Amazon’s NASDAQ:AMZN Growth Engine: Is This Tech Giant Still a Strong Buy?

As Amazon Expands Its Reach in Cloud Computing and Advertising, Investors Weigh the Risks and Rewards of Holding AMZN Stock | That's TradingNES

Amazon’s (NASDAQ:AMZN) Multi-Faceted Growth: A Comprehensive Analysis

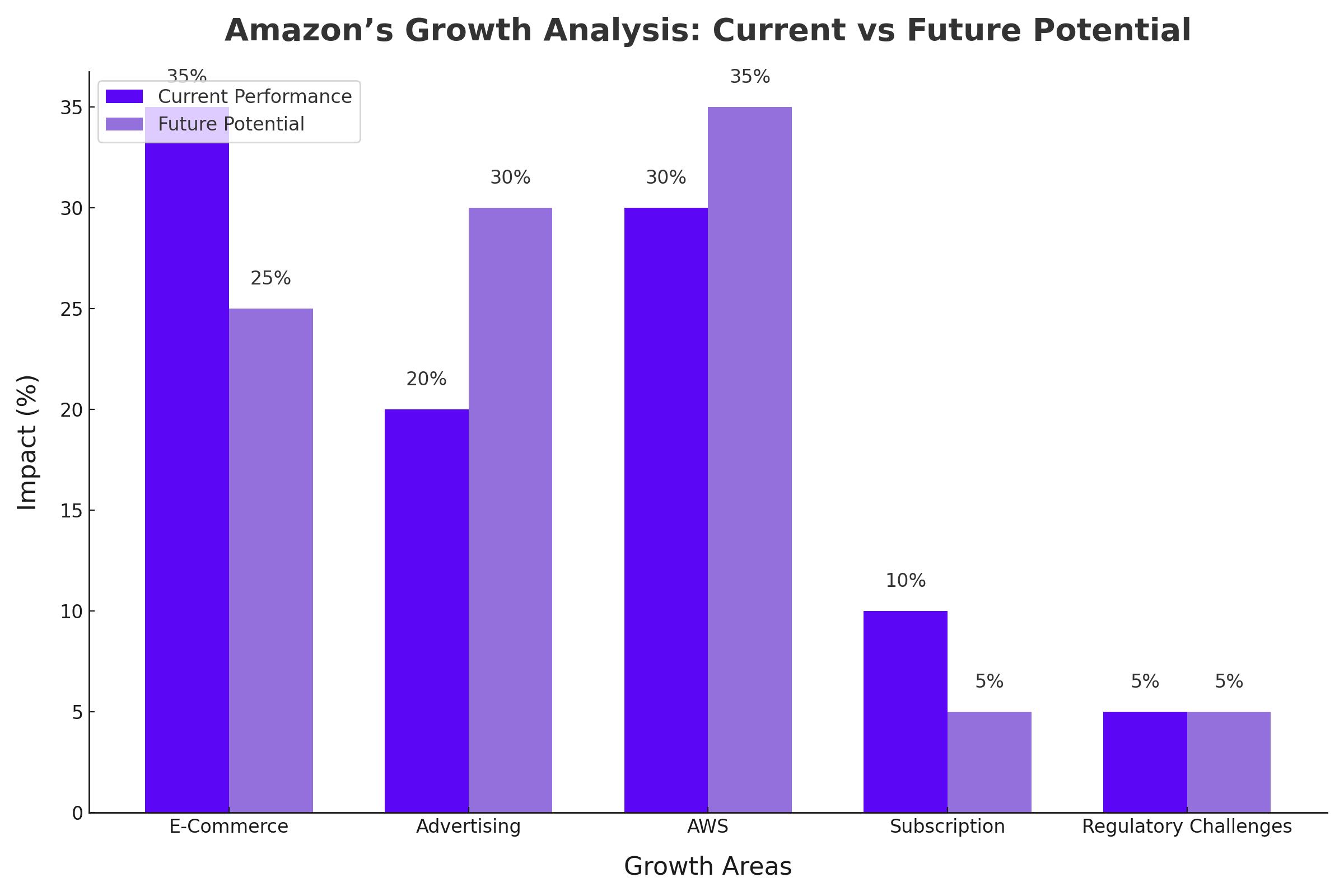

E-Commerce Expansion: Amazon’s Core Business Strength

Amazon’s e-commerce platform remains a cornerstone of its revenue model. While there are concerns that the online retail market is maturing, Amazon continues to show strong growth, particularly in key markets such as the U.S. and Canada, where e-commerce is projected to grow at compound annual rates of nearly 9-10%. This suggests that even in a more developed market, there is substantial room for Amazon to expand.

The real growth engine within Amazon’s e-commerce operation is its third-party (3P) marketplace. Amazon has strategically shifted from direct sales to enabling other sellers to use its platform, benefiting from the robust infrastructure Amazon has built. This segment has seen rapid growth, outperforming Amazon's direct sales due to its higher profit margins and lower operational costs. With commissions as high as 35%, the 3P marketplace is becoming a significant profit center for Amazon, supported by its unrivaled logistics network.

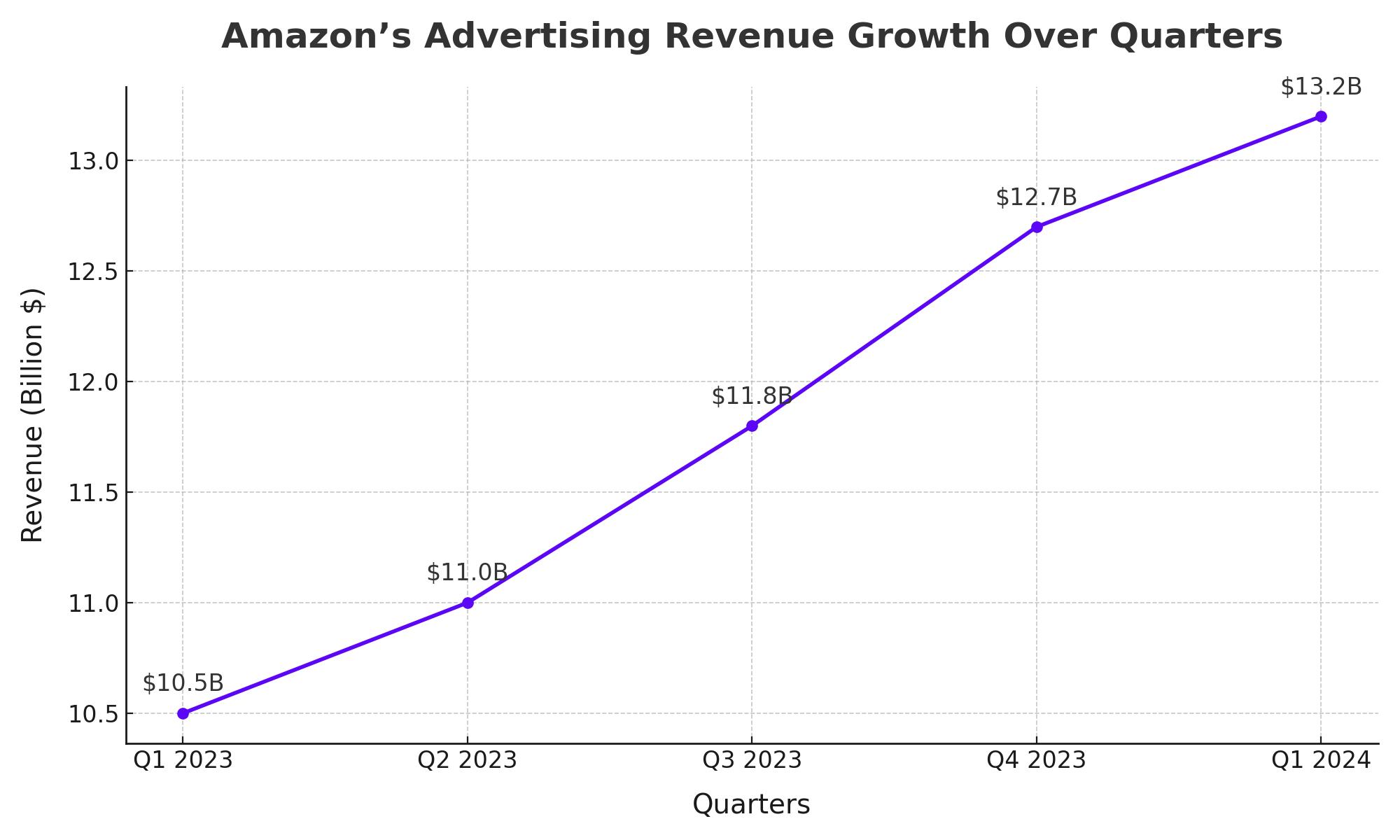

Amazon’s Advertising Surge: A Profitable Venture

Amazon’s advertising business is quickly becoming a significant contributor to its revenue. Unlike traditional advertising channels like Google and Meta, Amazon’s platform directly targets users who are already in a purchasing mindset, which makes its ads particularly effective. This effectiveness has translated into impressive growth, with Amazon’s ad revenue reaching $12.7 billion last quarter, despite slower growth compared to its competitors.

This segment is uniquely positioned to continue growing as it benefits directly from Amazon’s vast customer base and the data-driven insights the company can generate from consumer behavior on its platform. The synergy between its e-commerce operations and advertising capabilities provides Amazon with a powerful tool to monetize its user base more effectively than many of its peers.

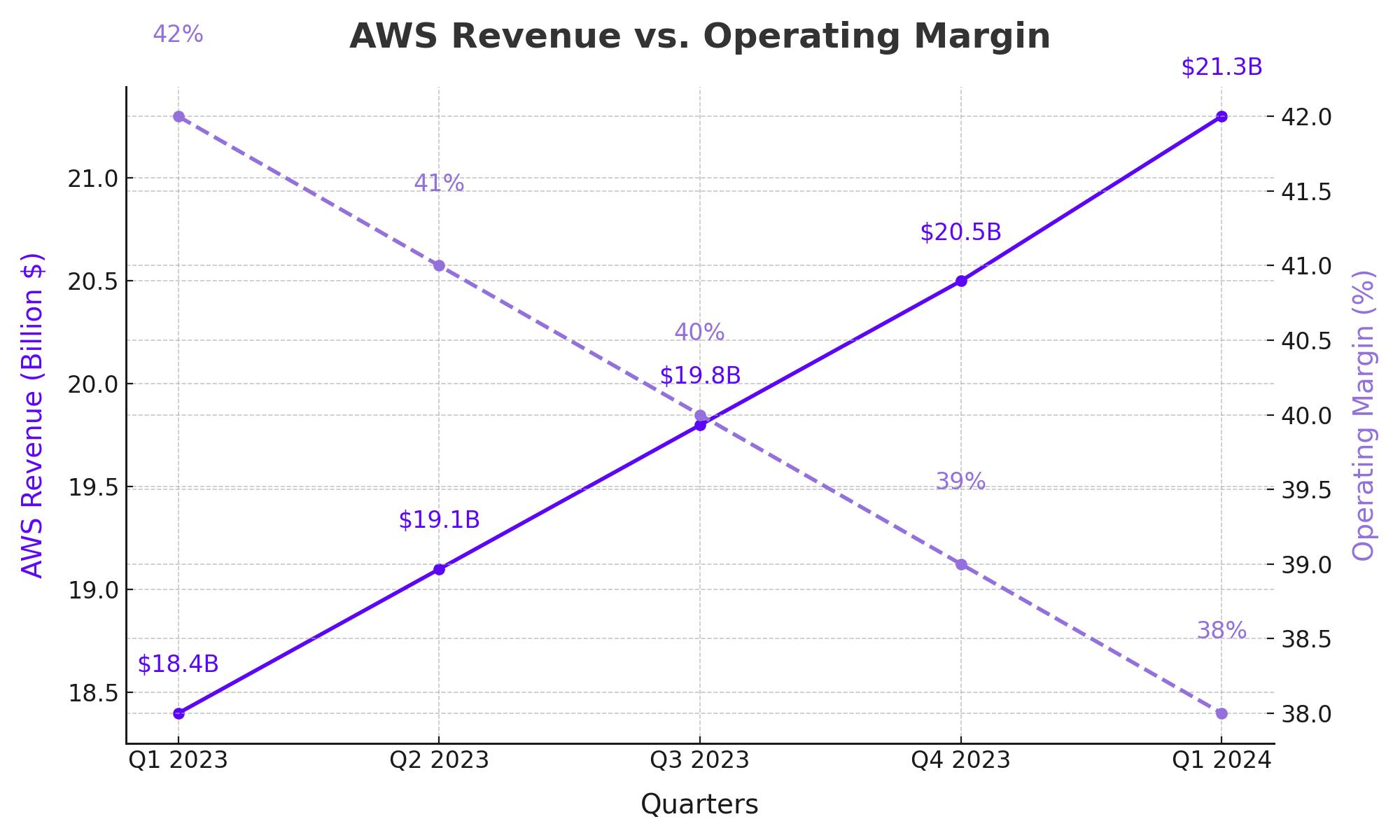

Amazon Web Services (AWS): The Growth Driver

Amazon Web Services (AWS) continues to be a pivotal part of Amazon’s business, driving significant profits and expanding rapidly as companies around the globe move to cloud computing. AWS reported a 19% increase in revenue last quarter, fueled by the growing demand for cloud-based solutions and artificial intelligence capabilities.

AWS’s profitability is a key factor in Amazon’s overall financial health, with operating margins exceeding 40%. This segment’s success underscores Amazon’s ability to leverage its early investments in cloud infrastructure, positioning itself as a leader in the industry. AWS’s consistent growth and profitability make it a vital component of Amazon’s broader strategy to dominate in technology services.

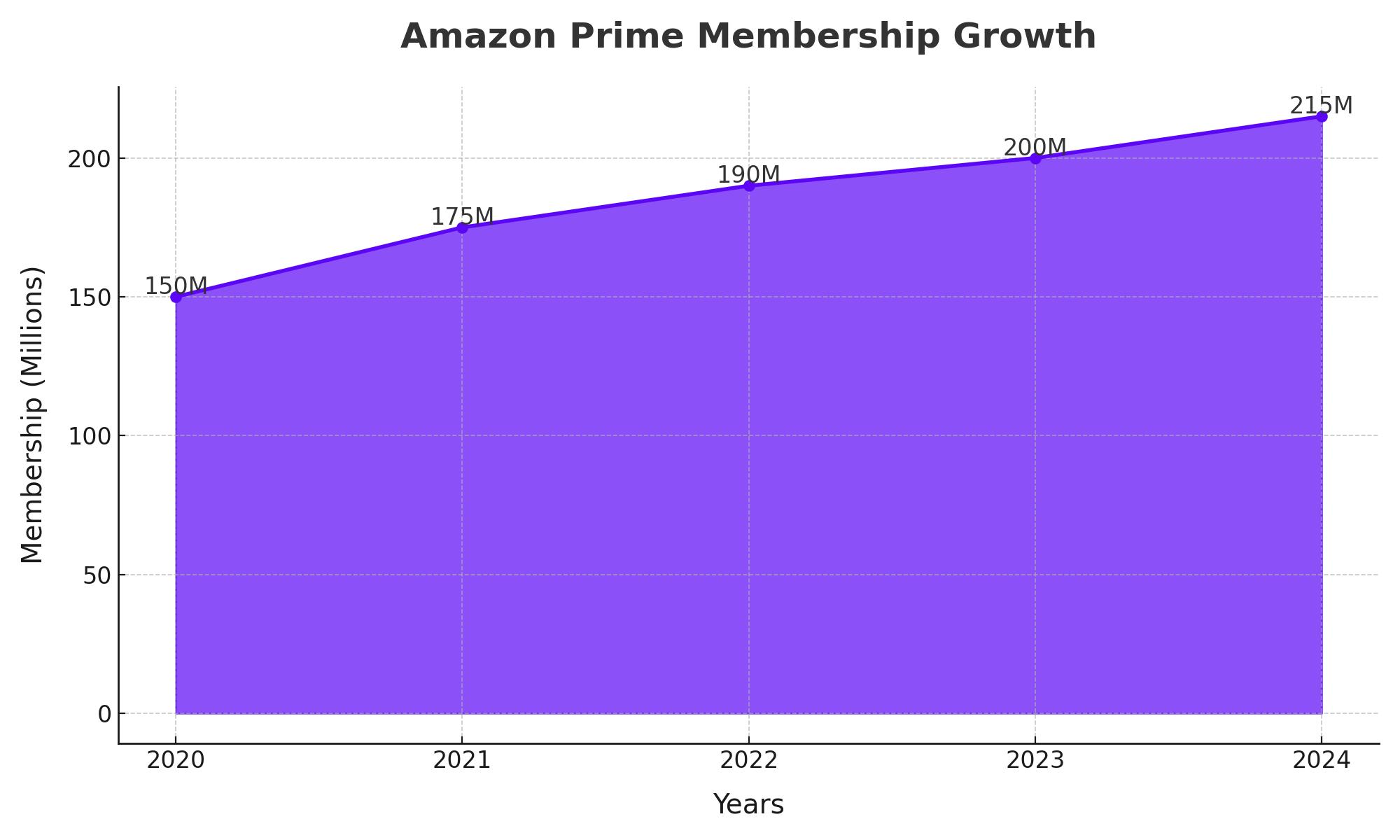

Subscription Services: The Sticky Revenue Stream

Amazon Prime remains one of the company’s most successful initiatives, offering a wide array of benefits that keep customers deeply integrated into the Amazon ecosystem. With over 200 million subscribers globally, Amazon Prime not only drives recurring revenue but also boosts customer loyalty, leading to increased spending on the platform.

The service’s value proposition continues to expand, with new features like discounted medication delivery and exclusive streaming content. Prime Video, in particular, has become a major draw, with sports streaming adding significant value to the subscription. As Amazon continues to enhance Prime’s offerings, it’s likely to see further growth in this segment, which plays a critical role in sustaining the company’s customer base.

Navigating Regulatory and Competitive Challenges

Amazon’s dominance has not gone unnoticed, drawing the attention of regulators and competitors alike. The ongoing antitrust investigations, including the recent lawsuit from the Federal Trade Commission, pose a significant risk to the company. These legal challenges could impact Amazon’s operations and lead to increased scrutiny of its business practices.

At the same time, Amazon faces growing competition in the digital advertising and e-commerce spaces, particularly from companies leveraging AI technology to enhance their offerings. Rivals like Meta and Google are making significant strides in integrating AI into their platforms, which could challenge Amazon’s position, particularly in the advertising market.

Financial Performance and Stock Valuation

Despite these challenges, Amazon’s financial performance remains robust. The company’s total revenue grew by 10% in the most recent quarter, with AWS and its advertising business leading the charge. Amazon has also focused on improving efficiency in its logistics network, which has helped boost profit margins.

Amazon’s stock, trading at a forward price-to-earnings (PE) ratio of around 35x, reflects the market’s expectations of continued growth, particularly from AWS. However, when adjusted for expected earnings growth, Amazon’s valuation appears reasonable given its strong performance and growth potential.

For investors, Amazon’s stock continues to be an attractive option, especially considering the company’s ability to generate substantial cash flow and its strategic positioning in high-growth sectors like cloud computing and digital advertising.

For real-time updates on Amazon’s stock, visit Amazon's Stock Profile.

That's TradingNEWS

Read More

-

AMLP ETF (NYSEARCA:AMLP): 8.29% Yield From America’s Midstream Toll Roads

06.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Lift XRPI to $13.12 and XRPR to $18.57 as XRP-USD Price Targets $2.40+

06.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Breaks Down as Henry Hub Spot Hits $2.86 and NG=F Slips Toward $3.00

06.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.70 While Markets Weigh Softer NFP Risk Against a Hawkish BoJ

06.01.2026 · TradingNEWS ArchiveForex