Apple’s High-Stakes Play: Can Stock (NASDAQ: AAPL) Defy the Odds and Reach New Heights?

Inside Apple’s Strategy: From Buffett’s Sell-Off to Revolutionary Tech—What Could Push AAPL to Unprecedented Levels? | That's TradingNEWS

Apple Inc. (NASDAQ:AAPL): A Comprehensive Analysis of Growth, Risks, and Market Position

Impact of Berkshire Hathaway's Reduction in Apple Holdings

The recent decision by Berkshire Hathaway (BRK.B) to reduce its position in Apple Inc. (NASDAQ:AAPL) by 49.33% has raised eyebrows among investors. However, it’s important to understand that Warren Buffett’s move to sell a portion of his Apple shares does not necessarily indicate a negative outlook on the company. Buffett has made it clear that Apple remains a cornerstone in his portfolio, with 400 million shares still held, valued at approximately $90.74 billion. This reduction seems to be more about capital allocation rather than a lack of confidence in Apple’s future.

Buffett’s strategy might involve freeing up cash for potential acquisitions or rebalancing Berkshire’s portfolio. Given Apple’s strong fundamentals, this reduction should not be viewed as a sign of weakness. Instead, focus on Apple’s ongoing growth and its ability to generate substantial free cash flow (FCF), which supports its continuous share buybacks and dividend payments.

Apple’s Financial Performance: Continued Strength Amidst Market Fluctuations

Apple’s stock has shown remarkable resilience, with a 25.24% increase over the past year and 17.82% year-to-date. This performance highlights Apple’s position as the most profitable company in the market, with a history of delivering strong returns for its shareholders. Over the past five years, Apple’s stock has appreciated by an impressive 347.77%, significantly outperforming the broader market.

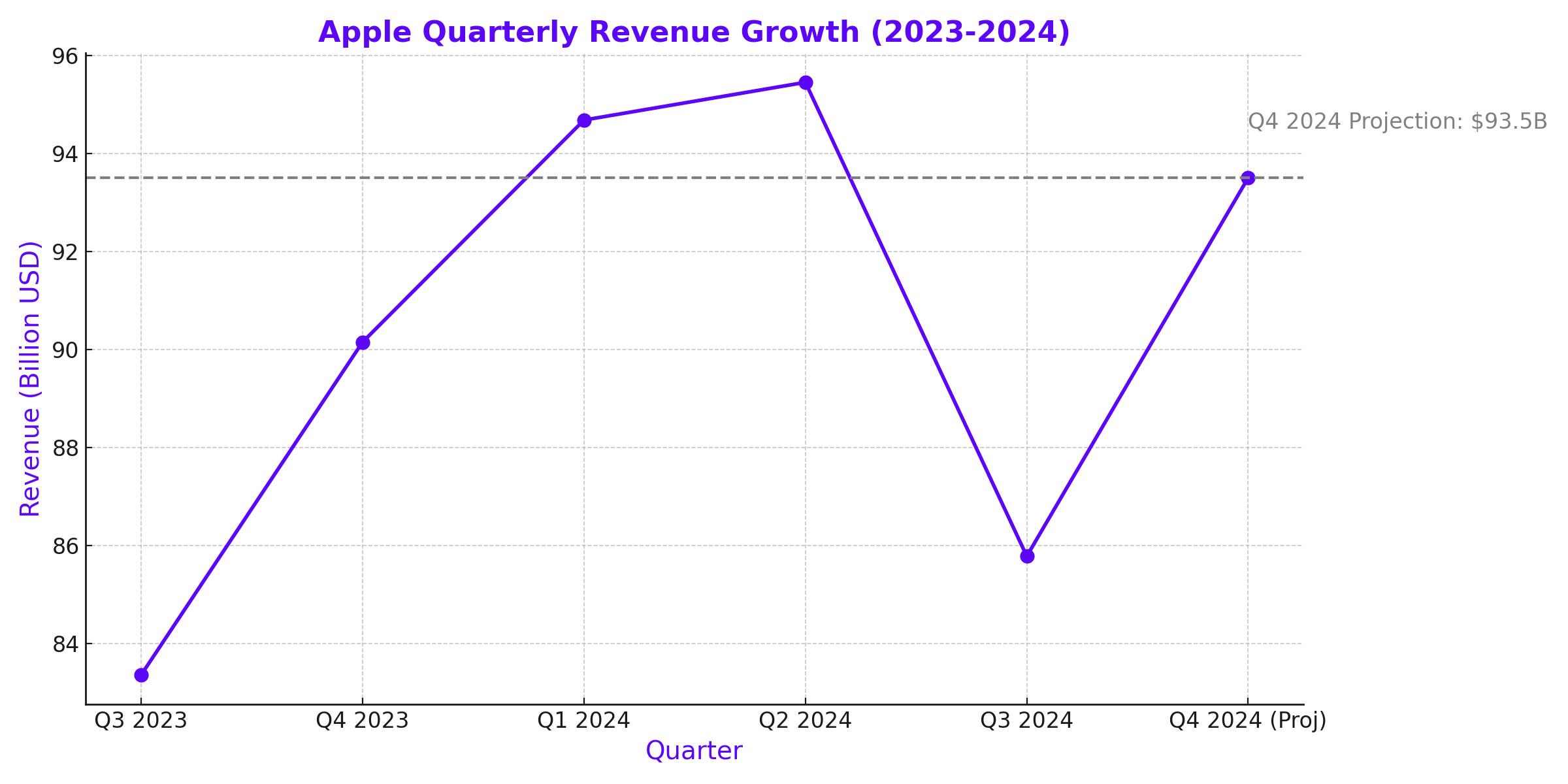

In Q3 2024, Apple reported revenues of $85.78 billion, representing a 4.9% year-over-year growth and surpassing street expectations by $1.42 billion. The company also posted GAAP EPS of $1.40, exceeding estimates by $0.06. These results underscore Apple’s robust business model and its ability to innovate and maintain customer loyalty across its product and service lines.

Apple’s CFO, Luca Maestri, has projected that Q4 2024 revenue will grow at a similar rate to Q3, estimating it to be between $93 and $94 billion. This would bring Apple’s total revenue for the fiscal year 2024 to around $390 billion, marking a year-over-year increase of approximately $6.79 billion. These figures reaffirm Apple’s continued dominance in the technology sector and its effective navigation of economic challenges.

The Importance of Apple’s Services Segment

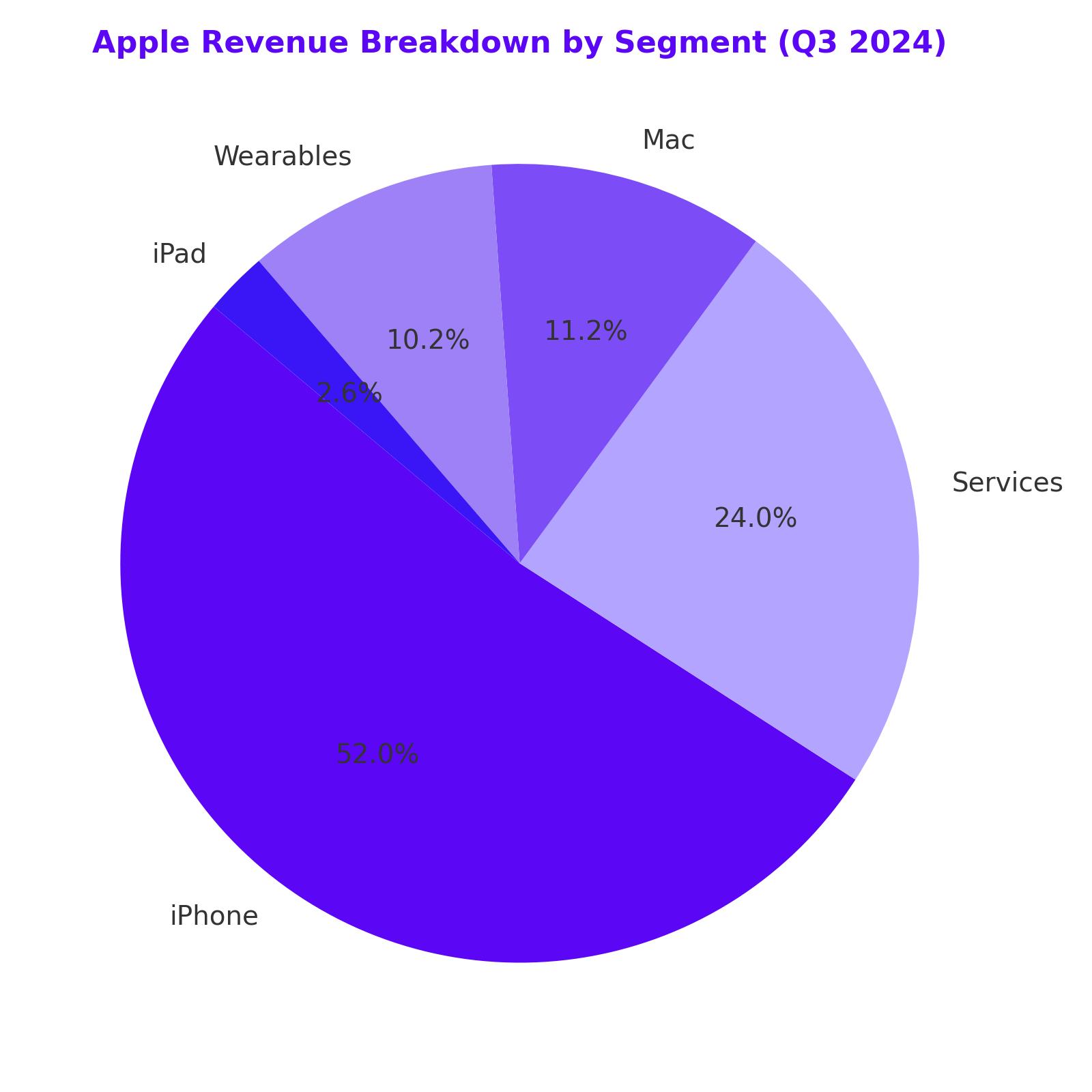

A key driver of Apple’s growth has been its Services division. Over the past five years, Apple has successfully built a recurring revenue stream that has significantly contributed to its overall financial health. In the first nine months of 2024, Services generated $71.2 billion in revenue, accounting for 24.04% of Apple’s total revenue, up from 17.75% in 2021.

The Services segment has seen an average annual growth rate of 16.62% and is on track to potentially reach a $100 billion run rate by the end of 2024 or early 2025. This growth is particularly noteworthy given the higher margins associated with services compared to hardware sales. Apple’s ability to expand its Services business not only diversifies its revenue streams but also enhances its overall profitability, with service gross margins typically around 70%.

The anticipated introduction of Apple Intelligence, which integrates AI and machine learning across Apple’s software ecosystem, is expected to further drive growth in the Services segment. This innovation could lead to a multi-year upgrade cycle, boosting both hardware sales and service subscriptions.

Impact of Federal Reserve Policy on Apple

The Federal Reserve’s recent signals of potential interest rate cuts by the end of the year could have a significant impact on Apple. Lower interest rates would reduce the cost of capital, making it easier for businesses and consumers to finance purchases of Apple’s products and services. This could lead to increased sales of iPhones, iPads, and Macs, as well as a boost in Apple’s Services revenue.

Moreover, Apple’s long-term debt, which currently stands at $86.2 billion, could be refinanced at lower interest rates, potentially reducing the company’s interest expenses. In 2021, Apple paid $2.65 billion in interest, which increased to $3.93 billion in the trailing twelve months. A reduction in interest rates would allow Apple to renegotiate its debt, further improving its financial position and profitability.

Apple’s Strategic Buybacks and Shareholder Returns

Apple has consistently been one of the most shareholder-friendly companies in the market, returning capital to investors through share buybacks and dividends. In Q3 2024 alone, Apple repurchased $26 billion worth of shares, bringing its total buybacks to $700.9 billion since 2012. This aggressive buyback strategy has reduced Apple’s share count by 35.11% since 2014, significantly boosting its EPS.

Apple’s ability to generate over $100 billion in FCF annually supports its buyback and dividend programs, making it a highly attractive investment for long-term holders. Despite criticisms of low growth, Apple’s consistent profitability and strategic capital allocation continue to drive shareholder value.

Conclusion

Apple Inc. (NASDAQ:AAPL) continues to demonstrate its strength as a market leader, driven by robust financial performance, strategic innovations, and shareholder-friendly practices. Despite Berkshire Hathaway’s reduction in its Apple holdings, the company’s fundamentals remain strong, with significant growth potential in its Services segment and the upcoming introduction of Apple Intelligence.

Investors should remain aware of the risks, particularly related to competition and geopolitical factors, but Apple’s consistent ability to innovate and generate substantial free cash flow makes it a compelling long-term investment. With the potential for further stock appreciation and a market cap that could reach $4 trillion by 2025, Apple remains a stock to hold and potentially add to during market opportunities.

That's TradingNEWS

Read More

-

SPYI ETF at $52.59: 11.7% Yield, 94% ROC and Near S&P 500 Returns

04.01.2026 · TradingNEWS ArchiveStocks

-

XRPI and XRPR Rally as XRP-USD Defends $2.00 on $1.2B XRP ETF Inflows

04.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Eyes $4.30 if Storage Draws Tighten

04.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X at 156.91: 157.75 Breakout Sets 160 Target as Fed Jobs Week Tests The Dollar

04.01.2026 · TradingNEWS ArchiveForex