Bank of America (NYSE:BAC) Poised for a Strong 2025 with Rate Tailwinds and Growth Potential

Riding the Higher-for-Longer Rate Wave

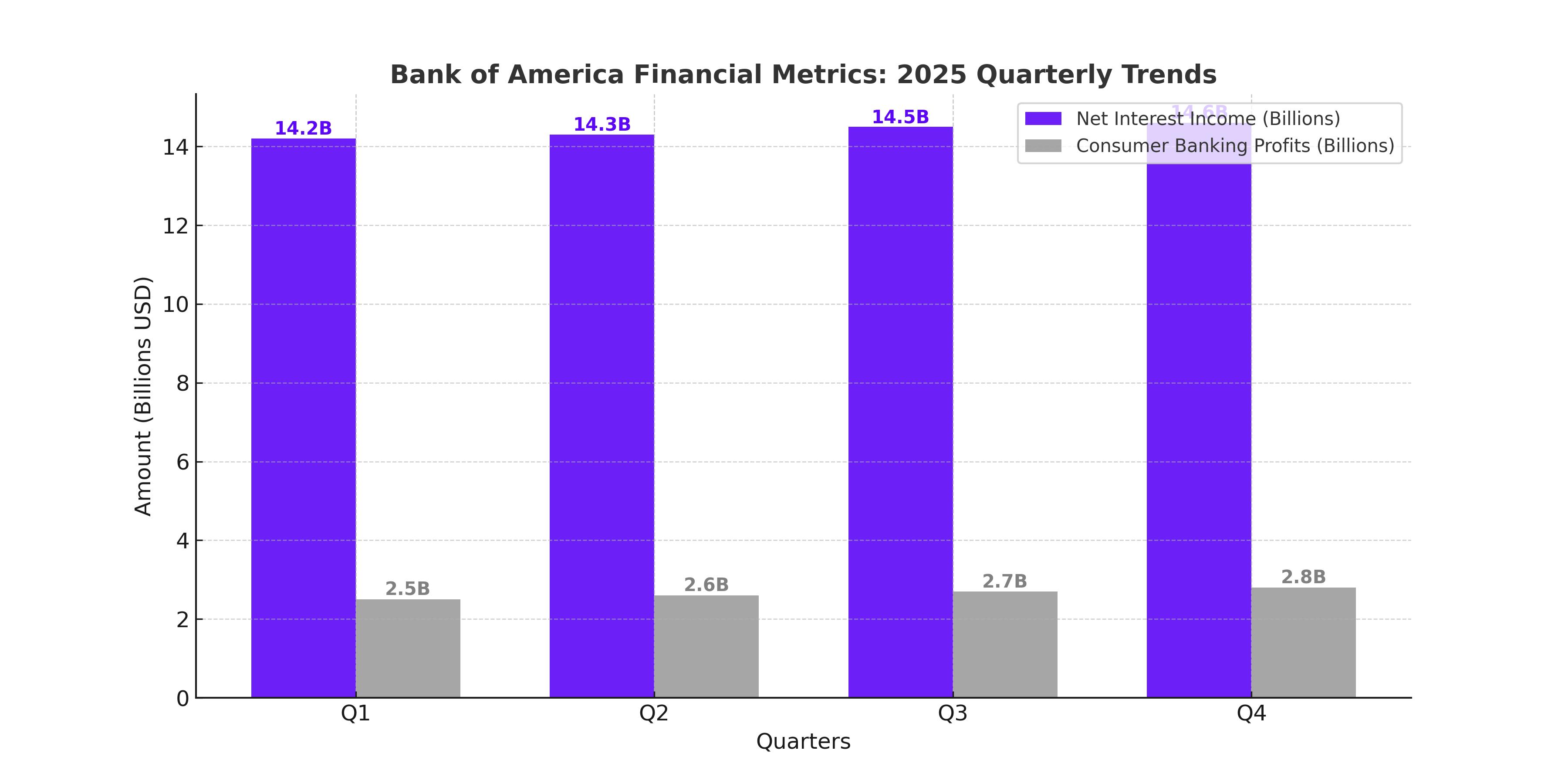

Bank of America Corporation (NYSE:BAC) is strategically positioned to benefit from the Federal Reserve's higher-for-longer interest rate stance heading into 2025. Despite a slight rate reduction in December 2024, the central bank maintains rates at a historically high range of 4.25%-4.50%, with cautious expectations for gradual cuts to around 3.75%-4.25% by the end of 2025. This creates an environment that significantly bolsters Bank of America’s net interest income (NII), a critical driver for profitability. In 2024, the bank forecast $14.5 billion in NII for Q4, and projections for 2025 suggest sustained quarterly NII between $14 billion and $15 billion, driven by strong deposit growth and favorable loan mix.

Consumer Banking Growth Amid Economic Expansion

Bank of America's Consumer Banking segment remains a cornerstone of its financial performance, generating $2.7 billion in profit in Q3 2024, a 4% sequential increase. Average deposits reached $1.92 trillion, showcasing a 24% growth since the end of 2019. This segment thrives on robust economic conditions, with the U.S. economy growing at an annualized rate of 3.1% in Q3 2024. Additionally, Bank of America's digitalization efforts, including its AI-powered assistant Erica with 2.4 billion interactions, enhance customer engagement and operational efficiency, setting the stage for sustainable margin expansion.

Capitalizing on Cyclical Tailwinds

The U.S. economic landscape is favorable for cyclical financial stocks like Bank of America. With record stock market highs and a growing economy, the bank’s core businesses, including Consumer Banking and Global Wealth and Investment Management (GWIM), are well-positioned for cyclical profit growth. GWIM reported $1.1 billion in profit in Q3 2024, an 8% revenue growth year-over-year, underpinned by a 14% increase in asset management fees and $4.2 trillion in client balances. This segment demonstrates the bank's strength in cultivating high-net-worth clients and expanding its footprint in investment banking.

Valuation and Book Value Comparison

Despite trading at a 24% premium to its book value, Bank of America offers attractive relative valuation compared to peers like Wells Fargo (1.42x book value). The bank's strong capital position, with a CET1 ratio of 11.8% exceeding regulatory requirements, supports capital returns through dividends and buybacks. In Q3 2024 alone, Bank of America returned $5.6 billion to shareholders. The tangible book value per share increased to $26.25, reflecting a 10% year-over-year growth. A Wells Fargo-comparable valuation suggests a potential intrinsic value of $51, offering upside from its current price of $44.

Outlook for Dividend Growth

Dividend increases are a compelling aspect of Bank of America's investment thesis. Historically constrained post-2008, the bank's dividend yield stands at 2.27% forward, with room for significant growth. Previous quarterly increases of $0.02, or approximately 9%, indicate a pattern of incremental growth. For 2025, a notable increase to $0.30 per share is plausible, representing a potential 15% hike and reflecting earnings growth coupled with a more favorable regulatory environment under a pro-business administration.

Investment Banking and Market Expansion

Bank of America’s investment banking segment shows promise, with revenues up 18% year-over-year in Q3 2024, benefiting from strong debt and equity capital markets activity. As capital markets recover and corporate M&A activity accelerates under a pro-business government, this segment is positioned for robust growth. The Global Markets segment also excelled, with sales and trading revenues increasing 12% year-over-year, supported by equities (up 18%) and fixed income (up 8%). This highlights the bank’s adaptability and strategic investments in technology and talent to capture market share.

Risks to the Outlook

A key risk for Bank of America (NYSE:BAC) lies in the Federal Reserve's monetary policy trajectory. Should the Fed cut interest rates more aggressively than anticipated, the bank’s net interest income (NII)—a vital revenue driver—could face compression. With 2025 rate expectations currently set at a gradual decline toward 3.75%-4.25%, any deviation to the downside would likely pressure the bank’s profitability margins. Another macroeconomic challenge includes the potential for rising unemployment or an unexpected recession, which could strain both consumer and commercial loan portfolios. In such a scenario, loan delinquencies may increase, and credit costs could rise, weighing on overall earnings.

While regulatory tailwinds have been a positive for the bank, particularly the scaled-back Basel III capital requirements, this remains an evolving factor. Future adjustments to these regulations or unforeseen compliance costs could impact Bank of America’s ability to deploy capital efficiently. Although the bank is well-capitalized with a CET1 ratio of 11.8%, further regulatory tightening could slow growth initiatives or shareholder returns. As always, macroeconomic uncertainty combined with regulatory volatility underscores the importance of cautious optimism in the banking sector.

Conclusion

Bank of America is well-positioned to excel in 2025, leveraging its strong Consumer Banking segment and expanding wealth management and investment banking divisions. The favorable rate environment, supported by the Federal Reserve's higher-for-longer stance, and a growing U.S. economy create a robust backdrop for cyclical growth. With average deposits reaching $1.92 trillion and consumer banking profits hitting $2.7 billion in Q3 2024, the bank demonstrates operational strength in capitalizing on economic expansion.

Despite trading at a 24% premium to its book value, Bank of America’s fundamentals and growth trajectory justify its valuation. Shareholders stand to benefit from a potential dividend hike to $0.30 per share, reflecting the bank’s confidence in its earnings power and capital position. Additionally, the bank’s strategic investments in AI-driven digitalization and client expansion are expected to drive long-term profitability and market leadership.

As the U.S. economy continues to strengthen and financial markets recover, Bank of America offers compelling value for long-term investors. Its ability to navigate macroeconomic uncertainties while capitalizing on growth opportunities makes it a standout in the financial sector. With its current price of $44 presenting a potential upside to $51, Bank of America remains a bullish pick heading into 2025.