Analyzing FedEx NYSE:FDX Strategy in Shifting Economic Landscape

Unpacking FedEx's Latest Financials, DRIVE Initiative Success, and Insider Confidence as It Adapts to Global Trade Dynamics and Market Demands | That's TradingNEWS

FedEx Corporation (NYSE:FDX): A Comprehensive Analysis Amid Economic Flux

Introduction to FedEx's Market Performance

In an era where the global economic landscape remains precariously balanced, FedEx Corporation (NYSE:FDX) emerges as a focal point for investors and market analysts alike. The company's recent fiscal activities, underscored by a significant stock surge of 7.35%, marking a close at 284.32 with an after-hours adjustment to 283.81, have sparked a renewed interest in its operational efficiency and strategic outlook in the face of shifting economic winds.

Fiscal Dynamics and Revenue Insights

FedEx's latest earnings report, detailing the third quarter of fiscal 2024, reveals a nuanced picture of resilience and challenge. Despite a slight revenue decline of 2%, amounting to $21.7 billion, the company's adept cost-cutting measures and efficiency enhancements under the DRIVE initiative have led to an unexpected uptick in profitability, with earnings per share (EPS) soaring to $3.86, surpassing analyst predictions.

The focal point of FedEx's operational strategy—its expansive DRIVE program—aims for a staggering $4 billion cost reduction by 2025. This initiative's early success is evident in the operational income growth and margin expansion, despite the ongoing demand volatility in the shipping and logistics sector.

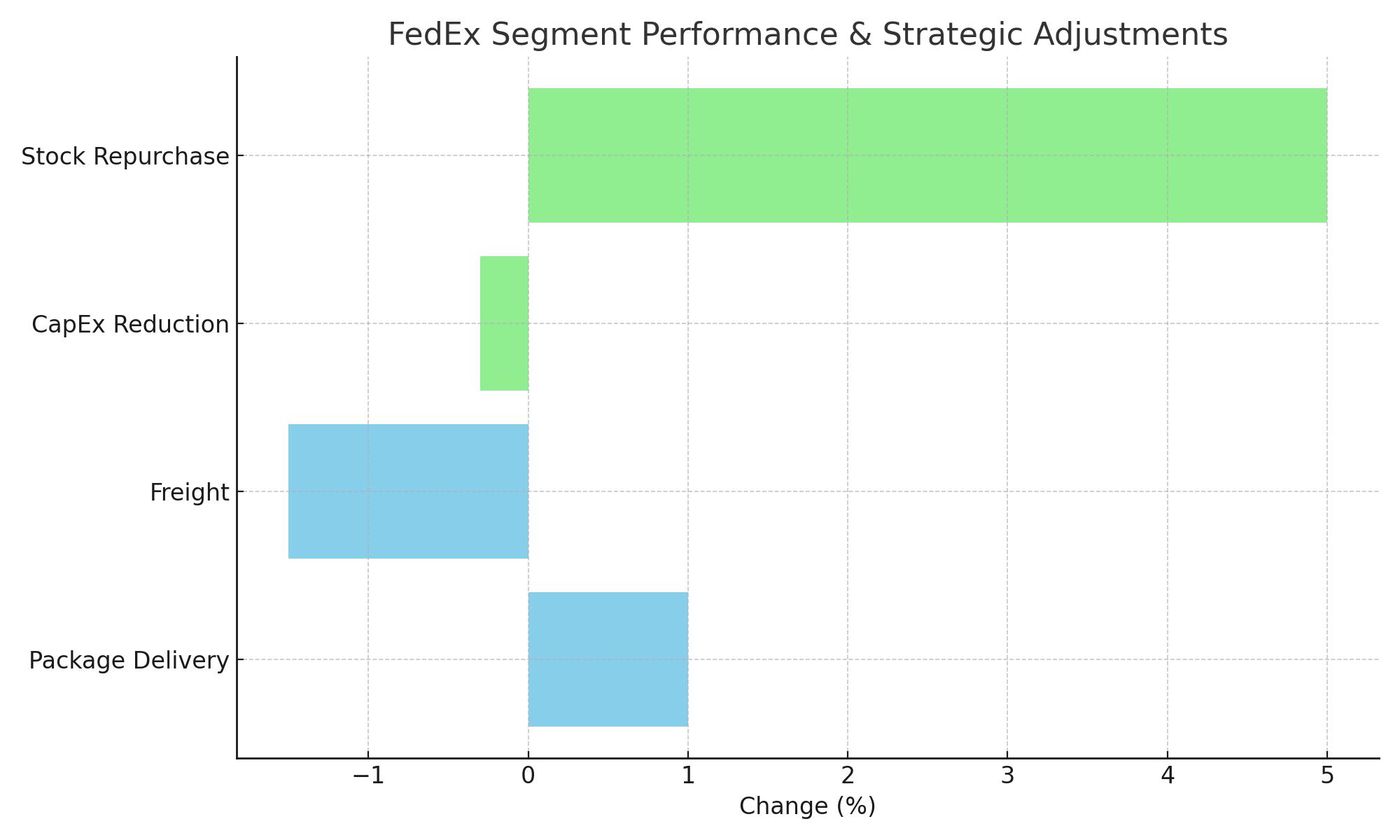

Segment Performance and Strategic Adjustments

An in-depth look at FedEx's segment performance unveils contrasting trends. The package delivery business saw a modest increase, while the freight segment experienced a downturn, reflecting broader industry challenges. However, FedEx's strategic foresight in reducing its planned capital expenditure to $5.4 billion from $5.7 billion signals a leaner approach geared towards sustainable growth.

Furthermore, FedEx's announcement of a $5 billion stock repurchase program, coupled with a narrowed full-year earnings projection, underscores a strategic pivot towards enhancing shareholder value and fortifying its market standing amidst uncertain economic conditions.

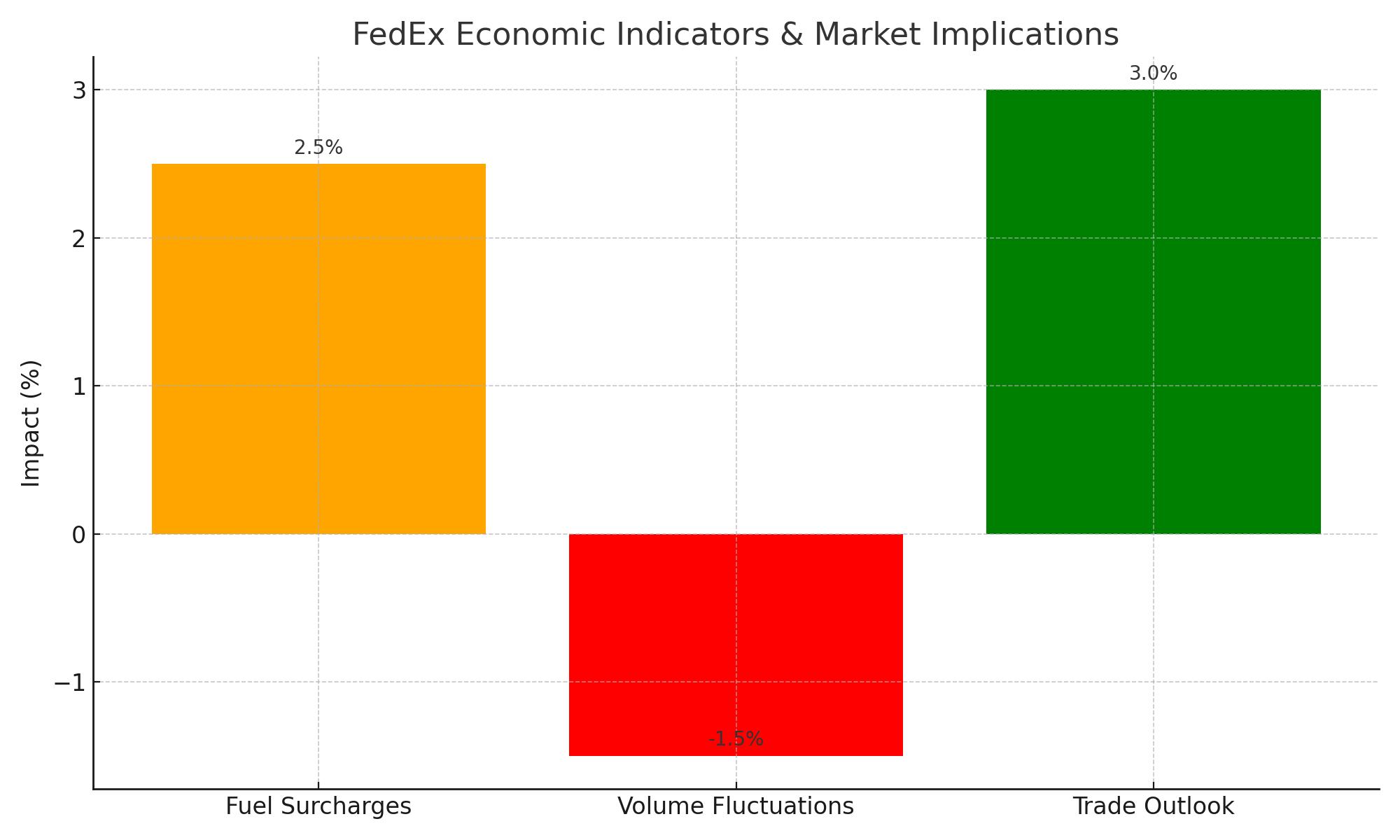

Economic Indicators and Market Implications

The broader economic indicators, including volatile fuel surcharges and fluctuating volumes in the FedEx Express and FedEx Freight segments, paint a picture of a sector in flux. The company's meticulous navigation through these challenges, particularly its ongoing negotiations for a new contract with the United Postal Service (USPS), will be pivotal in shaping its future trajectory.

The market's reception to FedEx's fiscal disclosures and strategic maneuvers has been overwhelmingly positive, as evidenced by the stock's robust performance. This optimism is further bolstered by industry peers like Hapag-Lloyd signaling a brighter outlook for trade and shipping demand in the latter half of 2024.

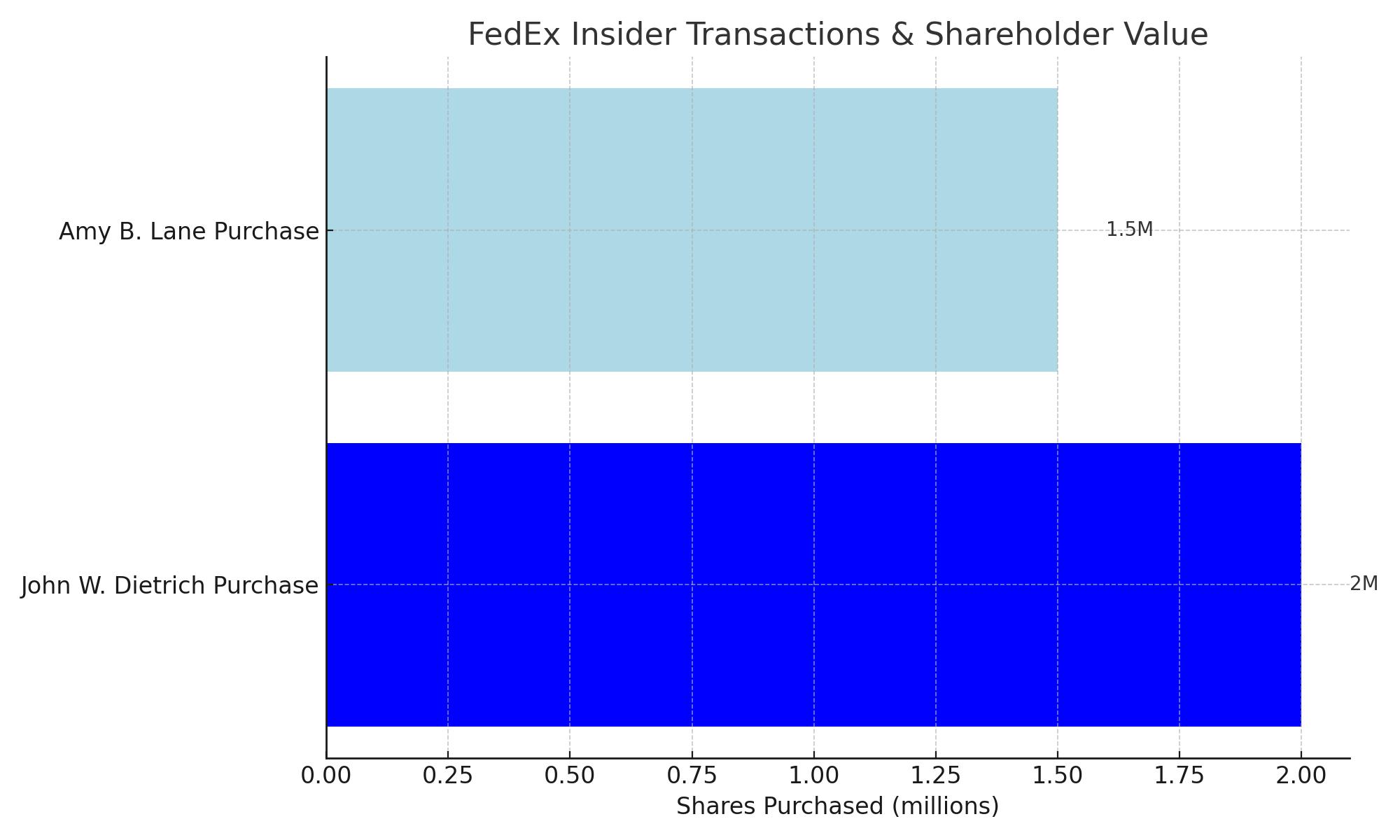

Insider Transactions and Shareholder Value

A closer examination of FedEx's insider transactions reveals a nuanced layer of confidence within the company's leadership about its financial health and future prospects. Recent acquisitions by EVP John W. Dietrich and Director Amy B. Lane underscore a bullish sentiment from those at the helm, with strategic purchases highlighting their belief in the company's undervalued stock and its long-term growth potential. This insider confidence, detailed in filings with the Securities & Exchange Commission, not only illuminates the optimism within FedEx's ranks but also serves as a signal to investors about the perceived intrinsic value and future trajectory of the company.

Institutional Investors and Market Dynamics

The role of institutional investors in shaping FedEx's market performance cannot be overstated. With a significant 78.80% of FedEx's shares held by institutional entities, their investment movements offer a critical insight into the stock's perceived value and future direction. Recent adjustments in holdings by Vanguard Group Inc., BlackRock Inc., and other financial behemoths reflect a broader market consensus on FedEx's resilience and growth potential amidst economic uncertainties. This institutional backing lends a layer of stability and confidence to FedEx's stock, reinforcing its appeal to both seasoned investors and market newcomers.

FedEx's Forward-Looking Strategies

Looking ahead, FedEx's strategic blueprint for navigating the murky waters of global trade tensions, fluctuating demand, and economic uncertainties is multifaceted. The company's robust DRIVE initiative, aimed at achieving unparalleled efficiency and cost reduction, is just the tip of the iceberg. FedEx's ambitious plans for share repurchases underscore a deliberate strategy to enhance shareholder value and underscore the company's bullish outlook on its financial future.

Moreover, FedEx's negotiations with the USPS for a new contract and its strategic recalibrations in response to global economic indicators reflect a dynamic approach to growth and sustainability. These maneuvers, coupled with FedEx's agile response to market demands and economic shifts, position the company as a nimble giant capable of weathering storms and seizing growth opportunities.

The Verdict: A Strategic Hold with a Watchful Eye

In conclusion, FedEx Corporation (NYSE:FDX) presents a compelling case study of a behemoth in the logistics and shipping industry, skillfully navigating the challenges and opportunities of a fluctuating economic landscape. With its strategic cost-cutting initiatives, insider confidence, institutional backing, and forward-looking strategies, FedEx stands on solid ground.

Investors are advised to maintain a "Hold" position on FedEx, with a vigilant watch on its quarterly performances, strategic initiatives' impact, and broader economic indicators. The interplay of these factors will be crucial in determining FedEx's ability to sustain its growth trajectory, enhance shareholder value, and maintain its competitive edge in the global logistics and shipping arena.

For continuous updates and in-depth analysis, keep an eye on FedEx's stock profile on Trading News and insider transaction details, which provide a real-time glimpse into the company's financial heartbeat and strategic direction.