Bitcoin’s Explosive Rally: $100K in Sight

Bitcoin storms past $95K, fueled by institutional bets, pro-Trump policies, and ETF momentum. What’s driving this historic run? | That's TradingNEWS

Bitcoin Approaches Historic Milestones: Insights on Its Surge Toward $100,000 and Beyond

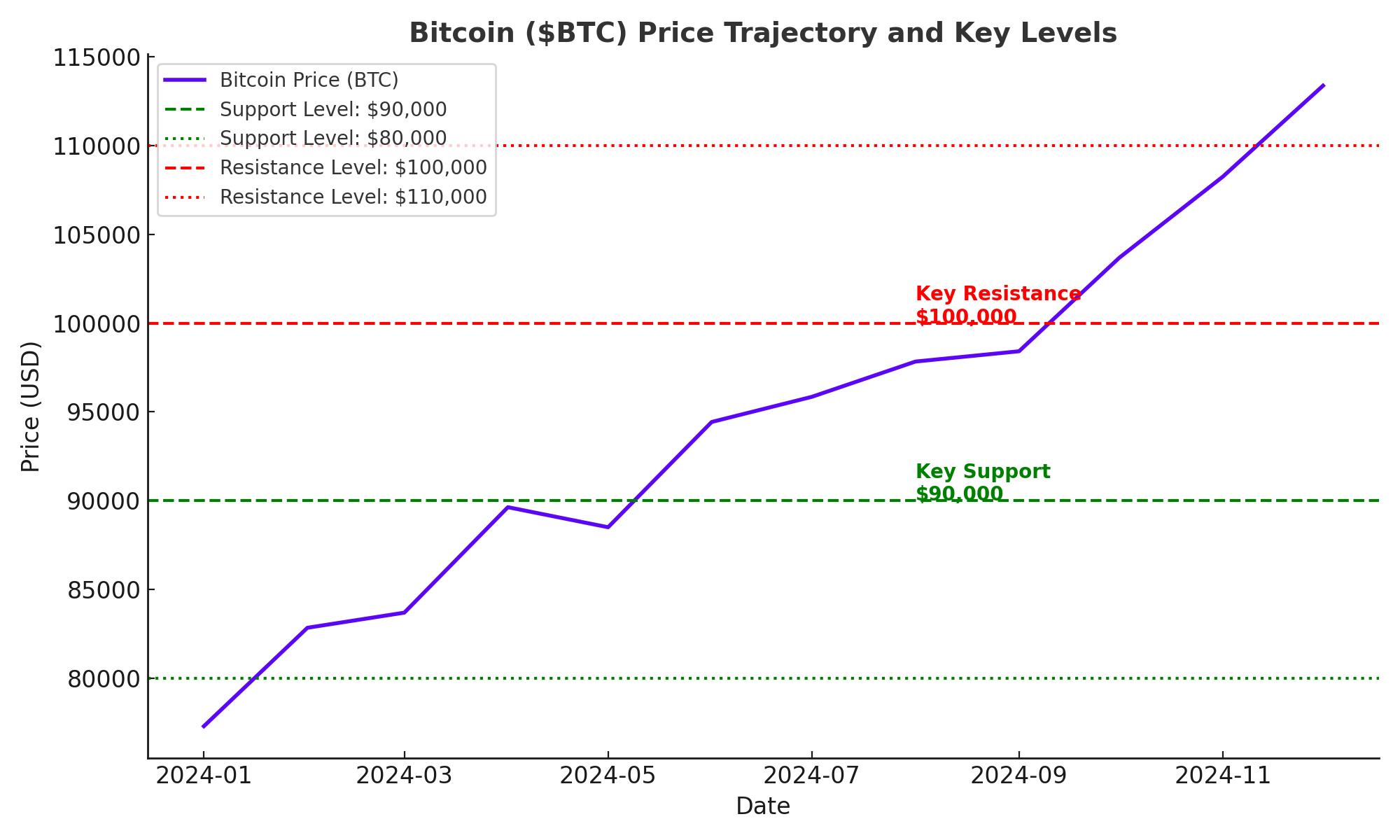

Bitcoin (BTC) continues to command global attention as it edges closer to the psychologically significant $100,000 mark. Currently trading at $95,493, Bitcoin has experienced a 2.2% gain in the past 24 hours, reflecting increasing demand and robust market activity. This rise follows a series of political, economic, and regulatory shifts, including the election of Donald Trump, whose administration has sparked optimism among crypto enthusiasts with promises of pro-Bitcoin policies. This analysis dives deep into Bitcoin’s remarkable rise, its underlying metrics, and its potential trajectory.

Political Winds Favor Bitcoin's Growth

Donald Trump’s return to the presidency has reinvigorated Bitcoin bulls. His administration is expected to adopt crypto-friendly policies, including transferring crypto oversight to the Commodity Futures Trading Commission (CFTC) from the Securities and Exchange Commission (SEC). The SEC, under outgoing chair Gary Gensler, was often criticized for its stringent enforcement against crypto firms like Coinbase (NASDAQ:COIN) and Ripple (XRP). Proposals for a Bitcoin Strategic Reserve and the appointment of pro-Bitcoin regulators such as Paul Atkins as SEC Chair underscore this shift.

Trump’s policies could position the U.S. as the global leader in cryptocurrency adoption. The Republican-led Congress is also expected to support initiatives like the BITCOIN Act, which aims to bolster the U.S. government’s Bitcoin holdings beyond the current 203,000 BTC ($21 billion) acquired through asset seizures.

Spot Bitcoin ETFs and Institutional Momentum

Institutional adoption of Bitcoin is accelerating, driven by the approval of spot Bitcoin ETFs earlier this year. Investment giants like BlackRock and Fidelity have brought unprecedented liquidity to the market, pushing Bitcoin closer to mainstream acceptance. Recent data shows that U.S.-based spot Bitcoin ETFs have attracted cumulative inflows of $30.3 billion, with $103 million recorded on November 26 alone.

These ETFs have catalyzed institutional interest, with 98% of weekly inflows into crypto investment products directed toward Bitcoin. This trend underscores Bitcoin’s status as the preferred asset among institutional investors, further validating its role as "digital gold." BlackRock CEO Larry Fink’s endorsement of Bitcoin as a "legitimate financial commodity" has only amplified this sentiment.

Rising Demand and Declining Exchange Balances

Bitcoin demand, particularly among U.S. retail investors, is rebounding. The Coinbase Premium Index, which measures BTC price differences on Coinbase and Binance, has turned positive, signaling increased buying activity from U.S.-based investors. Meanwhile, Bitcoin balances on exchanges have dropped to a 6-year low of less than 2.4 million BTC, indicating that investors are moving their holdings into self-custody—a bullish sign of reduced sell-side pressure.

Additionally, institutional players have been net buyers of Bitcoin, accumulating 130,000 BTC since October, while retail holdings declined by 41,000 BTC during the same period. This shift reflects changing market dynamics, with institutional accumulation becoming a key driver of Bitcoin’s price.

Macroeconomic and Global Factors Driving Momentum

The broader macroeconomic environment also supports Bitcoin’s ascent. Inflation concerns, currency devaluation, and geopolitical tensions have heightened its appeal as a hedge against economic instability. In South Korea, for example, Bitcoin’s rally to $100,000 has coincided with capital outflows from equities to cryptocurrencies, with trading volumes on crypto exchanges surpassing those on traditional stock markets.

The Bank of Korea’s recent rate cuts, lowering the benchmark rate to 3%, have injected additional liquidity into the market. This move, coupled with increasing demand for Bitcoin, highlights the cryptocurrency’s growing role as a store of value in volatile times.

Historical Trends: November 28 and Bitcoin’s Milestones

Historically, November 28 has been a significant date for Bitcoin, with past rallies marking pivotal moments. On November 28, 2013, Bitcoin surpassed $1,000, and on the same date in 2017, it crossed $10,000. These milestones are often tied to the post-halving momentum, with supply shocks driving prices higher. The most recent halving in April 2024 has set the stage for another potential all-time high, reinforcing the cyclical nature of Bitcoin’s market behavior.

Potential Roadblocks: Regulatory and Market Risks

Despite the optimism, Bitcoin’s journey to $100,000 is not without challenges. Regulatory uncertainties, particularly around international markets, could pose risks. For example, South Korea’s ongoing investigations into crypto exchanges for KYC violations highlight potential headwinds. Moreover, Bitcoin’s volatility remains a concern, with analysts cautioning about a possible 30% retracement before breaking six-figure levels.

Market indicators, such as the Relative Strength Index (RSI), suggest a short-term pullback could precede further gains. Analysts have identified key support levels at $90,000 and $85,000, which, if breached, could signal extended declines.

Long-Term Projections and Institutional Confidence

Despite these risks, long-term projections for Bitcoin remain bullish. Pantera Capital CEO Dan Morehead predicts Bitcoin could reach $740,000 by 2028, driven by increasing adoption and favorable regulatory climates. Tim Draper, another prominent Bitcoin advocate, envisions the cryptocurrency hitting $250,000 by 2025, fueled by corporate treasury adoption and broader financial inclusion.

MicroStrategy’s aggressive accumulation strategy exemplifies institutional confidence. The company recently announced the acquisition of 55,500 BTC at an average price of $97,862, bringing its total holdings to 386,700 BTC. This move underscores the growing trend of corporations integrating Bitcoin into their balance sheets as a hedge against fiat devaluation.

Conclusion: The Path to $100,000 and Beyond

Bitcoin’s rally toward $100,000 reflects a confluence of factors, from institutional adoption and regulatory shifts to macroeconomic dynamics. While challenges remain, the cryptocurrency’s fundamentals and market trends suggest it is well-positioned for continued growth. As November 28 approaches, Bitcoin’s historical performance and current trajectory could once again cement its status as a transformative financial asset. Whether it surpasses $100,000 this year or not, Bitcoin’s long-term prospects remain firmly bullish, driven by its scarcity, adoption, and evolving role in the global economy.

Thta's TradingNEWS

Bitcoin's Meteoric Rise: What’s Driving the Surge?

Bitcoin Price: Is $85,000 Resistance Holding BTC Back or Is a Bullish Breakout Imminent?