WTI and Brent Oil Prices Amid Global Market Shifts

WTI and Brent Prices Reflect Mixed Sentiment on Supply and Demand

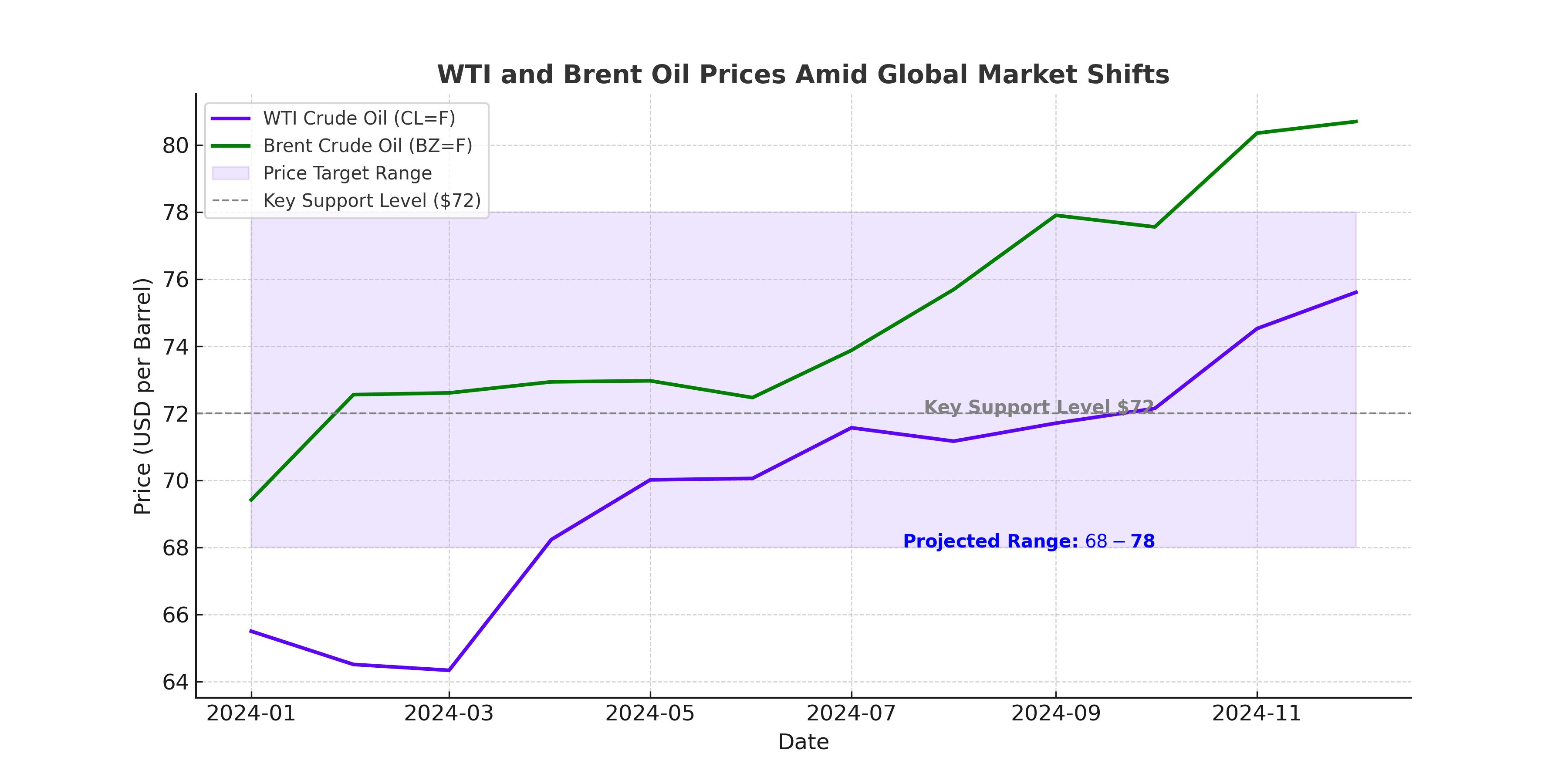

WTI crude oil (CL=F) and Brent crude oil (BZ=F) are grappling with opposing forces as global market dynamics shift. West Texas Intermediate (WTI) futures are trading near $69.12 per barrel, while Brent futures are slightly higher at $72.56 per barrel. These prices mark a stabilization after losses recorded last week, driven by conflicting narratives around global supply surpluses and demand trends. Concerns about U.S. inflation easing and supply uncertainties have played significant roles in recent market fluctuations.

Supply Constraints: Iraq Halts Exports to Syria

A major development affecting supply dynamics is Iraq's decision to suspend crude oil exports to Syria, which previously received 120,000 barrels daily. This move is part of a broader reaction to growing instability in Syria following recent political upheavals. Syria's domestic oil production, around 80,000 barrels daily, is insufficient to meet demand, especially with disruptions in supplies from Kurdish-controlled eastern regions and halted Iranian crude shipments. The situation is exacerbated by skyrocketing fuel prices in Syria, creating ripple effects across regional markets.

Global Macroeconomic Pressures

The U.S. Federal Reserve's cautious stance on monetary easing, combined with lower-than-expected inflation data, has offered temporary relief to investors. However, the strengthening of the U.S. dollar, currently hovering near two-year highs, continues to apply downward pressure on oil prices. A stronger dollar typically makes commodities priced in dollars, like crude oil, more expensive for holders of other currencies, curbing demand.

Chinese and Indian Demand Patterns

China's oil consumption, a critical driver of global demand, faces challenges. A Sinopec report predicts Chinese oil demand could peak by 2027. Meanwhile, India has emerged as a standout market, with demand projected to grow significantly, underpinned by imports of discounted Russian crude. In the first half of India's fiscal year, imports of Russian crude surged by 9.1% to 1.91 million barrels per day, underscoring its importance as a key buyer in the global oil landscape.

Geopolitical and Strategic Developments

The reactivation of the Druzhba pipeline, carrying Russian and Kazakh oil to Europe, offers some relief to European markets, reducing immediate supply concerns. However, the European Union's reliance on diversified suppliers remains crucial amid ongoing tensions with Russia. Simultaneously, Qatar's Energy Minister has warned the EU against enforcing strict corporate sustainability directives, threatening to withdraw LNG supplies if fines are imposed. This tension underscores the delicate balance between geopolitical strategies and market dependencies.

Technological Innovations and U.S. Shale Challenges

In the U.S., shale oil production faces depletion risks, with output showing signs of decline since peaking in late 2023. Enhanced oil recovery (EOR) techniques, particularly CO2 injection, present potential solutions to prolong productivity. Studies from Canada suggest that such methods could extend the lifespan of near-depleted wells by decades, offering a glimpse into the future of U.S. shale operations.

Market Projections and Analyst Outlooks

Macquarie analysts forecast a growing supply surplus in 2025, projecting Brent crude to average $70.50 per barrel, a notable drop from this year's $79.64. Despite this bearish sentiment, the demand recovery in key regions and innovative recovery technologies could offset some downward pressures.

Investor Considerations Amid Volatility

With WTI and Brent trading at these levels, investors must weigh geopolitical risks, supply disruptions, and macroeconomic indicators. The mixed signals from U.S. inflation data, global supply threats, and the strengthening dollar create a volatile yet opportunistic landscape for trading and long-term investments in crude oil markets. Decisions around buy, sell, or hold strategies should factor in both the immediate supply constraints and long-term demand prospects, particularly in rapidly growing markets like India.