AMD (NASDAQ:AMD): Is This AI-Powered Stock Worth the $500 Billion Opportunity?

Can AMD’s $15,000 GPUs Challenge NVIDIA’s $70,000 Chips in the AI Arms Race? | That's TradingNEWS

AMD (NASDAQ:AMD): Is This AI-Powered Stock Worth the $500 Billion Opportunity?

Advanced Micro Devices (NASDAQ:AMD) is at a critical juncture in its evolution as a dominant player in the tech industry, navigating through market headwinds while solidifying its position in artificial intelligence (AI) and data centers. AMD's shares have fallen by approximately 23.37% since October, primarily due to concerns about competition with NVIDIA's Blackwell chips. Despite this, AMD has shown significant growth potential driven by breakthroughs such as DeepSeek V3 and the rising demand for cost-efficient AI hardware. With a forward P/E of 24.5x and robust growth in its data center business, AMD offers compelling value and growth potential in the evolving AI and semiconductor markets.

AI Breakthroughs and the Growing Need for Cost-Effective Solutions

DeepSeek V3, a new AI model, has emerged as a game-changer for training and inference in large language models (LLMs). By dramatically reducing training costs, DeepSeek V3 makes AMD’s GPUs a cost-effective alternative to NVIDIA’s high-end GPUs. DeepSeek’s latest model cost $5.6 million to train, significantly less than traditional methods. This is pivotal for enterprises that are increasingly cost-sensitive in deploying AI solutions.

AMD’s Instinct MI325X GPUs, priced at approximately $15,000, are considerably more affordable than NVIDIA’s Blackwell chips, which can cost up to $70,000. This price advantage allows AMD to compete in a broader market segment, targeting enterprises and governments that require effective yet budget-friendly AI hardware. While NVIDIA dominates the premium segment with its state-of-the-art GPUs, AMD is carving a niche in providing high-performance GPUs optimized for cost-conscious deployments.

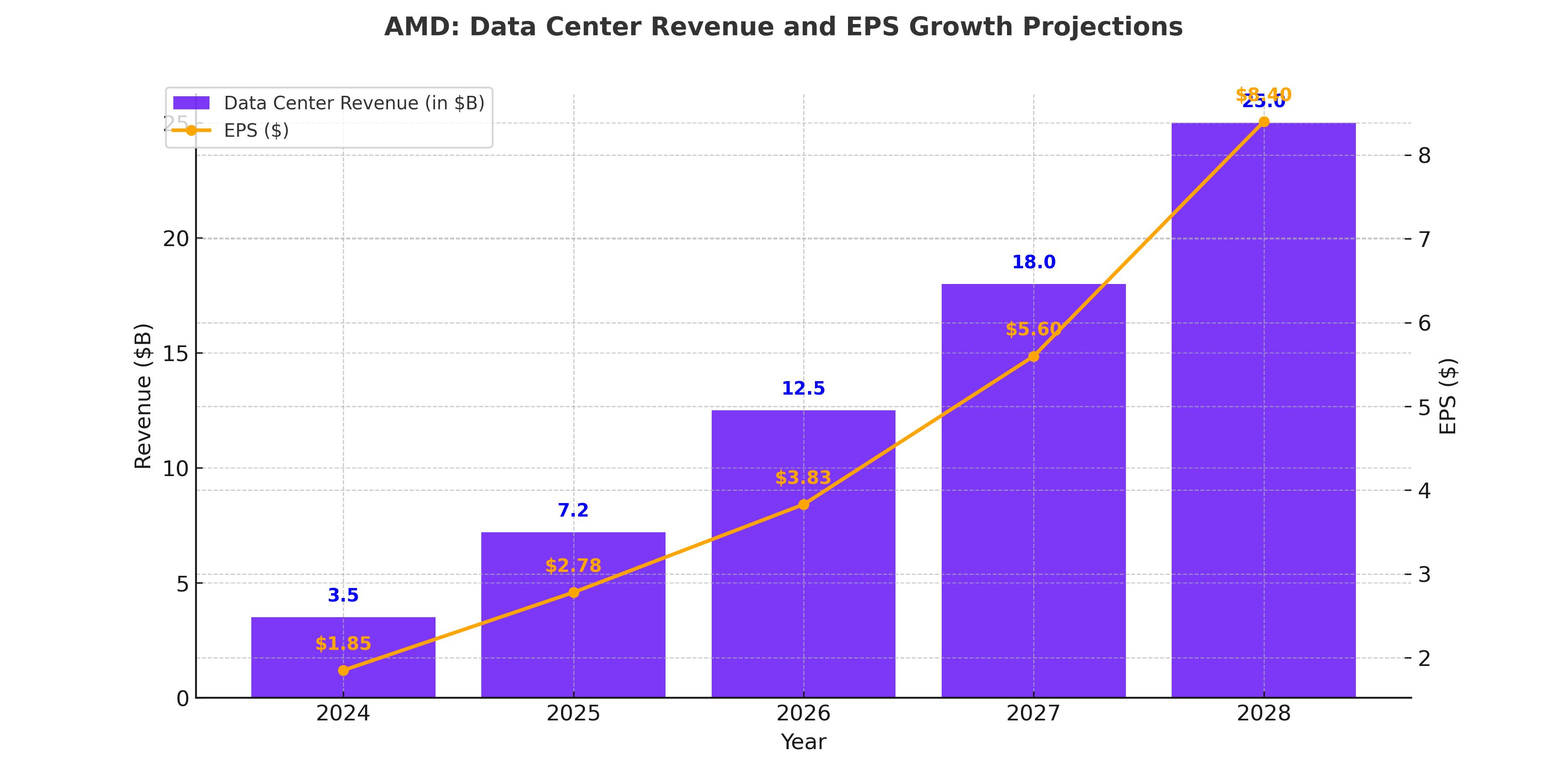

AMD's Q3 2024 results highlighted this potential, with data center revenue soaring to $3.5 billion, marking a 122% year-over-year growth. AMD has also increased its AI GPU sales guidance from $2 billion to $5 billion, demonstrating strong momentum in this rapidly growing market.

Data Center Growth and AI GPU Momentum

The data center segment is a cornerstone of AMD's growth strategy. AMD’s MI300 series GPUs are designed to handle inference-heavy workloads, a key requirement for next-generation AI applications. These GPUs feature a modular chiplet design, enhancing memory bandwidth and reducing latency—critical for reasoning models that demand significant inference compute. This architecture positions AMD well to serve the emerging needs of hyper-scalers like Google, Microsoft, and Amazon, which are projected to spend $500 billion on AI servers by 2028.

Meta’s adoption of AMD’s MI300x accelerators is a testament to AMD's growing traction in the AI market. Meta has deployed over 173,000 MI300x GPUs in its data centers to support its Llama models, which serve over three billion users globally. The MI300x's embedded memory capacity allows Meta to process large inference loads efficiently, making it a preferred choice for cost-sensitive AI applications.

Competitive Landscape and Market Challenges

While AMD is making significant strides, it faces formidable challenges from NVIDIA’s CUDA ecosystem, which dominates the market for AI workloads. CUDA’s extensive developer base and software support give NVIDIA a substantial edge. However, AMD’s ROCm ecosystem is gradually gaining traction, supported by its focus on modular chiplet designs and competitive pricing.

Another challenge is the rapid pace of innovation in AI models. As new architectures and use cases emerge, AMD must adapt quickly to remain competitive. The company’s modular approach provides flexibility to address these evolving requirements, mitigating the risk of obsolescence.

Financial Performance and Valuation

AMD’s financial performance underscores its growth potential. The company reported $6.8 billion in Q3 revenue, an 18% year-over-year increase, with non-GAAP gross margins improving to 54%. These results are driven by the strong performance of its data center segment and gains in the CPU market against Intel.

Despite its recent stock decline, AMD’s valuation remains attractive. The company’s forward P/E of 24.5x is below its historical average of 51.4x, reflecting market skepticism about its growth prospects. However, analysts project robust EPS growth of 50% in 2025, 38% in 2026, and 46% in 2027, suggesting significant upside potential. If AMD’s PEG ratio aligns with the sector median of 1.89, its valuation could increase by approximately 130.49%.

Risks and Opportunities

Key risks for AMD include slower adoption of its GPUs, potential delays in product launches, and macroeconomic factors that could impact semiconductor demand. However, the shift from training to inference in AI workloads presents a significant opportunity. AMD’s focus on cost-effective GPUs positions it well to capture market share as smaller enterprises and governments adopt AI solutions.

The upcoming MI350 series, expected to launch in late 2025, promises a 35x improvement in AI performance, further strengthening AMD’s competitive position. Additionally, the increasing demand for reasoning models and AI agents will drive inference workloads, creating new growth opportunities for AMD.

Strategic Outlook and Investment Case

AMD is well-positioned to capitalize on the evolving AI landscape. The company’s focus on cost-efficient GPUs, coupled with advancements like DeepSeek V3, aligns with the market’s need for scalable AI solutions. While NVIDIA remains the leader in premium GPUs, AMD’s ability to address a broader range of use cases makes it a strong contender in the AI market.

With its data center business growing rapidly and a clear strategy for addressing inference-heavy workloads, AMD is poised for long-term growth. At its current valuation, the stock offers an attractive entry point for investors seeking exposure to AI and semiconductor growth.

AMD is a Buy, supported by its competitive pricing, strong product roadmap, and growing market share in the AI GPU market. The company’s ability to deliver cost-effective solutions for emerging AI applications ensures its relevance and profitability in the years ahead.