Bitcoin (BTC-USD) Breaks $100K – Is a Push to $110K Next or Will Sellers Take Control?

Massive ETF inflows, institutional buying, and Trump’s sovereign wealth fund drive BTC higher – but can Bitcoin sustain this momentum, or is a correction imminent? | That's TradingNEWS

Bitcoin (BTC-USD) Surges Past $100,000 – Can It Sustain the Rally or Is a Pullback Coming?

Bitcoin Price Hits Historic Milestone Amid Trade War Uncertainty

Bitcoin (BTC-USD) has surged past $100,000, marking a historic breakthrough as market sentiment shifts bullish after a period of intense volatility. The rally comes as traders digest U.S. President Donald Trump’s decision to temporarily pause new tariffs on Canada and Mexico, alleviating some immediate liquidity concerns in the market. BTC’s price had previously dropped to a low of $91,000, triggering $8 billion in liquidations, before rebounding sharply as institutional investors seized the dip.

The macroeconomic backdrop remains tense, with Trump’s aggressive trade policies, rising inflation expectations, and geopolitical instability driving increased demand for Bitcoin as a hedge against uncertainty. The newly signed executive order mandating the creation of a U.S. sovereign wealth fund has sparked speculation that the fund could allocate a portion of its holdings to BTC, further fueling investor optimism. Meanwhile, Federal Reserve Chairman Jerome Powell’s confirmation of a Wall Street game-changer regarding monetary policy has added to the bullish momentum, with traders anticipating a potential shift in Fed strategy that could benefit risk assets like Bitcoin.

Will the U.S. Government Buy Bitcoin? Sovereign Wealth Fund Sparks Speculation

A major catalyst for Bitcoin’s latest surge has been Trump’s executive order directing the Treasury and Commerce Departments to establish a sovereign wealth fund within the next 12 months. While the order does not explicitly reference Bitcoin, speculation is growing that the U.S. government could use the fund to acquire BTC as part of a broader diversification strategy.

Prominent crypto advocates, including Senator Cynthia Lummis, have long pushed for the U.S. to accumulate Bitcoin as a strategic reserve asset, similar to gold. Market analysts believe a small allocation from the fund—potentially in the range of 2-5%—could drive unprecedented inflows into Bitcoin, adding $150 billion to $500 billion in potential demand.

The odds of Trump creating a Bitcoin reserve within his first 100 days have surged to 20% on prediction markets, reflecting increasing confidence among investors that the sovereign wealth fund could embrace digital assets. Howard Lutnick, Trump's Commerce Secretary and Cantor Fitzgerald CEO, has publicly stated that he personally holds "hundreds of millions" in BTC, further reinforcing speculation that Bitcoin could play a role in the U.S. economic strategy.

Bitcoin Technical Analysis – Key Levels to Watch

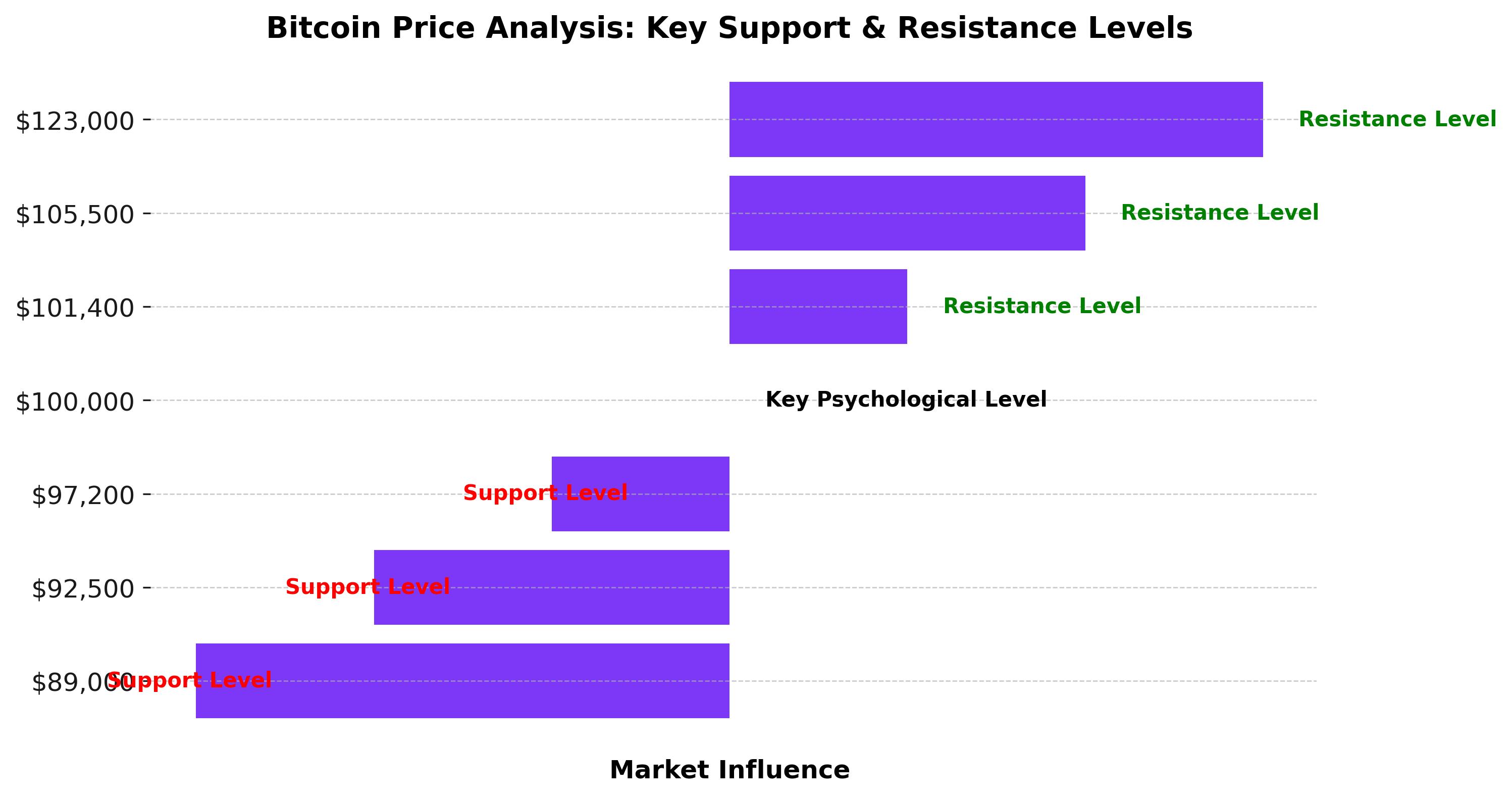

Bitcoin’s price action remains bullish, but traders are closely watching key resistance and support levels to determine the sustainability of the rally.

BTC has reclaimed the psychologically significant $100,000 level, with the next major resistance zone sitting between $101,400 and $105,500. If bulls can push Bitcoin above $105,500, the next major target is $123,000, a level that has emerged as a long-term technical objective based on historical price trends.

On the downside, support remains strong at $97,200, followed by deeper levels at $92,500 and $89,000. A failure to hold above $97,000 could trigger renewed selling pressure, potentially pushing BTC back toward the $90,000 range. However, institutional accumulation at lower levels has been strong, with on-chain data showing that large-scale buyers stepped in aggressively at the $90,000-$92,000 zone.

Institutional Interest and ETF Inflows Drive Market Strength

Institutional investors have played a pivotal role in Bitcoin’s latest rally. Spot Bitcoin ETFs saw over $1.9 billion in inflows last week, marking the second consecutive week of nearly $2 billion in fresh investment. Despite a temporary slowdown due to broader market volatility, institutional demand remains robust, with major asset managers increasing their BTC allocations.

ARK Invest’s latest report suggests that Bitcoin remains on track to meet its long-term price targets, projecting a base case of $700,000, a bull case of $1.5 million, and a bear case of $300,000 by 2030. The report highlights Bitcoin’s growing adoption among public companies, increasing realized capitalization, and decreasing transaction velocity as indicators of long-term strength.

On-Chain Metrics Show Bullish Momentum Despite Recent Liquidations

Bitcoin’s on-chain data suggests that the recent market wipeout, which saw $8 billion in liquidations, has not significantly dented investor confidence. Instead, BTC accumulation remains strong at key price levels, with over $1.8 billion in leveraged long positions concentrated around $90,000.

The Bitcoin perpetual futures funding rate has turned negative, historically a precursor to price recoveries. Negative funding rates indicate that short sellers are paying long holders to maintain their positions, suggesting a potential short squeeze could push Bitcoin higher in the short term.

Bitcoin’s Role as a Safe Haven Asset Strengthens Amid Trade War Fears

Bitcoin’s latest rally reinforces its evolving role as a global hedge against geopolitical and economic uncertainty. As Trump escalates trade tensions with China, Mexico, and Canada, Bitcoin’s appeal as a non-sovereign, censorship-resistant asset continues to grow.

Trump’s tariffs on Canadian and Mexican imports initially triggered a broad sell-off across risk assets, with BTC falling 15% in four days, but the delay in tariff implementation led to a swift recovery. The U.S.-China trade dispute remains a wildcard, with China imposing retaliatory tariffs of 10% on U.S. crude oil and other key imports, potentially impacting global liquidity conditions.

Bitcoin has historically performed well during periods of economic uncertainty, with past market cycles showing strong BTC rallies following global trade conflicts and inflationary pressures. If Trump’s aggressive trade policies persist, Bitcoin could see further demand as a hedge against fiat devaluation.

Will Bitcoin Break $110,000? What Comes Next for BTC?

The key question for traders now is whether BTC can maintain its momentum and break through its next resistance levels. If Bitcoin clears $105,500 convincingly, a push toward $110,000 and beyond becomes increasingly likely.

The broader macro backdrop remains favorable, with institutional interest at all-time highs, sovereign wealth fund speculation growing, and increasing geopolitical risks driving demand for BTC. However, short-term volatility remains a concern, with potential pullbacks toward $97,000-$92,000 likely to be buying opportunities.

With all eyes on the Federal Reserve’s next move, Trump’s policy actions, and continued ETF inflows, Bitcoin remains at a pivotal moment, poised for either a breakout to new highs or a temporary consolidation before the next leg higher. The coming weeks will determine whether BTC continues its march toward $123,000 or experiences a short-term correction before resuming its uptrend.