Bitcoin’s $100K Battle: Breakout or Breakdown? BTC Faces Critical Test

Will Bitcoin Surge Past $110K or Collapse to $90K? Traders Brace for a Big Move | That's TradingNEWS

Bitcoin (BTC-USD) Battles Key Resistance: Will It Hold Above $100K or Fall to $90K?

Bitcoin (BTC-USD) continues to struggle with the critical $100,000 resistance level, facing selling pressure as macroeconomic uncertainties intensify. The cryptocurrency briefly broke past six figures but failed to maintain momentum, retreating to $98,536 at last check. While institutional flows into spot Bitcoin ETFs remain strong, geopolitical tensions and profit-taking have kept BTC in a volatile range. With investors closely watching key support and resistance levels, the coming weeks will determine whether Bitcoin continues its bullish trajectory or faces a deeper correction.

Bitcoin’s Failed Breakout: Is $100K a Ceiling or a Launchpad?

Bitcoin’s attempt to sustain levels above $100,000 was short-lived, as sellers stepped in aggressively. Despite touching $100,760, BTC quickly pulled back to $97,821-$98,313, failing to establish a solid foothold in the six-figure territory. This rejection highlights the importance of psychological resistance levels, where traders take profits and institutions reassess their positions.

Technical indicators suggest a mixed outlook. The Relative Strength Index (RSI) sits at 47, reflecting neutral sentiment, while the Moving Average Convergence Divergence (MACD) remains in bearish territory, signaling that downward pressure could persist. Bitcoin’s 200-day moving average sits at $96,000, making this a key level to watch. If BTC fails to hold above $96K, a sharper correction toward $91,000-$93,000 could follow.

However, the Bitcoin Liquidation Map reveals that over $1.8 billion in leveraged long positions are concentrated at the $90,000 level. This suggests strong institutional buying pressure, making a drop below this zone unlikely unless a major macroeconomic shock occurs.

Bitcoin ETF Flows Signal Growing Institutional Demand

One of the biggest factors supporting Bitcoin’s long-term outlook is the continued inflows into spot Bitcoin ETFs. US-listed Bitcoin ETFs have now accumulated over $40.6 billion, making them one of the most successful ETF launches in history. BlackRock’s IBIT ETF alone has attracted $40.7 billion in net inflows, reinforcing institutional confidence in BTC.

Despite this, the distribution of inflows remains uneven. Only four out of ten spot Bitcoin ETFs saw inflows recently, with most funds stagnating. This suggests that while institutions are accumulating BTC, not all funds are seeing the same level of demand.

The basis trade strategy—where investors go long on spot BTC while shorting futures at a premium—has been a key driver of these inflows. However, open interest on the Chicago Mercantile Exchange (CME) has declined from 180,099 BTC to 168,549 BTC, signaling that ETF-driven demand may not be as dominant as it was earlier in 2024.

MicroStrategy and Corporations Betting on Bitcoin: A Game Changer?

MicroStrategy (MSTR) remains the largest corporate holder of Bitcoin, now controlling 471,107 BTC worth over $30 billion. However, the company paused its accumulation strategy after a record $1 billion BTC purchase, raising questions about whether institutions are slowing their Bitcoin buying.

Meanwhile, other publicly listed firms such as Semler Scientific and Rumble have added BTC to their balance sheets, using Bitcoin as an inflation hedge. Metaplanet, known as "Asia’s MicroStrategy," has seen its stock price surge 2,000% after pivoting to a Bitcoin treasury strategy.

Despite this corporate backing, some analysts worry that Bitcoin’s recent rally may be too reliant on institutional flows, leaving it vulnerable if market sentiment shifts. If institutional buyers slow their accumulation, BTC could struggle to hold its current levels.

Bitcoin vs. Macroeconomic Uncertainty: Can BTC Hold as a Safe Haven?

Bitcoin’s volatility remains heavily tied to global macroeconomic developments. The recent escalation of US-China trade tensions—triggered by new US tariffs and China’s retaliatory measures—has kept risk assets under pressure. The US government’s potential easing of crypto regulations under the Trump administration was expected to boost BTC sentiment, but macro headwinds have outweighed this development.

While Bitcoin’s correlation with gold has increased, positioning BTC as a hedge against inflation and geopolitical risks, its failure to sustain gains above $100,000 suggests that institutional investors are still cautious.

Bitcoin Price Levels to Watch: Can BTC Reclaim $110K or Drop to $90K?

Bitcoin is currently trapped between strong resistance at $102,000-$107,000 and support at $90,000. If BTC manages to reclaim $100,000 and break above $104,000, momentum could accelerate, pushing BTC toward $110,000-$115,000. However, failure to hold above $98,000 could see BTC retest $95,000 and possibly drop to $91,000, where institutional demand is heavily concentrated.

Buy, Sell, or Hold?

Bitcoin’s current market structure remains bullish in the long term but faces short-term risks. If BTC holds above $98,000, it remains a buy, with an upside potential toward $104,000-$110,000. However, if BTC drops below $95,000, investors should wait for a clearer reversal before re-entering.

Bullish Scenario: Bitcoin clears $104,000, triggering a move toward $110,000-$115,000 as ETF inflows and institutional demand strengthen.

Bearish Scenario: BTC fails to hold $98,000, leading to a correction toward $95,000-$91,000, where institutional buyers may step in.

Final Verdict: Is Bitcoin Headed for $250K or a Major Correction?

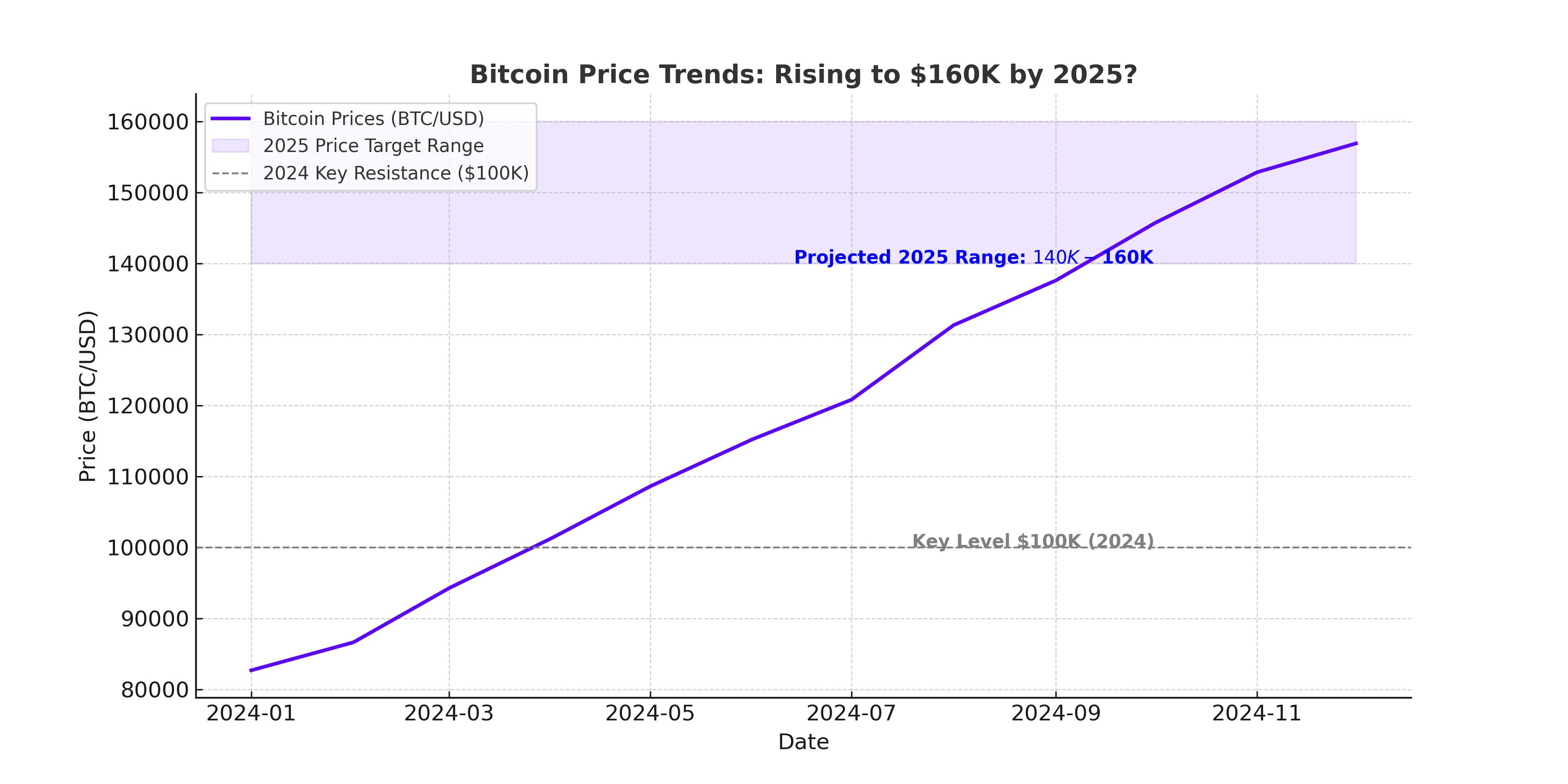

Analysts remain divided on Bitcoin’s next big move. Standard Chartered maintains its prediction of BTC hitting $200K by 2025 and $500K by 2028, citing increased adoption and lower volatility. However, the Bitcoin Rainbow Chart suggests BTC has not yet reached its cycle peak, leaving room for further upside.

With strong institutional demand, corporate adoption, and macroeconomic uncertainty, Bitcoin remains one of the strongest assets in the market. While short-term volatility is likely, long-term fundamentals favor continued accumulation—especially if Bitcoin manages to hold above key support levels in the coming weeks.