Bitcoin (BTC) Analysis: CPI, Market Trends & Price Forecast

Understanding Bitcoin's Price Movements Through Inflation Data, Technical Analysis, and Market Sentiment | That's TradingNEWS

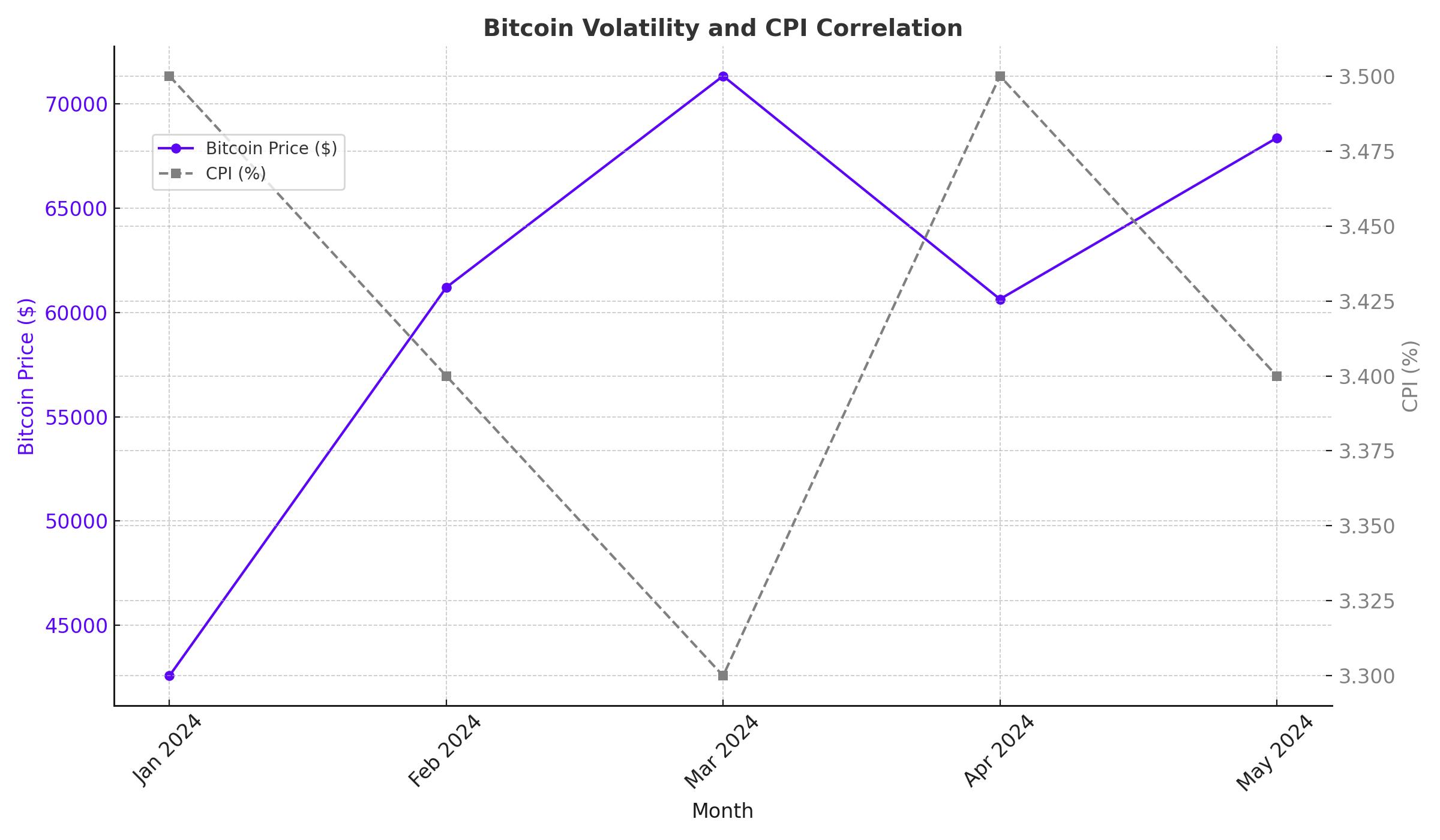

Bitcoin's Volatility and Inflation Correlation

Bitcoin (BTC) has captured the attention of investors worldwide, particularly as recent economic developments in the United States could dictate its next major move. A notable correlation between the Consumer Price Index (CPI) and Bitcoin's fluctuations has emerged, suggesting that inflation data could significantly impact Bitcoin's trajectory.

CPI Influence on Bitcoin Prices

Markus Thielen, chief analyst at 10x Research, posits that a lower CPI could propel Bitcoin to new all-time highs. He asserts that if the U.S. CPI, set for release on June 12, drops to 3.3% or lower, Bitcoin is likely to surge. The CPI for May was 3.4%, a slight decrease from the previous month but still high enough to suppress significant Bitcoin gains.

Recent data show strong inflows into Bitcoin exchange-traded funds (ETFs) leading up to the May CPI release, with the largest single-day influx of $305.7 million on May 21. Thielen notes that higher-than-expected CPI results earlier in the year caused Bitcoin prices to decline, such as the 6.67% drop to $56,000 following a 3.5% CPI print in April.

Implications of CPI on Bitcoin Market

Thielen explains that Bitcoin price movements are not random but influenced by critical factors like inflation. The introduction of Bitcoin ETFs in January, which saw initial inflows of $611 million, underscores how economic data can affect market behavior. Higher-than-expected CPI results have historically weakened Bitcoin, leading to consolidation periods.

Current Market Sentiment and On-Chain Activity

Bitcoin has recently surged over 2%, reflecting increased market interest and trading activity. Prominent analyst Ali Martinez highlighted a bullish pattern, noting that a close above $69,330 could trigger a rally to $74,400. On-chain data from IntoTheBlock indicates a "significant demand zone" between $66,900 and $68,900, suggesting strong support for further price increases.

Bitcoin Price Dynamics and Technical Analysis

Bitcoin's price action has been influenced by several key factors, including the approval of Bitcoin ETFs and macroeconomic data. The Bollinger Bands technical indicator suggests that if Bitcoin can maintain momentum above $69,100, a rally towards $75,000 is plausible.

Bitcoin's Correlation with Equity Markets

Bitcoin's recent performance mirrors buoyant equity markets. The cryptocurrency rose over 2% in the past 24 hours, trading at $69,035 as of 7:15 a.m. ET. Major European and UK indices also saw gains, with the FTSE 100 and Stoxx 600 index both posting increases.

The European Central Bank (ECB) is expected to lower interest rates, potentially benefiting Bitcoin by increasing market liquidity. Historically, Bitcoin has shown mixed correlations with equities, often mirroring stock market trends during economic stress but benefiting from liquidity inflows in stimulus-driven environments.

Institutional Interest and Bitcoin ETFs

The approval of U.S. Spot Bitcoin ETFs has opened new avenues for institutional investment, bringing additional liquidity and legitimacy to the market. Bitcoin's trading volume surged 119.15% to $24.29 billion in the last 24 hours, reflecting growing interest from traders.

Future Outlook and Price Forecast

Bitcoin's price dynamics are poised for significant movement. A breakout above key resistance levels could lead to new highs, driven by bullish sentiment in derivatives markets. The CryptoQuant’s Taker Buy/Sell Ratio, which measures the volume of active buy orders against sell orders, has reached a peak of 1.13, indicating strong bullish sentiment.

Key macro events, including the U.S. Non-Farm Payrolls data and the Fed Rate announcement, will be crucial in shaping Bitcoin's price trajectory in June 2024. With mounting bullish pressure, Bitcoin could see a rally towards $75,000, provided macroeconomic indicators align favorably.

Investment Recommendation: Bullish on Bitcoin

Given the current market conditions, strategic investments in Bitcoin ETFs, and the strong correlation with inflation data, Bitcoin presents a compelling bullish case. Investors should monitor key resistance levels and macroeconomic indicators to capitalize on potential price movements.

For detailed information on insider transactions, refer to Microsoft's Insider Transactions.

By leveraging technical analysis and on-chain data, investors can gain insights into Bitcoin's next potential moves, making it a valuable addition to portfolios seeking exposure to digital assets and hedging against inflation.