ASML Holding NASDAQ:ASML Stock Analysis: Short-Term Challenges & Future Growth

In-Depth Review of ASML's Q2 FY2024 Expectations, EUV Technology Advancements, Strategic Partnerships, and Geopolitical Risks | That's TradingNEWS

ASML Holding N.V. (NASDAQ:ASML) Stock Analysis: A Comprehensive Review of Future Growth Potential

Investment Thesis

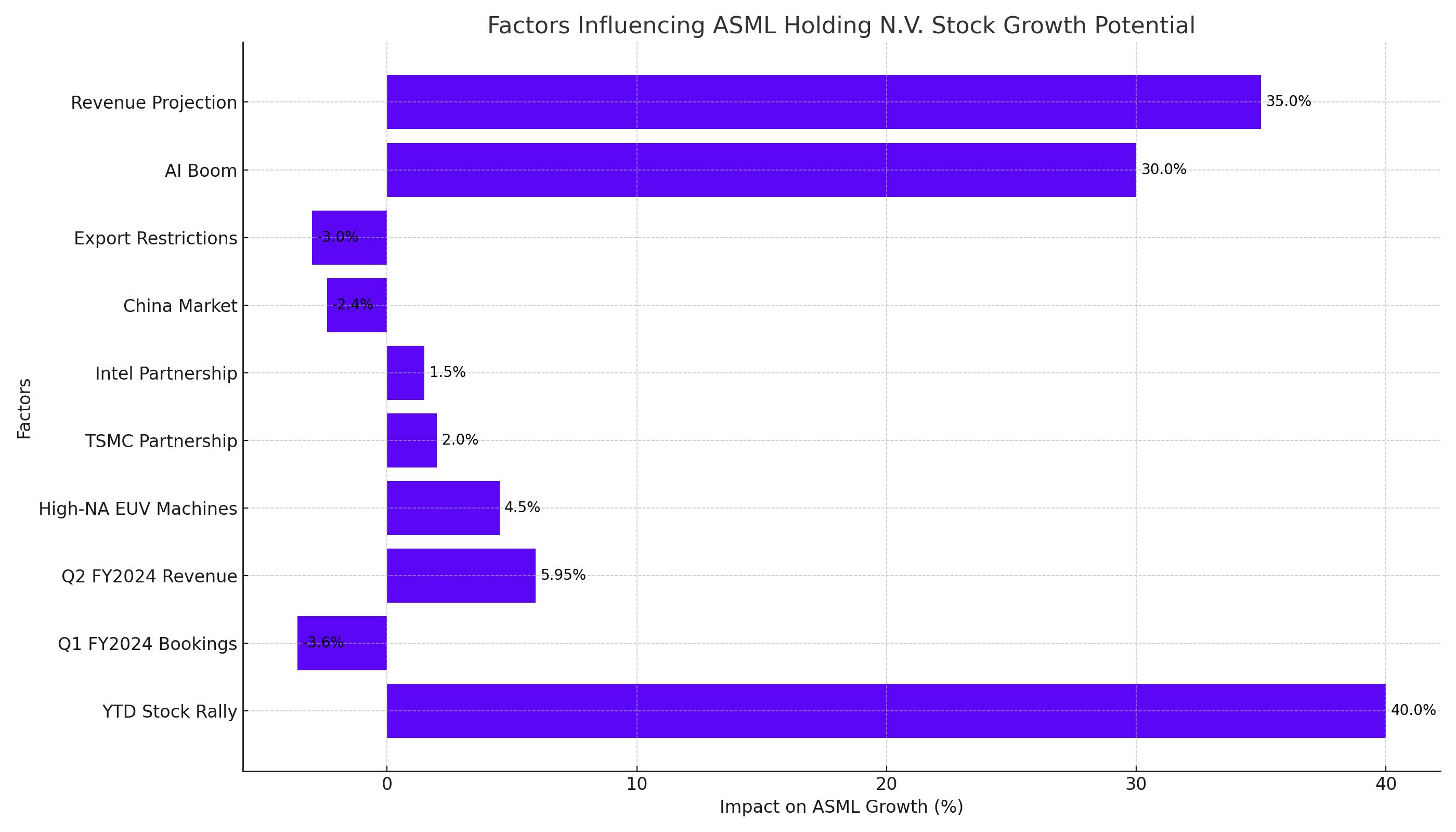

ASML Holding N.V. (NASDAQ:ASML) has experienced a substantial rally, gaining 40% year-to-date. This surge is primarily driven by the anticipated long-term demand for lithography systems, especially amid the growth of generative AI. ASML is the exclusive manufacturer of extreme ultraviolet (EUV) lithography machines, which are crucial for advanced semiconductor manufacturing. Despite facing short-term headwinds, such as weak bookings in Q1 FY2024 and revenue contraction due to export restrictions in China, the company is poised for strong growth in FY2025 and beyond, largely driven by its EUV technology and strategic partnerships with key players like Taiwan Semiconductor Manufacturing Company (TSMC) and Intel (INTC).

Financial Performance and Q2 FY2024 Preview

Q1 FY2024 Performance

In Q1 FY2024, ASML reported net system bookings of €3.6 billion, significantly below market expectations. This weakness was reflected in the company's guidance for Q2 FY2024, with expected net revenue between €5.7 billion and €6.2 billion and a midpoint gross margin of 50.5%, indicating further contraction. The earnings before interest and taxes (EBIT) margin is anticipated to be around 27.6%.

Q2 FY2024 Expectations

ASML is scheduled to report its Q2 FY2024 earnings on July 17, 2024. The company anticipates total net revenue between €5.7 billion and €6.2 billion. Despite a conservative outlook, focus will be on the product revenue mix, particularly the expanding contribution from EUV lithography. The company is expected to announce a significant high-NA EUV machine deal with TSMC, potentially boosting its growth outlook for FY2025.

EUV Technology: A Catalyst for Growth

High-NA EUV Machines

ASML's high-NA EUV machines, expected to be delivered in FY2025, are pivotal for the company's growth. Each machine costs around $380 million and is essential for manufacturing cutting-edge semiconductors. TSMC, ASML's largest EUV customer, is likely to place substantial orders, driving ASML's revenue growth. The market anticipates the deal to be around €4.5 billion, highlighting the significant impact of EUV technology on ASML's future revenue streams.

Strategic Partnerships and Market Position

TSMC and Intel Partnerships

ASML’s two biggest customers, TSMC and Intel, are integral to its success. TSMC is a leader in semiconductor manufacturing and heavily relies on ASML’s EUV technology for advanced nodes. Intel also depends on high-NA EUV for its 14A productions, underscoring the critical role of ASML’s technology in the semiconductor supply chain.

TSMC's 2nm Node and ASML’s Role

TSMC's upcoming 2nm node production, set for volume production in 2025, will significantly benefit ASML. The company is expected to supply multiple EUV systems for TSMC's new fabs in Taiwan, generating substantial revenue. This collaboration underscores ASML's strategic importance in the semiconductor manufacturing ecosystem.

China Market and Geopolitical Risks

Impact of Export Restrictions

ASML generates a significant portion of its revenue from China. However, U.S. export restrictions on advanced lithography equipment to China pose a challenge. In Q1 FY2024, China accounted for 49% of ASML's total system revenue. Despite this, the company expects strong demand from China, although geopolitical tensions and export controls could impact long-term growth.

Valuation and Market Sentiment

Current Valuation

ASML is currently trading at a high valuation due to its strong performance and growth prospects. Based on the high end of the company's revenue target for FY2025 (€40 billion), the stock’s EV/Sales FY2025 is 10.6x. Analysts expect ASML's GAAP EPS to decline by -5% YoY in FY2024, with significant growth anticipated in FY2025 as the company capitalizes on the demand for EUV technology.

Analyst Expectations

Analysts are cautiously optimistic about ASML's growth prospects. The company’s forward P/E ratio for FY2025 is 32.3x, which, while high, is justified by its strong market position and growth potential. The broader semiconductor industry, represented by the iShares Semiconductor ETF (SOXX), has a P/E TTM of 34x, indicating that ASML’s valuation is in line with industry standards.

Long-Term Growth Prospects

Revenue Projections

ASML’s revenue is projected to surge in FY2025, driven by the high-NA EUV machine sales and strategic partnerships. The company aims to achieve €35 billion to €40 billion in revenue, indicating a +30% YoY growth. This projection aligns with the anticipated demand for advanced semiconductor manufacturing technologies.

AI Boom and ASML’s Long-Term Framework for Growth

AI Infrastructure Demand

Chip stocks like Nvidia (NVDA) and AMD (AMD) are benefiting from the corporate sector's soaring demand for graphics processing units, part of a massive ramp in infrastructure spending. Companies are investing billions in data centers that run AI-customized chips to train and deploy large language systems. ASML, providing lithography systems needed to produce these microchips, stands to benefit significantly.

Revenue Growth from AI

ASML’s revenues nearly doubled to €27.6 billion from FY2020 to FY2023, with a 30% acceleration in FY2023. The company generated €5.3 billion in Q1 2024, and its future looks promising with robust demand for AI chips. TSMC's preliminary results for Q2 2024, showing 40% YoY growth, indicate that ASML is well-positioned to exceed its guidance.

Potential Uncertainty in China

Export Restrictions Impact

ASML's CFO previously indicated that around 20% of the company's backlog comes from Chinese customers. With U.S. government urging the Dutch government to introduce export restrictions on ASML’s DUV lithography machines to China, approximately 10% to 15% of ASML's sales in FY2024 could be impacted. This geopolitical tension poses a risk to ASML's long-term growth.

Valuation and Market Sentiment

Market Valuation

Despite a deterioration in its fundamentals, ASML's strong rally over the past year has led to a lofty valuation. The stock's EV/Sales FY2025 is 10.6x based on the high end of the company's revenue target (€40 billion). Analysts expect ASML's GAAP EPS to decline by -5% YoY in FY2024, with significant growth anticipated in FY2025, aligning with the broader semiconductor industry's premium valuation.

Free Cash Flow and Capital Return Potential

Cash Flow Generation

ASML generated €2.4 billion in trailing twelve-month (TTM) free cash flow on revenues of €26.1 billion, translating to a free cash flow margin of 9.1%. The company aims to achieve revenue between €30 billion and €40 billion by FY2025, implying an annual free cash flow potential of €3.0 billion to €4.0 billion.

Capital Return Strategy

ASML has a history of generous capital returns, including stock buybacks and dividends. With the projected ramp-up in revenues, the company is likely to accelerate its capital returns, benefiting shareholders significantly.

Risks and Challenges

Dependence on AI Infrastructure Spending

ASML's growth is heavily tied to infrastructure spending in the data center market. Companies like Meta Platforms (META), Amazon (AMZN), and Alphabet (GOOG) are driving demand for AI GPUs. Any slowdown in this spending could negatively impact ASML’s growth, affecting its gross margins and long-term growth plans.

Conclusion

ASML Holding N.V. (NASDAQ:ASML) faces short-term challenges, including geopolitical risks and revenue contraction. However, the company’s exclusive EUV technology and strategic partnerships position it for substantial growth in FY2025 and beyond. Despite a lofty current valuation, ASML's potential to dominate the advanced semiconductor manufacturing market makes it a compelling investment. Given the anticipated surge in demand for EUV systems and strategic deals with key players like TSMC, ASML's long-term growth outlook remains robust.

For real-time stock data, visit ASML Stock Profile.