Bitcoin Price Surges Past $105,000: Can BTC-USD Reach a New All-Time High?

Bitcoin (BTC-USD) Extends Rally as Institutional Demand and Federal Reserve Policies Drive Price Momentum

Bitcoin (BTC-USD) has continued its strong bullish momentum, surging past $105,500 and positioning itself for a potential breakout toward new all-time highs. The cryptocurrency market is responding to several macroeconomic catalysts, including the Federal Reserve’s steady monetary policy, institutional inflows into Bitcoin ETFs, and former President Donald Trump’s push for pro-crypto regulations.

Why Is Bitcoin Going Up? Fed’s Interest Rate Decision Fuels Crypto Market Growth

The Federal Reserve’s decision to hold interest rates steady at 4.25%-4.50% has created a favorable environment for risk assets, including Bitcoin. Fed Chair Jerome Powell reinforced a measured approach to monetary policy, stating that while inflation remains above target, the central bank sees no immediate need for rate adjustments. This signals a stabilizing economic outlook, reducing uncertainty for investors and prompting renewed capital flows into digital assets.

With inflation moderating and economic indicators showing resilience, Bitcoin has emerged as a hedge against fiat currency devaluation. Institutional investors are increasingly looking at BTC-USD as a long-term store of value, particularly with expectations that interest rate cuts could come later in 2025. The crypto market views a stable monetary environment as a tailwind, encouraging further accumulation of Bitcoin at current levels.

Trump’s Pro-Crypto Stance and Institutional Adoption Accelerate BTC-USD Gains

Bitcoin’s rally is also being driven by political and institutional factors. Trump Media and Technology Group recently announced Truth.Fi, a fintech initiative that includes a major investment in Bitcoin. The company plans to allocate up to $250 million of its $700 million cash reserves into Bitcoin and other digital assets, marking one of the most significant institutional endorsements for the crypto market.

Additionally, Trump has positioned himself as a pro-crypto candidate, advocating for policies that favor digital assets and blockchain innovation. His administration’s plans to remove regulatory barriers for Bitcoin-based financial products could further fuel market confidence.

The recent surge in Bitcoin ETF inflows also underscores the growing demand from institutional investors. BlackRock’s Bitcoin ETF (IBIT) has seen billions of dollars in inflows since its approval, reflecting broad-based institutional adoption. With Bitcoin’s scarcity—limited to 21 million coins—this increasing demand could drive prices significantly higher in 2025.

Bitcoin Price Predictions: Can BTC-USD Hit $117,000 or Higher?

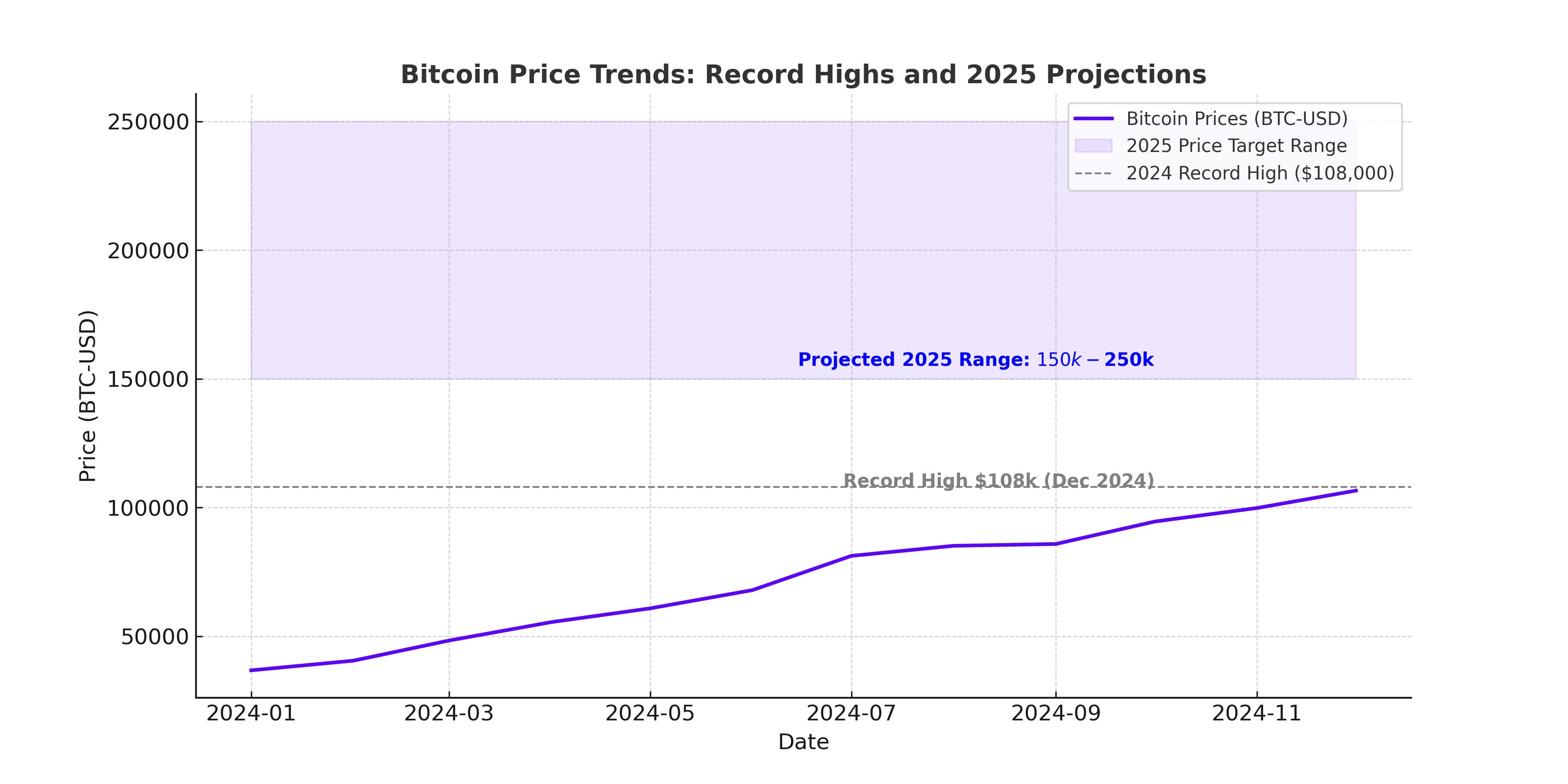

Analysts are growing increasingly bullish on Bitcoin’s price trajectory. Some projections indicate that BTC-USD could trade between $95,000 and $117,000 in the short term, with even more aggressive forecasts suggesting a move toward $200,000 by late 2025.

BlackRock CEO Larry Fink recently stated that sovereign wealth funds are considering allocating 2%-5% of their portfolios to Bitcoin, which could translate into a price surge toward $500,000 in the long run. Kraken’s head of strategy, Thomas Perfumo, also believes that Bitcoin ETFs will continue to attract massive capital inflows, further solidifying Bitcoin’s role as digital gold.

Meanwhile, analysts at Standard Chartered predict Bitcoin could hit $200,000 by the end of the year, driven by capital rotation from long-term holders to new institutional investors.

Technical Analysis: Is Bitcoin Ready for Another Breakout?

Bitcoin’s recent price action has been bullish, with the cryptocurrency holding above key support levels. The $100,000 psychological level remains a critical support zone, while resistance near $108,000 will be closely watched. A breakout above $110,000 could trigger another wave of FOMO-driven buying, pushing BTC-USD toward $120,000 in the near term.

Momentum indicators, including the Relative Strength Index (RSI), show Bitcoin remains in bullish territory, while the MACD is converging toward a bullish crossover. Bitcoin’s 50-day Exponential Moving Average (EMA) at $98,633 is acting as a strong support level, reinforcing the current uptrend.

Bitcoin ETFs and Institutional Demand Continue to Grow

Bitcoin ETF inflows have remained positive, despite some volatility in the market. Grayscale’s mini Bitcoin Trust saw $106.23 million in inflows, followed by Fidelity’s FBTC, which attracted $18.2 million. However, BlackRock’s IBIT recorded $92.09 million in outflows, marking a temporary pause in its record-breaking inflow streak.

The total trading volume for Bitcoin investment products stood at $3 billion, with total net assets reaching $121.36 billion—representing 5.88% of the total Bitcoin supply. As institutional interest in Bitcoin continues to grow, these ETFs will play a crucial role in driving long-term price appreciation.

Will Bitcoin’s Limited Supply Create a Supply Shock?

One of the key factors fueling Bitcoin’s bullish outlook is its diminishing supply on exchanges. According to CryptoQuant, Bitcoin balances on centralized exchanges have dropped to 2.4 million BTC, marking a seven-year low. This supply squeeze, combined with increasing institutional demand, could create upward pressure on prices.

Arthur Hayes, CIO of Maelstrom, believes that Bitcoin could experience a temporary pullback to $70,000 before resuming its march toward $250,000 by the end of the year. Similarly, CoinShares’ head of research, James Butterfill, sees Trump’s pro-crypto executive orders as a catalyst that could drive Bitcoin to unprecedented price levels.

Outlook: Is Bitcoin a Buy at $105,000?

Bitcoin remains in a strong uptrend, supported by institutional demand, favorable macroeconomic conditions, and growing mainstream adoption. With analysts projecting price targets ranging from $117,000 to $200,000, Bitcoin’s long-term trajectory remains bullish. However, traders should be prepared for volatility, particularly as regulatory developments and macroeconomic factors continue to influence the market.

For now, Bitcoin’s ability to hold above $100,000 will be crucial in determining its next move. If BTC-USD successfully breaks through resistance at $108,000, a run toward $120,000 and beyond could be in play. Investors and traders should closely monitor institutional inflows, Federal Reserve policy decisions, and broader market sentiment to gauge Bitcoin’s next major price movement.