AMD Beats Forecasts with Strong Q2 Growth in Data Center Revenue

Robust Performance Driven by AI Chip Sales and Strategic Market Moves Positions AMD as a Key Competitor in the Semiconductor Industry | That's TradingNEWS

AMD's Strategic Moves and Financial Performance: An In-Depth Analysis

Explosive Growth in Data Center Business NASDAQ:AMD

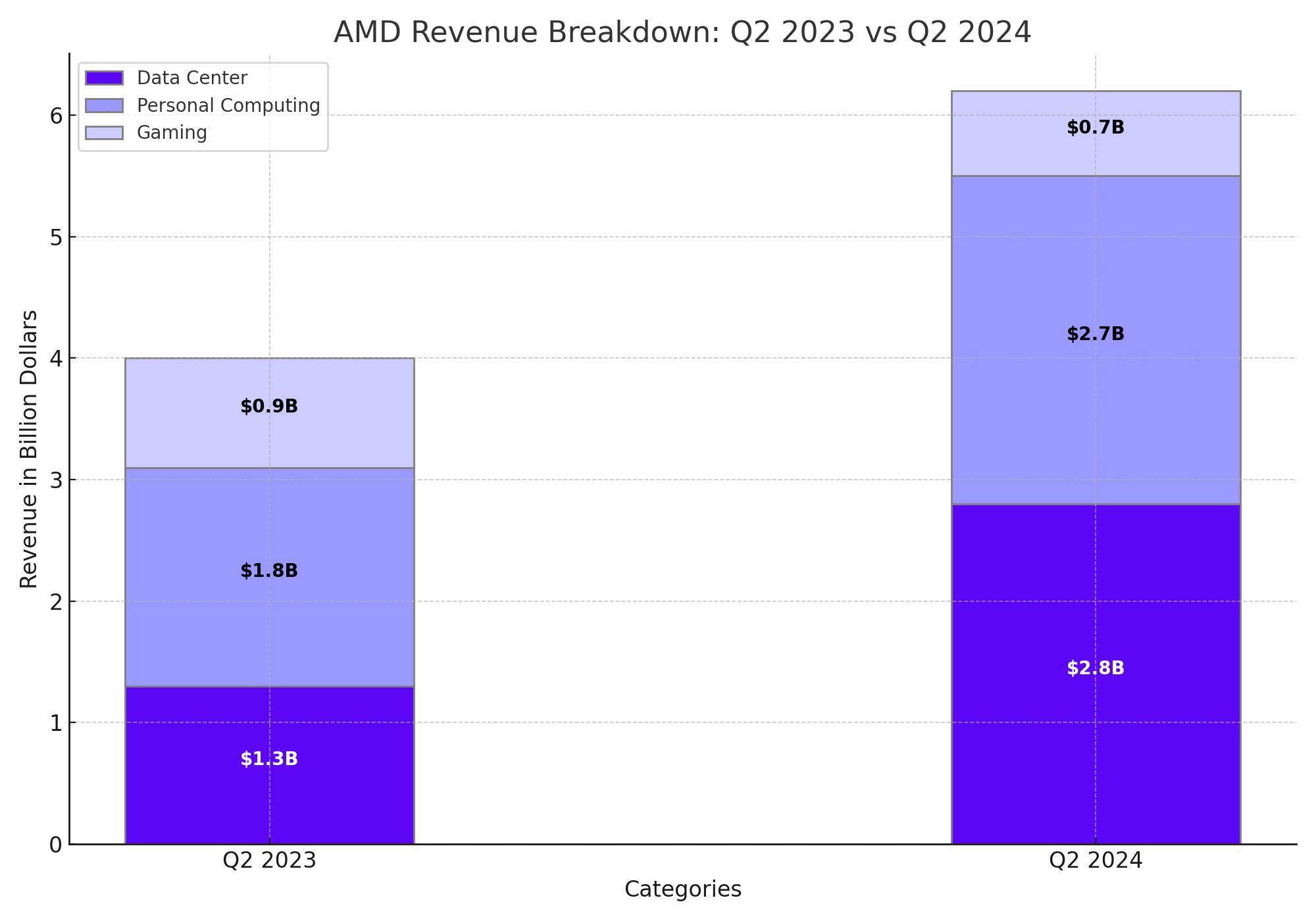

NASDAQ:AMD recently reported its Q2 2024 earnings, revealing a significant shift in its revenue sources. Nearly half of the company’s sales are now from data center products, marking a pivotal transition from its traditional focus on personal computers and gaming consoles. This surge is largely attributed to the AMD Instinct MI300 accelerator, which has directly competed with Nvidia's H100 AI chip. In just one quarter, the MI300 achieved over $1 billion in sales, a remarkable jump from its cumulative $1 billion since its December 2023 launch.

AMD’s Annual AI Chip Release Strategy

Following Nvidia's successful strategy, AMD plans to release new AI chips annually. The upcoming MI325X is set for Q4 2024, followed by the MI350 in 2025, and the MI400 in 2026. CEO Lisa Su emphasized that despite supply chain improvements, demand for the MI300 remains high, with tight supply expected through 2025.

Data Center Revenue Milestones

AMD’s data center segment has experienced phenomenal growth, with Q2 revenue reaching a record $2.8 billion. This represents a 115% year-over-year increase, primarily driven by the Instinct MI300 and EPYC server CPUs. However, the company faces stiff competition from Nvidia, whose data center revenue recently hit $22.6 billion in a quarter.

Impact on Personal Computing and Gaming Segments

Positive Trends in Personal Computing

While the data center business soars, AMD's personal computing segment also showed resilience. Ryzen CPUs saw a 49% year-over-year increase, with slight quarterly gains. Despite a 59% decline in gaming revenue, the Radeon 6000 GPUs posted year-over-year sales growth, indicating strength in specific product lines even as console sales wane.

Zen 5 Laptops and Market Penetration

AMD's Zen 5 laptops, equipped with Ryzen AI 300 “Strix Point” chips, are expected to significantly impact the market. Over 100 different platforms are slated for release, with major brands like Asus, HP, MSI, Acer, and Lenovo on board. This broad adoption signals AMD's strong position in the personal computing market.

Financial Highlights and Stock Performance

Earnings Beat and Revenue Growth

For Q2 2024, AMD reported revenue of $5.84 billion, beating consensus estimates by $120 million. Non-GAAP earnings per share stood at $0.69, slightly above the expected $0.68. This performance is attributed to robust growth in the data center and client segments.

Stock Market Reaction

Following the earnings release, AMD’s stock surged nearly 6% in post-market trading. Analysts highlighted the significant 49% YOY growth in the client segment and the 115% increase in data center revenue. Despite high inventory levels signaling competitive pressure, especially from Nvidia, AMD's financial outlook remains strong.

Future Projections and Market Strategy

Q3 Revenue Forecast

Looking ahead, AMD projects Q3 2024 revenue to be around $6.7 billion at the midpoint, slightly above analyst estimates of $6.61 billion. This optimistic outlook is supported by the continued demand for AI-related products and the company’s strategic focus on high-growth areas.

Competitive Landscape and Market Positioning

Nvidia's Dominance and AMD’s Response

Nvidia's H100 GPU has set a high bar in the AI chip market, but AMD is aggressively positioning its MI300 and future MI325X and MI350 chips to compete. While Nvidia’s lead is substantial, AMD's strategic releases and partnerships with major tech companies like Microsoft, Meta, Dell, HPE, and Lenovo are crucial to gaining market share.

Strategic Acquisitions and Sector Developments

M&A Activity in the U.S. Shale Sector

Parallel to its product advancements, AMD is also navigating a dynamic market landscape marked by strategic acquisitions. The semiconductor industry is witnessing a wave of M&A activities, with AMD’s own movements in acquiring and integrating new technologies playing a key role in its growth strategy.

Conclusion

AMD's Q2 2024 performance underscores its successful pivot towards data center products and AI-driven technologies. The company's strategic initiatives, including annual AI chip releases and broadening its product base in personal computing, position it well against formidable competitors like Nvidia. With robust financial health and promising future projections, AMD (NASDAQ:AMD) continues to be a significant player in the semiconductor market. Investors and industry watchers should closely monitor its developments, particularly in the rapidly evolving AI and data center sectors.