Bitcoin Breaks $60,000: Unpacking the Milestone Surge

From Institutional Inflows to Miner Accumulation: Exploring the Forces Behind Bitcoin's Record Rally | That's TradingNEWS

The Unprecedented Surge of Bitcoin: Analyzing the Catalysts Behind the Rally

Bitcoin's Meteoric Rise to $60,000: A Landmark Achievement

In an extraordinary display of market dynamics, Bitcoin has shattered expectations by soaring past the $60,000 threshold, marking a significant milestone not observed since November 2021. This remarkable ascent signifies a potent resurgence in the cryptocurrency's valuation, reflecting a robust 42% appreciation since the onset of February and solidifying its dominance at a commanding 50.3% market share. This surge is not merely a numerical triumph but a testament to the growing investor confidence and market maturity surrounding the world's leading cryptocurrency.

Institutional Inflows and ETFs: The New Frontier for Bitcoin Investment

A pivotal factor in this resurgence is the notable surge in institutional investments, highlighted by BlackRock's iShares Bitcoin ETF (IBIT), which witnessed an unprecedented daily inflow of $520 million. This influx is not only a record for IBIT but also emblematic of the broader institutional embrace of Bitcoin, with total net inflows into spot Bitcoin ETFs reaching a staggering $6.7 billion since their inception. Such significant institutional activity underscores the evolving perception of Bitcoin as a legitimate and attractive asset class among seasoned investors.

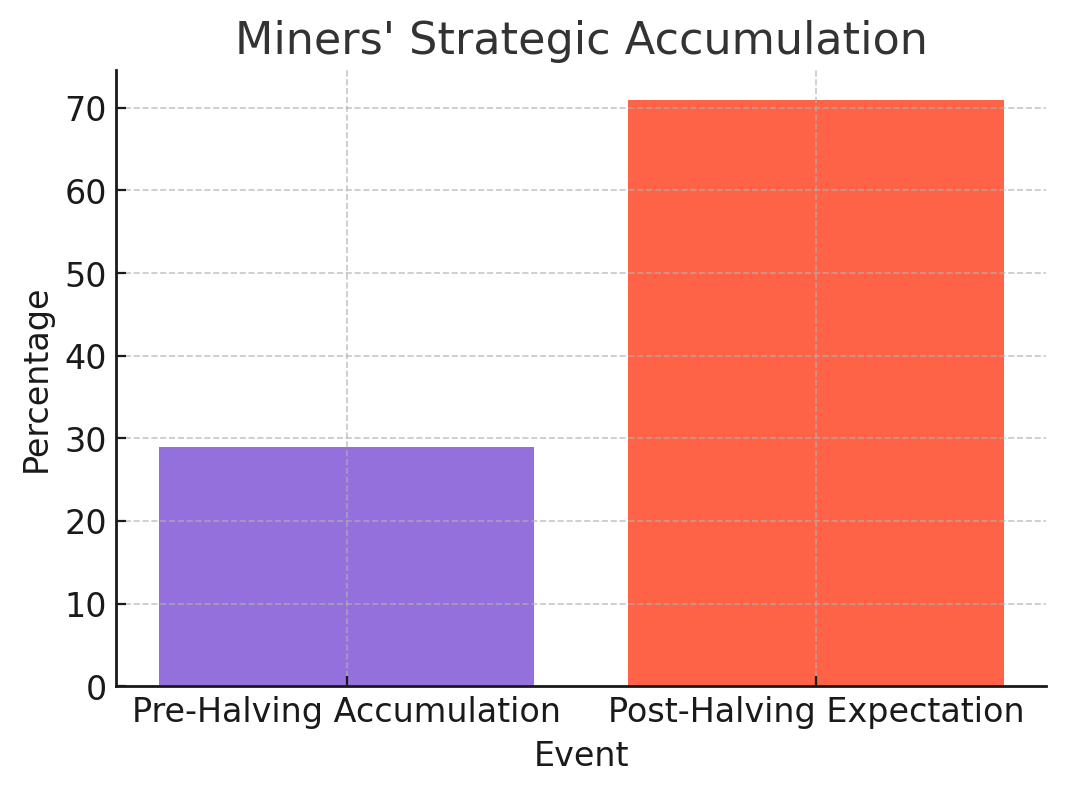

Miners' Strategic Accumulation and the Anticipated Halving Event

Adding to the complexity of Bitcoin's rally is the strategic behavior of Bitcoin miners. In anticipation of April's expected halving event, miners have markedly increased their accumulation rate, retaining an estimated 29% of all Bitcoin rewards. This strategic accumulation reflects a dual strategy of leveraging rising prices and preparing for post-halving reward reductions, a cycle that historically precedes a consolidation phase in Bitcoin's market.

Retail Enthusiasm: A Resurgence in Participation

Another dimension to Bitcoin's rally is the resurgence in retail enthusiasm, particularly highlighted by Coinbase's reported increase in trading volumes and retail activity. This uptick reverses a multi-year downtrend, indicating a broader base of participation and interest in the cryptocurrency market. Such trends are further buoyed by the growing intersections of cryptocurrency with mainstream interests in gaming, NFTs, and social platforms, signaling a diversification in the avenues through which new market participants are entering the cryptocurrency ecosystem.

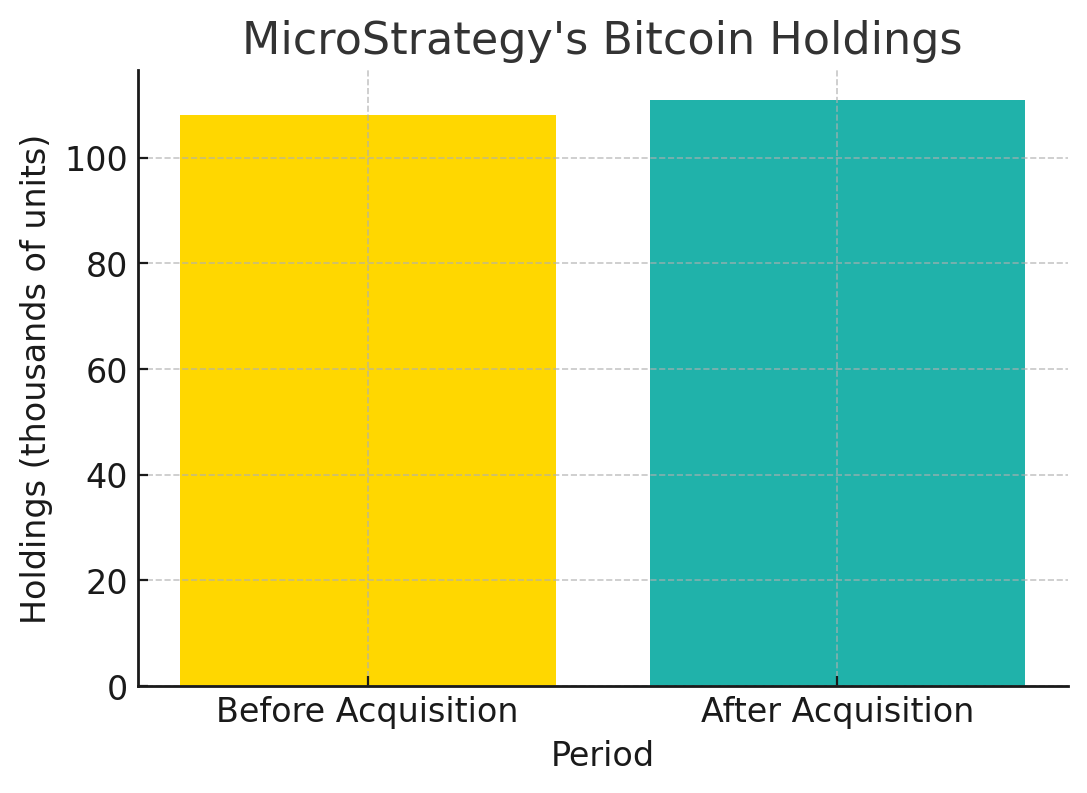

MicroStrategy's Bitcoin Strategy: A Testament to Long-Term Confidence

MicroStrategy's unwavering commitment to Bitcoin, demonstrated through its acquisition of an additional 3,000 Bitcoin units, reflects a profound long-term confidence in Bitcoin's value proposition. With an unrealized profit of $5.7 billion, MicroStrategy's strategy underscores a broader market sentiment that views Bitcoin not as a speculative play but as a foundational asset in the emerging digital economy.

The Path Ahead: Bitcoin's Price Trajectory and Market Dynamics

As Bitcoin navigates its post-halving landscape, the market is poised on the cusp of potentially transformative shifts. With institutional and retail participation reaching new heights, and strategic behaviors among miners indicating a preparation for reduced rewards, Bitcoin stands at a critical juncture. The convergence of these factors, coupled with the speculative anticipation of rate cuts and the burgeoning ETF market, paints a complex but optimistic picture for Bitcoin's future.

In this intricate mosaic of market dynamics, Bitcoin's recent achievements are not merely numerical milestones but reflective of a maturing asset class. The cryptocurrency's ability to attract diverse market participants—from institutional giants to individual enthusiasts—while navigating the inherent volatility and regulatory landscapes, signifies a robust and resilient market poised for future growth. As Bitcoin continues its journey, the market awaits with bated breath, ready to witness the unfolding of the next chapter in the cryptocurrency saga.