Bitcoin Breakout Looms Amid Bullish Market Sentiment

Analyzing Bitcoin’s Current Price Movement, Institutional Investment, and Technical Indicators | That's TradingNEWS

Bitcoin Price Analysis: Bullish Breakout Anticipated Amid Market Optimism

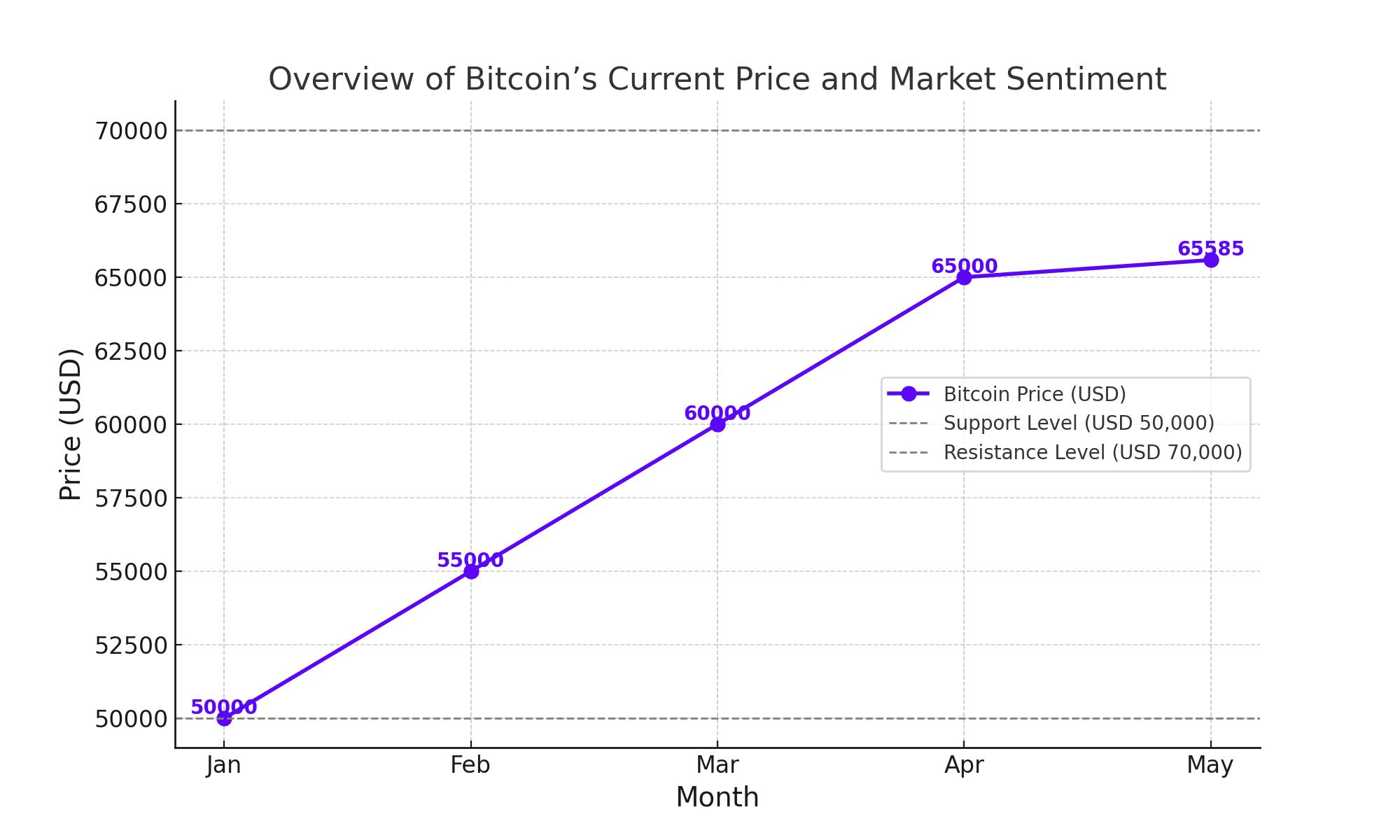

Overview of Bitcoin’s Current Price and Market Sentiment

Bitcoin’s price movement has captured the attention of market watchers, with many analysts focusing on potential breakouts as the cryptocurrency hovers near its all-time high. Currently trading at approximately $65,585, Bitcoin is at the upper end of a significant range between $50,000 and $70,000. Analysts suggest that a breakout from this range could propel Bitcoin to new heights.

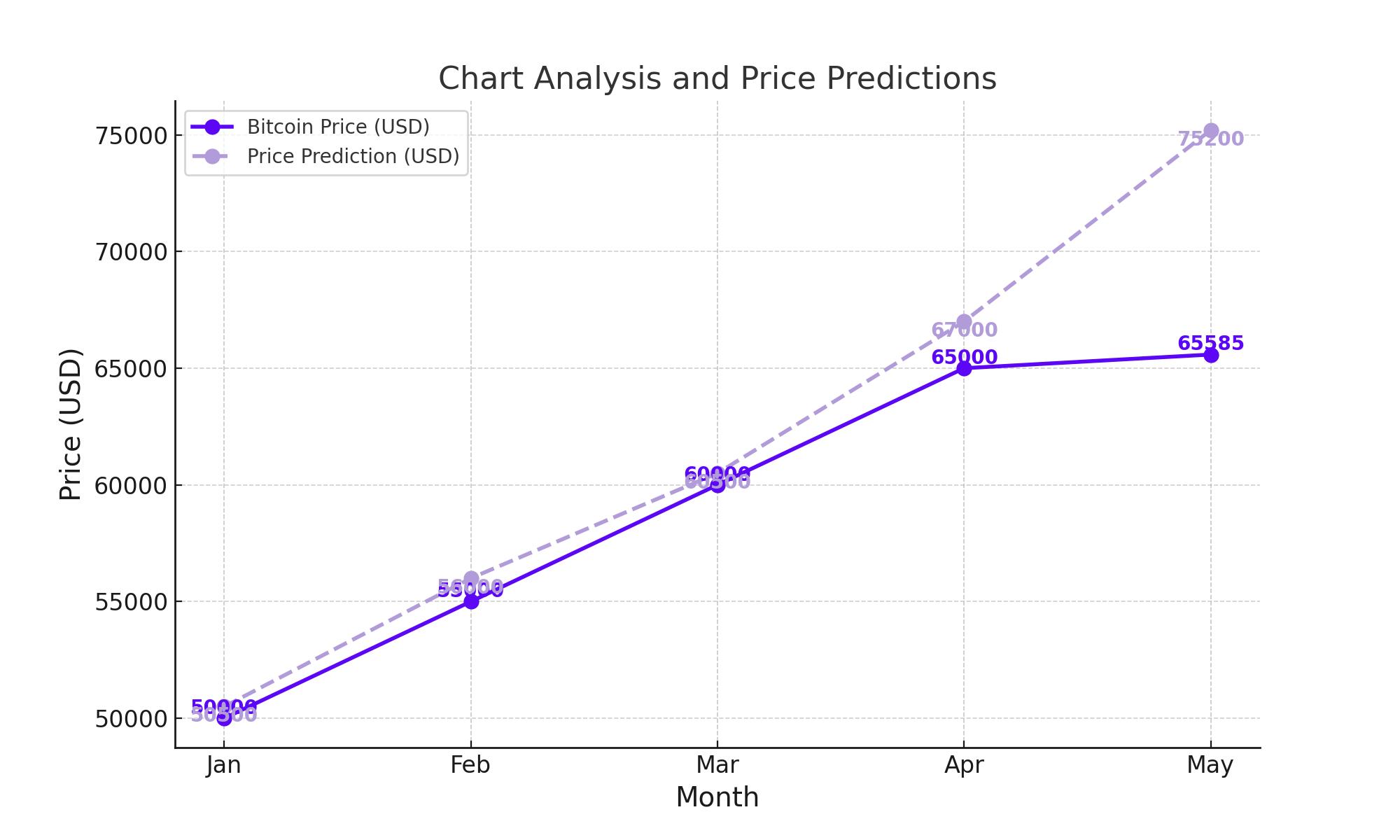

Chart Analysis and Price Predictions

According to Mati Greenspan, founder of Quantum Economics, analyzing Bitcoin’s charts within its current range is less significant until a breakout occurs. The key level to watch is $70,000, which is just a 6.7% increase from current levels. Pseudonymous crypto trader Yoddha supports this bullish outlook, suggesting that the current range is forming a bullish continuation pattern, potentially sending Bitcoin to a new all-time high.

Technical Indicators and Patterns

One bullish indicator is the inverse head-and-shoulders pattern observed by several traders. This pattern indicates that the price downtrend is easing, with buyers gaining market dominance. Pseudonymous trader Steph Is Crypto noted that Bitcoin is currently breaking out from this pattern, setting a technical price target at approximately $75,200. Another trader, Crypto Nova, pointed out that Bitcoin is likely in the process of printing a higher low, with a potential rebound level at $62,000-$63,000.

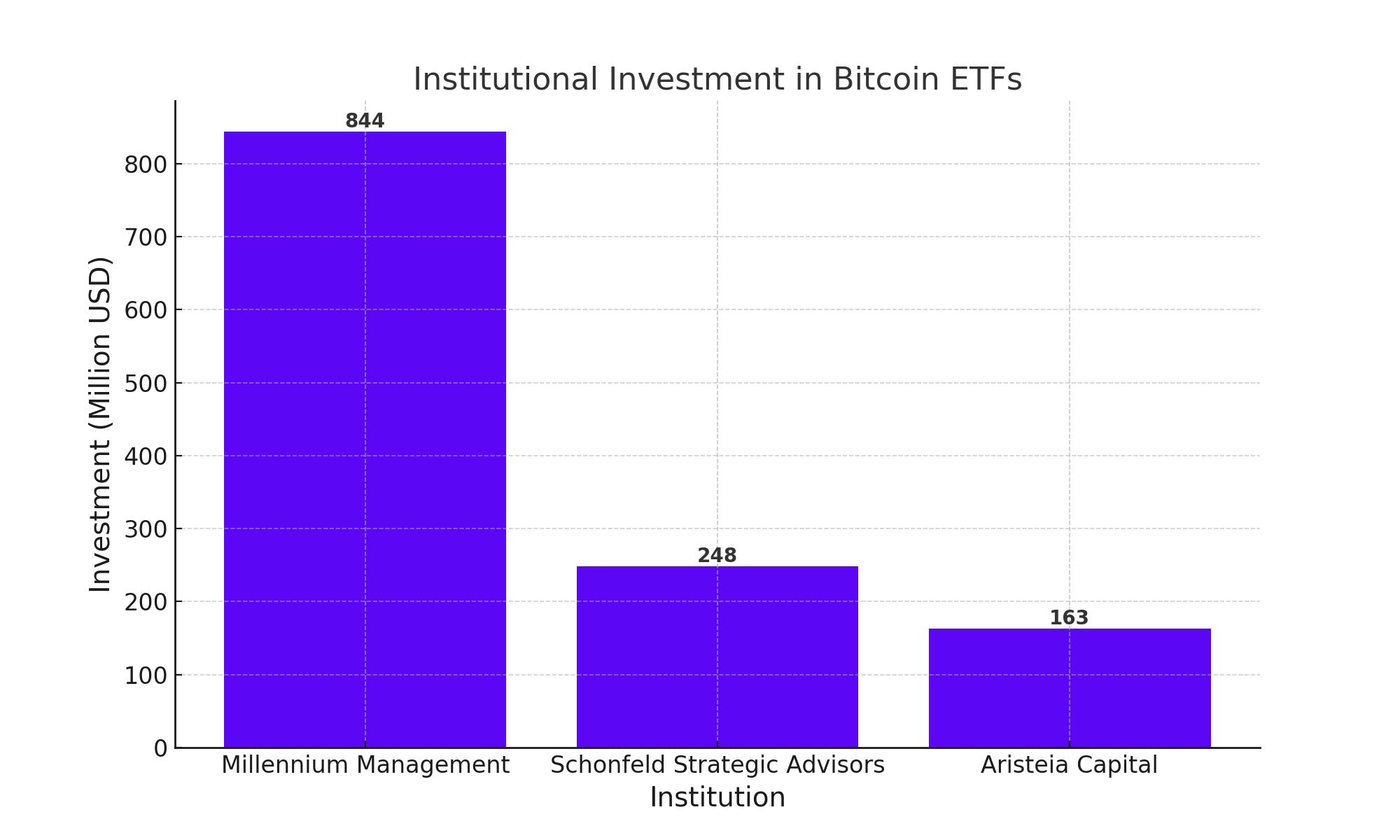

Institutional Investment and Market Dynamics

Institutional interest in Bitcoin is robust, with BlackRock’s spot Bitcoin ETF garnering significant attention. Bloomberg ETF analyst Eric Balchunas highlighted that BlackRock’s ETF had 414 reported holders in its first reporting season, a remarkable feat. Millennium Management leads with $844 million worth of shares, followed by Schonfeld Strategic Advisors and Aristeia Capital with $248 million and $163 million, respectively.

Bitcoin’s Price Surge and Inflation Data

Bitcoin’s recent price surge past $65,000 follows the latest U.S. inflation data, which showed a downward trend in price pressures. This data has increased market bets that the Federal Reserve might cut interest rates soon, boosting Bitcoin’s appeal. High-profile investors, including Elon Musk, have warned about the potential impact of "stealth money printing" on the U.S. dollar, further supporting Bitcoin's attractiveness as a hedge against inflation.

Bullish Predictions and Market Trends

Bullish investors believe that the current Bitcoin rally is still in its early stages, with some predicting that $6 trillion in sidelined cash could push Bitcoin’s price to $150,000 this year. This optimism is also reflected in El Salvador’s commitment to accumulating Bitcoin, with President Nayib Bukele announcing daily purchases to bolster the country’s BTC reserves.

Spot Bitcoin ETFs and Market Adoption

The approval of 11 spot Bitcoin ETFs by the U.S. Securities and Exchange Commission has simplified Bitcoin investments, making it as accessible as buying stocks. These ETFs have seen rapid growth, with BlackRock’s iShares Bitcoin Trust reaching $16.65 billion in assets under management since its January launch.

Evaluating Bitcoin ETFs: Fees and AUM

Investors looking to capitalize on Bitcoin’s growth should consider ETF fees and assets under management (AUM). For example, Franklin Templeton’s Digital Holding Trust offers the lowest fee at 0.19%, while Grayscale Bitcoin Trust has the highest at 1.5%. BlackRock’s iShares Bitcoin Trust offers a balance with a 0.25% fee and $17.3 billion in AUM, making it an attractive option for investors.

Conclusion

Bitcoin’s price trajectory remains bullish amid positive market sentiment and robust institutional interest. As the market anticipates potential Federal Reserve rate cuts and increasing adoption of Bitcoin ETFs, the cryptocurrency is well-positioned for continued growth. Analysts and investors alike are optimistic about Bitcoin’s potential to reach new all-time highs and beyond.