Bitcoin Breaks $104,000: Is $115K the Next Target?

BTC Hits $104K After Trump's Bitcoin Reserve Hints – Can It Set a New Record? | That's TradingNEWS

Bitcoin Price Soars Amid Trump's Crypto Push: Can BTC Hit New Highs?

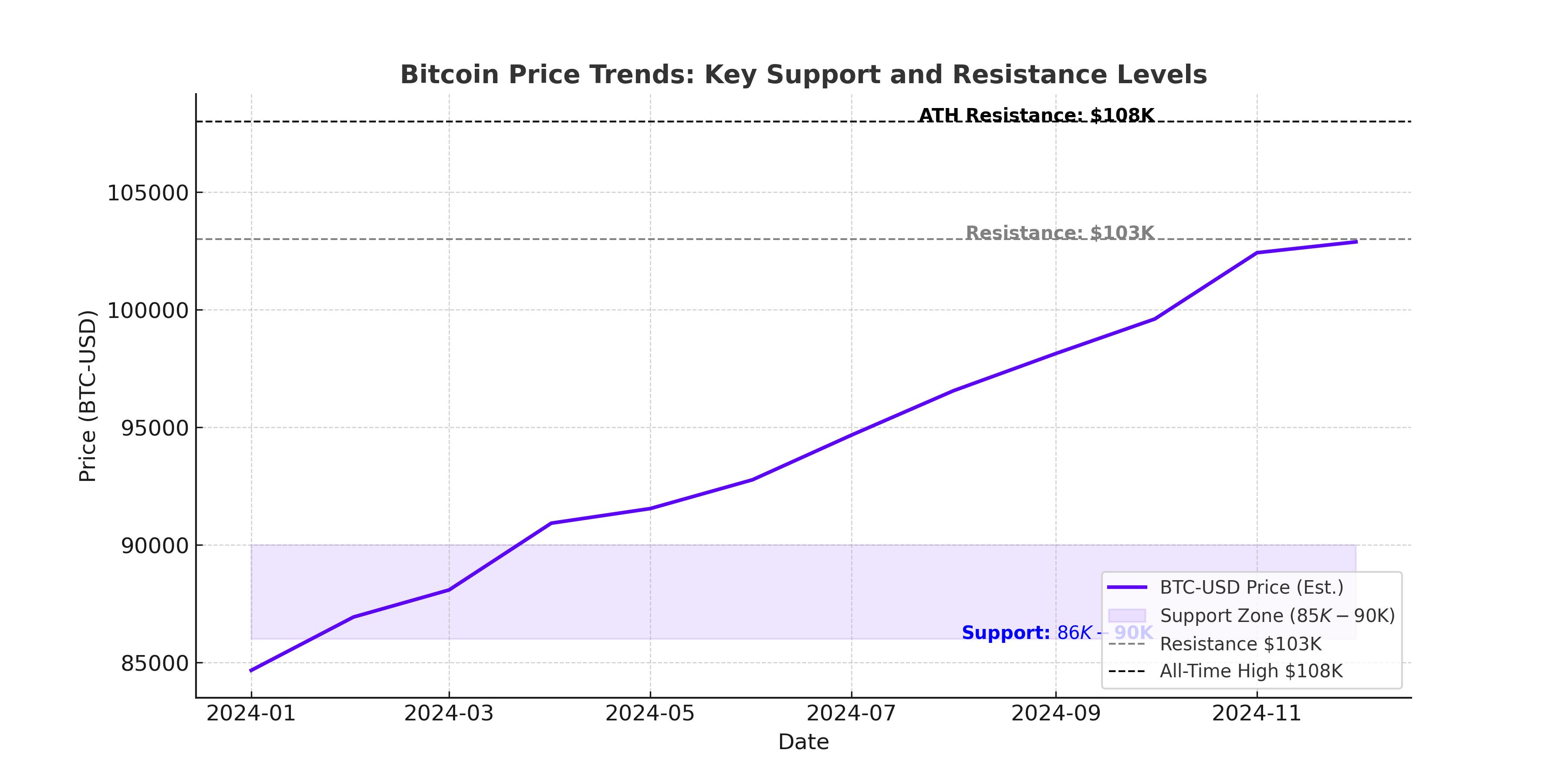

Bitcoin (BTC-USD) has seen dramatic price movements as it continues to hover near record levels, recently trading at $104,050 after a surge past key resistance at $104,000. The rally, fueled by growing institutional interest, speculation around President Trump's pro-crypto policies, and the prospect of regulatory clarity, has brought Bitcoin into sharp focus. The question now is whether BTC can break its previous all-time high of $109,000 and potentially target new levels, such as $115,000 or even $120,000.

BTC’s Breakout Beyond Key Resistance Levels

Bitcoin's recent move above $104,000 is significant, breaking through a resistance level that had held firm for weeks. Traders now eye $105,000 as the next hurdle, a level that has historically been a psychological and technical barrier. If BTC surpasses this, analysts predict the cryptocurrency could aim for a range between $110,000 and $115,000, propelled by the strong trading volume and increased interest from both retail and institutional investors.

Support levels remain critical in case of pullbacks, with $100,000 now serving as a short-term floor. Below that, $95,000 and $90,000 stand out as additional support zones where buyers might re-enter the market. The market's resilience above $100,000 highlights a bullish sentiment, further reinforced by Bitcoin’s current position above key moving averages.

Institutional Adoption and Market Drivers

One of the major tailwinds for Bitcoin has been the increasing involvement of institutional investors. Companies like MicroStrategy have continued to accumulate BTC, with their holdings now exceeding 450,000 BTC. Other publicly traded firms, such as Rumble and Quantum BioPharma, have followed suit, signaling a broader acceptance of Bitcoin as a legitimate asset class. Rumble recently announced the purchase of BTC, citing its potential as a hedge against inflation and currency devaluation.

The influence of pension funds is also growing, with entities like Michigan and Wisconsin’s investment boards allocating resources to Bitcoin ETFs. BlackRock’s Bitcoin ETF has seen substantial inflows, further boosting market confidence. Analysts expect institutional adoption to drive Bitcoin's price higher, especially as regulatory uncertainty diminishes under President Trump's administration.

Trump Administration’s Pro-Crypto Stance

President Donald Trump’s second term has sparked significant optimism in the crypto market. His administration’s announcement of a potential U.S. Bitcoin Reserve has garnered widespread attention. Trump’s campaign promise to establish this reserve could transform Bitcoin into a strategic national asset, akin to the U.S. Strategic Petroleum Reserve. The proposal aims to position the U.S. as a leader in cryptocurrency adoption, a move that could further drive BTC prices upward.

In addition, Trump's executive orders are expected to reduce regulatory barriers for digital assets, enabling broader adoption across financial institutions. This includes the SEC's establishment of a crypto task force to create a clearer regulatory framework, which has already buoyed sentiment among investors.

The Role of Memecoins and Retail Sentiment

Trump's recent launch of the $TRUMP memecoin, while initially met with skepticism, has reignited retail interest in the broader crypto market. The token, despite its volatility, has drawn attention to Bitcoin’s potential as a more stable investment. Retail traders view the memecoin’s success as an endorsement of cryptocurrencies, further bolstering confidence in BTC.

What Lies Ahead for Bitcoin Prices?

The market outlook for Bitcoin remains bullish, with projections for 2025 suggesting significant upside potential. Analysts from Standard Chartered forecast BTC could reach $200,000 by the end of the year, driven by institutional inflows and macroeconomic factors such as inflation concerns. However, the path to new highs is not without challenges. The possibility of rising U.S. interest rates, which could dampen non-yielding assets like Bitcoin, remains a critical factor to monitor.

In the immediate term, Bitcoin’s ability to maintain momentum above $105,000 will determine whether it can break past its all-time high of $109,000. With strong support from both institutional and retail investors, coupled with favorable policy developments, BTC is well-positioned for further gains. However, traders should remain vigilant to any shifts in regulatory or macroeconomic conditions that could impact the market.

As BTC continues to trade above $104,000, the stage is set for what could be one of the most significant price rallies in its history. The combination of strong technical signals, growing adoption, and supportive policies creates a potent mix that could propel Bitcoin to uncharted territory. Will Bitcoin break the $110,000 mark and solidify its position as theworld’s leading digital asset? Only time will tell.