AMD (NASDAQ: AMD) Poised for Massive Growth as AI and Data Centers Surge

With Data Center Sales Soaring and MI300 Accelerators Leading the Charge, Is AMD the Next Big Investment Opportunity? | That's TradingNEWS

(NASDAQ: AMD)– Accelerated Growth and Strong Market Position

Overview of Advanced Micro Devices (NASDAQ: AMD)

Advanced Micro Devices (NASDAQ: AMD) has gained significant traction in the technology and semiconductor sectors, particularly in the AI-driven market. With its data center sales and cutting-edge GPU technology, AMD is challenging industry giants like Nvidia. This year, AMD has recorded a rally of over 12%, fueled by key innovations like the upcoming MI325 and MI350 accelerators. These are expected to compete directly with Nvidia’s GPUs, providing AMD with a crucial growth catalyst for 2024 and beyond.

Strong Data Center Growth Driving AMD's Performance

AMD's data center sales have skyrocketed, marking a 115% year-over-year (YoY) increase in Q2 2024, hitting $2.8 billion. This substantial growth can be attributed to the company’s MI300 accelerator, designed for high-performance computing and AI workloads. This growth in data centers highlights the company’s potential to rival Nvidia, which saw a 154% YoY increase during the same period. AMD's expansion in the data center market is a key factor driving the company’s profit surge, indicating a strong potential for sustained growth.

Moreover, AMD’s EPYC server CPUs have contributed to this success, helping solidify AMD's position in the data center industry, which has become its most lucrative segment. As the company continues scaling its MI300 accelerators, projected shipment volumes of up to 400,000 units in 2024 could translate into further profit growth.

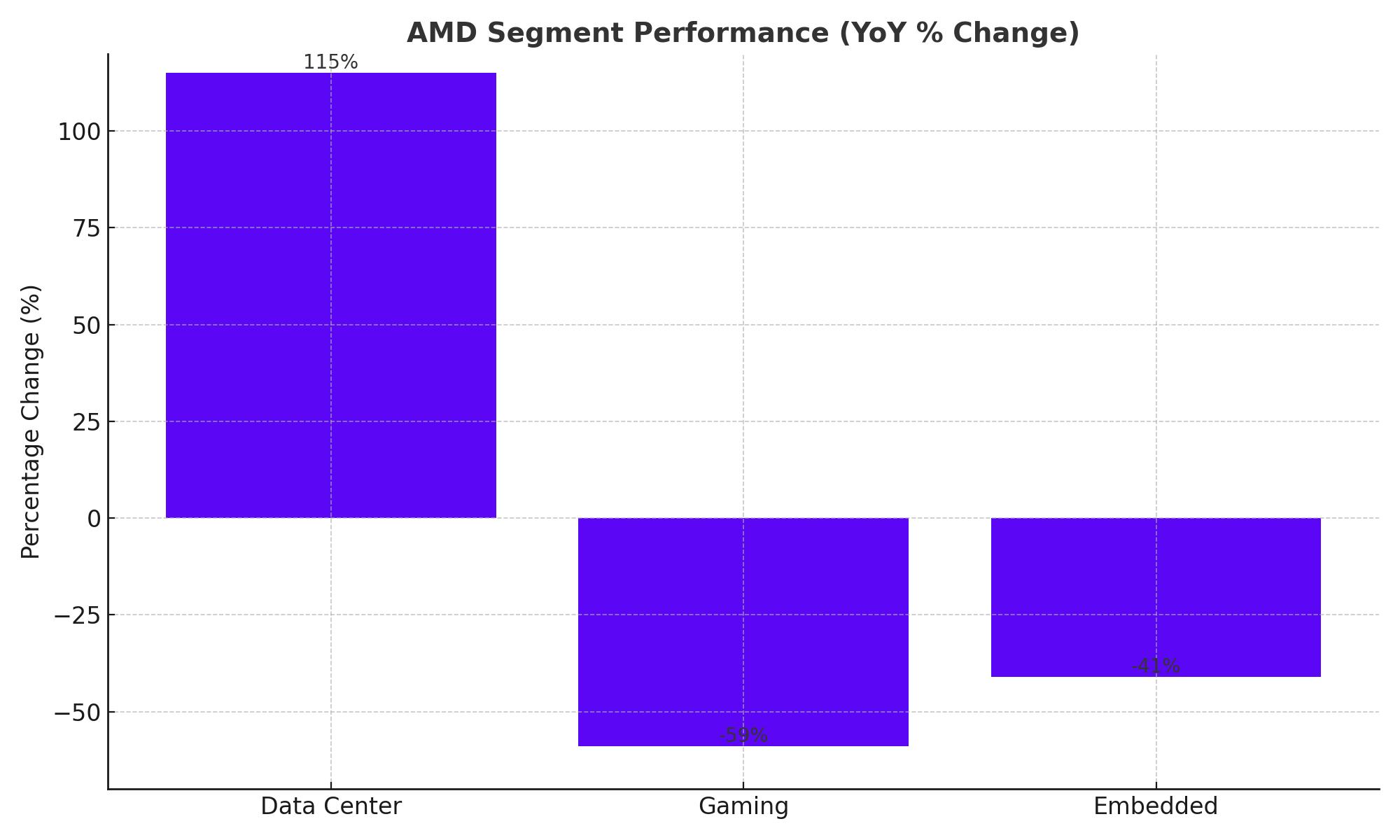

Segment Performance: Mixed Results but Data Centers Shine

In contrast to the robust performance of the data center segment, AMD's gaming division showed a significant 59% drop in YoY sales, reaching $648 million in Q2 2024. Additionally, the embedded segment, which serves industrial applications, also fell by 41%. Despite these declines, the company’s data center division continues to act as a counterbalance, boosting its overall growth trajectory.

With over $743 million in operating income from data centers alone in Q2 2024, this segment outpaced all others in AMD's portfolio. The company’s continued investment in high-performance GPUs for AI and data centers presents a lucrative opportunity for investors, especially with its MI300 series rapidly scaling.

AMD’s Stock Valuation: Compelling Investment Opportunity

Currently, AMD is trading at $152.08 per share, reflecting a forward price-to-earnings (P/E) ratio of 28x based on projected 2024 earnings. Compared to Nvidia, which trades at a 33x P/E ratio, AMD offers a relatively attractive valuation, especially when factoring in its projected 60% YoY profit growth in 2024.

Nvidia, despite being the industry leader, is expected to see a lower profit growth rate of 40%. This gap in growth projections presents an opportunity for investors to capitalize on AMD’s faster-paced expansion, particularly in data center markets.

Rising AI Demand and Competitive Edge

AI innovation remains a core driver for AMD (NASDAQ: AMD), with its MI300X accelerator being particularly well-positioned to capitalize on the surging demand for AI infrastructure. The accelerators have been widely adopted by major clients like Microsoft, Oracle, and Dell, demonstrating their versatility and reliability in large-scale AI and high-performance computing (HPC) environments.

Furthermore, AMD expects its data center segment to generate $4.5 billion in revenue directly from MI300X sales in 2024. This is a significant upward revision from the previous estimate of $4 billion, underscoring the strong demand for AMD’s cutting-edge technology in the AI and data center space.

Risk Factors and Market Dynamics

While AMD’s outlook remains strong, the rapid expansion of the AI hardware market comes with risks. One key risk is potential oversupply, as companies race to establish themselves in the growing AI space. Price softening for GPUs could also impact AMD’s profit margins, especially if demand growth for AI hardware stalls in the short term.

Additionally, geopolitical risks, such as the U.S. government’s ongoing export restrictions to China, could hamper growth prospects for semiconductor companies. AMD, like its peers, must navigate these challenges carefully to sustain its momentum.

AMD vs. Nvidia: A Shift in Market Dynamics

Although Nvidia continues to dominate the AI GPU market, AMD (NASDAQ: AMD) is steadily narrowing the gap. Nvidia’s data center sales hit $26.3 billion in Q2 2024, but the growth rate for AMD in the same sector shows that Nvidia is only growing 1.4 times faster. This narrowing performance gap suggests that AMD has the potential to rival Nvidia in data centers and AI hardware markets, giving investors reason to consider AMD as a top contender in the sector.

With AI-driven technologies becoming central to the future of computing, AMD’s innovations, particularly the MI300X series, have positioned the company for continued growth. Investors looking for a competitive edge in the semiconductor market may find AMD's potential upside compelling, particularly as the company scales its operations.

Conclusion:

AMD Set for a Strong Surge As Advanced Micro Devices (NASDAQ: AMD) accelerates its push into the AI and data center markets, the stock is poised for strong growth. Its impressive performance in the data center space, along with its MI300 series accelerators, places it in direct competition with Nvidia. AMD’s current stock valuation and projected profit growth suggest that the stock could outperform in the coming quarters, making it a potentially lucrative investment.

Explore real-time charts for AMD here to stay updated on the stock’s movements.

That's TradingNEWS

Read More

-

MAGS ETF Price Near $69 High: Mag 7 EPS Surge And AI Cash Flows Drive The $67.55 ETF

29.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI at $10.69 and XRPR at $15.15 Lead $1B Inflow Wave While Bitcoin ETFs Bleed $782M

29.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Jumps Above $4.60 as Storage Flips to Deficit and LNG Exports Hit Records

29.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Slips Toward 156 As BoJ Hawkish Turn Collides With Fed Cut Outlook

29.12.2025 · TradingNEWS ArchiveForex