Apple (NASDAQ:AAPL) Impressing Q3 Earnings, Buffett’s Sell-Off: Strong Buy Opportunity?

Analyzing Apple’s Q3 2024 financial performance, the impact of Warren Buffett's significant share reduction, and the company's strategic advancements in AI and market diversification for potential investors | That's TradingNEWS

Apple Inc. (NASDAQ:AAPL): A Comprehensive Analysis

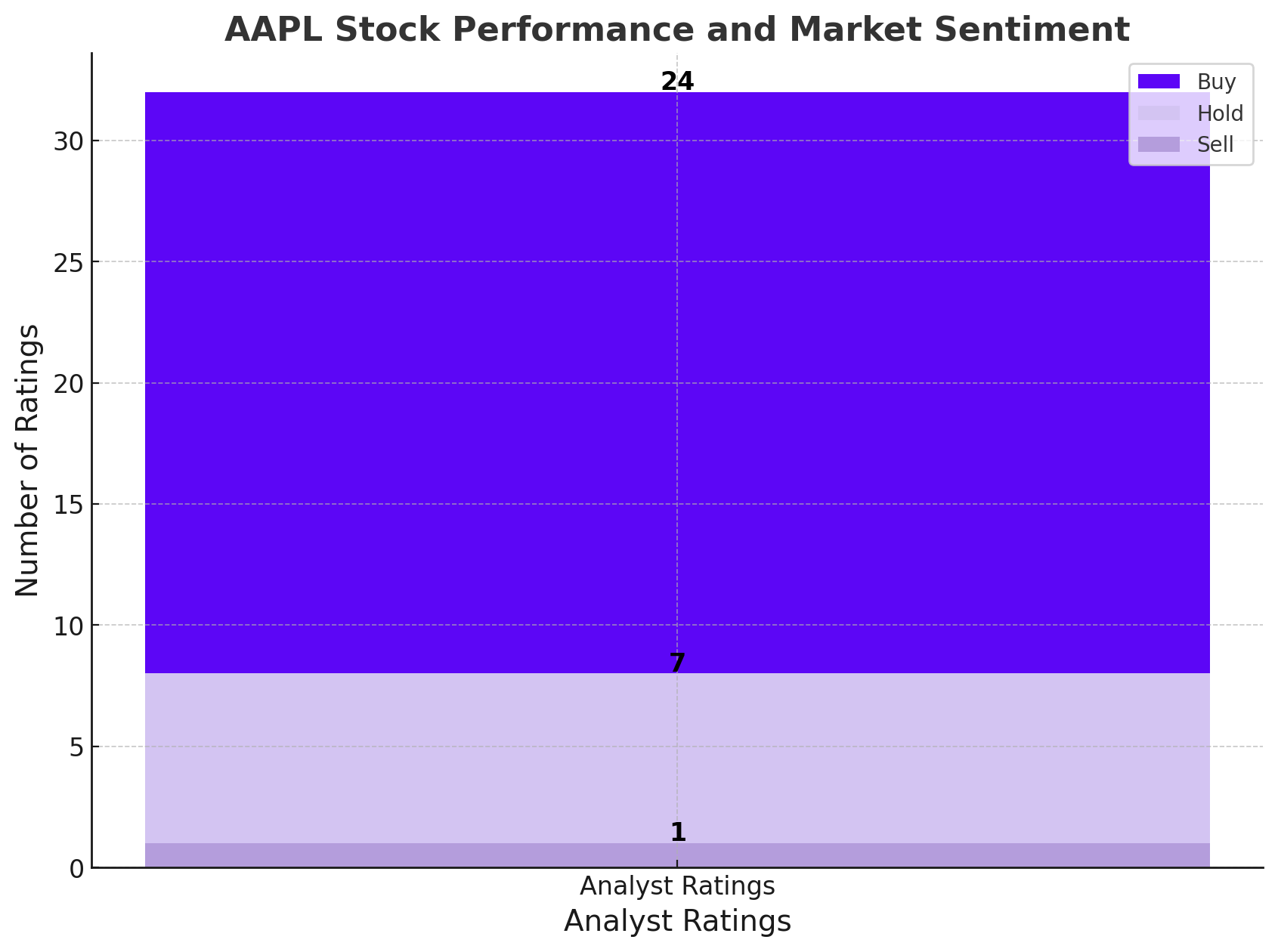

Recent Stock Performance and Market Sentiment

Amid a widespread downturn affecting global markets, Apple Inc. (NASDAQ:AAPL) has experienced significant fluctuations. Despite recent declines, Wall Street analysts maintain a cautiously optimistic outlook for AAPL's performance over the next 12 months. The consensus ratings from 32 Wall Street experts rate AAPL as a ‘moderate buy,’ with 24 ‘buy’ ratings, seven ‘hold’ ratings, and one ‘sell’ rating. The average price target for Apple stock stands at $248.96, indicating a potential increase of 19.58% from its current price. The price targets range from a low of $186 to a high of $300, reflecting varied but generally positive sentiment.

Impact of Berkshire Hathaway's Stake Reduction

One significant event impacting Apple’s stock recently has been the reduction of Berkshire Hathaway’s stake in the company. Warren Buffett’s investment firm sold approximately $51 billion worth of AAPL shares, reducing its holdings from around 49% to 30% of Berkshire's portfolio. This move has been interpreted by some as a strategic portfolio rebalancing rather than a bearish signal on Apple’s business fundamentals. Despite this, Apple shares have seen price declines, with the stock currently trading at $208.19, down 8.10% over the past week and 8.62% over the past month. However, it still holds a 12.10% gain year-to-date.

Fiscal Q3 2024 Earnings and Future Prospects

Key Financial Highlights

Apple’s fiscal Q3 2024 results were strong, with the company reporting $85.8 billion in revenue, surpassing Wall Street’s $84.4 billion estimate. Earnings per share (EPS) came in at $1.40, exceeding the expected $1.34, marking an 11% year-over-year increase. Notably, the Services segment generated $24 billion in net sales, up 14% year-over-year, contributing significantly to Apple’s overall gross margin of 74% for services compared to 35.3% for products.

Performance in China and CapEx Strategy

Apple faced challenges in China, with sales falling 6.5% year-over-year. Despite this, the decline was not as severe as anticipated, signaling potential resilience in the market. Analysts from Wedbush and Bernstein highlighted the potential for a rebound, driven by a large base of iPhones in China that haven’t been upgraded in the past three years. Additionally, Apple’s capital expenditure strategy contrasts with its peers, reducing spending by 26% year-to-date, which aligns with its focus on generating revenue from its existing customer base through services and product upgrades.

Diversification and Innovation Strategies

Expanding into New Markets

Apple is strategically shifting its focus from China to more promising markets such as India and Southeast Asia. CEO Tim Cook’s recent visit to Singapore and the $250 million investment to grow operations there, along with significant investments in India, underscore this strategy. India produced $14 billion worth of iPhones in the last fiscal year, with revenue growing by 33%. The opening of Apple stores in India, such as the one in Mumbai, has shown immediate success, generating $1.2 million in sales on the first day. These efforts are part of Apple’s strategy to reduce its reliance on the Chinese market, which has become increasingly competitive.

AI Integration and the Apple Intelligence Supercycle

Apple’s commitment to innovation is evident in its upcoming product lineup, particularly the anticipated AI-driven Apple Intelligence features. These advancements include enhanced Siri capabilities and on-device processing for privacy-focused AI tasks. The introduction of Apple Intelligence is expected to drive a significant upgrade supercycle, particularly for devices equipped with the latest hardware capable of supporting these new features. Analysts predict this AI-driven supercycle could generate an incremental $10 billion annually in high-margin services revenue.

Market Valuation and Investment Outlook

Despite recent growth in Apple’s stock price, it remains the second least valued stock among top mega caps with a PE ratio of 33.46. A Discounted Cash Flow (DCF) analysis, using a conservative growth rate of 11% and a discount rate of 8.9%, suggests a fair value of $251.62 per share, indicating a 14% margin of safety. Analysts forecast Apple achieving revenue growth of 7.5% annually for fiscal 2025 and 2026, supporting a potential market cap of $4.13 trillion by the end of fiscal 2026, up from the current $3.34 trillion.

Q3 2024 Report: Highlights

On 1st August 2024, Apple reported its Q3 2024 earnings with the following major highlights and my thoughts. First of all, it declared $85.8 billion in quarterly sales beating estimated by $1.40 billion, a 5% rise year over year. This growth indicates a robust demand for Apple's products and services, even in the face of global economic uncertainty. Its earnings per share increased by 11% to $1.40, exceeding projections by $0.06, a sign of increased profitability and effective cost control.

Furthermore, services income reached a new all-time high of $24.2 billion. This move away from a reliance on hardware demonstrates a revenue source that is maturing and may provide more stability and room for expansion. The organization has demonstrated its dedication to innovation by introducing a personal intelligence system that uses generative AI models. This can revolutionize the industry by improving user experience and creating new income opportunities.

The company gave back more than $32 billion to shareholders during the quarter, including $26 billion in open market share repurchases and $3.9 billion in dividends and equivalents as well as announcing the payment of a $0.25 dividend per share of common stock to shareholders who were registered as of August 12, 2024, on August 15, 2024. This illustrates the company's confidence in its cash flow and dedication to providing shareholders with value.

In summary, these factors point to Apple's continued growth and ability to leverage emerging technologies, such as artificial intelligence, to adjust to shifting market conditions. An optimistic prognosis is further supported by the company's capacity to produce substantial operating cash flow, which permits sizable shareholder payouts. Furthermore, the growth of the services sector points to a strong ecosystem that may support further expansion.

Conclusion

Apple Inc. (NASDAQ:AAPL) presents a compelling investment opportunity, supported by its strategic diversification, innovative AI initiatives, and robust financial performance. While recent reductions in Berkshire Hathaway’s stake and market fluctuations have impacted its stock, the long-term prospects remain strong. With a strategic focus on expanding into new markets and leveraging AI to drive growth, Apple is well-positioned to continue delivering value to its shareholders. Given the current market conditions and future growth potential, Apple offers a blend of stability and growth, making it an attractive investment for those looking to capitalize on the upcoming supercycle and beyond.

For real-time updates on Apple’s stock, visit TradingNews. For insights into insider transactions, see Apple's stock profile.