Berkshire Hathaway: A Beacon of Stability and Growth Amid Economic Uncertainty

Market Performance, Valuation Metrics, and Strategic Investments | That's TradingNEWS

Berkshire Hathaway: A Beacon of Stability and Growth Amid Economic Uncertainty

Market Performance and Key Metrics

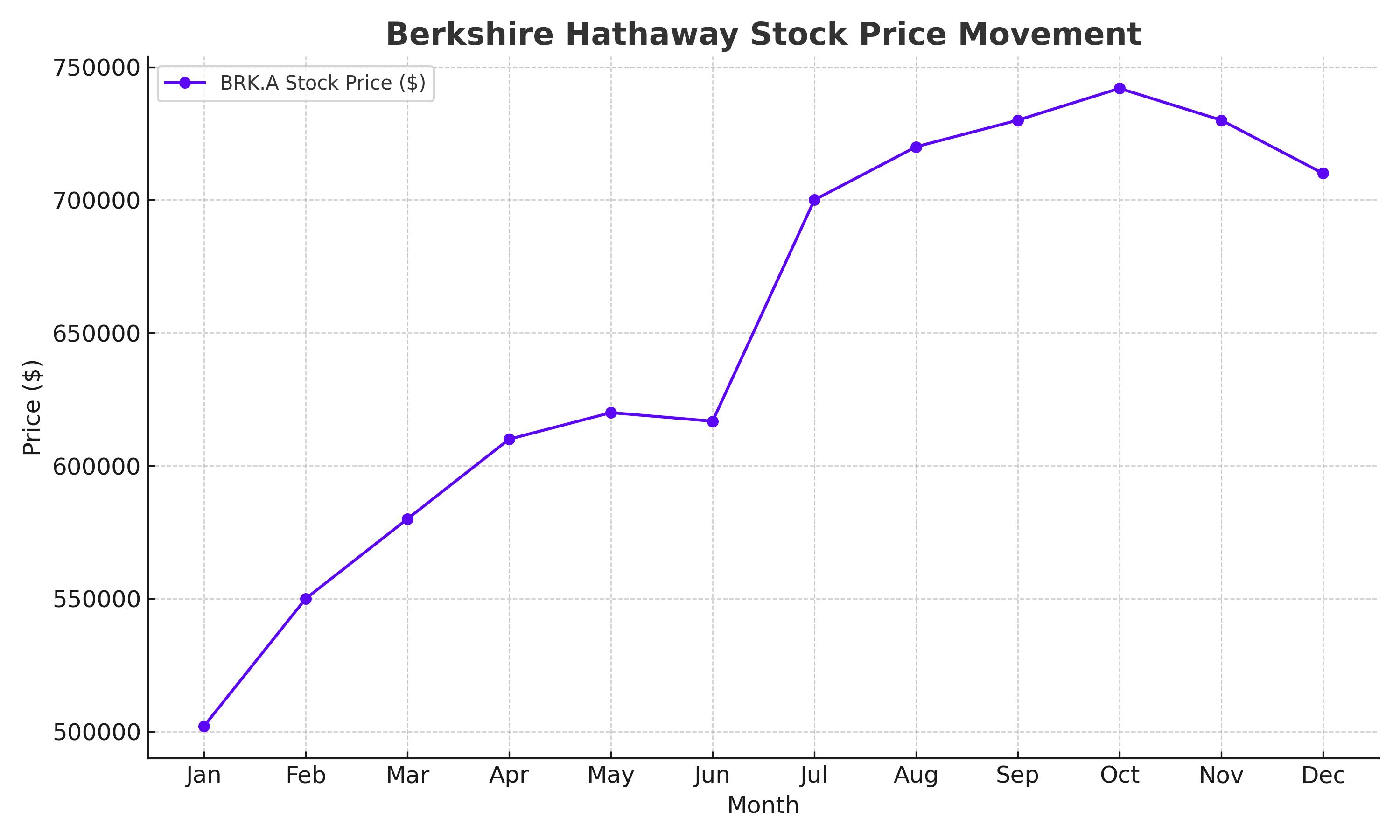

Berkshire Hathaway Inc. (NYSE:BRK.A) stands out in the financial world for its exceptional track record of stable earnings growth, wise investments, and resilient management. As of the latest trading session, BRK.A is priced at $616,774.88, with a slight dip of $475.12 from the previous close. The stock has traded within a day's range of $613,195.00 to $617,347.50, showcasing its robustness amidst market fluctuations. Over the past 52 weeks, BRK.A has seen a low of $502,000.00 and a high of $741,971.00, reflecting significant growth potential.

Valuation and Financial Strength

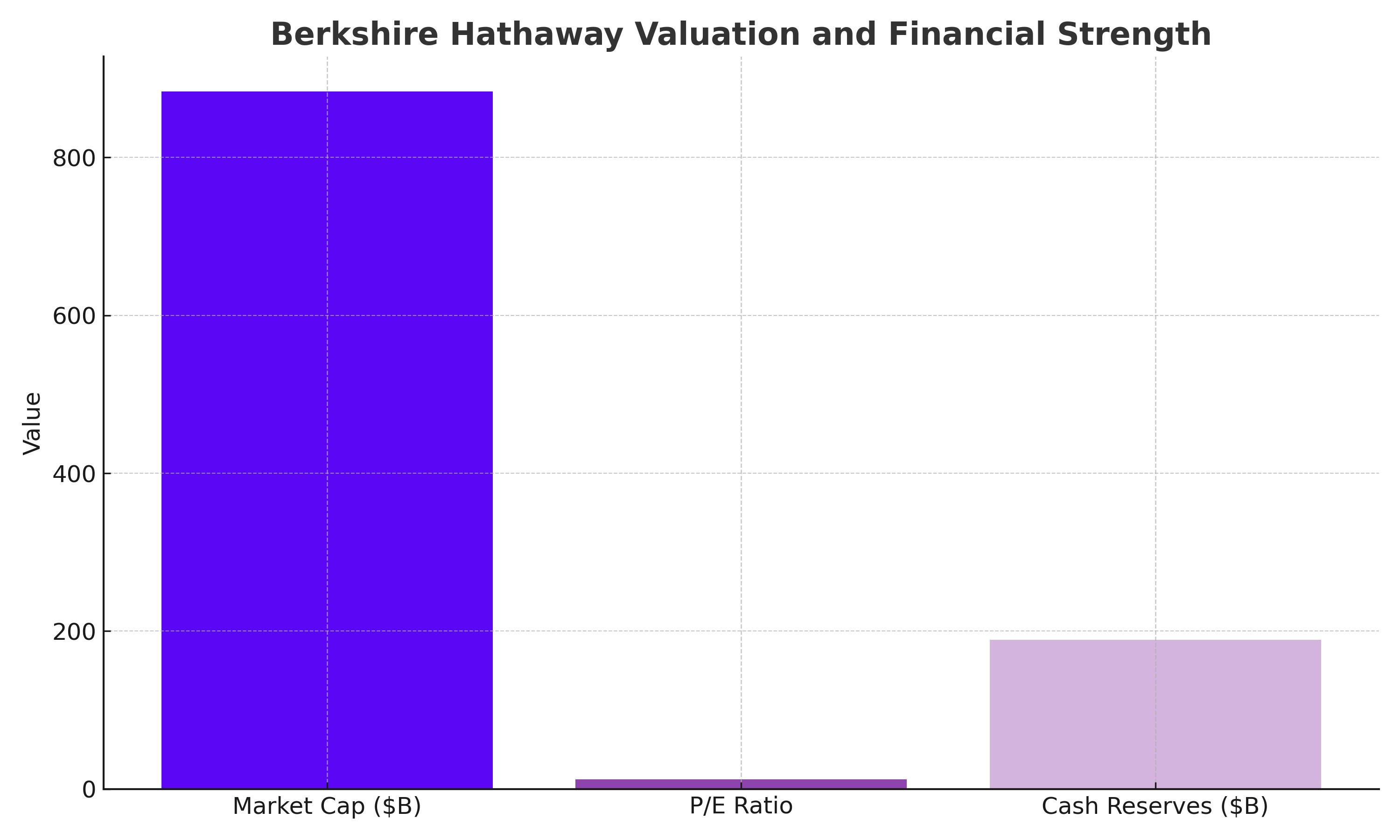

Berkshire Hathaway’s market cap stands at an impressive $883.593 billion, with a trailing P/E ratio of 12.13 and EPS (TTM) of 50,861.39. These figures underline the company’s strong financial health and its ability to generate substantial profits. As of March 31, 2024, the company holds $188.99 billion in cash, providing it with a formidable war chest to capitalize on future investment opportunities. The total debt is relatively modest at $122.75 billion, resulting in a debt-to-equity ratio of 21.25%.

Profitability and Operational Efficiency

Berkshire Hathaway boasts a profit margin of 19.90% and an operating margin of 18.39%, underscoring its efficiency in managing operations and generating profits. The return on assets (ROA) stands at 5.71%, while the return on equity (ROE) is a healthy 13.57%, indicating effective use of shareholders’ equity.

Revenue and Earnings Growth

For the trailing twelve months, Berkshire Hathaway reported revenue of $368.96 billion, with a quarterly revenue growth of 5.20% year-over-year. The net income attributable to common stockholders is $73.42 billion, despite a quarterly earnings growth decline of 64.20% year-over-year. This decline is primarily attributed to the high base effect of the previous year’s exceptional earnings.

Stock Performance and Insider Transactions

The stock’s beta (5Y monthly) of 0.88 indicates lower volatility compared to the broader market, making it a safer bet for conservative investors. Over the past year, the stock has gained 21.03%, trailing the S&P 500’s 25.87% gain. Insider transactions provide additional insights into the company's prospects. For detailed insider transactions, visit Berkshire Hathaway Insider Transactions.

Investment Thesis: Anti-Fragile Investing with Berkshire Hathaway

Berkshire Hathaway exemplifies anti-fragility, thriving during economic downturns while maintaining stability during market stress. This characteristic makes it a perfect hedge for equity portfolios. The company’s diversified business model and strong balance sheet position it to capitalize on market weaknesses and emerge stronger post-crisis.

Historical Performance and Market Psychology

Historically, BRK.A has outperformed the market during periods of economic stress. For instance, during the Global Financial Crisis (GFC), BRK.A significantly outperformed the SPDR S&P 500 Index (SPY), showcasing its resilience and investor trust in Warren Buffett’s strategic leadership.

Berkshire’s Strategic Investments

Berkshire’s portfolio includes substantial holdings in energy and technology sectors. The company owns nearly 29% of Occidental Petroleum (OXY) shares and has a significant stake in Chevron. These investments reflect Buffett’s strategic pivot towards the energy sector, anticipating future gains despite the global shift towards renewable energy.

Technology Sector Holdings

Apple Inc. (AAPL) remains Berkshire’s largest investment, valued at nearly $175 billion. The recent venture of Apple into AI and its potential integration into their devices positions it for substantial growth, benefiting Berkshire’s portfolio significantly.

Valuation Metrics and Investment Strategy

Berkshire Hathaway’s stock trades at a forward P/E ratio of 18.52, below its historical average, suggesting potential for price appreciation. The company’s strategy of repurchasing shares and investing in undervalued assets continues to drive shareholder value. For real-time stock information, visit Berkshire Hathaway Real-Time Chart.

Share Repurchase Program

During the first quarter of 2023, Berkshire repurchased more than 4,000 shares of BRK.A, totaling over $2 billion. This share repurchase program significantly boosts shareholder value by reducing the number of outstanding shares, thus increasing the earnings per share (EPS). There is no cap on the number of shares Berkshire can repurchase, nor an expiration date on the program, giving the company flexibility to enhance shareholder returns continuously.

Operating Earnings and Cash Reserves

Berkshire’s operating earnings grew by 21% between 2022 and 2023, from $30.9 billion to $37.4 billion. The company's massive cash reserves, totaling over $188 billion, provide a robust buffer against economic downturns and position it to seize investment opportunities when valuations are attractive.

Berkshire Hathaway's Portfolio Composition

Berkshire Hathaway’s portfolio is a diverse mix of robust businesses and strategic equity holdings. The company’s major investments include energy, technology, financial services, and consumer goods.

Energy Holdings:

- Occidental Petroleum (OXY): Berkshire owns nearly 29% of OXY shares outstanding, amounting to over 250 million shares valued at over $15 billion. Berkshire also holds $10 billion in OXY cumulative preferred shares purchased in 2019, which pay an 8% annual dividend.

- Chevron (CVX): Berkshire’s portfolio includes roughly 122 million shares of Chevron, representing about 5.5% of its portfolio. These energy investments provide a hedge against inflation and energy price volatility.

Technology Holdings:

- Apple Inc. (AAPL): Apple remains Berkshire’s largest single investment, valued at nearly $175 billion, accounting for around 20% of Berkshire’s $875 billion market cap. Apple’s venture into AI and continuous product innovation bolster its growth prospects.

Financial and Consumer Goods Holdings:

- Bank of America (BAC): With a substantial stake in BAC, Berkshire benefits from the financial sector's stability and potential for long-term growth.

- Coca-Cola (KO): A long-term holding, Coca-Cola provides steady dividends and is a staple in Berkshire’s portfolio.

Investment in Renewable Energy:

Berkshire Hathaway Energy (BHE) is a significant component of Berkshire’s diversified portfolio. BHE, along with OXY, has ventured into lithium extraction in California’s Imperial Valley, positioning Berkshire to benefit from the growing demand for renewable energy and battery technology.

Management and Leadership

Warren Buffett, Berkshire Hathaway’s CEO, and his partner, the late Charlie Munger, have built a legacy of prudent investment and shareholder value creation. Their philosophy of investing in businesses with durable economic advantages and capable management teams continues to guide Berkshire’s investment strategy.

Risks and Considerations

- Leadership Transition: With Warren Buffett’s advanced age, the potential for a leadership transition poses a risk. However, Berkshire’s strong bench of capable managers is expected to maintain the company’s strategic direction.

- Market Valuations: While Berkshire’s investment in companies like OXY has drawn criticism, its diversified portfolio and strategic investments are designed to weather economic cycles and capitalize on long-term growth opportunities.

Berkshire Hathaway's Performance Amid Economic Cycles

Historical Performance

Berkshire Hathaway has a history of outperforming the market during times of economic stress. For example, during the Global Financial Crisis (GFC), BRK.A significantly outperformed the SPDR S&P 500 Index (SPY), showcasing its resilience.

Market Psychology and Investment Strategy

The market’s psychology plays a crucial role in Berkshire’s performance. During periods of market stress, investors flock to Berkshire as a safe haven due to its strong balance sheet, diversified portfolio, and prudent management. This behavior is evident in the company’s historical performance, where BRK.A outperformed SPY during the GFC and other economic downturns.

Comparative Analysis: The Magnificent Seven

Berkshire’s recent underperformance relative to the S&P 500 can be attributed to the outsized gains of the “Magnificent Seven” – Microsoft (MSFT), Amazon (AMZN), Meta (META), Apple (AAPL), Alphabet (GOOGL), Nvidia (NVDA), and Tesla (TSLA). Despite this, Berkshire’s conservative investment approach and focus on value investing continue to provide long-term stability and growth.

Conclusion: A Safe Haven in Turbulent Times

Berkshire Hathaway stands out as a beacon of stability and growth in the volatile financial landscape. Its diversified business model, strong financial health, and strategic investments in both traditional and emerging sectors make it an ideal hedge for equity portfolios. Investors looking for a safe haven during economic uncertainty can rely on Berkshire Hathaway’s proven track record and resilient business strategy.

With its robust balance sheet, continuous share repurchase program, and strategic investments, Berkshire Hathaway is well-positioned to navigate future economic challenges and capitalize on growth opportunities. As analysts predict higher price targets and anticipate significant ETF inflows, Berkshire’s market position continues to strengthen. Investors are advised to stay informed on market trends and institutional activities to navigate this dynamic environment effectively.