Amazon Stock’s 35% Upside Makes It a Must-Buy for Long-Term Growth

Undervalued NASDAQ:AMZN offers a rare buying opportunity, driven by cloud dominance, AI advancements, and e-commerce leadership | That's TradingNEWS

Amazon's Strategic Dominance in E-Commerce and Cloud Technology: A Comprehensive Analysis

NASDAQ:AMZN's momentum continues to impress, demonstrating its unmatched ability to capitalize on market trends and sustain growth across its core sectors. With the recent quarterly results highlighting robust financial metrics and strategic investments in AI and cloud infrastructure, Amazon’s stock has solidified its position as a long-term buy.

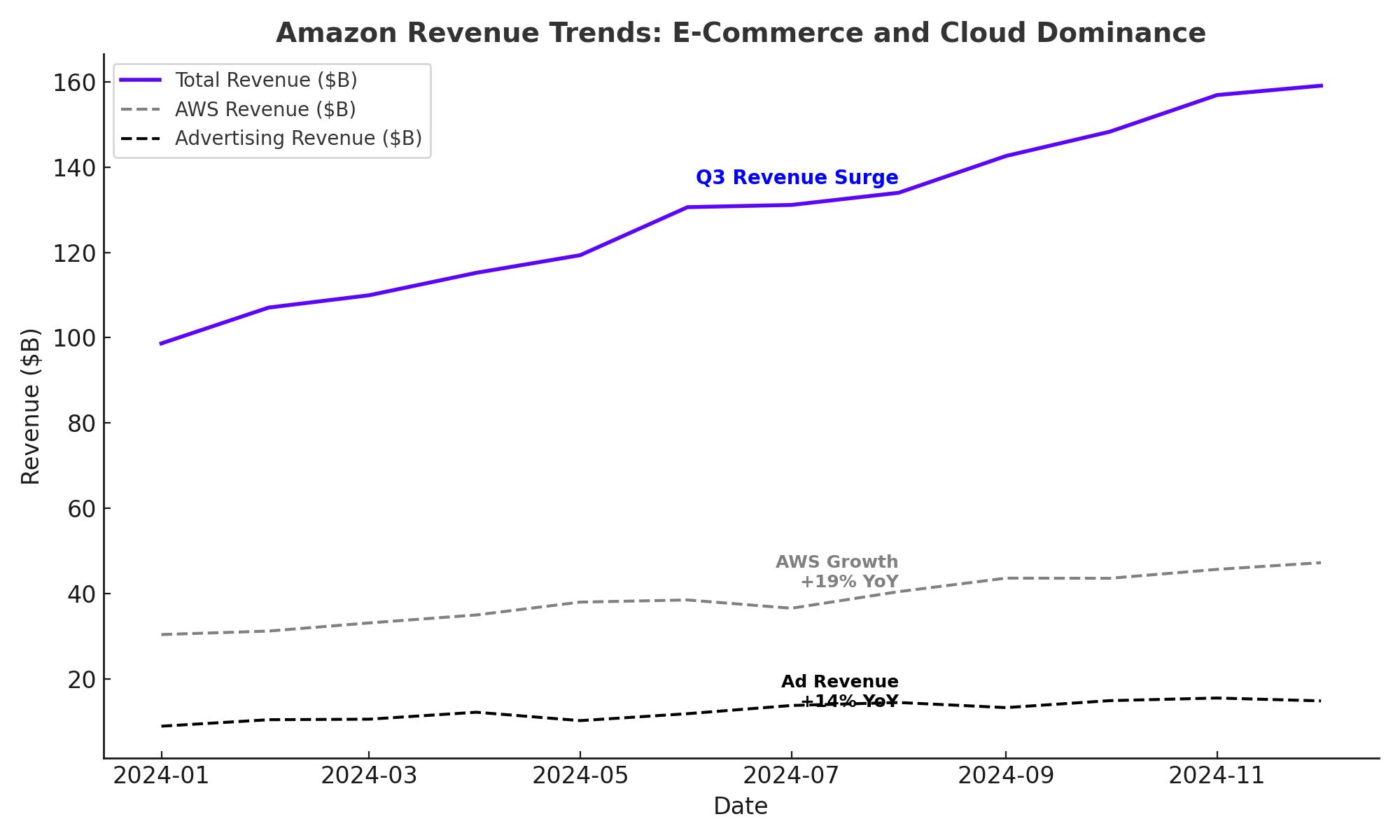

Explosive Revenue Growth and Operating Margin Expansion

Amazon reported stellar Q3 2024 results, with net sales surging by 11% YoY to $159 billion. This growth was driven by both product (up 7%) and service sales (up 14%), underscoring its diverse revenue streams. Operating income jumped a staggering 55.6% YoY, reflecting effective cost management and strategic investments. The operating margin increased substantially, buoyed by improvements in its high-margin cloud division, AWS, which remains a critical profitability driver.

AWS: A Cloud Leader Scaling AI Innovations

Amazon Web Services (AWS) remains the crown jewel of NASDAQ:AMZN's portfolio, contributing 19% YoY revenue growth in Q3 to reach $27.5 billion. AWS commands a commanding 31% global market share, significantly outpacing competitors like Microsoft Azure and Google Cloud. This dominance stems from Amazon's aggressive R&D spending, which totaled $21.3 billion in Q3 2024, an 88% increase YoY. These investments primarily focus on generative AI, a market projected to grow at a 46.5% CAGR through 2030.

AWS has also strengthened its ecosystem through partnerships with Lumen Technologies, Box, and Smarsh, aimed at enhancing AI capabilities. Plans for a $2 billion data center in Ohio further illustrate Amazon’s commitment to expanding its cloud infrastructure. With operating margins at 38%, AWS is not only the leader in market share but also in profitability.

E-Commerce Resilience and Infrastructure Advancements

Amazon’s North America segment, the bedrock of its e-commerce operations, posted 8.7% YoY growth, reaching $95.5 billion in Q3. The International segment also delivered an impressive 11.7% growth, showcasing the company’s ability to capture market share globally. Amazon’s ongoing investments in its fulfillment network, including cutting-edge centers in Louisiana and Cottage Grove, ensure it remains ahead in logistics efficiency.

These infrastructure upgrades, coupled with innovations like AI-powered robotics, have enabled Amazon to manage costs while meeting rising consumer demands. As holiday shopping ramps up, Amazon is poised to capture a larger share of the retail market, supported by a 4% YoY increase in online U.S. holiday sales, according to Salesforce data.

Digital Advertising: A Rising Star

Amazon’s advertising business emerged as a standout performer, generating $14.3 billion in Q3, up 19% YoY. This growth outpaced industry heavyweights like Google and Meta, highlighting Amazon’s unique position to leverage its e-commerce platform for targeted advertising. With AI-driven tools enhancing ad efficacy, Amazon’s advertising segment is well-positioned to sustain its growth trajectory into 2025.

Free Cash Flow and Balance Sheet Strength

Amazon’s free cash flow surged to $47.7 billion over the past 12 months, reflecting disciplined cost management and operational efficiencies. Net cash and marketable securities stand at $33.2 billion, underscoring the company’s financial health. This robust liquidity has enabled Amazon to transition from a net interest expense of $421 million to a net interest income of $1.6 billion in 2024.

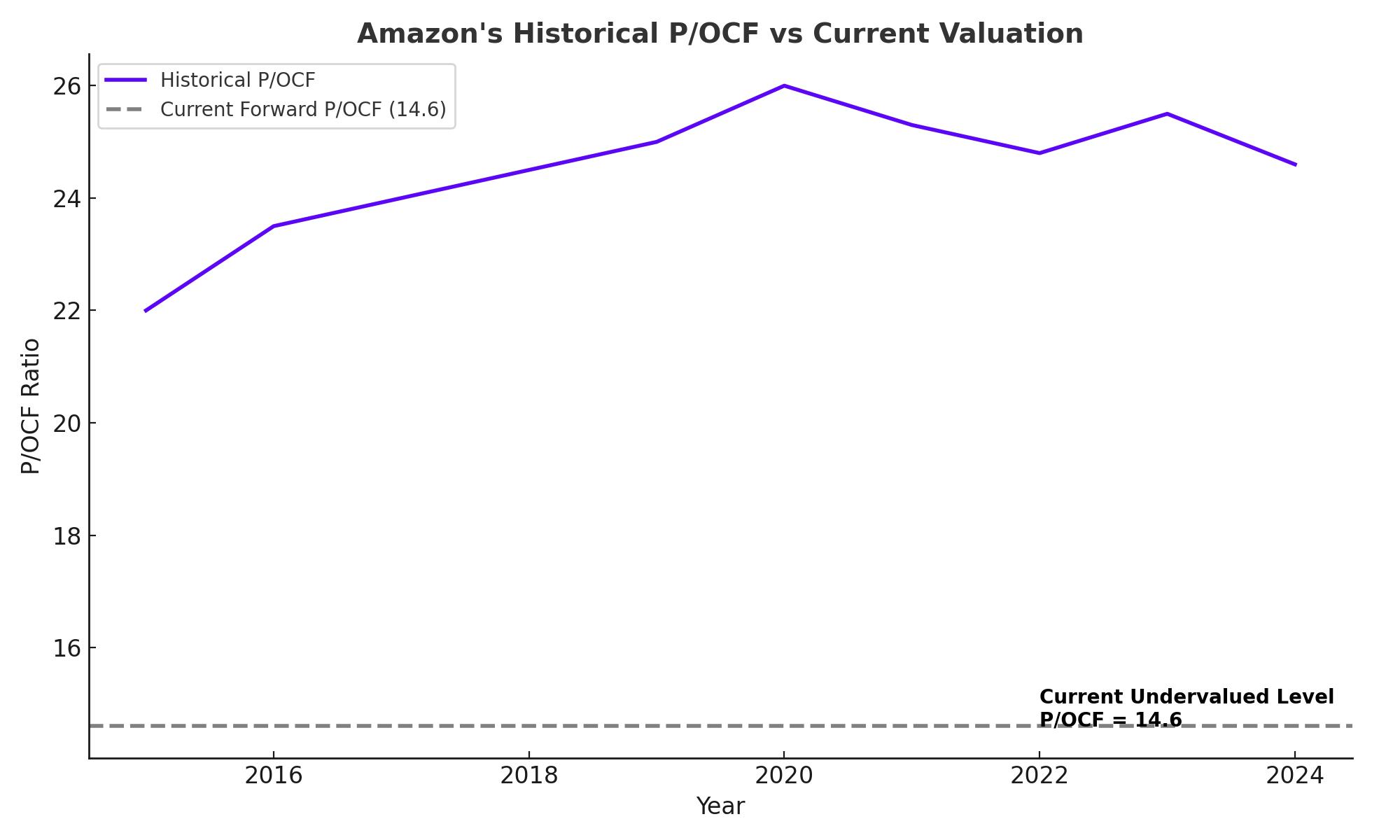

Amazon Stock NASDAQ:AMZN Undervalued Valuation Reveals 35% Upside – A Strong Buy Opportunity

Amazon.com Inc. (NASDAQ:AMZN) presents a compelling buy opportunity, with its valuation significantly below historical norms despite strong growth prospects. The stock currently trades at a forward P/OCF (Price to Operating Cash Flow) ratio of 14.6, a steep discount compared to its 10-year average of 25.3, signaling that the market may be underestimating its potential. This discrepancy highlights Amazon’s undervaluation relative to its growth trajectory, creating an attractive entry point for investors.

Projected operating cash flow per share is expected to grow at an impressive 23.8% annually through 2026, driven by Amazon’s leadership in high-growth industries like cloud computing, e-commerce, and digital advertising. Analysts estimate Amazon's fair value at $315 per share, representing a 35% upside from its current trading level of approximately $206. This valuation reflects the company's ability to generate substantial free cash flow, maintain dominance in critical markets, and expand its footprint in emerging sectors like AI and generative cloud technologies.

Amazon’s combination of robust fundamentals, consistent revenue growth, and aggressive investments in innovation underscores why NASDAQ:AMZN remains a strong buy. With a unique position in thriving industries and an undervalued stock price relative to its historical metrics, Amazon offers an exceptional opportunity for long-term investors seeking both stability and growth.

Navigating Risks in NASDAQ:AMZN’s Growth Journey

Despite NASDAQ:AMZN's clear market leadership, the road ahead is not without challenges. The strength of the U.S. dollar, which has surged nearly 5% since Q3 2024, poses a headwind for international revenues, particularly as the International segment contributed $35.9 billion in Q3 sales. A sustained dollar rally could erode the profitability of Amazon’s operations in Europe and Asia, where currency translations impact margins directly.

In the fiercely competitive cloud computing market, AWS faces pressure from Microsoft Azure, which grew 35% YoY in the most recent quarter, and Google Cloud, which reported a 33% increase YoY. Although AWS maintains a 31% market share, its growth rate trails these rivals, emphasizing the need for Amazon to continue its aggressive investments in AI and infrastructure to sustain its leadership. Additionally, regulatory environments, particularly in the EU, present potential hurdles, as data privacy and anti-monopoly probes could lead to fines or operational restrictions, jeopardizing Amazon’s efficiency.

Insider Transactions Reinforce Investor Confidence

Insider activity around NASDAQ:AMZN offers critical insights into executive confidence. Recent transactions show a pattern of significant insider purchases, underscoring belief in Amazon's long-term trajectory. Notably, senior management acquired shares at price points between $195 and $210, suggesting their valuation aligns with analysts' projections of upside potential beyond $300 per share. For deeper insights into these transactions and patterns, explore the Amazon Insider Transactions page.

Why NASDAQ:AMZN Remains a Buy

Amazon's market dominance in e-commerce and its pivotal position in cloud computing are bolstered by its $47.7 billion free cash flow and robust investments in AI-driven innovation. The company's 19% growth in digital advertising revenue and its 14% increase in service sales reinforce its ability to tap into multiple high-growth sectors. Analysts project a 35% undervaluation, with the stock currently trading near $206 compared to a fair value estimate of $315. This translates into a potential annual total return of over 36% through 2026, solidifying Amazon as a premier investment choice. For real-time tracking and updated metrics, visit the Amazon stock page.