Fidelity Wise Origin Bitcoin Fund (BATS:FBTC) – A Deep Dive into Its Market Position, Institutional Demand, and Price Outlook

Is BATS:FBTC Positioned to Dominate the Bitcoin ETF Market?

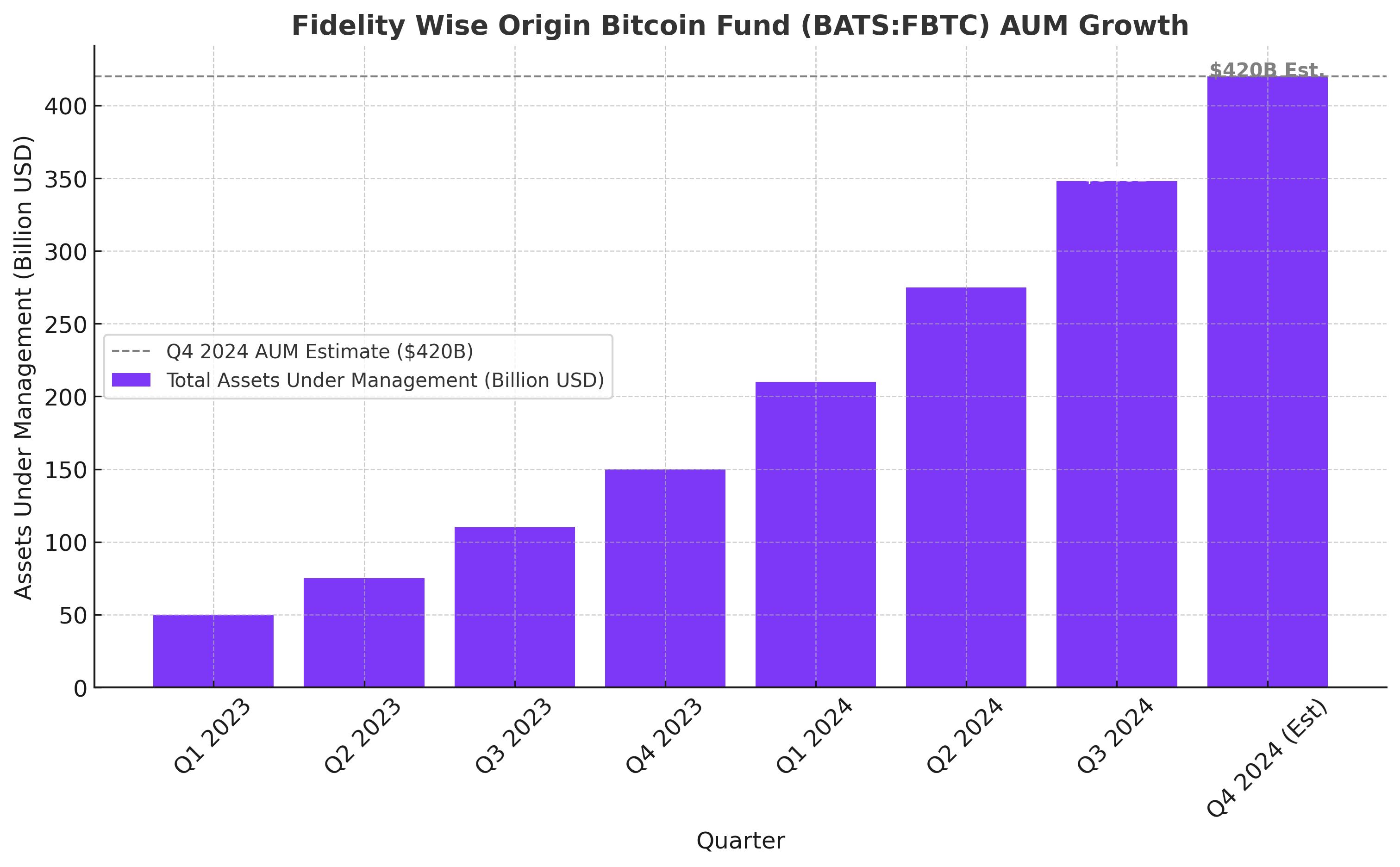

The Bitcoin ETF market has been one of the most explosive areas of growth in financial markets, attracting billions in institutional capital. Fidelity Wise Origin Bitcoin Fund (BATS:FBTC) has emerged as a major player in this race, competing with BlackRock’s iShares Bitcoin Trust (IBIT) and Grayscale Bitcoin Trust (GBTC) for dominance. As Bitcoin trades near its all-time high, breaking above $100,000, investors are looking for the best vehicle to gain exposure to the world’s largest cryptocurrency.

How does FBTC compare to other Bitcoin ETFs? Does it offer better value, lower costs, or higher security? And most importantly—what is the outlook for Bitcoin’s price in 2025, and how will it impact BATS:FBTC?

Institutional Capital Flows into Bitcoin ETFs – How Much Has FBTC Captured?

Since the launch of spot Bitcoin ETFs in early 2024, institutions have poured billions into Bitcoin investment products. The demand has been staggering, with Bitcoin ETFs holding over 1.2 million BTC as of Q1 2025. Fidelity’s FBTC has been a key player, accumulating 273,000 BTC, ranking among the top three Bitcoin ETFs in total holdings.

According to CoinShares, Bitcoin has accounted for 92% of all digital asset capital inflows in 2025, an indication of growing institutional dominance. FBTC, in particular, has seen $348 million in net inflows year-to-date, cementing its place as a leading Bitcoin ETF.

Why Fidelity’s BATS:FBTC Stands Out Among Bitcoin ETFs

1. Fidelity’s In-House Custody Reduces Risk – Unlike most major Bitcoin ETFs that rely on Coinbase Custody (NASDAQ:COIN), FBTC stores its Bitcoin through Fidelity Digital Asset Services. This eliminates counterparty risk associated with third-party custodians, an advantage over competitors like IBIT and GBTC.

2. FBTC’s Expense Ratio Is One of the Lowest – With a 0.25% expense ratio, FBTC matches IBIT as one of the most cost-effective Bitcoin ETFs. In contrast, GBTC still carries a high 1.5% expense fee, making it far less attractive for long-term holders.

3. Highest Bitcoin Exposure Per Share – FBTC provides more Bitcoin exposure per dollar invested than most of its competitors. Investors receive 88,000 satoshis per share (0.00088 BTC), making it one of the most efficient ETFs for tracking Bitcoin’s performance.

4. Growing Trading Volume & Institutional Adoption – FBTC has experienced a surge in daily trading volume, reflecting its increasing appeal among institutional investors and high-net-worth traders.

Bitcoin’s Supply Crisis – How ETFs and Corporate Buyers Are Absorbing BTC at Record Rates

Bitcoin ETFs are not the only entities absorbing Bitcoin at an unprecedented pace. Publicly traded companies have massively increased BTC holdings, tightening supply further.

MicroStrategy (NASDAQ:MSTR) has been the most aggressive, accumulating 471,107 BTC valued at over $30 billion. Other firms, including Tesla (NASDAQ:TSLA), Marathon Digital (NASDAQ:MARA), and Semler Scientific (NASDAQ:SMLR), have also increased Bitcoin holdings.

Publicly traded companies now control over 619,000 BTC, up 125% year-over-year, signaling a significant shift toward Bitcoin as a treasury reserve asset. This institutional buying spree is one of the strongest drivers of Bitcoin’s long-term price appreciation—and by extension, BATS:FBTC’s value.

Bitcoin’s On-Chain Metrics – Are We Entering a Supply Shock?

Bitcoin’s network activity presents an interesting contradiction. While prices are surging, on-chain activity has weakened, a phenomenon historically associated with supply crunches and major rallies.

1. Network Fees Have Dropped Significantly – In January 2025, Bitcoin network fees totaled $20.4 million, down 48% month-over-month and a staggering 85% from $133.7 million in January 2024.

2. Daily Active Addresses (DAAs) Remain Low – Bitcoin’s DAAs dropped from 700,000 in September 2023 to 400,000 in mid-2024, before recovering to 500,000 in January 2025. This suggests that long-term holders are accumulating BTC rather than spending it, further reducing market supply.

3. Bitcoin’s HODLer Balance Is Near Record Highs – Bitcoin supply that has remained unmoved for over a year is at 13.8 million BTC, the highest level since early 2024. Historically, such accumulation precedes parabolic price increases.

Price Forecast: How High Can FBTC Go in 2025?

Bitcoin’s price trajectory has historically followed a predictable post-halving cycle, with major price surges occurring within 12-18 months of each halving event. With Bitcoin now trading above $100,000, many analysts predict prices could reach $150,000 to $250,000 by late 2025.

If Bitcoin reaches $200,000, FBTC’s net asset value (NAV) could double, pushing the ETF’s price toward $170–$200 per share.

Risks: What Could Derail FBTC’s Growth?

1. Bitcoin’s Volatility Could Lead to Large Pullbacks – While Bitcoin’s long-term trajectory remains bullish, 30–40% corrections are common, even in bull markets. A sharp BTC correction could temporarily impact FBTC’s price.

2. Regulatory Uncertainty Still Exists – The U.S. regulatory environment surrounding Bitcoin ETFs is still evolving. While approvals for spot Bitcoin ETFs were a major milestone, any unexpected regulatory actions from the SEC or global governments could impact institutional demand.

3. Potential Geopolitical Risks & Market Liquidity Issues – If macroeconomic conditions deteriorate, risk assets like Bitcoin and FBTC could see temporary slowdowns in demand. However, Bitcoin’s growing role as a hedge against fiat devaluation may offset these risks.

Final Verdict: Is BATS:FBTC a Buy, Sell, or Hold?

FBTC remains a STRONG BUY for long-term investors.

With institutional demand skyrocketing, Bitcoin’s supply tightening, and macroeconomic conditions favoring alternative assets like Bitcoin, Fidelity’s FBTC is one of the most attractive investment vehicles for gaining Bitcoin exposure.

FBTC Price Outlook for 2025

Short-Term (3–6 months): $100–$120 per share (assuming Bitcoin maintains support above $90,000)

Mid-Term (12 months): $150–$200 per share (if Bitcoin reaches $200,000)

Long-Term (2+ years): $300+ per share (assuming Bitcoin’s institutional adoption accelerates further)

Bottom Line: Why FBTC Is One of the Best Bitcoin ETFs to Buy Now

With Fidelity’s unmatched custodial framework, cost efficiency, and rising institutional adoption, FBTC remains one of the top choices for Bitcoin exposure.

For investors looking to capitalize on Bitcoin’s continued rise in 2025 and beyond, FBTC is one of the best-positioned ETFs in the market.

Track BATS:FBTC’s Real-Time Price Here: FBTC Live Chart