computing: A Future Catalyst

Alphabet’s quantum computing breakthrough, led by its Willow chip, represents a long-term growth opportunity. Willow completed a computation in five minutes that would take classical supercomputers over 10 septillion years, underscoring Alphabet’s leadership in quantum technology. While still in prototype stages, Willow’s potential applications in areas such as drug discovery, energy optimization, and AI model training could unlock substantial economic value over the next decade.

Investors should view Alphabet’s quantum computing advancements as a free call option embedded in the stock. With quantum technology still years away from commercialization, Alphabet’s early lead positions it for significant upside should quantum computing achieve practical deployment.

Risks: Regulatory Pressure and Ad Revenue Concentration

Despite its strengths, Alphabet faces notable risks, particularly from regulatory scrutiny and competition. The U.S. Department of Justice’s (DOJ) antitrust case threatens Alphabet’s dominance in both search and advertising. Potential remedies, such as the divestiture of Chrome or unbundling of Android, could impact Alphabet’s ability to maintain market dominance. However, historical precedent, including Microsoft’s antitrust battle, suggests a worst-case breakup is unlikely. A negotiated remedy, such as browser choice screens, would likely have minimal long-term impact on Alphabet’s market position.

Alphabet’s dependence on ad revenue, which comprises over 57% of its total revenue, remains another risk. Competitors like Amazon, Meta, and TikTok continue capturing digital ad spend through alternative channels, putting pressure on Alphabet’s growth. That said, Alphabet’s diversification into cloud, AI, and other segments mitigates this risk over the long term.

Valuation: Alphabet’s Undervalued Opportunity

Alphabet currently trades at a trailing P/E of 26.06 and a forward P/E of 22.8, both well below Microsoft’s trailing P/E of 37.5 and Amazon’s 49.1. Alphabet’s EV/Sales ratio of 6.87 is lower than Microsoft’s 13.2, highlighting its relative undervaluation despite stronger profitability metrics. Alphabet boasts an operating margin of 32%, significantly higher than the S&P 500 tech sector average of 22.2%, while its balance sheet holds $64 billion in net cash.

Wall Street sentiment remains bullish, with 55% of analysts rating Alphabet a Buy and price targets rising to a median of $210. Alphabet’s valuation discount to peers, combined with its improving growth trajectory and margin expansion, presents a compelling opportunity for investors.

Insider Transactions and Buyback Program

Insider activity remains a point of interest for Alphabet investors. For real-time insider transaction data, investors can refer to this link. Alphabet’s aggressive share buyback program further enhances shareholder value. The company repurchased $15.3 billion in shares in Q3 2024 alone, maintaining its multi-year trend of significant capital return. Share repurchases reduce outstanding shares, supporting EPS growth and providing downside protection.

Stock Performance and Investment Outlook

Alphabet shares are up 5.6% over the past month, outperforming the S&P 500’s 1.2% gain but trailing Amazon’s 9.6% and Microsoft’s 6.2%. The stock’s relative underperformance reflects short-term concerns around regulatory risks and AI competition. However, Alphabet’s long-term fundamentals remain intact, with upside catalysts across AI, cloud, and quantum computing driving future growth.

Final Analysis: Buy, Hold, or Sell?

Based on Alphabet’s current valuation, accelerating growth in Google Cloud, advancements in AI, and long-term quantum computing potential, NASDAQ:GOOGL presents a strong Buy opportunity. The company’s core search business remains resilient despite rising competition, while its diversification strategy positions it for sustainable growth. Alphabet’s AI leadership, custom silicon capabilities, and robust balance sheet provide significant competitive advantages, making it an attractive investment for both near-term upside and long-term value creation.

For real-time stock performance, you can track Alphabet’s movements here.