Apple Stock (NASDAQ:AAPL): Unlocking Hidden Under Value at $234.93 - Buy Opportunity

Don’t Miss This Undervalued Opportunity – Record Revenue, Bold Innovation, and Massive Growth Potential Await! | That's TradingnNEWS

Apple Inc. (NASDAQ:AAPL): Unveiling an Undervalued Powerhouse at $234.93

Apple Inc. (NASDAQ:AAPL), the unrivaled leader in consumer technology, continues to command global attention with its unrelenting innovation, financial strength, and market dominance. As of November 30, 2024, Apple’s stock is trading at $234.93, and its market capitalization exceeds $3.55 trillion, reinforcing its status as the largest publicly traded company in the world. Despite its size and recent volatility, Apple presents a compelling investment opportunity, driven by strong revenue growth, record-breaking shareholder returns, and game-changing innovations.

Apple’s Stellar Q4 FY2024 Performance: A Business Built for Growth

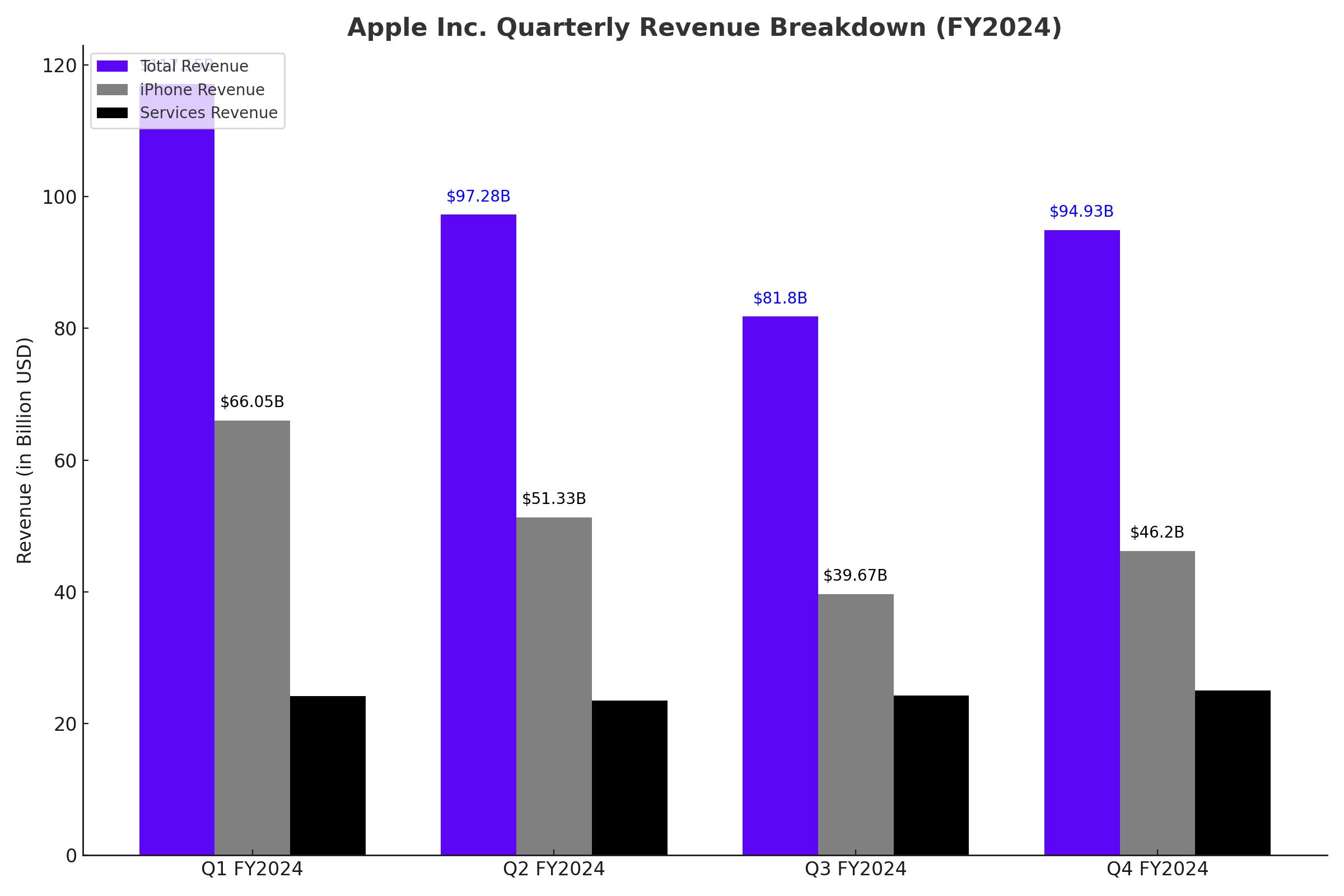

Apple’s Q4 FY2024 earnings report was a masterclass in operational excellence. The company posted $94.93 billion in revenue, marking a 6.1% year-over-year increase. This growth was powered by continued strength in its core product lines and unprecedented performance in its Services segment. The iPhone, Apple’s flagship product, brought in $46.2 billion during the quarter, growing 6% year-over-year and accounting for 49% of total revenue.

This remarkable performance was driven by the launch of the iPhone 16 lineup, which achieved record installations globally and maintained Apple’s dominant 17.7% market share in global smartphone shipments. With customer satisfaction rates of 98% in the U.S., the iPhone remains the gold standard in mobile devices.

Apple’s Services division, however, emerged as the star of the quarter. This segment generated $25 billion in revenue, reflecting a 12% year-over-year increase and contributing 24.6% to total revenue. The division’s gross margin of 74% underscores its profitability and scalability, making it a key driver of Apple’s overall margin stability. With more than 1 billion paid subscriptions, Services is on track to become a $100 billion revenue engine by 2025, positioning itself as a cornerstone of Apple’s future growth.

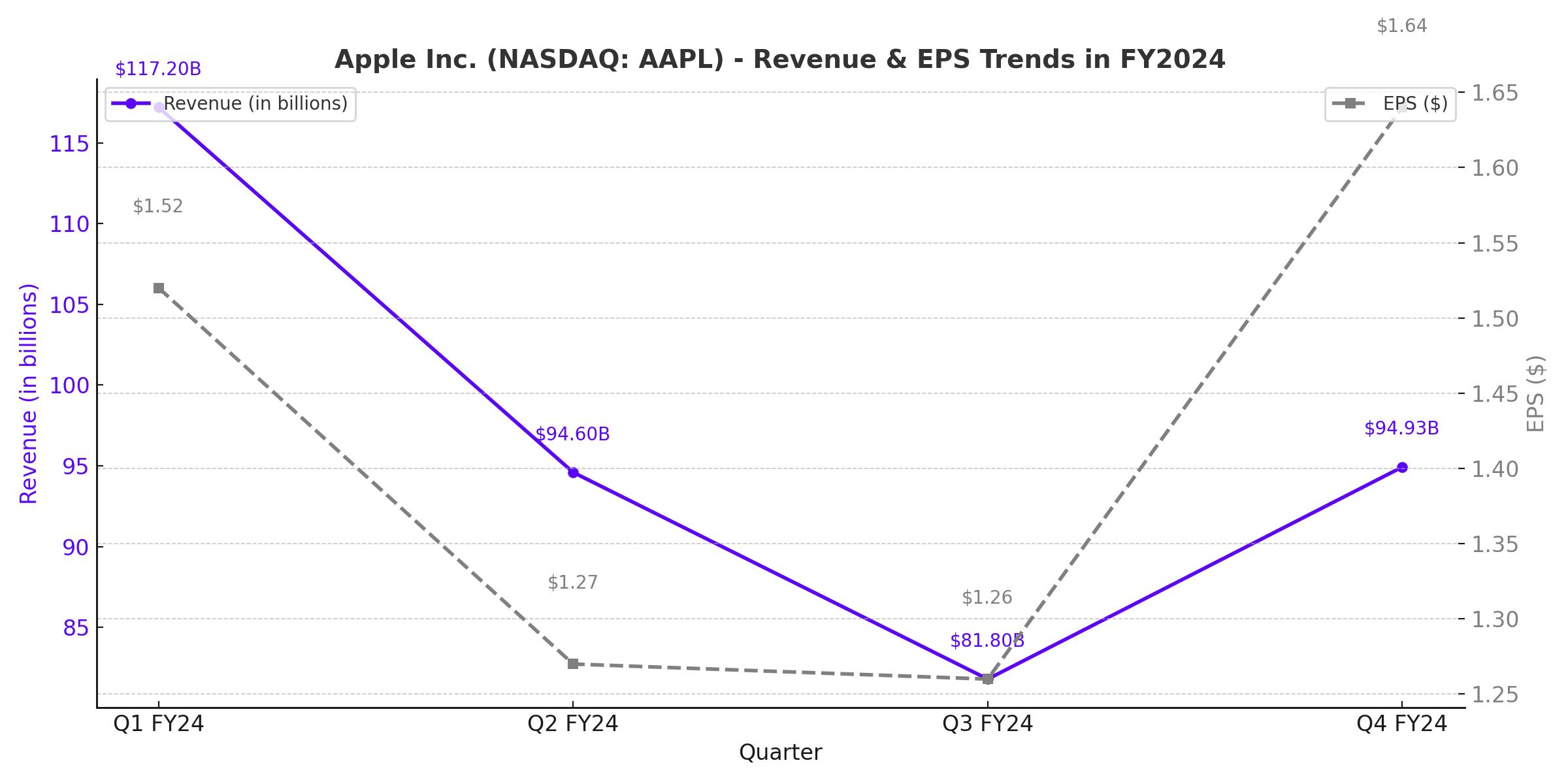

Apple Stock Revenue & EPS Trends - 2024 BreakDown

Shareholder Returns: A Masterclass in Capital Allocation

Apple continues to set the standard for shareholder returns. During Q4, the company returned $29 billion to shareholders through dividends and stock buybacks. Over the past fiscal year, Apple allocated $95 billion to share repurchases and $15.2 billion to dividends, reinforcing its commitment to delivering value. Since initiating its capital return program in 2012, Apple has returned a staggering $927.9 billion to shareholders, repurchasing $725.9 billion worth of shares and paying over $160 billion in dividends.

This disciplined capital allocation strategy has not only reduced Apple’s share count by 12% over the past five years but has also amplified its earnings per share (EPS) growth. In Q4 FY2024, Apple reported EPS of $1.64, a 12% increase year-over-year. The company’s ability to generate nearly $2 billion in free cash flow (FCF) per week underscores its unparalleled profitability.

Services: The Billion-Dollar Growth Engine

Apple’s Services segment has transformed from a complementary business line into a core revenue driver. With $96.17 billion in annualized revenue, Services has grown at a compound annual growth rate (CAGR) of 12.87% over the past five years. This growth is fueled by an expanding ecosystem of over 2 billion active devices and innovations like Apple Intelligence, which integrates AI-driven features into Apple’s suite of products.

In 2024, Services accounted for 24.6% of Apple’s total revenue, up from 22.2% in 2023. The division’s 74% gross margin makes it the most profitable segment in Apple’s portfolio. Analysts project that Services could exceed $200 billion in annual revenue by the end of the decade, driven by new offerings like Vision Pro and health-focused initiatives.

Regional Dynamics: Strength and Challenges

Apple’s geographic performance in Q4 FY2024 was a mixed bag. The Americas, Europe, and the Rest of Asia Pacific delivered strong growth, with Europe posting an 11% year-over-year revenue increase. Emerging markets like India and Brazil also recorded double-digit growth, highlighting Apple’s ability to capture new customers in underpenetrated regions.

However, China remains a concern. Revenue in the region was relatively flat, reflecting intensifying competition from local brands like Huawei and Xiaomi. While Apple continues to dominate the premium smartphone segment in urban China, the broader market presents challenges that could impact future growth.

Innovation at the Forefront: AI and Beyond

Apple’s commitment to innovation is evident in its recent launches and ongoing investments in artificial intelligence (AI). Apple Intelligence, the company’s AI platform, is seamlessly integrated into its products, enhancing user experience and driving ecosystem engagement. Similarly, Vision Pro, Apple’s spatial computing device, has the potential to redefine how consumers interact with technology.

These advancements position Apple to lead in high-growth markets like AI and augmented reality, offering new monetization opportunities. The Apple Watch, which now includes health-monitoring features like sleep apnea notifications, further exemplifies the company’s ability to integrate cutting-edge technology into its product lineup.

Valuation: A Misunderstood Opportunity

Despite its $3.55 trillion market cap, Apple’s valuation metrics suggest it remains attractively priced. The stock trades at 37.62x trailing earnings and 31.93x free cash flow, making it one of the most reasonably valued tech giants. Analysts project EPS growth of 36% over the next two years, with 2026 EPS expected to reach $8.31. Apple’s forward P/E ratio of 27.66x for 2026 earnings compares favorably to peers like Walmart and Home Depot, which trade at significantly higher multiples.

In 2024, Apple generated $108.81 billion in free cash flow, reinforcing its ability to sustain shareholder returns and invest in growth. With a forward price-to-FCF ratio of 31.93x, Apple offers a compelling combination of growth and profitability.

Risks: Dependency and Economic Sensitivities

Apple’s heavy reliance on the iPhone, which accounts for nearly half of its revenue, remains a key risk. Any slowdown in iPhone sales or shifts in consumer preferences could impact the company’s financial performance. Additionally, macroeconomic factors like tariffs and rising component costs pose challenges. NAND and DRAM prices, for instance, have been rising, potentially squeezing margins in the coming quarters.

Moreover, uneven regional performance and competitive pressures in China could weigh on Apple’s growth trajectory. While the company’s diversification efforts are commendable, these challenges highlight the need for continued innovation and market adaptation.

Final Thoughts: AAPL at $234.93—A Strategic Buy

Apple Inc. (NASDAQ:AAPL) is more than just a technology company; it’s a financial powerhouse and a market leader with a proven track record of delivering value. With its stock trading at $234.93, Apple represents a unique blend of stability, growth, and profitability. Its robust Services segment, innovative product pipeline, and disciplined capital allocation make it a compelling investment opportunity.

As Apple continues to evolve and adapt, it remains well-positioned to navigate challenges and capitalize on opportunities, making it a cornerstone investment for long-term growth.