ASML Stock Plunges: A Deep Dive Into NASDAQ:ASML's Q3 Earnings and Future Outlook

ASML's stock has tumbled following weak bookings and lower guidance. But with strong profit growth projected for 2025, is this the perfect chance for long-term investors to capitalize? Explore the market dynamics and why this semiconductor giant might still shine | That's TradingNEWS

NASDAQ: ASML Faces Short-Term Challenges Amid Long-Term Growth Potential

ASML’s 2024 Third-Quarter Performance: A Deeper Look at the Results

ASML Holding N.V. (NASDAQ: ASML), a leading semiconductor equipment supplier, recently reported its third-quarter earnings, and the stock reacted sharply. Following the release, the stock experienced a significant sell-off, dropping 16% on the first day and an additional 6% the following day. ASML’s third-quarter earnings disappointed investors, leading to heightened concerns about the future of the semiconductor industry, especially in the context of ASML’s role as a bellwether for the sector.

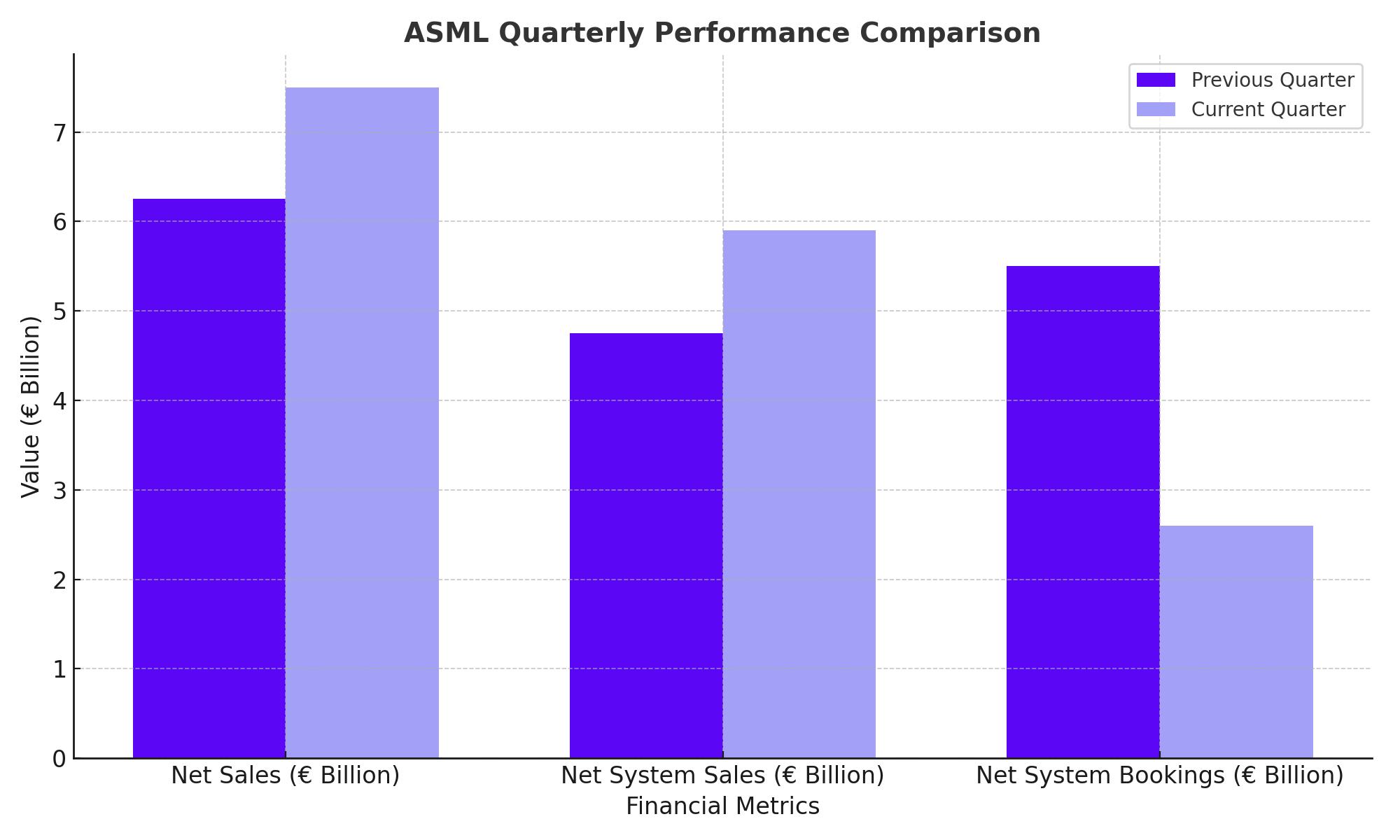

The company’s third-quarter net sales amounted to €7.5 billion, a 20% increase from the prior quarter, surpassing analyst expectations of €7.17 billion. However, it’s essential to note that despite this rise, the company faced headwinds with its net system bookings, a key metric for predicting future revenues. ASML reported net system sales of €5.9 billion, up 24% from the previous quarter. Yet, net system bookings were down, declining 53% QoQ to €2.6 billion, mainly due to a sluggish recovery in the broader semiconductor market.

The Impact of Export Restrictions on NASDAQ: ASML

One of the critical challenges ASML is currently facing is the tightening of export restrictions on its advanced extreme ultraviolet (EUV) lithography machines. These machines are vital for producing cutting-edge chips for industries ranging from electronics to electric vehicles (EVs). The U.S. and Dutch governments have imposed restrictions that require ASML to obtain export licenses for selling its TWINSCAN NXT: 1970i and 1980i DUV systems to China. This is significant because 47% of ASML's net system sales came from China in the third quarter.

While ASML has diversified its customer base, the restrictions on its China business could create a substantial headwind moving forward. Export controls are likely to continue being a point of concern, particularly as political and economic tensions between the U.S. and China escalate.

For more detailed insights, check out ASML Insider Transactions and monitor how internal trades reflect market sentiment.

Volatility in Net System Bookings: A Historical Perspective

While the sharp decline in net system bookings for Q3 raised red flags, it is important to put this into context. Historically, ASML's order volumes have been volatile. For instance, net system bookings fell 42% in Q3 2023 but rebounded 253% in Q4 2023. This cyclical nature of ASML's bookings suggests that while the semiconductor market may be experiencing a temporary slowdown, the company could bounce back just as it has done in previous quarters.

Moreover, despite the temporary dip in bookings, ASML remains confident in its long-term outlook. The company forecasts total revenue for 2025 to fall between €30 billion and €35 billion, up from an expected €28 billion in 2024. Even though this guidance represents a reduction from the previous forecast of €30-40 billion, the company still expects growth in both sales and profits moving forward.

Operating Margins Remain Strong Despite Headwinds

From a profitability perspective, ASML continues to perform well. In Q3 2024, the company posted an operating income margin of 32.7%, up by 3.3 percentage points compared to the previous quarter. This increase in margins indicates that, despite declining system bookings, ASML is maintaining robust profitability. This is a positive signal for long-term investors, suggesting that the company's fundamentals remain intact.

Why ASML (NASDAQ: ASML) Remains a Contrarian Buy Despite the Selloff

For long-term investors, ASML's recent stock dip may represent a contrarian buying opportunity. The stock is currently trading at $723.26, reflecting a 37% discount from its July highs of around $1,100. Despite the selloff, ASML remains fundamentally strong, with its profit margins expected to grow at a faster pace than sales over the next few years.

According to analysts, the market is currently pricing in €20.72 per share in profits for 2024, with an expected increase to €28.20 per share in 2025. This translates to a 36% YoY profit growth rate, indicating significant upside potential. Furthermore, ASML’s current valuation multiple of 33.8x 2024 earnings falls to 24.8x 2025 earnings, making it an attractive long-term buy. Analysts suggest that a return to a 31x earnings multiple in 2025 could push the stock price to $875.

Given the cyclical nature of the semiconductor market, ASML’s stock could rebound significantly if net system bookings recover in Q4 2024, as they did last year. Investors should keep an eye on how the company manages its backlog and the timing of demand recovery in the chip sector.

ASML Insider Transactions and Institutional Activity

ASML’s recent insider transactions provide additional insight into market sentiment around the stock. Notably, hedge funds and institutional investors have been adjusting their positions, signaling both confidence and caution depending on their outlook. Insider buying has shown that some high-ranking executives believe the stock is undervalued at current levels, further supporting the contrarian view.

For the latest updates on institutional and insider activity, check out the ASML Insider Transactions for real-time data.

Geopolitical and Macro Risks: How They Affect ASML’s Future Growth

ASML's exposure to China has been a double-edged sword. On the one hand, the country represents a significant revenue source, contributing 20% of its sales. However, ongoing geopolitical tensions between China and the U.S., combined with tighter export controls, could lead to reduced sales in 2025. In the worst-case scenario, ASML could face a steep decline in Chinese sales, but this appears to be a manageable risk given the company's diversified global customer base.

From a macroeconomic perspective, ASML benefits from growing global demand for semiconductor equipment, particularly as AI, 5G, and electric vehicles drive increased chip production. While some markets, like EVs and consumer electronics, are currently experiencing a slowdown, the overall trajectory for semiconductor demand remains positive in the long term. Governments worldwide are investing heavily in building semiconductor fabs, creating a tailwind for ASML's EUV machines.

Technical Analysis and Short-Term Outlook for NASDAQ: ASML

Technically, the stock has broken below key support levels, but this doesn’t mean that the long-term outlook is dim. The current price of $723.26 is far below the 50-day and 100-day moving averages, indicating oversold conditions. Some analysts suggest that the stock could find a floor at the $680 level, representing a potential near-term entry point for investors.

A rebound is likely once investors refocus on the company's strong long-term fundamentals, especially if net system bookings rebound in Q4. Analysts are targeting $875 as a short-term price objective, driven by a 31x 2025 earnings multiple.

Conclusion: Is ASML a Buy, Sell, or Hold?

Based on the company’s earnings potential, strong operating margins, and robust demand for EUV lithography systems, NASDAQ: ASML remains a compelling long-term investment. Despite the short-term dip and lowered guidance for 2025, the company's unique market position and long-term growth prospects make it a "buy" for investors with a multi-year time horizon.

For more details on NASDAQ: ASML, check out the real-time ASML stock chart.

With geopolitical risks, cyclical semiconductor demand, and the company's long-term competitive advantage, investors should carefully weigh the short-term volatility against the long-term growth opportunities.

That's TradingNEWS

Read More

-

PayPal Stock Price Forecast - PYPL At $58 Becomes A Cash Machine With 10 Percent Yield

01.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast 2026: XRP-USD At $1.85 Eyes $3 Breakout And Path Toward $8

01.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: Can Brent Hold $60 As WTI Slides Toward A $50–$60 Range In 2026?

01.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today And 2026 Forecast: S&P 500 6,845, Nasdaq 23,242, Gold $4,332

01.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Holds Around 1.34 As Fed Easing And BoE Weakness Set The 2026 Trading Range

01.01.2026 · TradingNEWS ArchiveForex