Strategic Partnerships and Order Backlog Drive ACHR Growth

Archer has built a robust pipeline of partnerships that underpin its growth trajectory. Key among them is a $1 billion order from United Airlines (UAL) for its flagship Midnight aircraft, with an additional $500 million option. The partnership aims to replace hour-long car commutes with 10-20 minute air taxi flights. Similarly, a collaboration with Southwest Airlines focuses on deploying eVTOL aircraft across 14 airports in California.

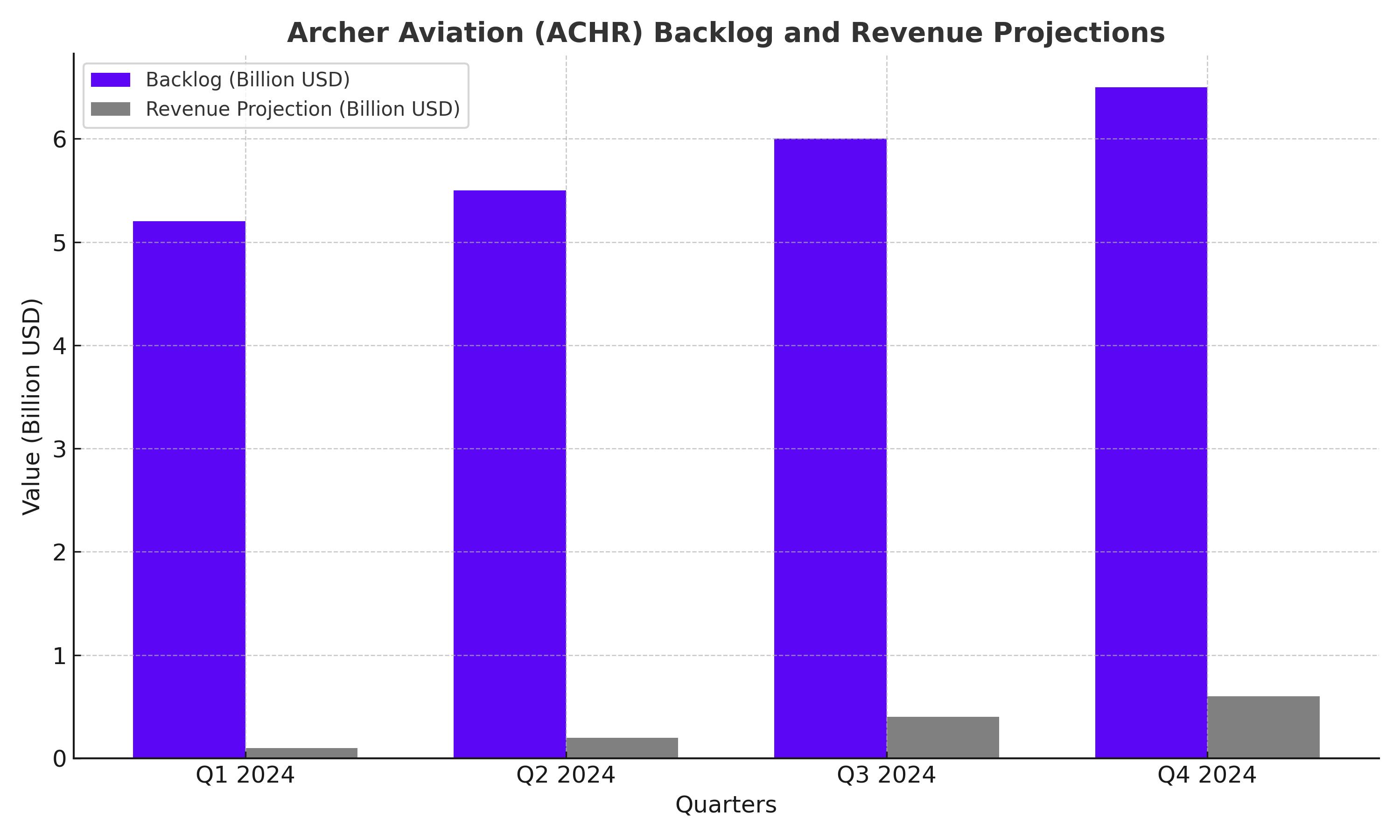

Internationally, Archer has secured a $500 million commitment from Soracle, a joint venture between Japan Airlines and Sumitomo. Deliveries to Japan are expected to begin in 2025, targeting high-demand routes such as airport-to-city-center connections. Another notable partnership is with Signature Aviation, which grants Archer access to key takeoff and landing sites worldwide. Archer’s growing backlog now exceeds $6 billion, showcasing robust demand even before full commercialization.

The defense sector also bolsters Archer's credibility, with a $142 million contract from the U.S. Air Force to integrate eVTOL technology into its operations. This includes the delivery of Midnight aircraft for logistics and medical missions. The backing of Stellantis, which provides up to $400 million in funding and manufacturing expertise, further solidifies Archer’s industrial partnerships.

Technological Innovations Fuel Archer’s Competitive Edge

Archer’s Midnight aircraft is at the center of its technological push. Designed for short urban trips of around 20 miles, Midnight offers swift 10-minute recharging capabilities, making it highly efficient for high-frequency operations. Archer has already completed over 400 test flights in 2024, exceeding its target well ahead of schedule. These flights tested crucial parameters such as durability, landing in adverse weather, and extended operations, ensuring Midnight is ready for real-world conditions.

Archer’s choice to rely on established Tier 1 suppliers accelerates its path to certification and production. In contrast, competitor Joby Aviation (JOBY) focuses on in-house production, highlighting two distinct approaches to market leadership. Archer’s strategy aligns closely with the commercial aviation sector, prioritizing scalability and rapid deployment.

Regulatory Progress Opens the Door for eVTOL Commercialization

The Federal Aviation Administration (FAA) recently finalized its Special Federal Aviation Regulation (SFAR) for powered-lift aircraft, paving the way for eVTOL operations in the United States. Archer achieved Part 135 Air Carrier Certification in June 2024 and is on track for full aircraft certification by late 2025. The FAA’s Innovate28 plan aims to integrate eVTOLs into U.S. airspace by 2028, underscoring Archer’s timely positioning.

Internationally, Archer is making strides in the United Arab Emirates (UAE), where it collaborates with Etihad, the Abu Dhabi Investment Office, and Falcon Aviation. The UAE’s regulatory backing is expected to accelerate the launch of air taxi services by late 2025. Archer has also secured its foothold in Japan, where its partnership with Soracle aims to influence the Japanese Civil Aviation Bureau’s stance on eVTOL operations.

Manufacturing Milestones and Scaling Plans

Archer’s newly completed $65 million manufacturing facility in Covington, Georgia, is a critical step in scaling production. With an annual capacity of 650 aircraft by 2029, the plant will start producing two aircraft per month by late 2025. Archer is integrating lessons from test aircraft to optimize quality and efficiency, ensuring readiness for high-volume production.

This operational ramp-up is supported by Archer’s defense contracts, which provide valuable cash flow and operational insights. The $148 million deal with the Department of Defense for logistics and medical applications highlights Archer’s dual-market approach, balancing commercial and government demand.

Financials Highlight Growth Potential and Risks

As of Q3 2024, Archer holds $501.7 million in cash and equivalents, strengthened by Stellantis’ funding commitments. However, its R&D expenses have ballooned to $342.6 million, reflecting the capital-intensive nature of eVTOL development. Archer plans to seek shareholder approval to increase its authorized shares to 1.4 billion, potentially diluting existing holdings but ensuring sufficient capital for scaling.

Despite its pre-revenue status, Archer has set ambitious targets of $3.2 billion in annual revenue by 2028, with a 20% operating margin. If successful, these projections would place the company among the leaders in the $9 trillion urban air mobility market expected by 2050.

Global Expansion and Revenue Opportunities

Archer is targeting major U.S. cities like New York, Los Angeles, and Miami for initial operations in 2025. Internationally, its strategic entry into markets like Japan, the UAE, and India reflects its global ambitions. Archer’s focus on high-demand routes and its partnerships with leading mobility platforms position it as a key player in urban air mobility.

In Japan, Soracle’s $500 million commitment includes a pre-delivery payment, underscoring customer confidence. Similarly, Archer’s collaboration with UAE stakeholders ensures a smooth entry into a region eager to embrace innovative transportation solutions.

Market Position and Outlook

Archer’s competitive advantage lies in its partnerships, regulatory progress, and scalable production capabilities. Its rivalry with Joby Aviation underscores the importance of execution, as both companies vie for leadership in a market projected to reach $1 trillion by 2040. Archer’s focus on shorter trips and third-party operators complements Joby’s emphasis on longer distances and direct operations.

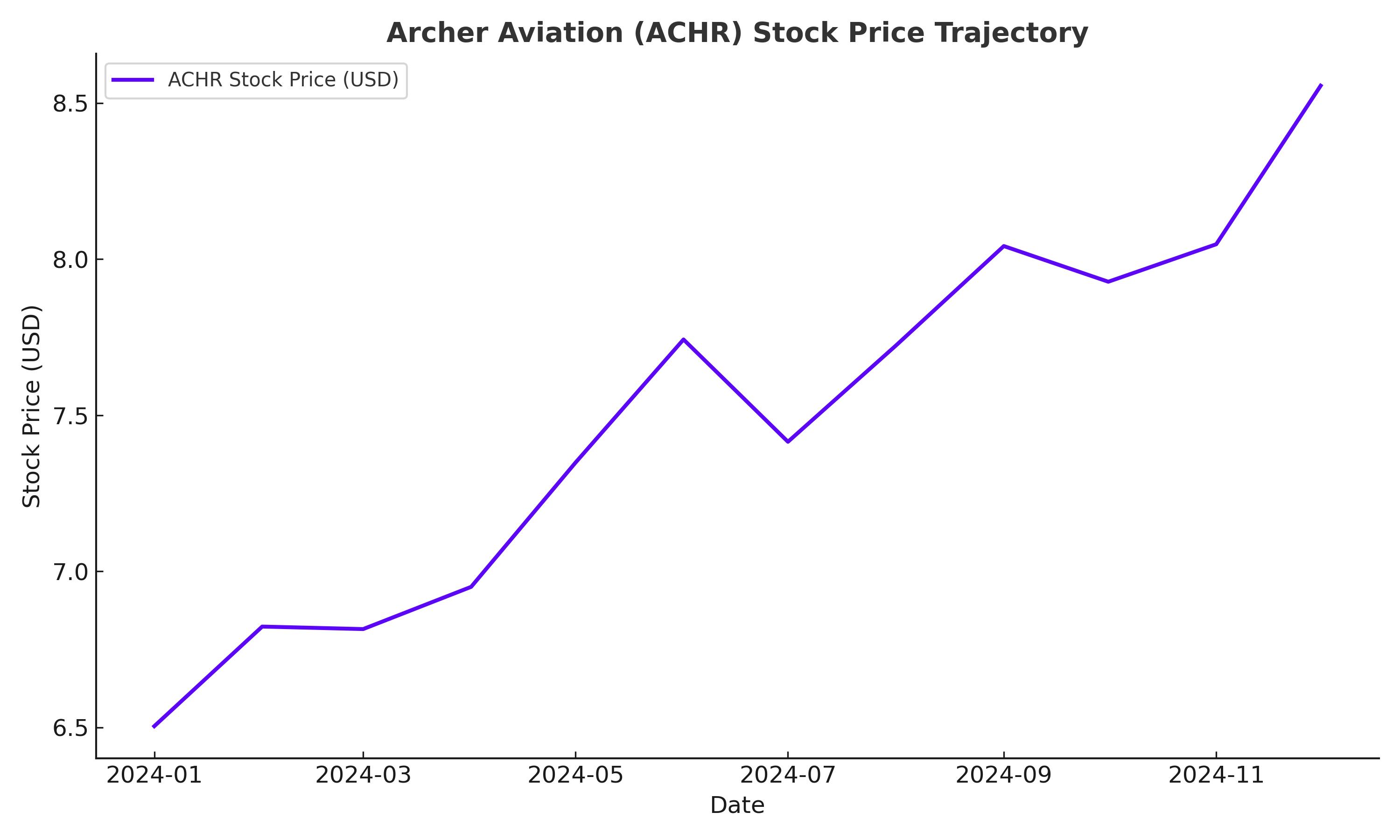

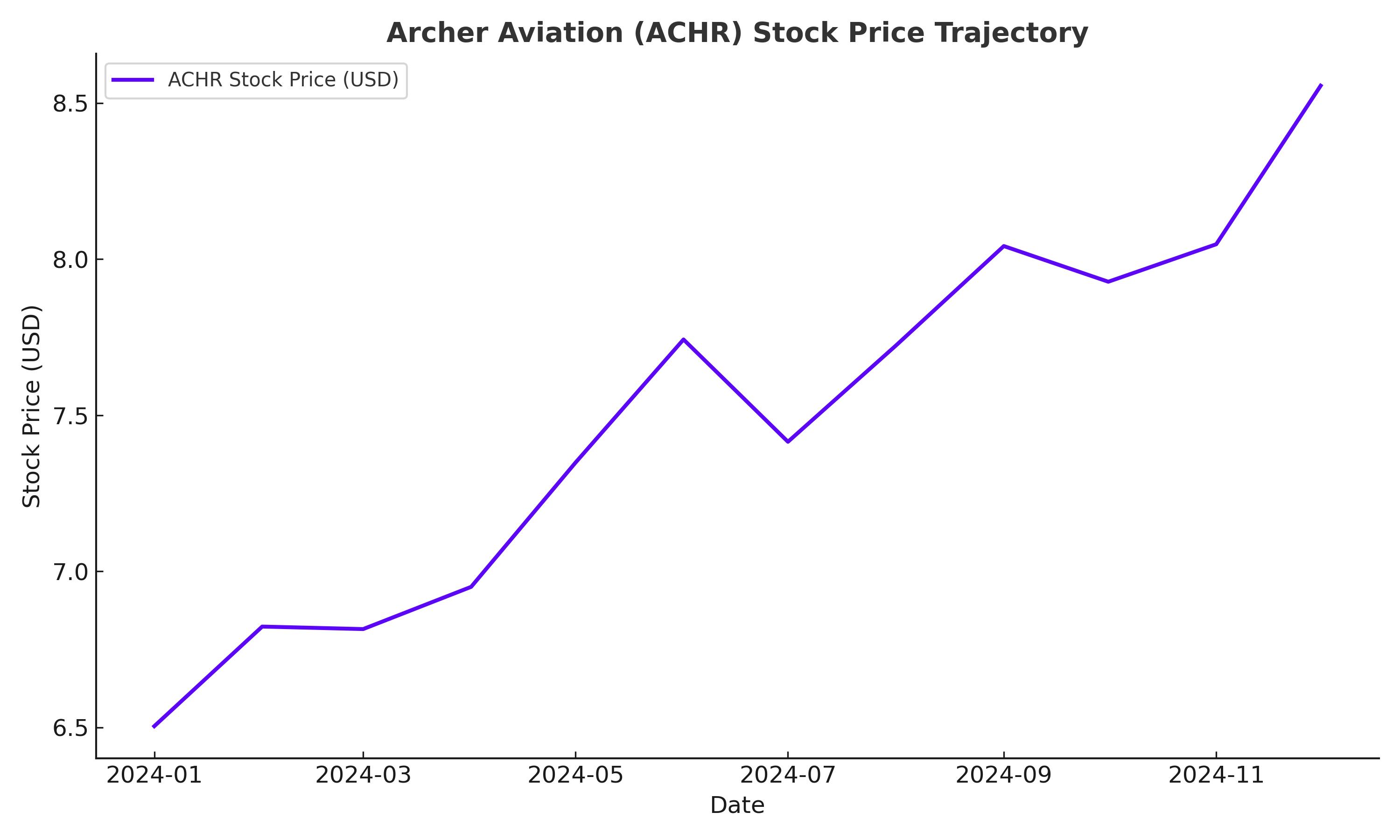

With its stock trading at $8.18 and a market cap of $2.21 billion, Archer appears undervalued relative to its potential. If it achieves its 2029 production goals, the stock’s intrinsic value could exceed $17. However, dilution risks and the company’s cash burn remain critical concerns.

Final Thoughts

NYSE:ACHR represents a high-risk, high-reward opportunity in the burgeoning eVTOL market. Its strategic partnerships, technological progress, and favorable regulatory environment position it for success, but investors should weigh the risks of dilution and early-stage losses. Archer’s ability to execute on its ambitious goals will determine whether it becomes a transformative player in urban air mobility. For those with a long-term horizon and appetite for risk, ACHR offers compelling upside potential.

That's TradingNEWS

Adobe (NASDAQ:ADBE): Redefining Growth and 52% Potential Upside

Adobe (NASDAQ:ADBE): Redefining Growth and 52% Potential Upside

Is SoundHound AI (NASDAQ:SOUN) the Next Big AI Disruptor?

Is SoundHound AI (NASDAQ:SOUN) the Next Big AI Disruptor?

Can Alphabet (GOOGL) Deliver Over 20% Upside by 2025?

Can Alphabet (GOOGL) Deliver Over 20% Upside by 2025?

Can NVIDIA (NASDAQ:NVDA) Reach $350 Amid Soaring AI Demand?

Can NVIDIA (NASDAQ:NVDA) Reach $350 Amid Soaring AI Demand?

Will Micron Technology (NASDAQ:MU) Regain Momentum and Hit $115?

Will Micron Technology (NASDAQ:MU) Regain Momentum and Hit $115?