Bitcoin Battles Liquidity Woes and Government Sell-offs, with Eyes on $87K Breakout by 2025

Despite recent setbacks and looming sell-off threats, Bitcoin's long-term technical indicators hint at a potential surge to $87,000, but short-term volatility remains a key challenge | That's TradingNEWS

Bitcoin Faces Persistent Headwinds Amid Liquidity Crunch and Government Sell-off Concerns

Bitcoin's August Struggles: Market Dynamics and Potential Government Sell-offs

Bitcoin (BTC-USD) has faced a challenging August, underperforming traditional assets like stocks and bonds. The cryptocurrency’s decline of nearly 9% this month contrasts with a 2% gain in global markets, illustrating the digital asset's vulnerability to current market conditions. One of the primary concerns contributing to this underperformance is the potential sell-off by governments holding significant Bitcoin reserves, including the US, China, the UK, and Ukraine.

Government Holdings and the Overhang of Potential Sell-offs

The looming threat of sell-offs from government stockpiles has cast a shadow over Bitcoin's price stability. As per data, the US government holds approximately 203,220 BTC, China possesses 190,000 BTC, the UK has 61,200 BTC, and Ukraine holds 46,350 BTC. These reserves, primarily accumulated through seizures in criminal cases or donations in the case of Ukraine, represent a significant potential supply that could flood the market, exerting downward pressure on prices. Additionally, the defunct Mt. Gox exchange still holds 46,170 BTC, which it plans to distribute to creditors, adding to the market’s uncertainty.

Liquidity Challenges Exacerbate Price Volatility

Bitcoin's liquidity has seen a noticeable decline, intensifying the impact of large trades on the market. The seven-day average of Bitcoin turnover, a key liquidity metric, has dropped to near 2%, down from a peak of around 5% during the record rally in March. This thinning liquidity has made Bitcoin more susceptible to price swings, as evidenced by the cryptocurrency's 8% drop this month.

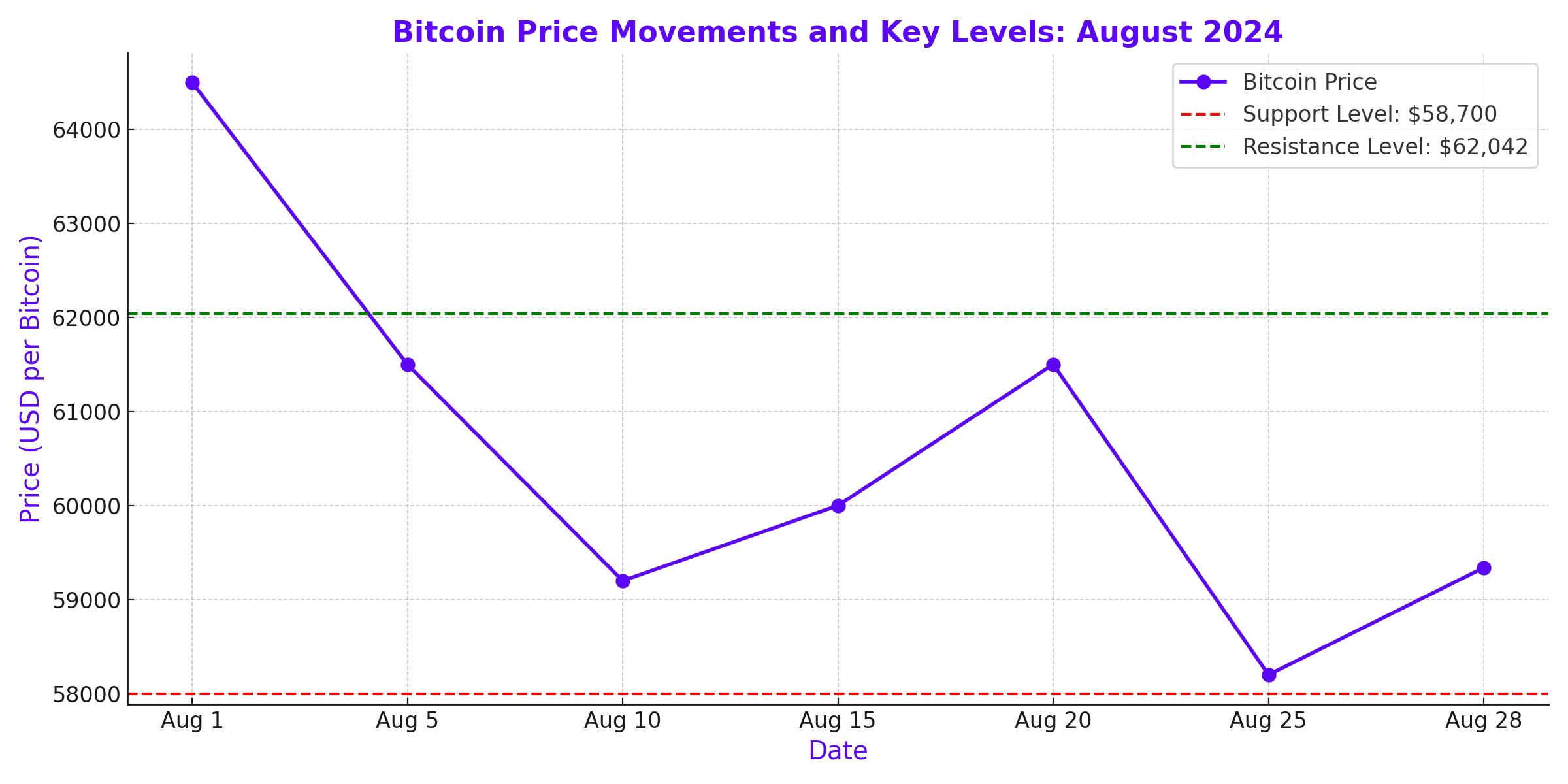

Spot market volumes remain subdued, contributing to the choppy price action. For instance, Bitcoin briefly surged to $64,000 following the US Federal Reserve's announcement of potential rate cuts but quickly reversed course, dropping below $59,000 as the market digested broader economic concerns and ongoing bear market pressures.

ETF Market and the Impact on Bitcoin Liquidity

The US Bitcoin ETF sector has also seen a decline in liquidity, with the Hui-Heubel ratio—a metric indicating how many trades it takes to move prices—showing a deterioration since March. The combined daily trading volume for US Bitcoin ETFs has dropped from over $10 billion in March to less than $2 billion. This decline in trading volume and liquidity has added another layer of complexity to Bitcoin's price movements, as ETFs play a crucial role in the broader market's access to cryptocurrency investments.

Market Reactions and Investor Behavior Amidst Volatility

The volatile environment has led to significant liquidations in the market. On August 27, a price drop triggered $313 million in liquidations of leveraged crypto derivatives positions, marking the largest washout since early August. This underscores the heightened risk in the current market, where even small shifts in sentiment can lead to large-scale sell-offs.

Despite these challenges, there has been some resilience in the market. For example, wallets holding between 10 to 10,000 BTC added 133,300 BTC to their holdings in the past month, reflecting a continued belief in Bitcoin's long-term value among larger holders. These wallets now control approximately 66.6% of the total Bitcoin supply, indicating significant concentration among a relatively small number of holders.

Technical Indicators Signal Potential for Recovery

From a technical perspective, Bitcoin remains in a precarious position, hovering around the $59,000 level. The Relative Strength Index (RSI) and the Awesome Oscillator (AO) suggest weakening momentum, with both indicators below their neutral levels. However, if Bitcoin can find support around $58,700 and break above the $62,042 resistance level, it could invalidate the bearish thesis and set the stage for a potential rally towards $65,379.

Long-term technical setups, such as the power law corridor, suggest that Bitcoin could be on track for a significant breakout, potentially reaching $87,000 by early 2025. However, for this bullish scenario to materialize, Bitcoin must overcome key resistance levels and maintain a stable trading range in the short term.

Conclusion: Navigating Bitcoin's Volatile Landscape

As Bitcoin navigates the complex landscape of government sell-offs, liquidity challenges, and volatile market conditions, investors must weigh the risks and rewards carefully. While the long-term outlook remains positive, with potential for significant gains, the short-term environment is fraught with uncertainty. Traders and investors should closely monitor key technical levels and broader market indicators to make informed decisions in this turbulent market.

Bitcoin's current price movements and market dynamics underscore the importance of a well-considered strategy, especially in an asset class as volatile as cryptocurrency. Whether Bitcoin can break out of its current range and resume its upward trajectory will depend on a confluence of factors, including liquidity conditions, investor sentiment, and broader economic trends.