BATS:XDTE ETF – Can This 63% Yield Last, or Is It a High-Risk Bet?

Is XDTE’s 0DTE Covered Call Strategy the Future of Income Investing? | That's TradingNEWS

Is BATS:XDTE the Ultimate High-Yield Play? Inside the Zero-Day Options Revolution

Why Is BATS:XDTE’s 0DTE Strategy Different from Traditional Covered Calls?

BATS:XDTE, the Roundhill S&P 500 0DTE Covered Call Strategy ETF, has taken the market by storm with a revolutionary approach to covered call investing. Unlike traditional covered call ETFs that sell monthly or weekly options, XDTE sells zero-days-to-expiration (0DTE) call options on the S&P 500 Index every single day. This daily reset strategy aims to maximize premium income while capturing overnight market gains, a feature absent in other covered call funds like JEPI (JPMorgan Equity Premium Income ETF) and XYLD (Global X S&P 500 Covered Call ETF).

Since its inception in March 2024, XDTE has amassed over $371 million in assets under management (AUM), proving there is significant investor demand for high-yield, actively managed income strategies. But is this ETF truly delivering on its promise, or is it just another high-yield trap? More importantly, does the 0DTE approach offer a sustainable long-term advantage, or will it collapse under volatility pressure?

How Does BATS:XDTE Generate Its 63% Annualized Yield?

At the core of BATS:XDTE's strategy is its ability to sell call options daily at a slight premium while maintaining exposure to the S&P 500. The ETF buys deep-in-the-money call options with a long expiration date to mimic an S&P 500 position while selling out-of-the-money 0DTE call options daily to generate income.

By selling 0DTE calls at approximately 0.15-0.19% above the S&P 500 closing price, the ETF captures consistent premium income, resulting in weekly distributions that annualize to an eye-popping 63.02% yield. Recent payouts confirm this aggressive distribution model:

- January 31, 2025: $0.254857

- January 24, 2025: $0.213664

- January 17, 2025: $0.368099

- January 10, 2025: $0.189527

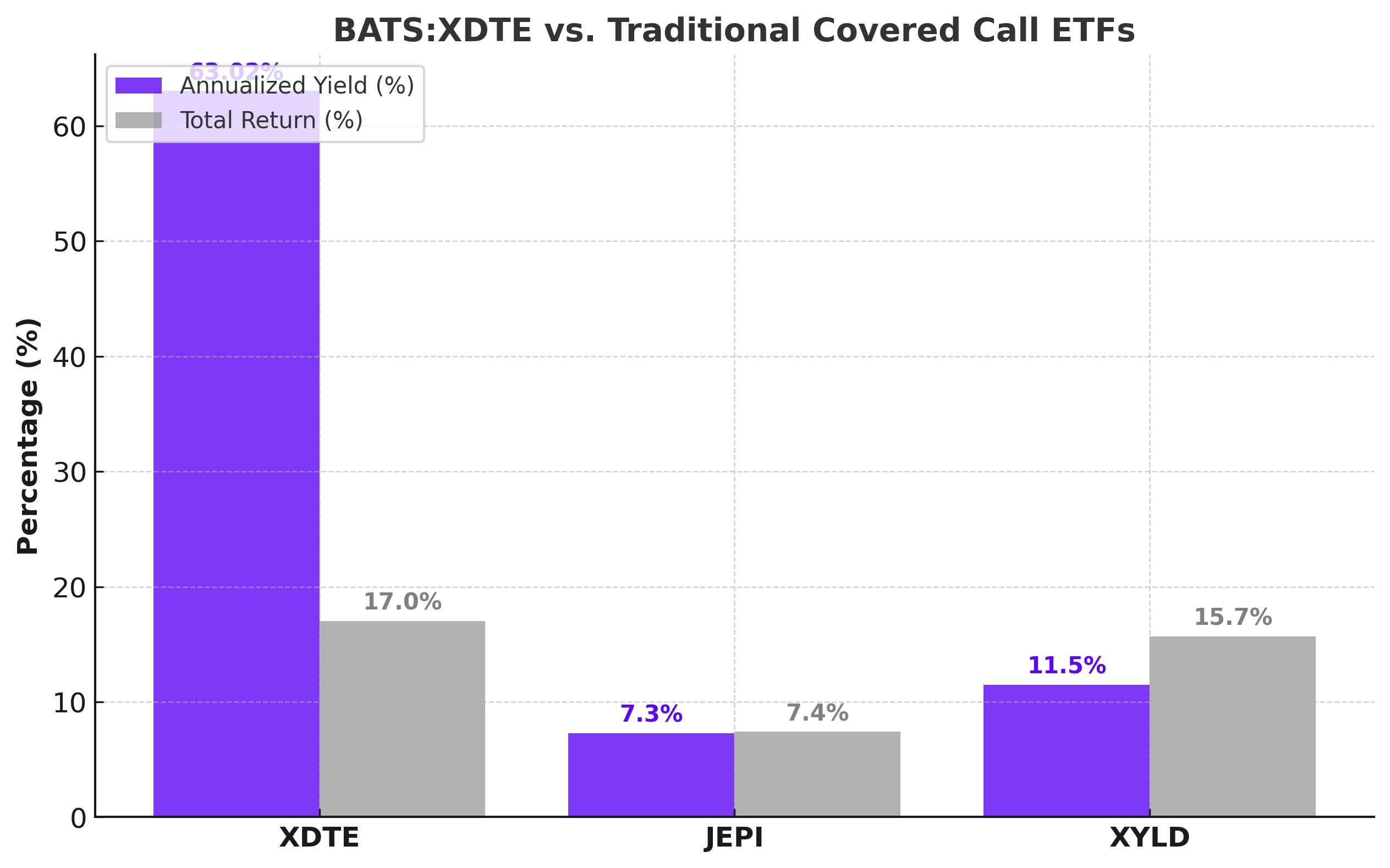

In comparison, leading covered call ETFs such as JEPI (7.3%) and XYLD (11.5%) fall far behind. XDTE is rewriting the playbook, but the big question remains: can it sustain such high yields, or will volatility eventually break the strategy?

What Gives BATS:XDTE an Edge Over Traditional Covered Call ETFs?

One of XDTE’s biggest advantages is its ability to capture overnight gains, a phenomenon known as the "overnight effect." Historical data shows that a significant portion of the S&P 500’s total gains occurs while the U.S. markets are closed, driven by overseas trading.

Unlike traditional covered call ETFs that sell 1-month call options, which cap gains for extended periods, XDTE resets its call options every single day, allowing it to fully participate in overnight market movements before writing a new option at the next open. This means that XDTE behaves like a long-only fund during the overnight session, a major structural advantage.

The result? A far higher total return potential compared to traditional covered call ETFs. Since launch, XDTE has returned 17.0%, significantly outperforming:

- JEPI: 7.4%

- XYLD: 15.7%

This suggests that while the fund prioritizes high yield, it does not entirely sacrifice total return, an issue that has historically plagued covered call funds.

What Are the Risks of XDTE’s 0DTE Strategy?

While BATS:XDTE’s strategy is innovative and high-yielding, it does not come without serious risks.

-

Gamma Risk and Market Volatility

Unlike longer-duration covered calls, 0DTE options carry significant gamma risk, meaning their value fluctuates wildly with even small intraday market moves. If the S&P 500 experiences a sudden rally, XDTE’s call options could become in-the-money rapidly, resulting in large unrealized losses or forced rollovers. -

No Protection in a Market Crash

Like most covered call ETFs, XDTE does not hedge downside risk. If the market enters a severe drawdown, the ETF will continue selling calls at reduced premiums, generating lower income. Recent data shows XDTE underperformed significantly during pullbacks:- July 16 - August 5, 2024: XDTE lost 6.9%, compared to JEPI (-3.4%) and XYLD (-5.1%).

-

Fund Size and Liquidity Concerns

If XDTE attracts billions in assets, market makers and institutions could exploit the fund’s daily call-selling strategy, making it less effective over time. Increased volume in 0DTE options also raises concerns about liquidity squeezes and sudden price swings. -

High Expense Ratio

The 0.95% management fee is expensive for an ETF that mainly trades S&P 500 options. In contrast, JEPI charges 0.35% and XYLD 0.60%. Investors must decide whether the higher distribution yield justifies the added cost.

How Does BATS:XDTE Fit into an Income Portfolio?

Despite its risks, XDTE has undeniable appeal for yield-focused investors. The ETF provides exceptionally high income while maintaining moderate market participation, making it a potential alternative to dividend stocks, REITs, and other income-generating funds.

- For aggressive income seekers: XDTE could serve as a primary yield vehicle, significantly outpacing traditional dividend funds.

- For balanced portfolios: Pairing XDTE with traditional covered call funds (JEPI, QYLD) or dividend stocks could smooth out volatility while maximizing income potential.

- For risk-averse investors: Given XDTE’s reliance on 0DTE options, caution is warranted, especially in bear markets. A blend of covered call ETFs and defensive equities may be more appropriate.

Final Verdict: Is BATS:XDTE a Buy, Sell, or Hold?

BATS:XDTE is an exciting, high-yield ETF that takes covered call investing to the next level. By selling 0DTE call options daily, it creates a powerful cash-flow machine, distributing an annualized 63% yield, far surpassing competitors like JEPI (7.3%) and XYLD (11.5%).

Additionally, XDTE’s unique ability to capture overnight gains provides a structural advantage over traditional covered call funds, leading to higher total returns (17.0%) compared to JEPI (7.4%) and XYLD (15.7%).

However, serious risks remain. Gamma risk, lack of downside protection, and high expense ratios pose challenges. Investors should also consider market conditions, as XDTE may struggle in high-volatility environments.

At current valuations, XDTE is a speculative buy for high-income investors, but a hold for those concerned about market pullbacks. While it is unlikely to maintain a 63% yield indefinitely, its strategy has clear advantages over traditional covered call ETFs. Investors should weigh risk versus reward before making a decision.

For real-time updates and insider transactions, track BATS:XDTE at: XDTE Live Chart