Bitcoin Price Analysis: BTC Surges Beyond $100,000, Eyes $120,000 and Beyond

The cryptocurrency market continues to buzz with excitement as Bitcoin (BTC-USD) recently broke the $100,000 threshold, climbing to $102,430. This milestone signals renewed bullish momentum in the market, driven by a combination of macroeconomic factors, investor sentiment, and speculative fervor. Bitcoin's current trajectory suggests further upside, with analysts forecasting potential levels of $120,000 and even $130,000 in the near term. Let’s dive deep into the driving forces behind Bitcoin's price movements, explore its technical setup, and assess its longer-term potential.

Macroeconomic Influences on Bitcoin (BTC-USD)

Bitcoin's price surge has been heavily influenced by external factors, most notably the impending inauguration of U.S. President-elect Donald Trump. Expectations surrounding pro-crypto policies under the new administration have fueled optimism among investors. Trump’s potential executive orders, such as creating a national Bitcoin reserve and appointing crypto advocates to key regulatory positions, have significantly bolstered confidence. The markets are also responding to the easing inflationary pressures in the U.S., with December’s core inflation dipping to 3.2% from 3.3%, prompting speculation about a more accommodative Federal Reserve policy in 2025.

Additionally, geopolitical developments, such as the Bank of Japan's (BOJ) anticipated interest rate hike, have introduced complexities. Historically, higher Japanese interest rates have strengthened the yen, reducing liquidity for speculative assets like Bitcoin. Despite these headwinds, Bitcoin has managed to hold steady above $100,000, signaling robust support levels.

On-Chain Metrics Support Bullish Momentum

Bitcoin's on-chain data further underscores its bullish case. The Market Value to Realized Value (MVRV) ratio currently stands at 5.25%, well below the cyclical high of 20%. This suggests significant room for growth before Bitcoin reaches overbought conditions. In addition, IntoTheBlock’s "In/Out of Money Around Price" (IOMAP) metric reveals strong support at the $93,617 level, where nearly 820 million BTC are held by over 1 million addresses. This robust base of accumulated holdings provides a cushion against downside risks, reinforcing the potential for further price gains.

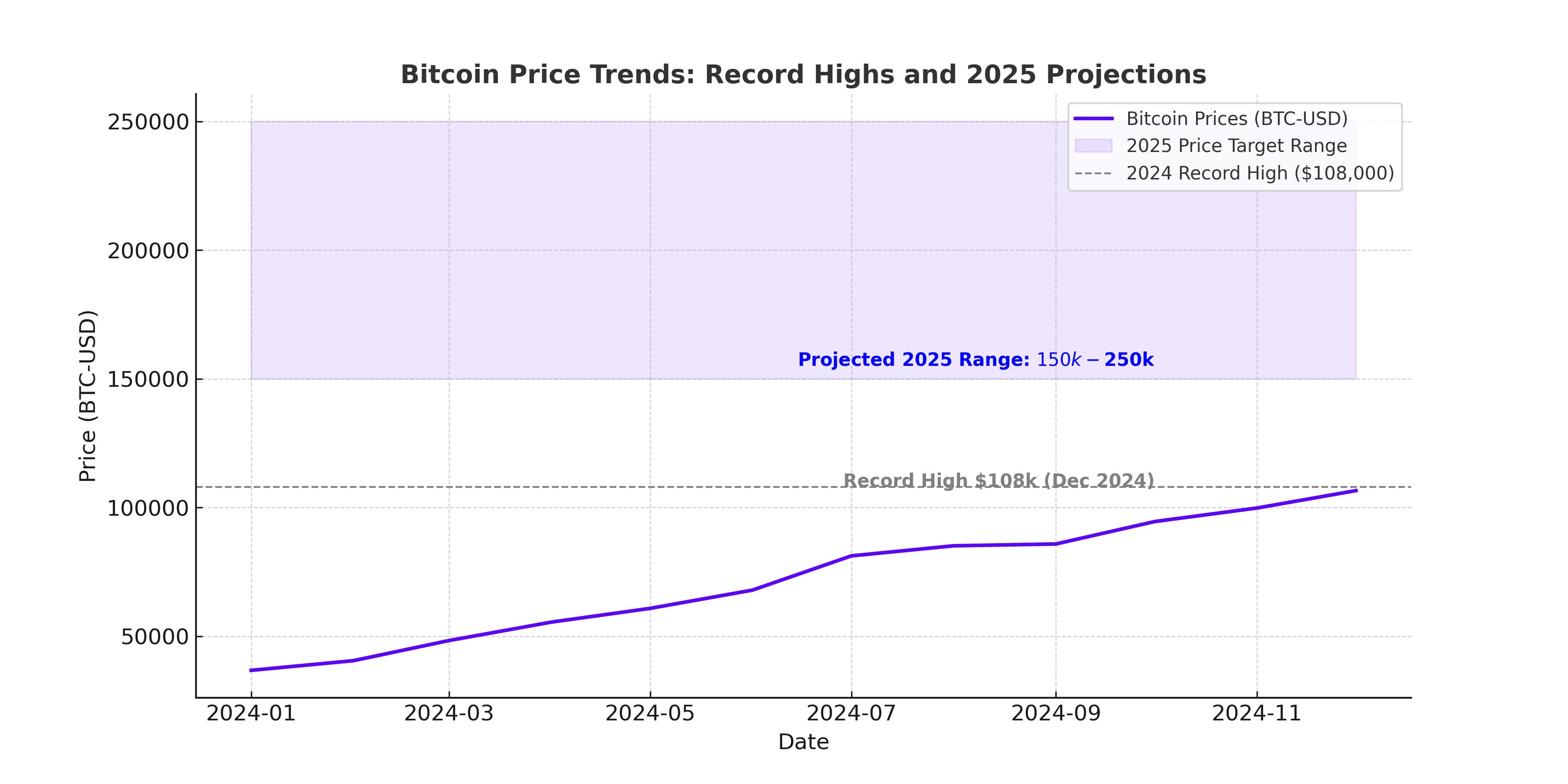

Institutional interest remains a driving force behind Bitcoin’s performance. Reports suggest that BTC could achieve price levels between $145,000 and $249,000 by 2025, fueled by institutional capital flows and favorable regulatory environments. Major corporate buyers like MicroStrategy, with ongoing Bitcoin acquisitions valued at $42 billion, have continued to bolster demand.

Technical Analysis: BTC-USD Eyes $120,000

From a technical standpoint, Bitcoin's price action paints a bullish picture. The cryptocurrency recently broke out of a descending trendline formed between December 2024 and mid-January 2025. The breakout above the $102,000 level coincides with Bitcoin crossing its 20-day Exponential Moving Average (EMA), a bullish signal that suggests further upward momentum.

Key resistance levels to watch include $108,422, followed by the psychological milestone of $120,000. If Bitcoin sustains its bullish trajectory, analysts forecast that it could test $130,000 or higher in Q1 2025. However, failure to maintain momentum could result in a pullback to the Fibonacci retracement level of $93,617, providing a critical support zone.

Bitcoin Dominance and Market Implications

Bitcoin's market dominance has risen steadily, surpassing 50% as altcoins struggle to keep pace. This dominance underscores Bitcoin's role as the primary driver of the cryptocurrency market. While other digital assets like Ethereum (ETH) and Litecoin (LTC) have posted gains, their movements are largely reactive to Bitcoin's price action.

Litecoin surged by over 12% recently, fueled by optimism surrounding the potential approval of an LTC-focused exchange-traded fund (ETF). Meanwhile, altcoins like Solana and Cardano have also rallied, though Bitcoin remains the anchor of investor sentiment and liquidity flows.

Long-Term Outlook: $180,000 on the Horizon?

Looking further ahead, Bitcoin's longer-term prospects appear bright. Analysts point to a potential macro top of $180,000, driven by increasing institutional adoption, growing retail interest, and advancements in blockchain technology. Bitcoin's role as "digital gold" continues to attract ETF inflows, while Layer 2 solutions like the Lightning Network enhance its scalability and utility.

However, risks remain. A resurgence in regulatory scrutiny, unexpected macroeconomic shifts, or a decline in speculative interest could dampen Bitcoin's ascent. Investors should remain vigilant, balancing bullish optimism with an awareness of potential headwinds.

Conclusion: Is Bitcoin a Buy, Hold, or Sell?

Bitcoin's recent surge above $100,000 has reignited enthusiasm for the cryptocurrency, with strong on-chain metrics, favorable macroeconomic conditions, and robust technical signals supporting its bullish outlook. While near-term resistance levels could pose challenges, the broader trajectory points to continued upside, with $120,000 and $130,000 within reach. For investors, Bitcoin represents a high-risk, high-reward opportunity in the evolving digital asset ecosystem. Whether it's a buy, hold, or sell ultimately depends on individual risk tolerance and market conditions, but the data suggests that Bitcoin’s journey is far from over.