Bitcoin (BTC-USD) Nears $100K Again – Is a Major Breakout on the Horizon?

With rising ETF inflows and growing institutional demand, can Bitcoin finally shatter its $100K resistance? | That's TradingNEWS

Bitcoin (BTC-USD) Eyes $100K – Can the Bulls Take Control or Will Bears Drag It Back to $90K?

Bitcoin (BTC-USD) continues to flirt with the $100K level, but so far, buyers haven’t been able to sustain momentum above this key psychological threshold. Currently trading around $98,094, BTC has recovered from last week’s dip to $91K, yet faces strong resistance just below six figures. Traders are now eyeing the upcoming U.S. Consumer Price Index (CPI) report and Federal Reserve policy signals as major catalysts for Bitcoin’s next move. Will Bitcoin finally explode past $100K, or is another round of selling pressure about to send it back toward $90K?

Bitcoin’s Struggle With $100K – Key Resistance Holding the Market Hostage

Bitcoin’s recovery from its $91K low has been strong, but every attempt to push beyond $100K has met with heavy selling pressure. The recent rally has been supported by a wave of institutional demand, with ETF inflows surpassing $196 billion, signaling that investors continue to accumulate Bitcoin despite short-term volatility.

However, the correlation between BTC and traditional equities remains strong, which means macroeconomic factors—such as inflation data and central bank policy—will heavily impact Bitcoin’s price action. Currently, the S&P 500 and Nasdaq are trading near record highs, but if risk sentiment shifts due to higher-than-expected inflation, BTC could face renewed downside pressure.

Institutional Inflows Show Strength, But Will It Be Enough?

Bitcoin ETFs have become a massive force in the market, with billions of dollars flowing into these investment vehicles. Since their January 2024 approval, Bitcoin ETF products have driven significant demand, reinforcing BTC’s status as an institutional asset. BlackRock’s iShares Bitcoin Trust (IBIT) alone has amassed over $10 billion in holdings, while Fidelity’s Wise Origin Bitcoin Trust (FBTC) and Grayscale’s GBTC have also seen steady inflows.

However, despite this accumulation, Bitcoin has struggled to gain upside momentum, suggesting that some investors are still cautious amid global macroeconomic uncertainty and fears of increased regulation. Additionally, funding rates across major exchanges have remained positive, indicating that long traders are heavily positioned, which increases the risk of a potential liquidation event if BTC fails to hold key support levels.

Economic Data to Watch – Will CPI Trigger a Bitcoin Breakout or Breakdown?

One of the biggest short-term catalysts for Bitcoin will be the upcoming U.S. CPI report on Wednesday, which will provide insight into inflation trends. If CPI data comes in hotter than expected, markets may shift their Fed rate cut expectations, causing a stronger dollar and putting pressure on risk assets like Bitcoin.

Conversely, a lower-than-expected inflation reading could fuel speculation that the Federal Reserve will ease monetary policy sooner than anticipated, providing a potential bullish trigger for BTC. As of now, the Fed is expected to hold rates steady, but any shift in sentiment regarding future cuts could cause major volatility in Bitcoin and broader crypto markets.

Technical Analysis – Key Levels to Watch for BTC-USD

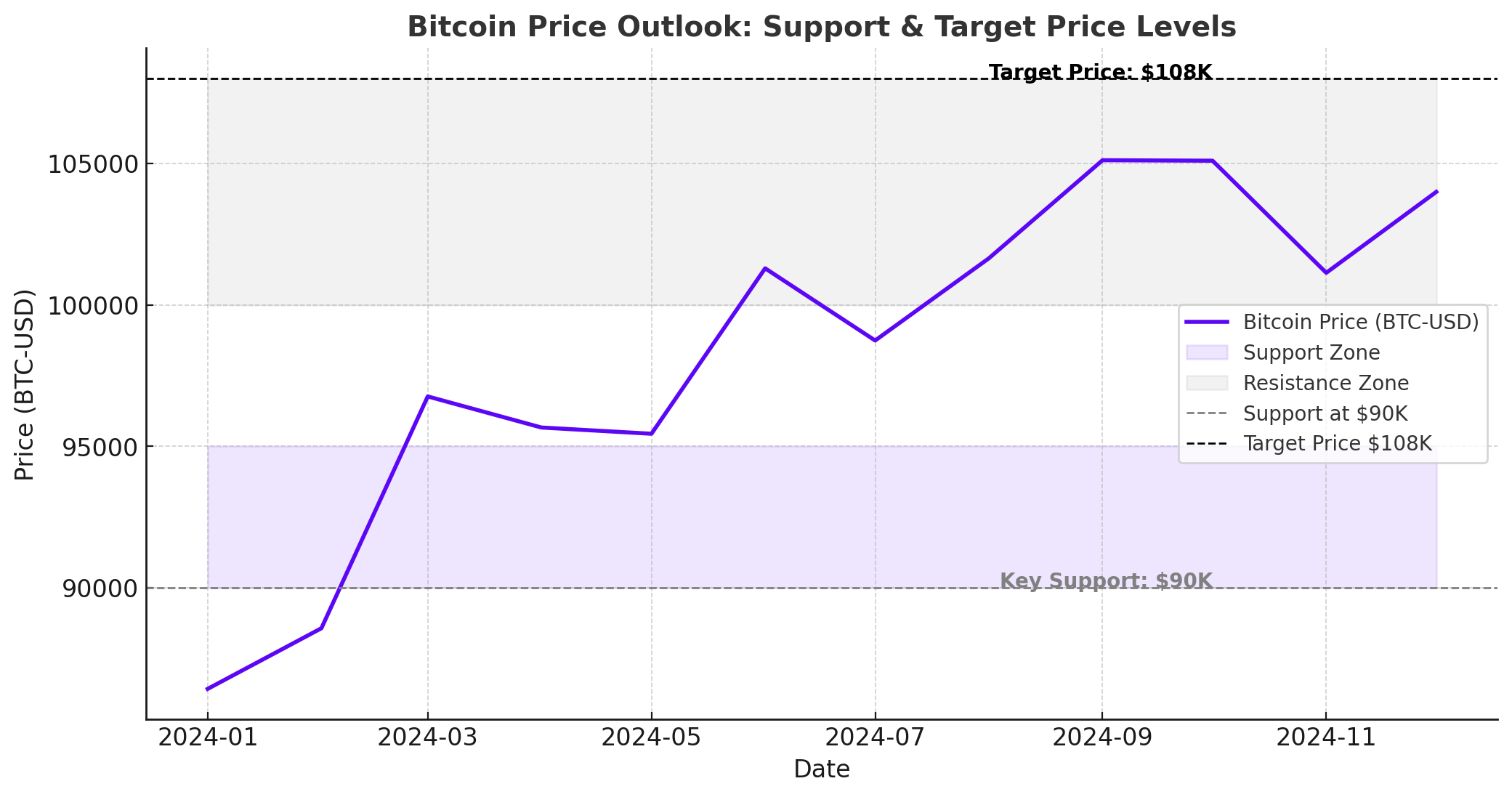

Bitcoin is currently trading at $98,094, facing immediate resistance at $100K. A decisive break above $100K would set the stage for a retest of its all-time high near $108K, and potentially even higher toward $130K in the coming months.

On the downside, if Bitcoin fails to clear $100K, a pullback toward $94K-$95K is likely, with major support at $90K. If $90K is lost, BTC could enter a deeper correction, with the next significant support around $88K.

- Resistance Levels: $100K, $106K, $108K

- Support Levels: $94K, $90K, $88K

- RSI (Relative Strength Index): Currently at 47, indicating neutral momentum, with no clear overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): Recently flipped bearish, suggesting that BTC may struggle to sustain a breakout in the short term.

Bitcoin’s Market Sentiment – Are Investors Bullish or Bearish?

Despite the short-term resistance at $100K, long-term investor sentiment remains overwhelmingly bullish. On-chain data shows that exchange outflows have surged, with whales accumulating BTC at an aggressive pace. This suggests that while traders may be uncertain about BTC’s short-term direction, long-term holders remain confident in Bitcoin’s upside potential.

Additionally, Coinbase’s Premium Index—which tracks institutional demand—has flipped positive, indicating that U.S.-based investors are accumulating BTC at a premium compared to global markets. This is a bullish signal that institutions are still betting on Bitcoin’s continued appreciation.

Final Outlook – Will Bitcoin Break $100K or Face a Major Pullback?

Bitcoin is at a critical inflection point. If macro conditions align favorably, BTC could surge past $100K, triggering a wave of FOMO buying and pushing toward new all-time highs. However, if inflation data surprises to the upside or the Fed signals a prolonged tightening cycle, Bitcoin may struggle to maintain its gains and could see a correction back to $90K or lower.

In the short term, Bitcoin’s ability to sustain momentum above $98K and break through $100K resistance will be key. If bulls can overpower sellers, the next leg up could take BTC to $110K+ in the coming weeks. But if sellers continue to defend $100K, BTC may need another retest of lower support levels before attempting a breakout.