Analyzing NASDAQ:IBM Stock: Q2 Earnings and Future Growth Prospects

In-Depth Look at IBM's (NASDAQ:IBM) Q2 Financial Performance and Strategic Outlook Amid AI Advancements and Market Positioning | That's TradingNEWS

Financial Performance of NASDAQ:IBM

IBM (NASDAQ:IBM) shares surged 5% in extended trading on Wednesday following second-quarter results that surpassed analysts’ predictions. The company reported earnings per share of $2.43, beating the expected $2.20. Revenue also exceeded expectations, coming in at $15.77 billion compared to the anticipated $15.62 billion. This marks a 1.9% increase from $15.48 billion a year ago. Net income rose to $1.83 billion, or $1.96 per share, up from $1.58 billion, or $1.72 per share, the previous year.

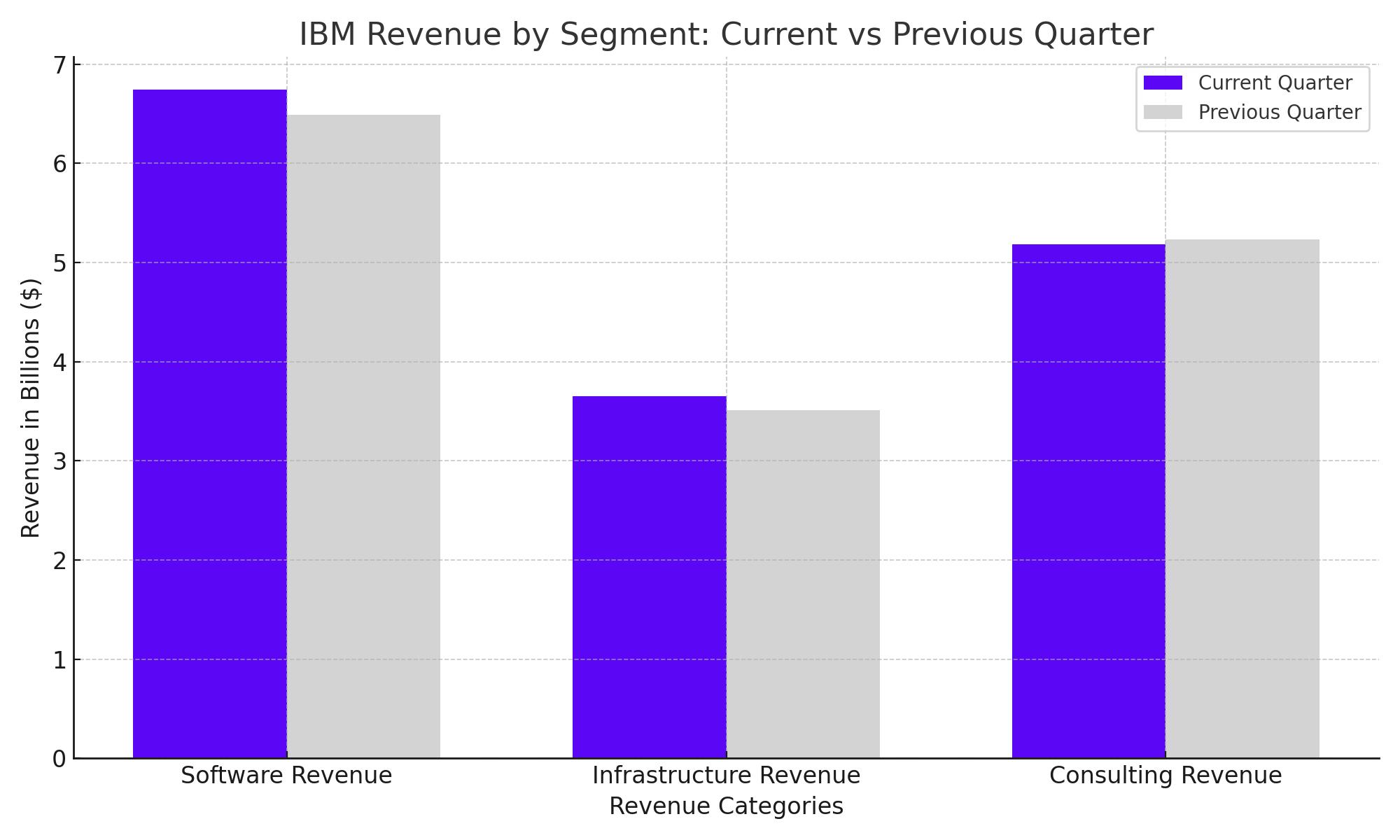

Revenue Growth and Segment Performance

IBM's revenue growth was driven by its software and infrastructure segments. Software revenue increased by 7% to $6.74 billion, surpassing the StreetAccount consensus of $6.49 billion. The infrastructure segment, which includes mainframe computers, contributed $3.65 billion in revenue, a 0.8% rise and above the $3.51 billion consensus. However, the consulting unit saw a decline, contributing $5.18 billion in revenue, down 0.9% and below the $5.23 billion consensus.

Strategic Focus on Artificial Intelligence

CEO Arvind Krishna highlighted the company's focus on generative AI, with a book of business for AI exceeding $2 billion. This reflects significant growth from over $1 billion reported in April. IBM's AI initiatives, particularly with Watsonx, launched last year, have positioned the company as a leader in enterprise AI. About a quarter of the AI-related revenue stems from software solutions, with the remainder from consulting services.

Impact of Market Dynamics and Economic Factors

Krishna acknowledged the ongoing impacts of higher interest rates, inflation, and geopolitical uncertainties, particularly the prolonged conflicts in Europe and the Middle East. Despite these challenges, IBM remains optimistic about the macro outlook for technology spending, emphasizing its resilient performance and strategic adjustments.

IBM's Strategic Acquisitions and Divestitures

In the second quarter, IBM announced its intent to acquire HashiCorp in a deal valued at $6.4 billion. Additionally, Palo Alto Networks agreed to purchase IBM’s QRadar cloud software and migrate customers to the Cortex Xsiam product. These strategic moves are aimed at enhancing IBM's portfolio and strengthening its position in the cybersecurity and cloud computing markets.

Free Cash Flow and Financial Health

IBM has raised its outlook for 2024 free cash flow, now expecting it to exceed $12 billion, up from the previous forecast of around $12 billion. Year-to-date, net cash from operating activities stands at $6.2 billion, with free cash flow at $4.5 billion. Over the last twelve months, net cash from operating activities was $13.8 billion, with free cash flow of $12.3 billion. The company's strong cash generation supports continued investment in innovation and shareholder returns through dividends.

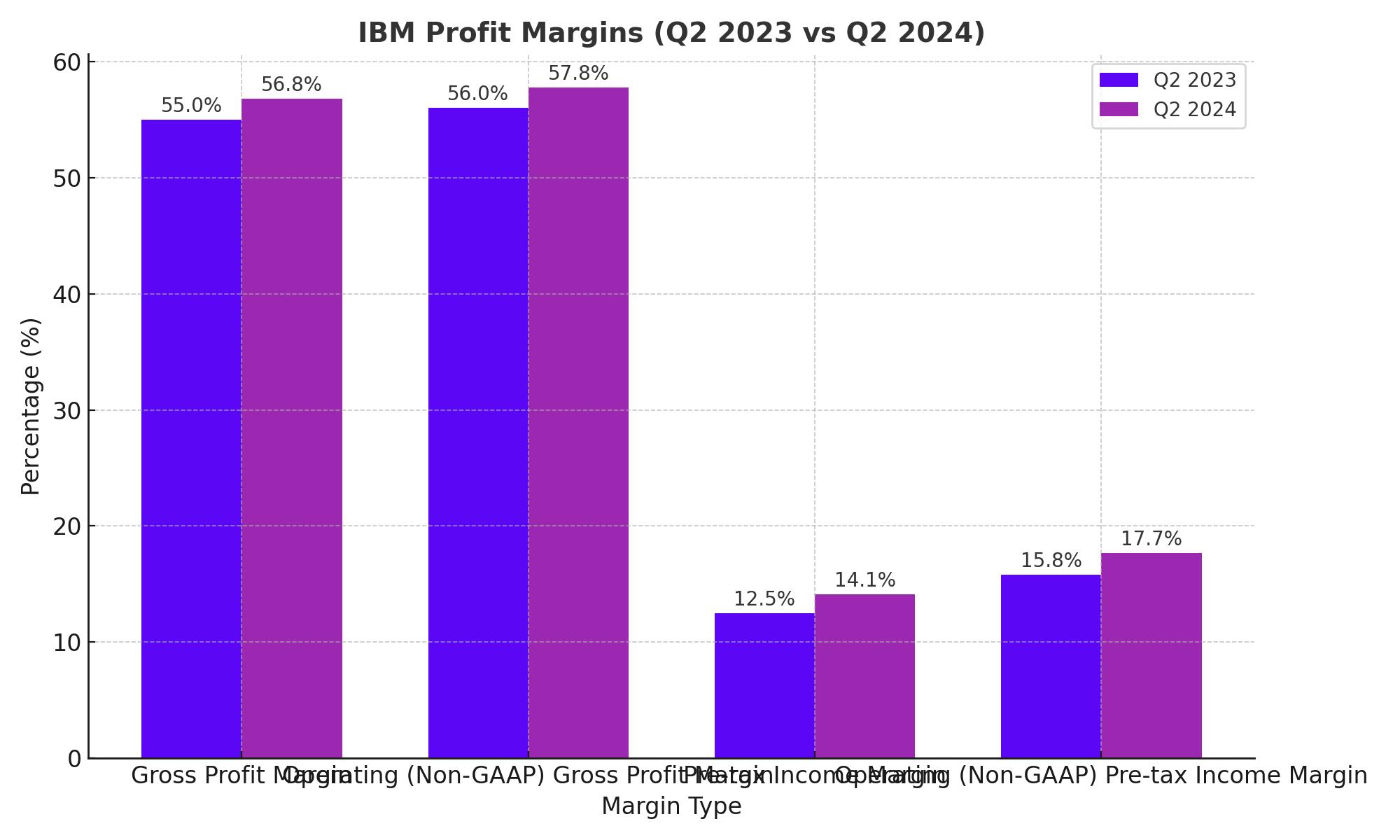

Profit Margins and Operating Efficiency

IBM reported a gross profit margin of 56.8%, up 180 basis points from the previous year. The operating (Non-GAAP) gross profit margin was 57.8%, up 190 basis points. The pre-tax income margin improved to 14.1%, with the operating (Non-GAAP) pre-tax income margin at 17.7%. These figures reflect the company's effective cost management and operational efficiency initiatives.

Comparison with Competitors and Market Position

When comparing IBM to its competitors, IBM’s valuation metrics stand out. The company's forward P/E ratio is 10.98, indicating potential undervaluation relative to future earnings expectations. In contrast, competitors like Microsoft and Amazon have higher P/E ratios, reflecting different market perceptions and growth prospects. IBM's focus on hybrid cloud and AI, along with its strategic acquisitions, positions it well against industry peers.

Technical Analysis and Stock Performance

From a technical standpoint, IBM has shown resilience despite market volatility. The stock has held higher lows following earnings-induced drops, with a notable recovery from the May low. Key support levels are identified at $184, with resistance levels at $199.18. The stock’s ability to maintain these levels indicates potential for continued upward momentum.

Future Projections and Investment Outlook

IBM's revenue projections for the current quarter (June 2024) are estimated at $3.53 billion, reflecting a 5.20% year-over-year growth. For the next quarter (September 2024), revenue is expected to reach $4.2 billion, a 6.90% increase. Full-year revenue for 2024 is projected at $13.79 billion, up 7.40%, with a forecast of $14.87 billion for 2025, indicating a 7.80% growth.

Earnings Per Share (EPS) Projections:

- Current Quarter (June 2024): Average EPS estimate is $3.05, compared to $2.89 in the same quarter last year.

- Next Quarter (September 2024): Expected EPS is $6.31, up from $5.41 in the previous year.

- Full Year (2024): Projected EPS is $11.68, up from $9.69 in 2023.

- Next Year (2025): EPS is forecasted to be $14.87, indicating significant growth.

Financial Performance and Cash Flow Management

IBM’s robust financial performance in Q2 2024 reflects its effective cash flow management and strategic cost-cutting measures. The company reported a free cash flow of $2.6 billion for the quarter, contributing to a total of $4.5 billion for the first half of the year. This strong cash flow has enabled IBM to maintain its investment in innovation while also returning value to shareholders.

Free Cash Flow Projections and Dividend Strategy

For the full year 2024, IBM expects free cash flow to exceed $12 billion, an upward revision from earlier forecasts. This increase highlights the company's ability to generate substantial cash from operations, which is crucial for sustaining its dividend strategy. In the second quarter alone, IBM returned $1.5 billion to shareholders through dividends, underscoring its commitment to providing consistent returns.

Revenue and Earnings Projections

IBM’s revenue and earnings projections for the upcoming quarters reflect a positive outlook. Analysts estimate revenues of $3.53 billion for Q3 2024, with an expected EPS of $3.05. For the full year, revenue is projected at $13.79 billion, with EPS forecasted at $11.68.

Revenue Estimates:

- Current Quarter (June 2024): $3.53 billion

- Next Quarter (September 2024): $4.2 billion

- Full Year (2024): $13.79 billion

- Next Year (2025): $14.87 billion

Earnings Per Share (EPS) Projections:

- Current Quarter (June 2024): $3.05

- Next Quarter (September 2024): $6.31

- Full Year (2024): $11.68

- Next Year (2025): $14.87

Investment Outlook and Strategic Recommendations for NASDAQ:IBM

IBM's strategic emphasis on artificial intelligence (AI) and cloud computing, combined with strong financial health and efficient cash flow management, positions the company for robust future growth. The company's initiatives to streamline operations and invest in cutting-edge innovations are poised to generate significant long-term value.

Investment Recommendation: Buy

-

Strategic Focus on AI and Cloud Computing: IBM has strategically positioned itself as a leader in AI and cloud computing. With its AI platform, Watsonx, generating over $2 billion in business since its launch, and continued expansion in cloud services, IBM is well-placed to capitalize on the growing demand for these technologies. The company's expertise in these areas is expected to drive significant revenue growth.

-

Strong Financial Performance: IBM reported impressive financial results for the second quarter of 2024, surpassing analysts' expectations with revenues of $15.77 billion and an adjusted earnings per share of $2.43. This strong financial performance, coupled with a raised outlook for free cash flow now expected to exceed $12 billion for the year, underscores the company's robust financial health.

-

Robust Cash Flow Management: IBM’s efficient cash flow management is a critical factor supporting its growth initiatives. The company generated $2.6 billion in free cash flow for the June-ended quarter and has achieved $4.5 billion in free cash flow for the first six months of the year. This strong cash position enables IBM to continue investing in innovation and growth while returning value to shareholders through dividends.

-

Strategic Acquisitions and Partnerships: IBM's recent strategic moves, such as the acquisition of HashiCorp and the sale of its QRadar cloud software to Palo Alto Networks, highlight its focus on enhancing its technological capabilities and market reach. These acquisitions and partnerships are expected to further strengthen IBM's market position and drive future growth.

-

Market Position and Valuation: Despite economic and geopolitical challenges, IBM's market position remains strong. With a forward P/E ratio of 10.98, IBM is potentially undervalued compared to its growth prospects. This valuation, combined with the company’s strategic focus and strong financial health, makes IBM a compelling buy for long-term investors.

In conclusion, IBM (NASDAQ:IBM) presents a strong buy opportunity due to its strategic focus on AI and cloud computing, impressive financial performance, robust cash flow management, and strategic acquisitions. These factors collectively position IBM for significant long-term growth, making it an attractive investment for long-term investors.