Bitcoin Blasts to $96K: Will $100K Be the Next Big Move?

With Bitcoin nearing $100,000, traders are bracing for either a historic breakout or a surprising reversal. What’s fueling the momentum? Dive into the data driving BTC’s explosive run | That's TradingNEWS

Bitcoin ($BTC): Breaking the $100,000 Barrier or Consolidating for the Next Bull Run?

Bitcoin’s Current Performance and Key Metrics

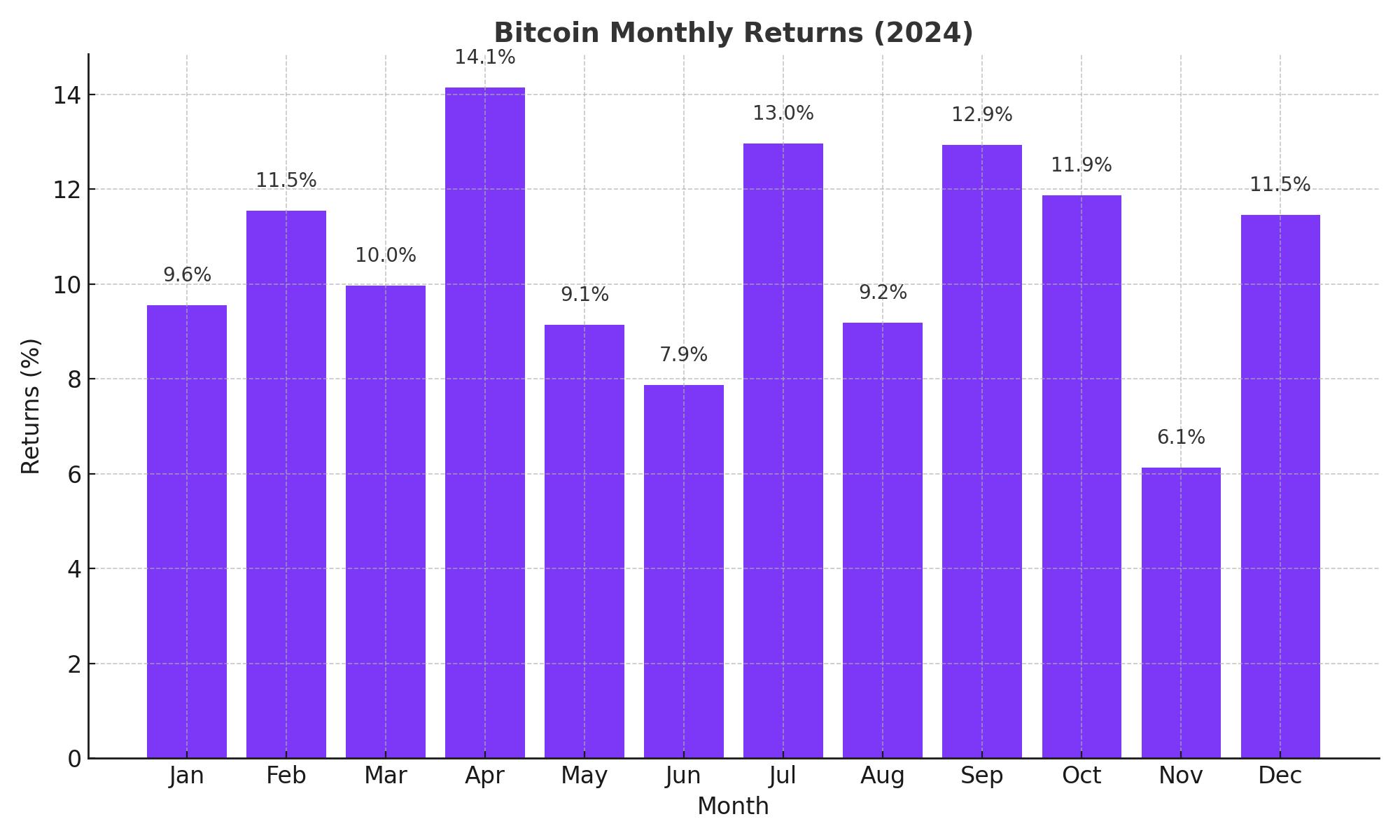

Bitcoin ($BTC) has been flirting with record highs, trading around $96,000 as of December 2, 2024. This marks a 129% gain year-to-date, fueled by pivotal events such as the April halving and heightened investor enthusiasm surrounding the U.S. presidential election. In November alone, Bitcoin recorded a 37% surge, making it one of the strongest months in recent years. Comparatively, only 2013, 2017, and 2020 saw better November gains, with increases of 459%, 54%, and 42%, respectively.

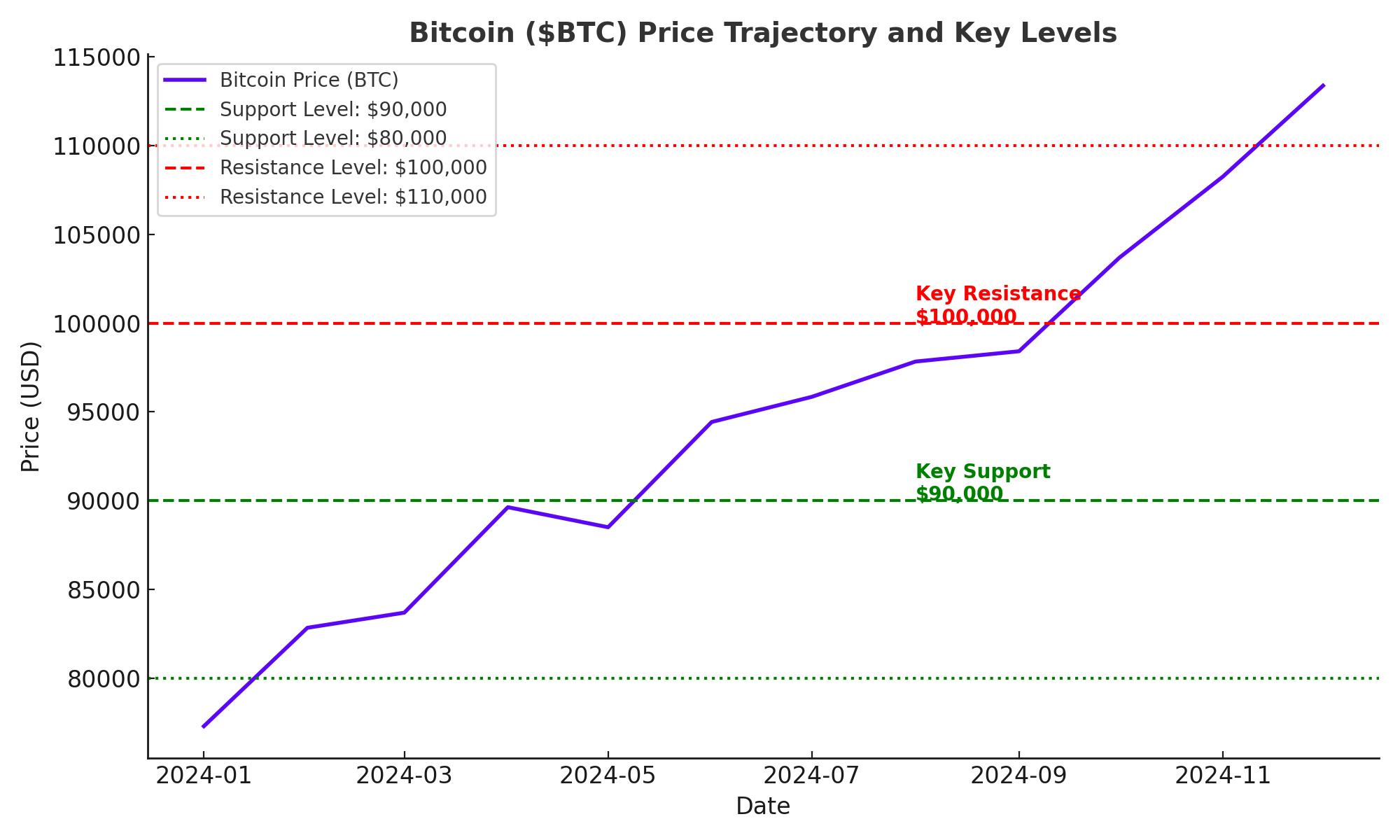

Despite these bullish moves, Bitcoin has faced resistance near the $100,000 level. On November 22, it touched $99,000 before retreating to the $96,000-$98,000 range. However, optimism remains high, with Bitcoin futures on the Chicago Mercantile Exchange (CME) crossing $100,200 twice within a week. This divergence between futures and spot prices has fueled speculation about an imminent breakout in the spot market.

Supply Dynamics and Scarcity

The scarcity of Bitcoin remains a critical driver of its valuation. According to CryptoQuant, less than 2.5 million Bitcoin are available on exchanges, highlighting a dwindling supply in circulation. This scarcity is further emphasized by data showing significant negative netflows, as investors continue accumulating BTC in anticipation of a breakout above $100,000. The reduced supply, coupled with increasing institutional and retail adoption, has cemented Bitcoin’s status as a scarce, decentralized digital asset.

Technical Analysis: Key Levels to Watch

From a technical perspective, Bitcoin’s daily chart presents a mixed outlook. The Relative Strength Index (RSI) sits at 65, signaling bullish momentum but leaving room for potential pullbacks. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator recently flashed a bearish crossover, raising caution about short-term trends.

Bitcoin’s price action has been consolidating within a symmetrical triangle pattern, a setup that often precedes significant price movements. If BTC breaks above the triangle, the $100,000 milestone could quickly become reality, with subsequent resistance levels around $110,000. Conversely, a failure to hold above $90,000 could trigger a pullback to the $80,000 support zone.

Institutional and Retail Drivers

Institutional adoption has played a pivotal role in Bitcoin’s rally. The approval of spot Bitcoin ETFs has opened the floodgates for traditional investors, while companies like MicroStrategy continue to add Bitcoin to their balance sheets. CEO Michael Saylor has been vocal about Bitcoin’s potential, emphasizing its outperformance compared to traditional assets like bonds and stocks. His forecast aligns with Ark Invest CEO Cathie Wood’s bullish prediction of Bitcoin reaching $1 million by 2030, supported by institutional adoption and clearer regulatory frameworks.

Retail investors have also been significant contributors, with platforms like Binance and OKX accounting for substantial trading volumes. Over 41% of Bitcoin’s daily trading volume comes from perpetual contracts, underscoring its appeal as a speculative asset.

Historical Patterns and Market Sentiment

Bitcoin’s performance in 2024 aligns with historical patterns seen in halving years. Historically, BTC tends to rally approximately six months after a halving event, as reduced mining rewards create supply scarcity. This year’s gains have followed a similar trajectory, reinforcing Bitcoin’s reputation as a resilient and predictable digital asset in the long term.

Analysts like Raoul Pal predict Bitcoin could reach a local high of $110,000 by January 2025, with a more significant peak later in the year. Another bold forecast comes from Samson Mow, who believes that surpassing $100,000 could trigger the "Omega Candle," a rapid price surge fueled by heightened demand from institutions and even governments. Such a rally could add $10,000 daily, potentially pushing Bitcoin to unprecedented levels.

On-Chain Metrics and Market Structure

On-chain metrics further support the bullish case. Bitcoin’s exchange netflows have consistently shown negative values, indicating strong accumulation by investors. However, short-term market structure suggests caution. A recent bearish break of structure (BOS) hints at a potential downtrend, with BTC failing to make higher highs. If the bearish trend persists, Bitcoin could revisit lower Fibonacci support levels near $90,000.

Despite these signals, a liquidity grab—a deceptive move to trigger stop losses before a sharp reversal—remains a possibility. If this occurs, Bitcoin could reclaim bullish momentum and target the $100,000 mark and beyond.

Broader Market Impacts

Bitcoin’s dominance has slightly declined to 56.1%, as investors rotate profits into altcoins. Ethereum ($ETH) has rallied above $3,600, while Ripple ($XRP) surged 60% last week, supported by speculation about a favorable resolution to its SEC lawsuit. This shift signals the potential beginning of an altcoin season, though Bitcoin remains the primary driver of market sentiment.

Future Outlook

The next few weeks will be pivotal for Bitcoin. While it consolidates below the psychological $100,000 barrier, the cryptocurrency market is bracing for potential catalysts. Key factors include institutional adoption, regulatory developments, and continued accumulation by long-term holders. Whether Bitcoin breaks higher or faces a deeper correction, its role as a market bellwether remains undisputed.

For traders, the $90,000 support and $100,000 resistance levels will be crucial in determining short-term direction. For long-term investors, Bitcoin’s scarcity and adoption narrative continue to make it an attractive asset in a rapidly evolving financial landscape. The stage is set for Bitcoin to either redefine its historical trajectory or test the patience of its loyal believers.