Is BATS:BTCI the Best Way to Generate Income from Bitcoin's Volatility?

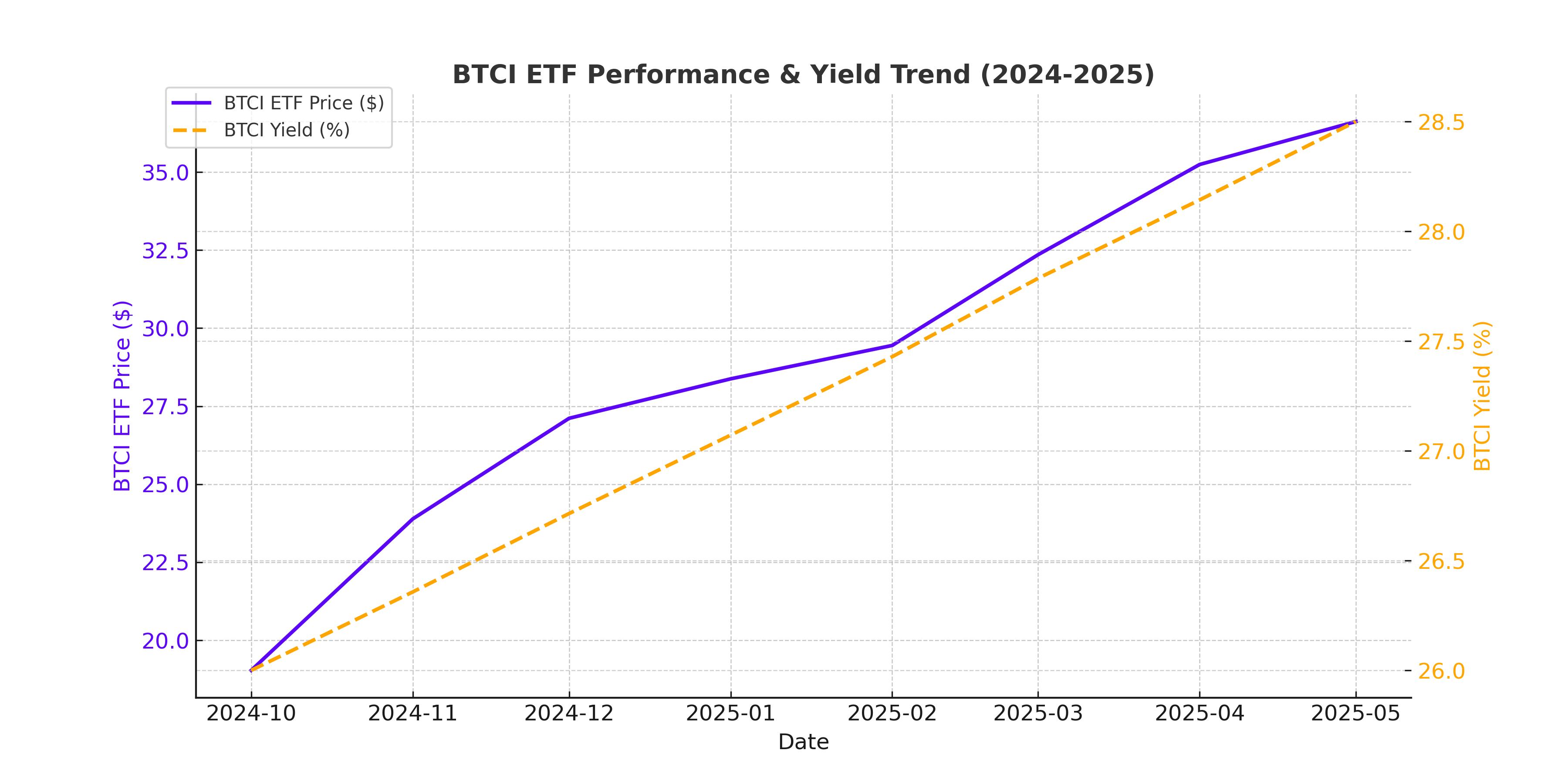

The NEOS Bitcoin High Income ETF (BATS:BTCI) has gained attention as one of the few ways investors can generate high monthly income from Bitcoin while still capturing price appreciation. Since its launch in October 2024, BTCI has returned 38%, while Bitcoin itself has gained 48% in the same timeframe. What makes BTCI unique is that it provides 28% distribution yield through a sophisticated options strategy, which is designed to hedge downside risk while still allowing for capital appreciation. But how sustainable is this model, and does BTCI offer a better risk-adjusted return than simply holding Bitcoin or other Bitcoin-related ETFs?

BTCI's core strategy relies on covered call writing on the Cboe Bitcoin U.S. ETF Index (CBTX), which provides income in the form of option premiums. The fund also holds Bitcoin through the VanEck Bitcoin ETF (HODL) while using short-term treasuries and cash holdings to fund its buy-write strategy. The result is a fund that attempts to balance high-income generation with Bitcoin price exposure, making it appealing to income-focused investors who still want upside participation in the world's most volatile asset.

How Does BATS:BTCI Generate Its 28% Yield?

BTCI stands out due to its remarkably high yield of 28.17%, which is directly tied to Bitcoin’s extreme volatility. Unlike traditional dividend-paying stocks or bond funds, BTCI relies on selling call options on Bitcoin-linked assets, capturing high option premiums while holding underlying Bitcoin exposure.

Currently, BTCI’s portfolio consists of Bitcoin via the VanEck Bitcoin ETF (HODL), cash holdings, and covered call options at various strike prices. The fund's managers have sold 2280, 2510, and 2700 strike call options for February expiry, meaning BTCI continues to generate high income even as Bitcoin moves through a volatile trading range.

Because Bitcoin is one of the most volatile assets, with an implied volatility 5x higher than the S&P 500, BTCI can generate significant options premiums every month. The ETF is structured to collect income regardless of Bitcoin’s direction—whether it rises, falls, or trades sideways, BTCI's covered call strategy ensures that premiums continue to flow in.

Even in a bearish scenario, BTCI’s option premiums help mitigate some losses, making it a compelling income-focused play on Bitcoin that doesn't require direct ownership of the asset.

Comparing BTCI to Other Bitcoin Income ETFs

BTCI is not the only ETF attempting to generate income from Bitcoin's volatility. A key competitor is the YieldMax Bitcoin Option Income Strategy ETF (NYSE:YBIT), which uses a synthetic covered call strategy but has struggled with NAV erosion and poor total returns. Since inception, YBIT has seen its price fall 37.7%, while BTCI has posted 41.52% total returns. BTCI has consistently outperformed YBIT due to its superior European-style options and better NAV management.

One major difference between BTCI and YBIT is the type of options used. BTCI sells index options (CBTX), which are taxed under Section 1256 (60% long-term, 40% short-term capital gains), making them far more tax-efficient than YBIT’s ETF options, which are taxed as ordinary income. Additionally, BTCI’s target distribution strategy allows it to avoid excessive NAV erosion, whereas YBIT has struggled to maintain principal value due to aggressive distribution payouts.

For investors looking for a more stable and sustainable approach, BTCI appears to be the superior choice over YBIT, despite YBIT’s higher 80.29% yield. The tradeoff is that BTCI sacrifices some short-term yield to maintain long-term capital appreciation.

Key Risks for BTCI: Can High Yields Last?

While BTCI’s covered call strategy works well in most environments, there are significant risks that investors should consider. Bitcoin remains one of the most speculative and volatile assets, and while BTCI's structure provides some downside protection, it cannot fully eliminate Bitcoin’s inherent price swings.

- Bitcoin's Price Volatility: Bitcoin has experienced multiple 50%+ drawdowns in the past, and BTCI’s NAV will still decline during major sell-offs, even with its options strategy.

- Regulatory Uncertainty: Governments worldwide continue to discuss new regulations on Bitcoin ETFs and derivatives trading, which could impact BTCI’s ability to continue operating its strategy efficiently.

- Liquidity Risks: BTCI is still a relatively new fund, launched in October 2024, with around $75M in AUM. If the fund fails to attract significant capital, it may struggle with liquidity and high bid-ask spreads.

- Early Performance Bias: Since BTCI launched in a Bitcoin bull market, it has yet to experience a prolonged Bitcoin bear market. Its long-term viability remains untested in bearish conditions.

Despite these risks, BTCI remains an innovative approach to Bitcoin investing, providing tax-efficient, high-yield income while maintaining some level of price appreciation.

Should You Buy, Sell, or Hold BATS:BTCI ETF?

BTCI presents a unique opportunity for income investors looking to gain exposure to Bitcoin with less volatility than directly holding the asset. However, its success is dependent on Bitcoin’s continued price growth and the sustainability of its options premiums.

Investors who want income first and capital appreciation second may find BTCI attractive for a 3-10% portfolio allocation, as it can provide strong passive income while still participating in Bitcoin’s long-term price trends. However, those looking for pure upside exposure to Bitcoin may prefer a spot Bitcoin ETF like IBIT or VanEck’s HODL ETF instead.

Given BTCI's high distribution yield, strong NAV management, and superior tax efficiency over competitors, it currently holds a BUY rating. However, investors should closely monitor its performance through market cycles and be aware that its NAV will still be impacted by major Bitcoin downturns.

For those seeking high-yield passive income from Bitcoin with lower risk than direct ownership, BTCI remains one of the best available options in the market today.