Bitcoin (BTC-USD) Stuck Under $100K—Breakout Coming or Crash Ahead?

After weeks of sideways action, Bitcoin hovers near $96,000-$99,000. Will BTC surge past $100K or tumble below $94K? Key price levels, whale activity, and ETF inflows analyzed | That's TradingNEWS

Bitcoin (BTC-USD) Analysis: Will BTC Break $100,000 or Face a Deeper Correction?

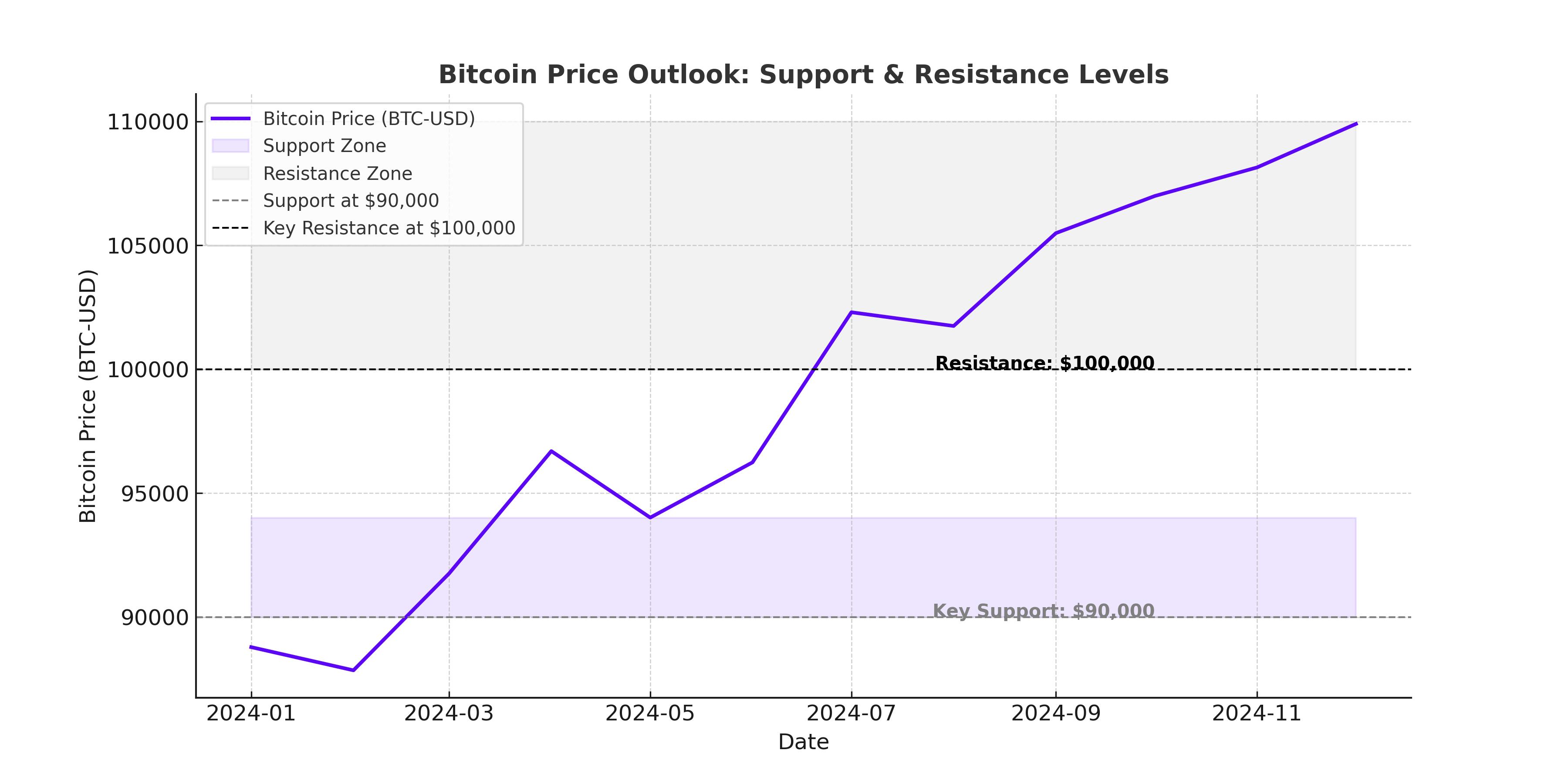

Bitcoin has been locked in a volatile range, fluctuating between $96,000 and $99,000 while struggling to reclaim the crucial $100,000 level. Despite multiple attempts, BTC remains below its all-time high of $109,588, reached in January 2025. The lack of momentum above this psychological barrier has left traders divided—will Bitcoin finally break higher, or is a deeper correction coming?

Bitcoin Faces Resistance at $100,000 - $110,000

Bitcoin’s price action has been defined by strong resistance near $100,000, with multiple failed attempts to sustain a move above this level. The 50-day EMA is currently acting as resistance, preventing further upside. On the downside, support is holding at $93,500, with additional buyers stepping in near $90,000.

If Bitcoin fails to reclaim $100,000, the next major support level lies at $88,000, followed by $84,000, which aligns with a previous accumulation zone from late 2024. However, if BTC breaks above $100,000 with strong volume, the next targets become $103,000, $108,000, and eventually $110,000.

Institutional Buying and ETF Demand Could Fuel a Rally

One of the biggest drivers of Bitcoin’s price has been institutional adoption and Bitcoin ETFs. Since the approval of spot Bitcoin ETFs, the market has seen a massive influx of institutional capital. BlackRock and Fidelity's ETFs have collectively brought in over $55 billion in inflows, signaling that demand remains strong among institutional investors.

However, recent ETF outflows of $540 million in the past week suggest that some institutions are taking profits after BTC’s recent rally. If these outflows continue, Bitcoin could struggle to gain momentum. But if institutional demand picks back up, it could provide the necessary push to send BTC past $100,000 and into price discovery mode.

Bitcoin Whale Accumulation vs. Retail Capitulation

On-chain data reveals an interesting dynamic—whale wallets are accumulating Bitcoin while smaller retail investors are selling. Data from Santiment shows that Bitcoin has 277,240 fewer non-empty wallets than three weeks ago, suggesting that retail traders are capitulating out of fear. Historically, retail selling combined with whale accumulation has been a bullish signal, as large investors often take advantage of price dips to increase their holdings.

Meanwhile, Bitcoin's realized volatility has increased from 45% to 55%, indicating that traders are preparing for larger price movements. If whale accumulation continues, BTC could be setting up for a breakout above $100,000.

Technical Indicators Show Mixed Signals

Bitcoin’s technical indicators are flashing mixed signals, creating uncertainty about its next move.

- MACD (Moving Average Convergence Divergence) is showing bearish momentum, with histogram bars still in the red, but declining in intensity. If this trend continues, BTC could regain strength.

- RSI (Relative Strength Index) is hovering around 48, indicating a neutral zone with no clear overbought or oversold conditions. A push above 55 would signal renewed bullish momentum.

- The Bollinger Bands are tightening, suggesting that a major breakout or breakdown is imminent. When volatility contracts this much, a significant move is typically around the corner.

If BTC breaks and holds above $100,000, the next logical target would be $108,000-$110,000, where previous highs provide resistance. However, if Bitcoin falls below $94,000, it could trigger a larger correction toward $90,000 or even $88,000.

Market Sentiment: Fear or Optimism?

Despite Bitcoin's price consolidation, market sentiment remains mixed. While some traders expect BTC to rally past $100,000 in the coming months, others fear a deeper correction if selling pressure increases.

Cathie Wood of ARK Invest maintains a $1.5 million long-term Bitcoin price target, citing growing institutional demand and the potential for BTC to become a strategic reserve asset. Meanwhile, MicroStrategy and other corporate Bitcoin buyers continue to accumulate BTC, reinforcing the long-term bullish case.

However, short-term traders remain cautious, with many watching the March options expiry for clues about Bitcoin’s next move. Options open interest has risen to $61.11 billion, indicating that leveraged traders are positioning for increased volatility.

Final Outlook: Is Bitcoin a Buy, Hold, or Sell?

Bitcoin is at a make-or-break point. If BTC reclaims $100,000 and holds it as support, the next upside targets are $103,000, $108,000, and $110,000. If Bitcoin fails to clear resistance and falls below $94,000, traders should prepare for a potential drop to $90,000 or even $88,000.

With institutional buying, ETF momentum, and whale accumulation, the long-term outlook remains bullish, but short-term uncertainty remains. A decisive break above $100,000 could trigger a rapid move higher, while a failure to do so could result in a prolonged consolidation phase.

Will Bitcoin finally break past its all-time high, or is a deeper correction coming? The next few weeks will be critical in shaping BTC’s trajectory.