Bitcoin (BTC) Fluctuates Wildly as U.S. Government Transfers $2 Billion Worth of Bitcoin

Price Swings from $70,000 to Below $66,000 Highlight Market Sensitivity to Large Transactions | That's TradingNEWS

Bitcoin (BTC): Bullish Trends Amid Market Volatility and Institutional Moves

Current Price Dynamics and Technical Analysis

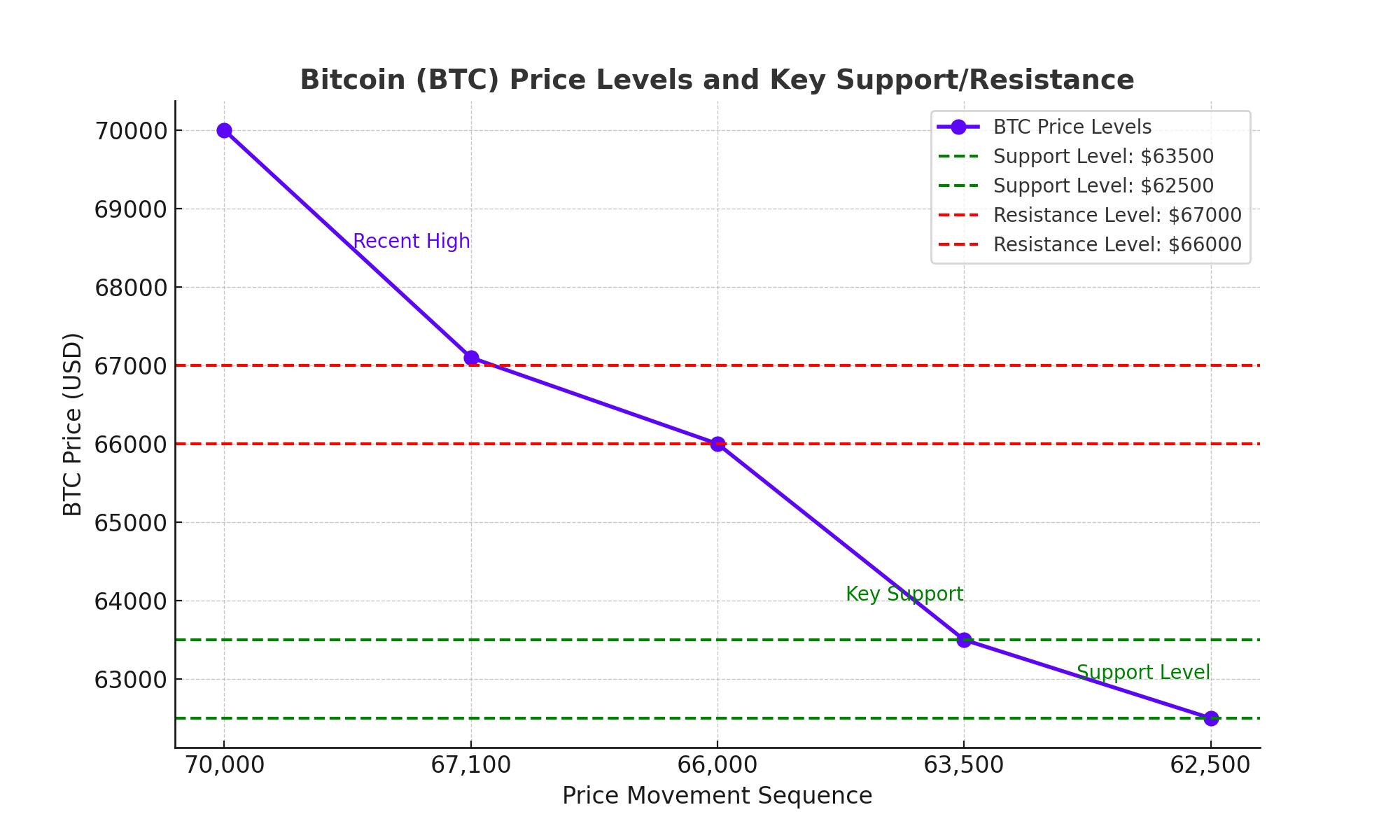

Bitcoin (BTC) has demonstrated significant volatility in recent weeks, reaching highs of $70,000 before experiencing a correction to sub-$66,000 levels. As of now, Bitcoin is trading around $67,100, reflecting some buying interest but also showing signs of weakness. Key support levels are identified at $63,500 and $62,500, with potential rebounds expected if the price drops to these points. Bitcoin’s medium to long-term trend remains bullish, supported by its position above the 50 and 200-day moving averages. This period of consolidation could provide a foundation for future rallies, but the market remains cautious and susceptible to fluctuations.

Derivatives Market and Open Interest

The derivatives market shows increasing open interest in Bitcoin perpetual contracts, indicating significant interest from speculators. Positive funding rates suggest that the majority of traders are maintaining long positions. Recent liquidations have been notable, with over $68 million in Bitcoin long positions liquidated in the past 24 hours, out of a total of $75 million liquidated BTC positions. This trend highlights the market's volatility and the potential for sharp movements driven by leveraged positions.

U.S. Government Bitcoin Transfers and Market Impact

Bitcoin's recent price movement has also been influenced by significant transfers from wallets reportedly belonging to the U.S. government. On Monday, $2 billion worth of Bitcoin, approximately 28,000 BTC, was transferred, raising concerns about potential market impacts. These funds are tied to the U.S. Department of Justice’s confiscations from the Silk Road marketplace. The market reacted to these movements, adding to the selling pressure and contributing to Bitcoin’s dip below $67,000.

Indicators of Potential Upside

Despite recent corrections, several macro catalysts suggest a bullish outlook for Bitcoin. Anticipated interest rate cuts, growing institutional adoption, and increased interest from developed countries in holding Bitcoin as a reserve asset create a favorable environment. The U.S. economy's strength further supports this positive sentiment. Bitcoin's market dominance currently stands at 52.5%, reinforcing its leading position in the cryptocurrency market.

Political Developments and Regulatory Environment

Former President Donald Trump's recent comments at the Bitcoin Conference have injected political support into the cryptocurrency market. Trump pledged to "fire Gary Gensler," the SEC chair, and install pro-crypto regulators, which could significantly influence Bitcoin's regulatory landscape. This political backing could tie Bitcoin’s near-term price movements to the outcome of the U.S. presidential election, introducing a new variable to consider for investors.

Mining Sector Developments

The post-halving landscape for Bitcoin mining is evolving differently than anticipated. While Bitcoin’s price has increased by around 5% since the halving in April, the network’s hashrate has declined by 8% over May and June. This decline has improved profitability for miners despite a drop in revenue per unit of computing power. The mining sector is also undergoing consolidation, with recent deals highlighting the importance of access to cheap energy.

Broader Cryptocurrency Market Trends

Bitcoin's recent price dip has had a ripple effect across the broader cryptocurrency market. Ethereum, the second-largest cryptocurrency, also experienced pressure, with its price currently at $3,352.94. Other major cryptocurrencies like XRP, ADA, and SOL have also seen declines. This trend is partly influenced by the overall risk-off sentiment ahead of the Federal Reserve’s meeting, where interest rate decisions could further impact market dynamics.

SEC Developments in the Binance Case

In other regulatory news, the SEC may drop charges against certain third-party tokens, including Solana's SOL and Polygon's MATIC, in its case against Binance. This development could impact market perceptions and investor confidence in these tokens.

That's TradingNEWS

Read More

-

SPYI ETF at $52.59: 11.7% Yield, 94% ROC and Near S&P 500 Returns

04.01.2026 · TradingNEWS ArchiveStocks

-

XRPI and XRPR Rally as XRP-USD Defends $2.00 on $1.2B XRP ETF Inflows

04.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Eyes $4.30 if Storage Draws Tighten

04.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X at 156.91: 157.75 Breakout Sets 160 Target as Fed Jobs Week Tests The Dollar

04.01.2026 · TradingNEWS ArchiveForex