Bitcoin (BTC) Surges Above $63,000: Detailed Market Analysis and Future Outlook

Examining Technical Indicators, Market Sentiment, and Influential Factors Shaping Bitcoin's Bullish Momentum | That's TradingNEWS

Bitcoin (BTC): A Comprehensive Analysis and Future Outlook

Surging Above $63,000: Recent Performance and Market Dynamics

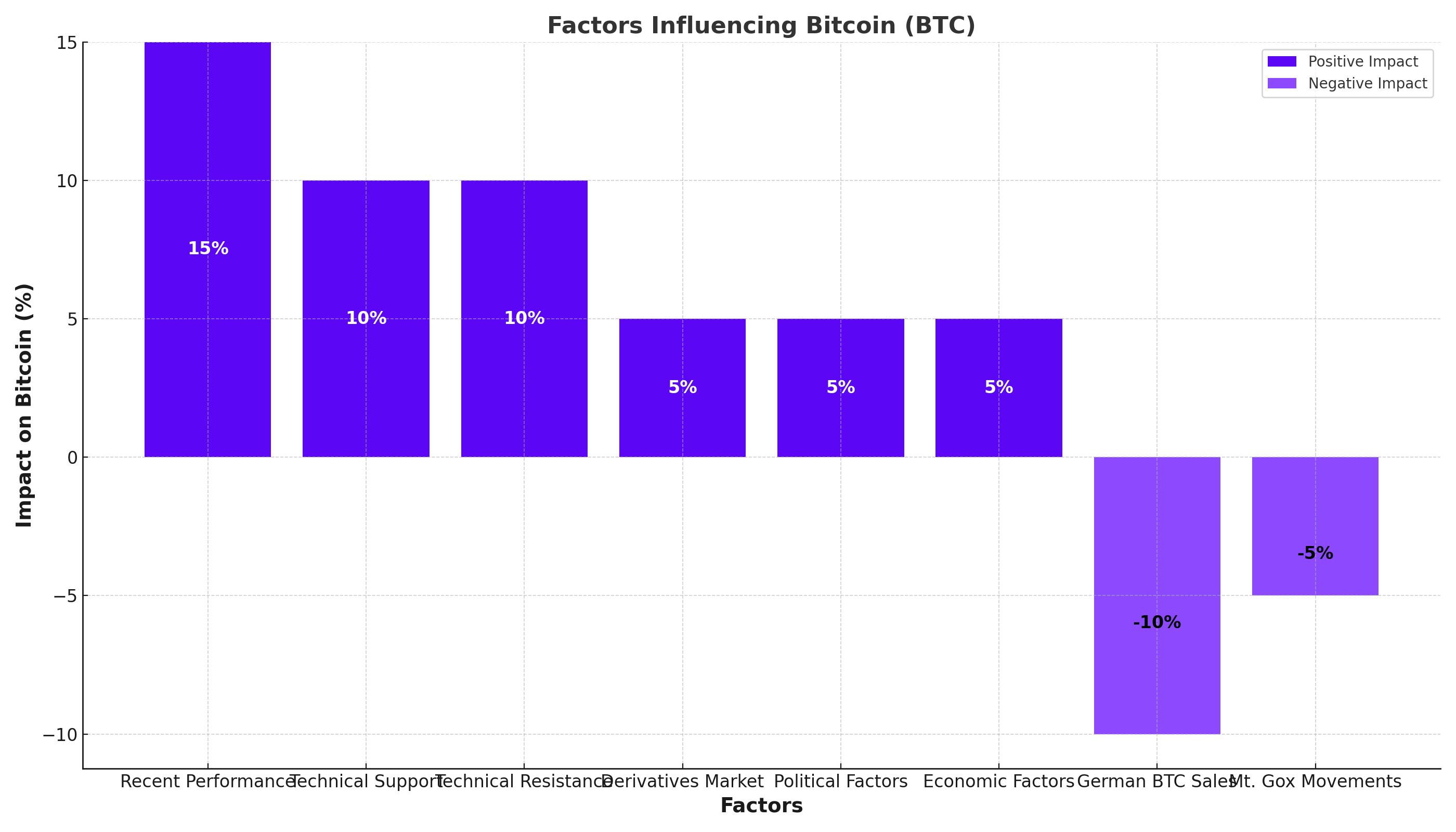

Bitcoin (BTC) has demonstrated significant resilience and upward momentum, trading around $63,000 at the time of writing. This represents a more than 15% increase from last week's low of $53,500. This rebound occurred after a period of consolidation and buyer support, propelling Bitcoin above its last identified peak around $63,800. This technical breakout suggests the potential for a trend reversal in Bitcoin's short-term downtrend.

Technical Analysis: Key Support and Resistance Levels

The current technical setup indicates strong support at $61,000. As long as Bitcoin remains above this level, the next resistance to watch is around $64,000 to $65,000, with further resistance at $67,500 and $69,500. Conversely, if Bitcoin fails to maintain support at $61,000, the next support levels to monitor are $60,000, $58,000, and $54,000. The current momentum and oscillators suggest renewed buying interest, making the path of least resistance upward.

Impact of Derivatives and Market Sentiment

The open interest of Bitcoin perpetual contracts has surged by more than 28%, adding positions worth nearly $2.5 billion. This increase, coupled with a positive funding rate and minimal liquidations, indicates that a majority of speculators are anticipating a rise in Bitcoin’s price. Additionally, Bitcoin CME contracts have left behind a bullish gap, often signaling strong buying pressure and an imminent upward movement.

Influence of Political and Economic Factors

Bitcoin’s recent price momentum is partially attributed to the increased odds of former President Donald Trump's re-election, who is viewed as a supporter of cryptocurrency. Trump's attendance at a Bitcoin conference and positive remarks from influential figures like BlackRock's CEO Larry Fink, who endorsed Bitcoin as a "legitimate financial instrument," have further fueled bullish sentiment. BlackRock's spot Bitcoin exchange-traded fund (ETF) has been one of the most successful products in its category, attracting significant inflows.

Effect of German Government Bitcoin Sales

The German government's recent offloading of Bitcoin holdings, which amounted to approximately $2 billion, initially exerted downward pressure on Bitcoin’s price. However, the market absorbed these sales with relative ease. The on-chain balance of Bitcoin held by Germany is now near zero, removing a significant drag on the price.

Market Response to Mt. Gox Bitcoin Movements

The rehabilitation program of Mt. Gox has initiated the transfer of significant Bitcoin holdings, totaling around 92,000 BTC. This movement has raised concerns about potential market sell-offs. However, the market has shown resilience, maintaining price levels despite the anticipated pressure.

Bitcoin’s Role in the Broader Market and Future Prospects

Bitcoin continues to be a central player in the cryptocurrency market, influencing and being influenced by broader market trends. The recent increase in Bitcoin's price has also positively impacted crypto-related stocks, with companies like MicroStrategy (MSTR) and Coinbase (COIN) seeing significant gains. The bullish sentiment extends beyond Bitcoin to other cryptocurrencies, although some like Ethereum (ETH) and Polkadot (DOT) have experienced slight declines.

Conclusion: A Bullish Outlook for Bitcoin

Bitcoin's current market dynamics, supported by strong technical indicators, positive sentiment from influential figures, and resilience against major sell-offs, suggest a bullish outlook. As Bitcoin continues to navigate through political, economic, and market-specific challenges, its position as a leading cryptocurrency remains robust. Investors should watch key support and resistance levels closely, along with market reactions to significant events like the Mt. Gox Bitcoin transfers and political developments in the U.S.

Decision: Buy, Hold, or Sell?

Bitcoin appears to be a strong buy, with significant upside potential driven by continued institutional support, strategic market positioning, and the overall bullish sentiment in the cryptocurrency market. Investors should remain vigilant of market developments and adjust their positions accordingly to capitalize on Bitcoin’s potential growth.