Alphabet (NASDAQ: GOOGL) Faces DOJ Scrutiny While Cloud and AI Fuel Future Growth

Despite legal challenges, Alphabet's diversified growth in cloud computing and AI positions it for long-term success. Should investors stay bullish on GOOGL? | That's TradingNEWS

(NASDAQ: GOOGL)- Google Under Fire: The DOJ’s Antitrust Case and Future Growth Prospects

Google’s Legal Battle: Advertising Monopoly Under Scrutiny

Alphabet Inc. (NASDAQ: GOOGL), the parent company of Google, is facing one of its most significant legal challenges to date—a lawsuit from the U.S. Department of Justice (DOJ) accusing the tech giant of running a monopoly in the digital advertising space. Google, a company with a 90% share of the global search engine market, is accused of using its dominant position to control both the buy and sell sides of the advertising process. The DOJ argues that Google’s acquisitions, particularly its $3.1 billion purchase of DoubleClick in 2008, allowed it to consolidate control over the entire digital ad supply chain.

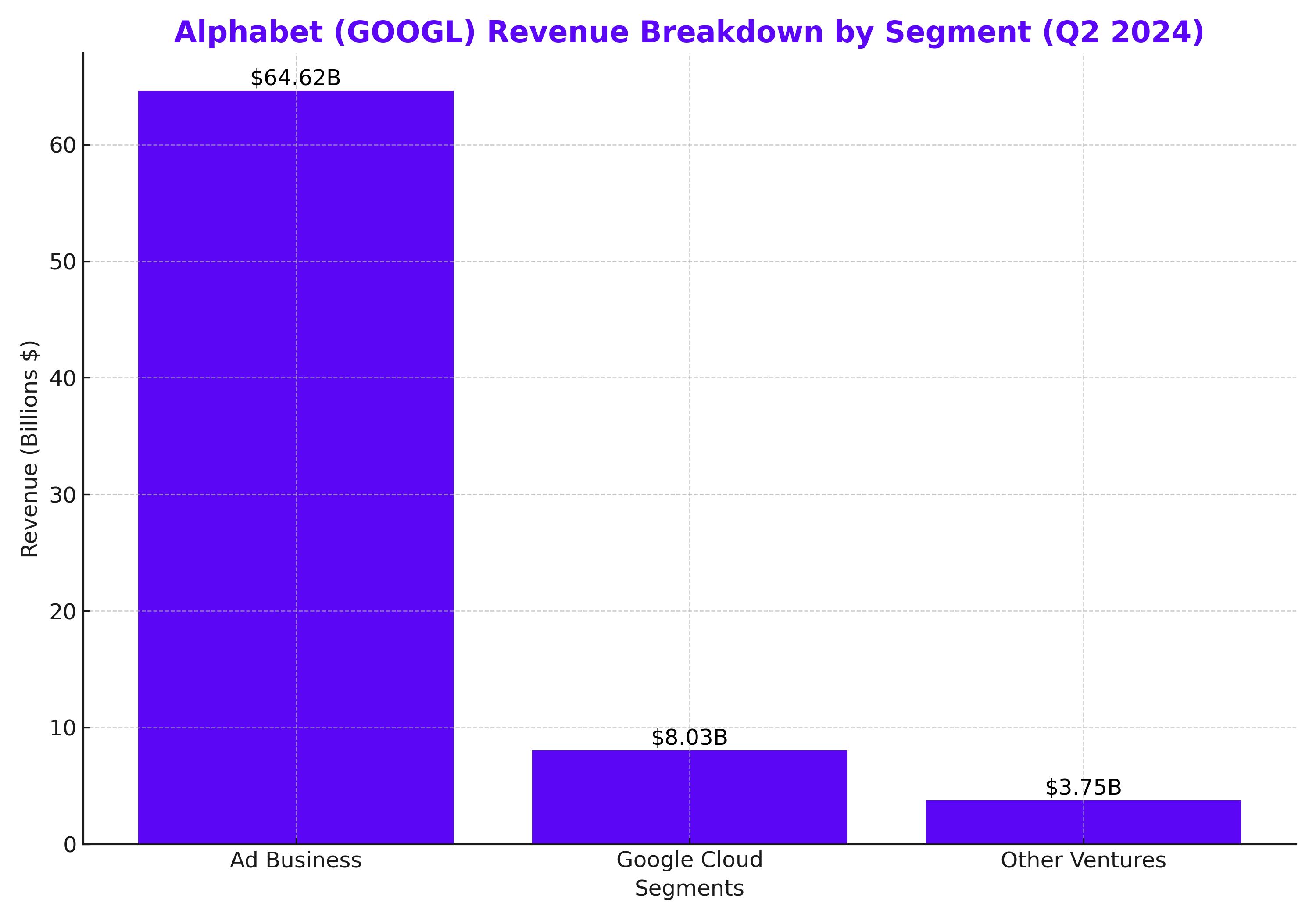

The implications of this lawsuit go beyond just a legal battle; the DOJ is calling for a potential breakup of Google’s ad tech business. Specifically, the focus is on Google Ad Manager, a key revenue driver for the company. In Q2 2024, Google’s Network business, which includes Ad Manager, contributed $7.44 billion to total advertising revenues of $64.62 billion—representing over 76% of Alphabet's total revenue. If the court rules against Google, a forced divestiture of its ad tech operations could severely impact its financial structure and revenue streams.

The Financial Impact: What’s at Stake for Google?

With the DOJ trial underway, there’s heightened concern about what this means for Google’s financial performance. Google’s ad business has been the cornerstone of its revenue model since its inception, and any disruption to this system would create a ripple effect across its entire business. The DOJ’s argument hinges on the notion that Google’s ad tech practices have inflated prices for advertisers and reduced revenue for publishers, limiting competition and stifling innovation. If Google is forced to divest parts of its ad business, its vertically integrated structure would be dismantled, affecting its ability to offer a comprehensive ad platform that attracts large-scale advertisers.

However, it’s not all doom and gloom. While the DOJ’s case is serious, many analysts believe that a full breakup of Google’s ad business is unlikely. Instead, we may see Google agreeing to certain regulatory restrictions, including more transparency in its operations and possibly the removal of exclusivity agreements with key partners like Apple. The company could also face fines and limitations on its future expansion, but these would be manageable for a company of Google’s size and financial strength.

Long-Term Operational Adjustments: Slowing Down but Not Stopping

Even without a full breakup, the scrutiny from regulators will likely lead to a more cautious approach from Google in the future. Alphabet has been known for its aggressive expansion tactics, acquiring companies to bolster its market share and entering new sectors like artificial intelligence (AI) and autonomous vehicles. However, with the current antitrust climate, we can expect Google to slow down its pursuit of total market dominance, especially in ad tech. This slowdown isn’t necessarily a bad thing. By focusing on smaller but more sustainable growth strategies, Google could open the door to new opportunities in the digital advertising ecosystem, encouraging more innovation from smaller players and even attracting a broader range of advertising customers.

While some might see this as a negative for the company’s short-term growth, a more measured approach could lead to long-term gains, not just for Alphabet but for the overall tech ecosystem. A more balanced competitive landscape would foster innovation and potentially open up new revenue streams for the company that don’t rely so heavily on its ad business.

Alphabet’s Other Growth Engines: Cloud and AI Offer Strong Potential

While Google’s ad business is under fire, its other ventures are showing significant promise. Google Cloud, for instance, has emerged as one of the fastest-growing parts of Alphabet’s business, with Q2 2024 revenues up 29% year-over-year. More importantly, Google Cloud posted its first-ever $1 billion in operating income, with operating margins reaching 11%. While still a small percentage of Alphabet’s overall profits, Google Cloud has the potential to be a significant revenue driver in the future.

Given the broader shift towards digital transformation and cloud computing, Google Cloud is well-positioned to capture a growing share of the market. Competitors like Amazon Web Services and Microsoft Azure have had a head start, but Google’s investments in AI, data analytics, and its robust cloud infrastructure could allow it to close the gap. In fact, Google’s AI capabilities, including its Gemini model, are already being integrated into its core products like search and YouTube, adding even more value to its cloud offerings.

AI and Autonomous Ventures: The Future Beyond Ads

In addition to cloud computing, Alphabet is investing heavily in artificial intelligence (AI) and autonomous technologies, both of which have the potential to be game-changers in the long term. The company has already integrated AI into its core search and advertising products, but its ambitions go far beyond that. Google’s AI-driven chatbot Gemini, for instance, has been integrated into YouTube advertising and Google Cloud, enhancing the company's AI credentials. Moreover, Alphabet’s self-driving unit, Waymo, continues to make strides in rolling out autonomous vehicle services, with the company committing to a $5 billion multi-year investment in this segment.

These growth areas—cloud computing, AI, and autonomous vehicles—provide Alphabet with multiple levers to pull as it navigates the regulatory landscape. While these ventures currently account for a smaller portion of Alphabet’s revenue, they offer significant upside potential as the company diversifies away from its traditional advertising business.

Financial Health: Alphabet's Stability Amidst Challenges

Despite the legal headwinds, Alphabet remains in a strong financial position. The company ended Q2 2024 with $100.7 billion in cash and $34 billion in non-marketable securities, against $13.2 billion in debt. Alphabet’s ability to generate free cash flow remains robust, with $13.5 billion in Q2, allowing it to continue returning value to shareholders through share buybacks and dividends. The company spent $15.7 billion on buybacks and paid out $2.5 billion in dividends during the quarter, reflecting its confidence in its long-term growth prospects.

Alphabet’s stock currently trades at a forward P/E ratio of around 20x, which is notably lower than its peers like Amazon (NASDAQ: AMZN) and Nvidia (NASDAQ: NVDA)

). With expected year-over-year EPS growth of 14% in 2025, Alphabet offers a compelling value proposition for long-term investors, particularly given its diversified growth engines in cloud, AI, and autonomous technologies.

What Does This Mean for Investors? Buy, Sell, or Hold (NASDAQ: GOOGL) Stock ?

Alphabet’s current situation presents a unique opportunity for investors. The stock has declined by nearly 9.5% since its August highs, primarily due to concerns over the DOJ lawsuit and broader regulatory risks. However, these challenges, while significant, are not insurmountable. The company’s robust financial health, diversified growth strategies, and continued dominance in the digital ecosystem make it a strong long-term investment.

The potential downside from the DOJ case is already priced into the stock, and even in a worst-case scenario where Google is forced to divest parts of its ad business, the company’s cloud and AI ventures offer substantial upside potential. Moreover, the stock’s current valuation, at around 20x forward earnings, provides a margin of safety for long-term investors.

Given these factors, I believe Alphabet remains a Buy. The stock’s near-term downside risk is likely overstated, while its long-term growth potential remains strong. Investors looking for a tech stock with strong fundamentals, diversified growth engines, and a reasonable valuation should consider NASDAQ:GOOGL as a solid addition to their portfolio.

For real-time stock data, click here, and to review insider transactions, click here.

Thta's TradingNEWS

Read More

-

Goldman Sachs GPIQ ETF Surges to $51.46 With 9.9% Yield

12.09.2025 · TradingNEWS ArchiveStocks

-

Bitcoin ETFs See $1.7B Inflows as BTC-USD Climbs to $116,600

12.09.2025 · TradingNEWS ArchiveCrypto

-

Copper Price (HG=F) at $4.65 Rallies on Grasberg Mine Halt and Chinese Demand Recovery

12.09.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price at 147.50 as Political Turmoil and Fed Cuts Shape Forecast Toward 145.00

12.09.2025 · TradingNEWS ArchiveForex